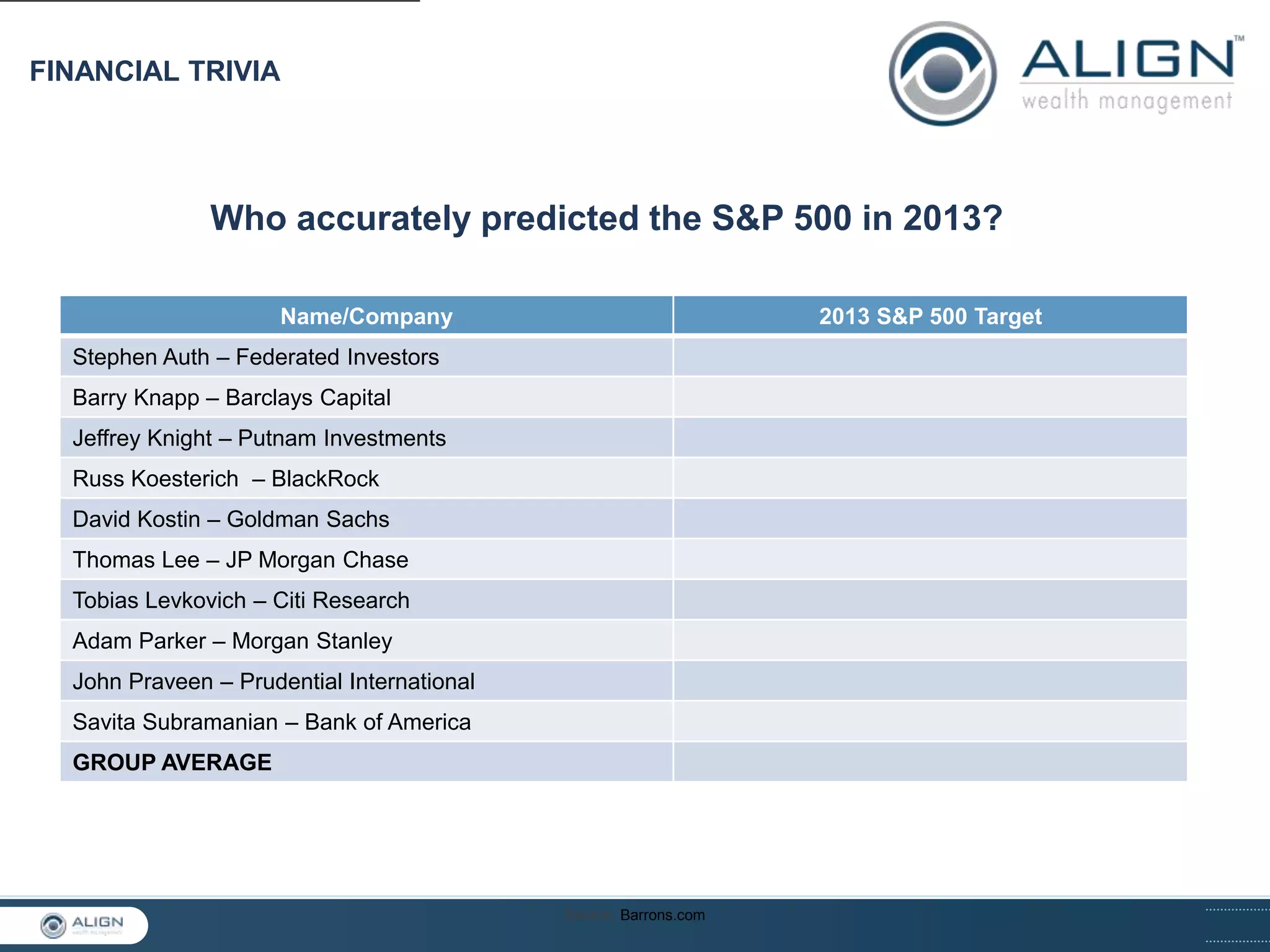

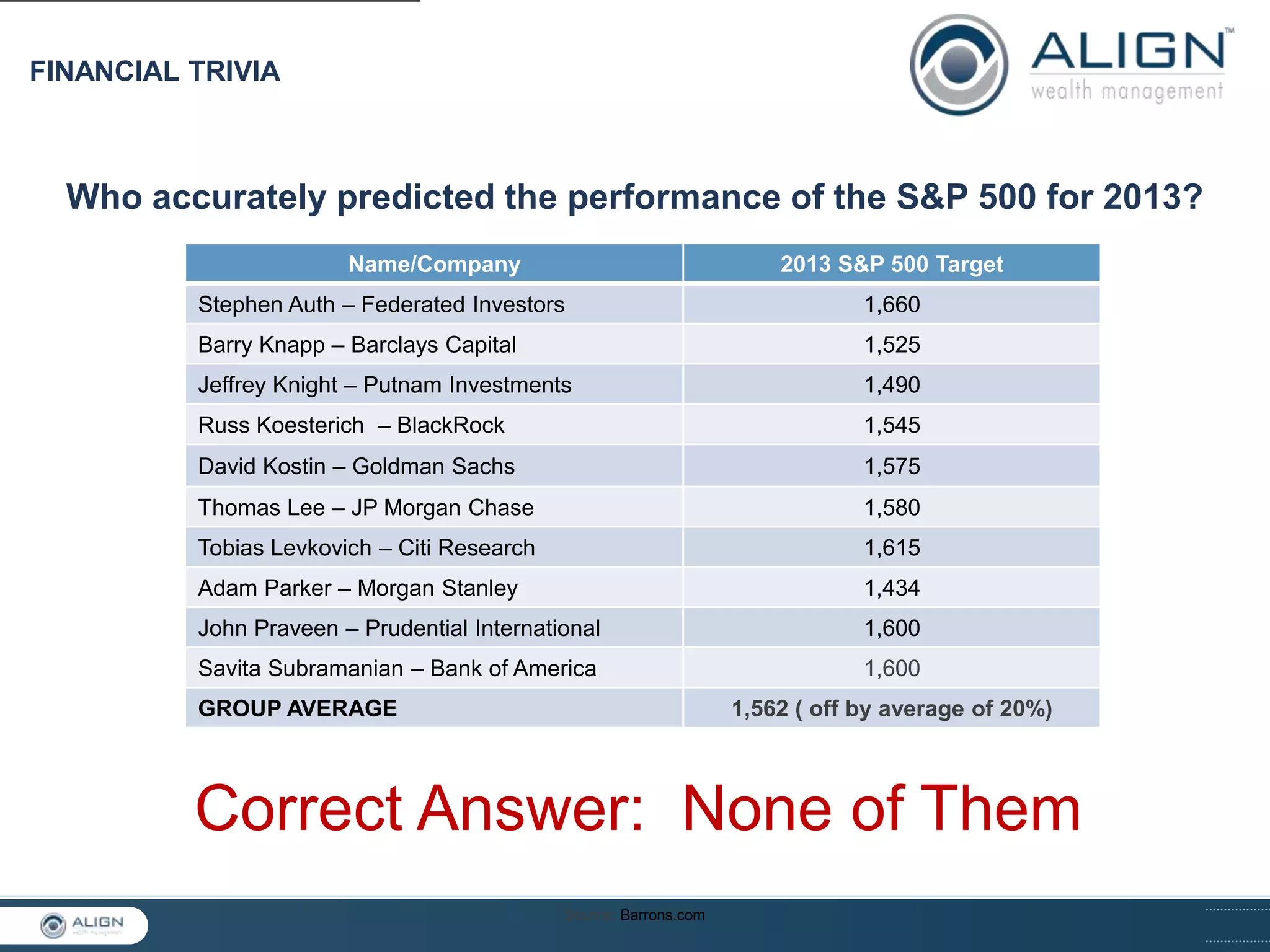

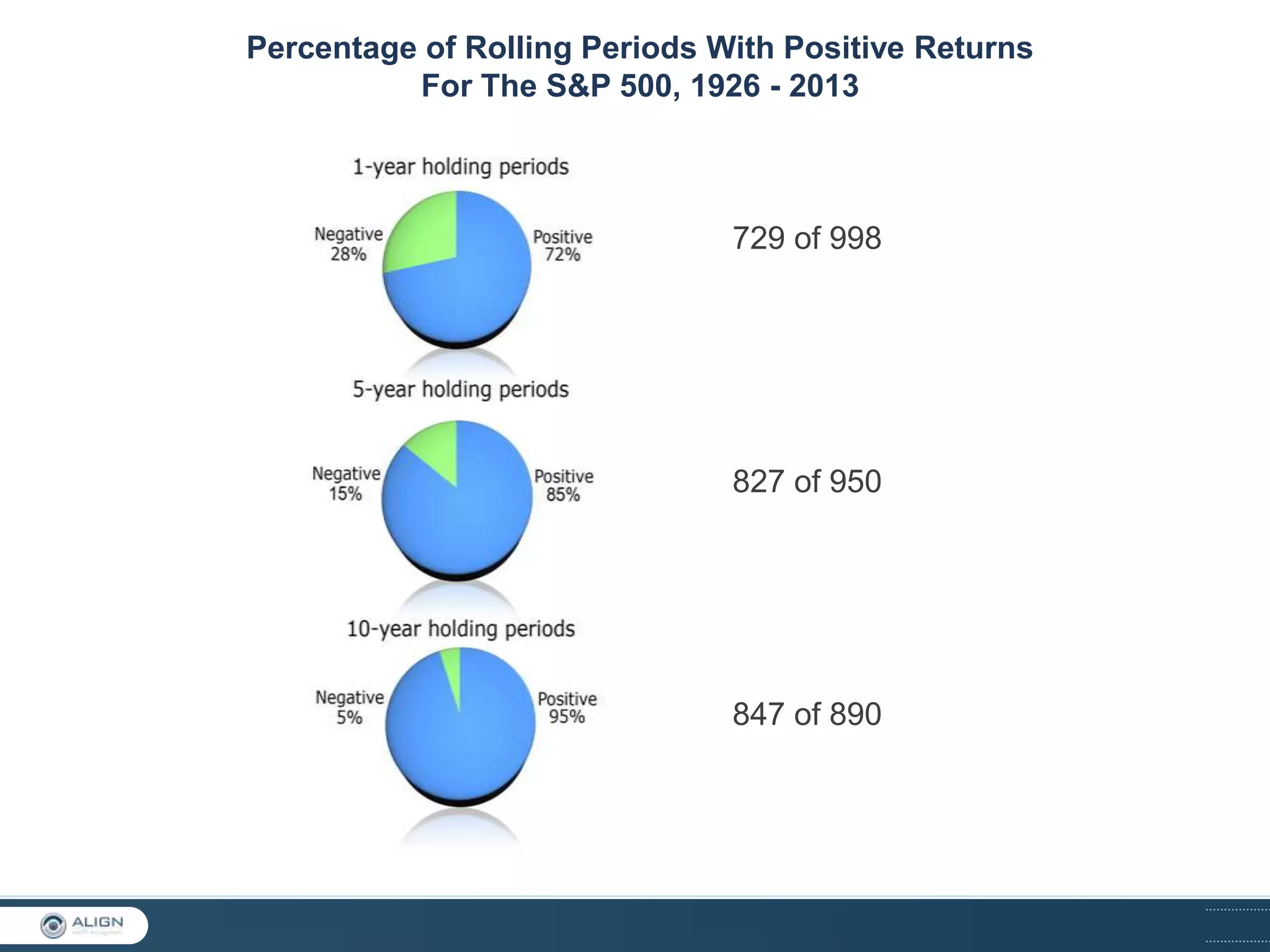

The document provides a summary of forecasts for the S&P 500 index in 2013 from various analysts and investment firms. It shows that none of the analysts accurately predicted the performance of the S&P 500, with their forecasts being off by an average of 20%. The document also includes quotes from Warren Buffett emphasizing that stock forecasting has little value and that one cannot predict movements in the stock market with accuracy.