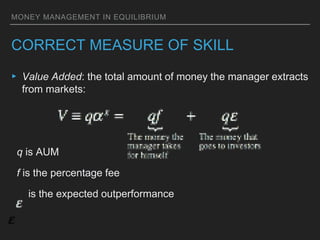

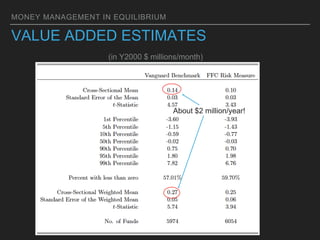

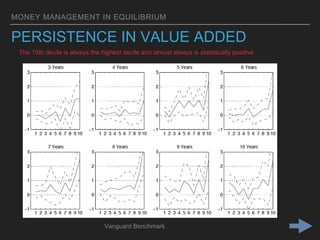

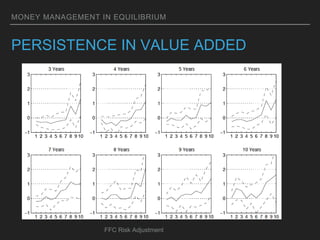

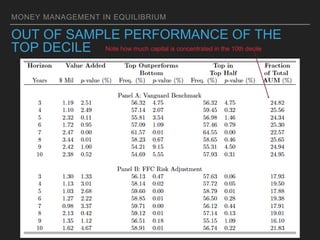

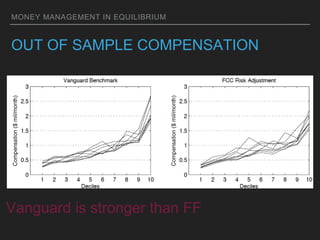

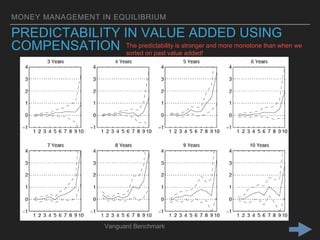

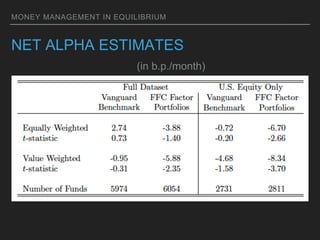

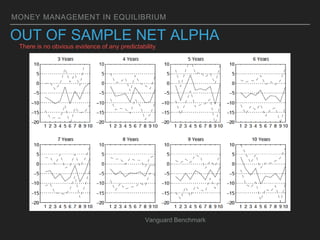

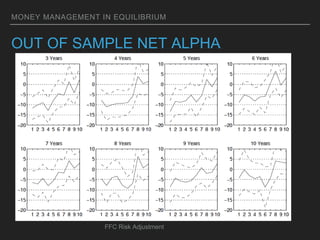

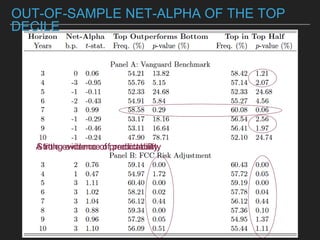

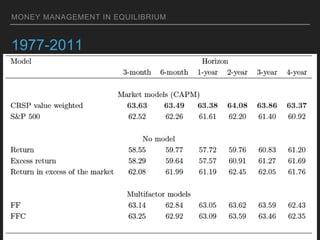

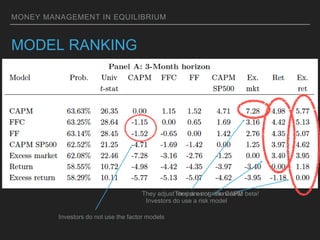

The document discusses the concept of money management in equilibrium, focusing on mutual funds, their performance, and the relationship between fund size and expected returns. It critiques the rational competitive market theory and explores how net alpha is a better measure of manager quality than gross alpha due to their dependence on fund size. The findings indicate that while investors may struggle with predictability in net alpha, they appear to utilize risk models like CAPM in their decision-making.