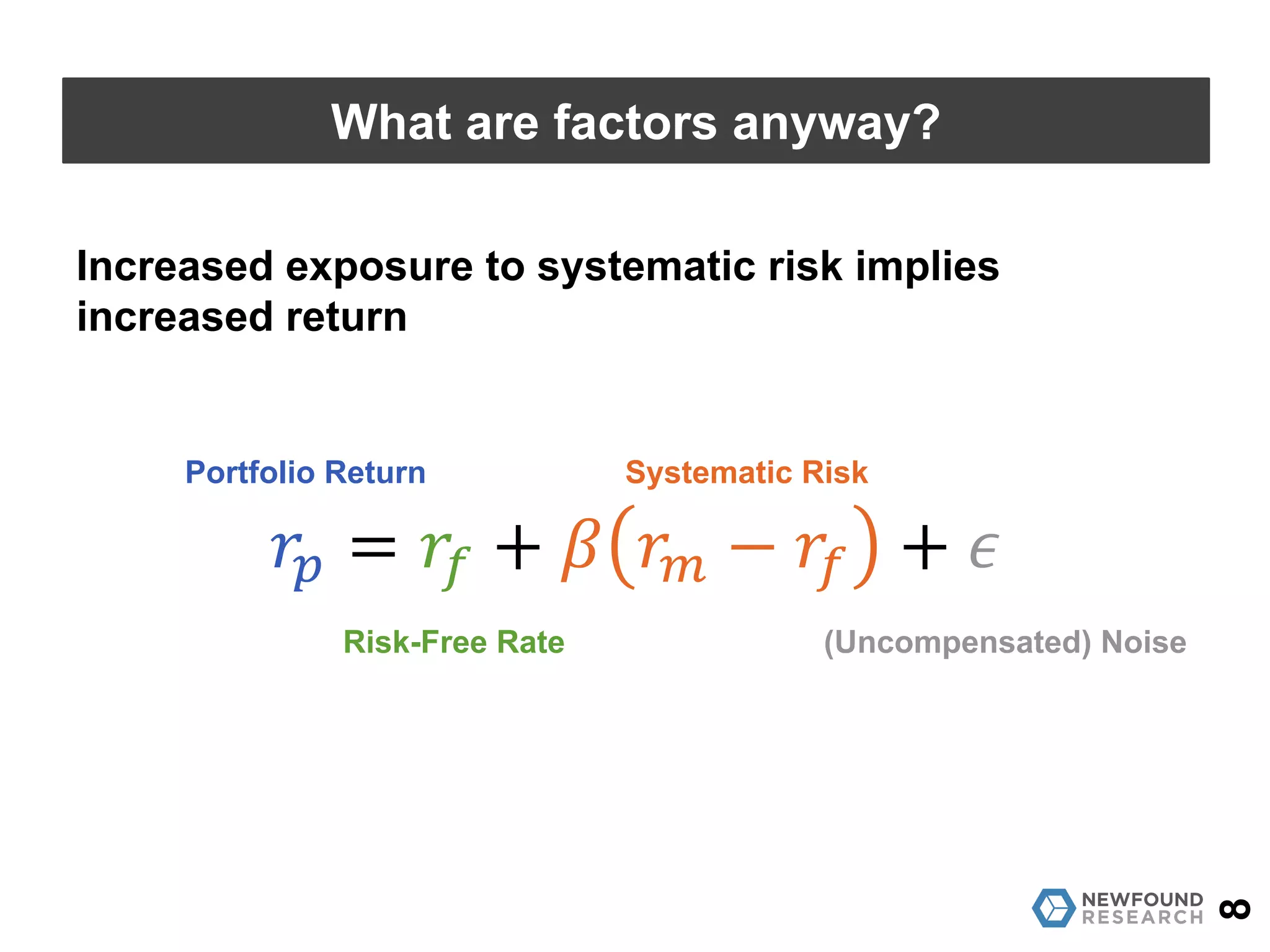

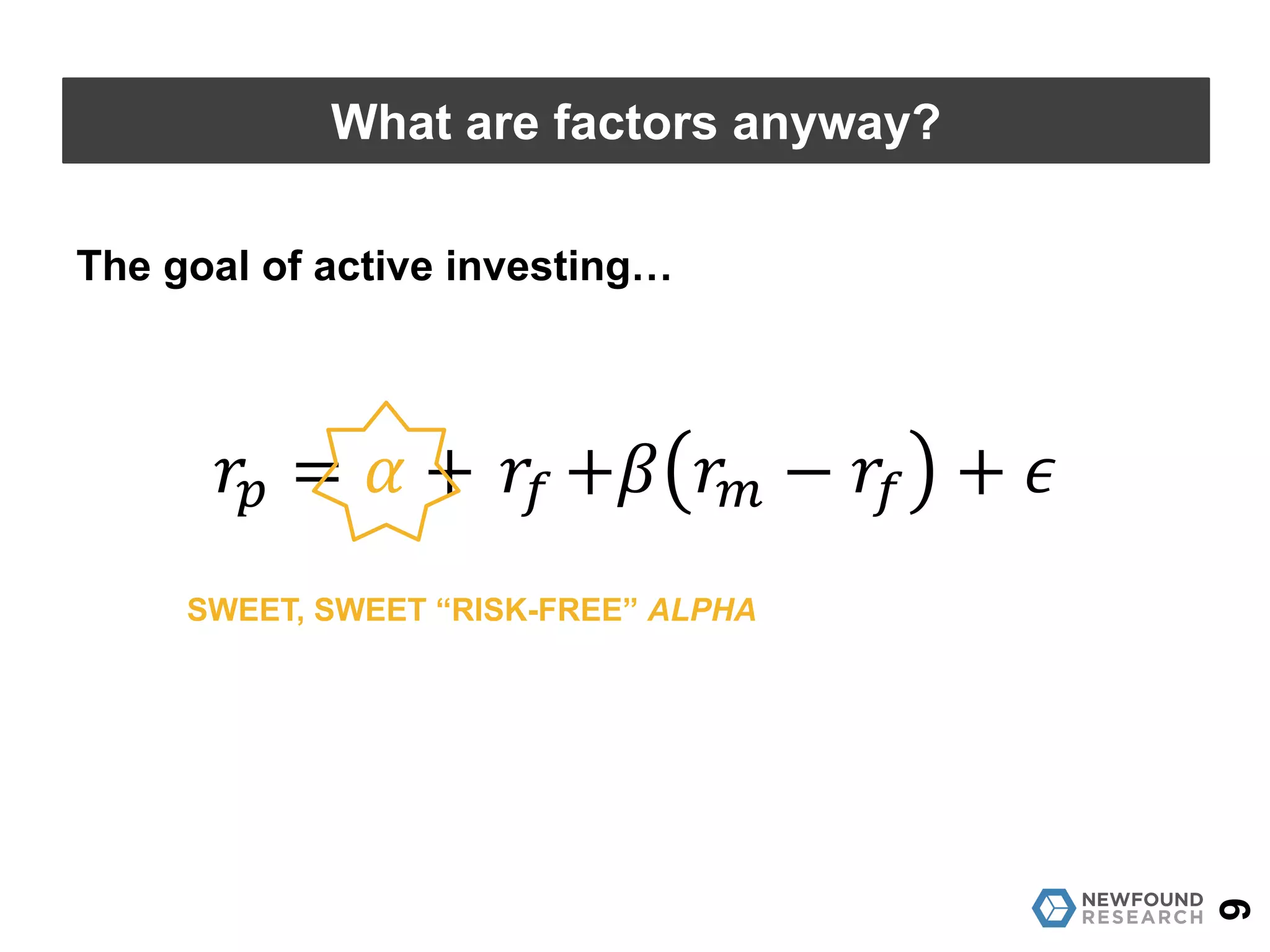

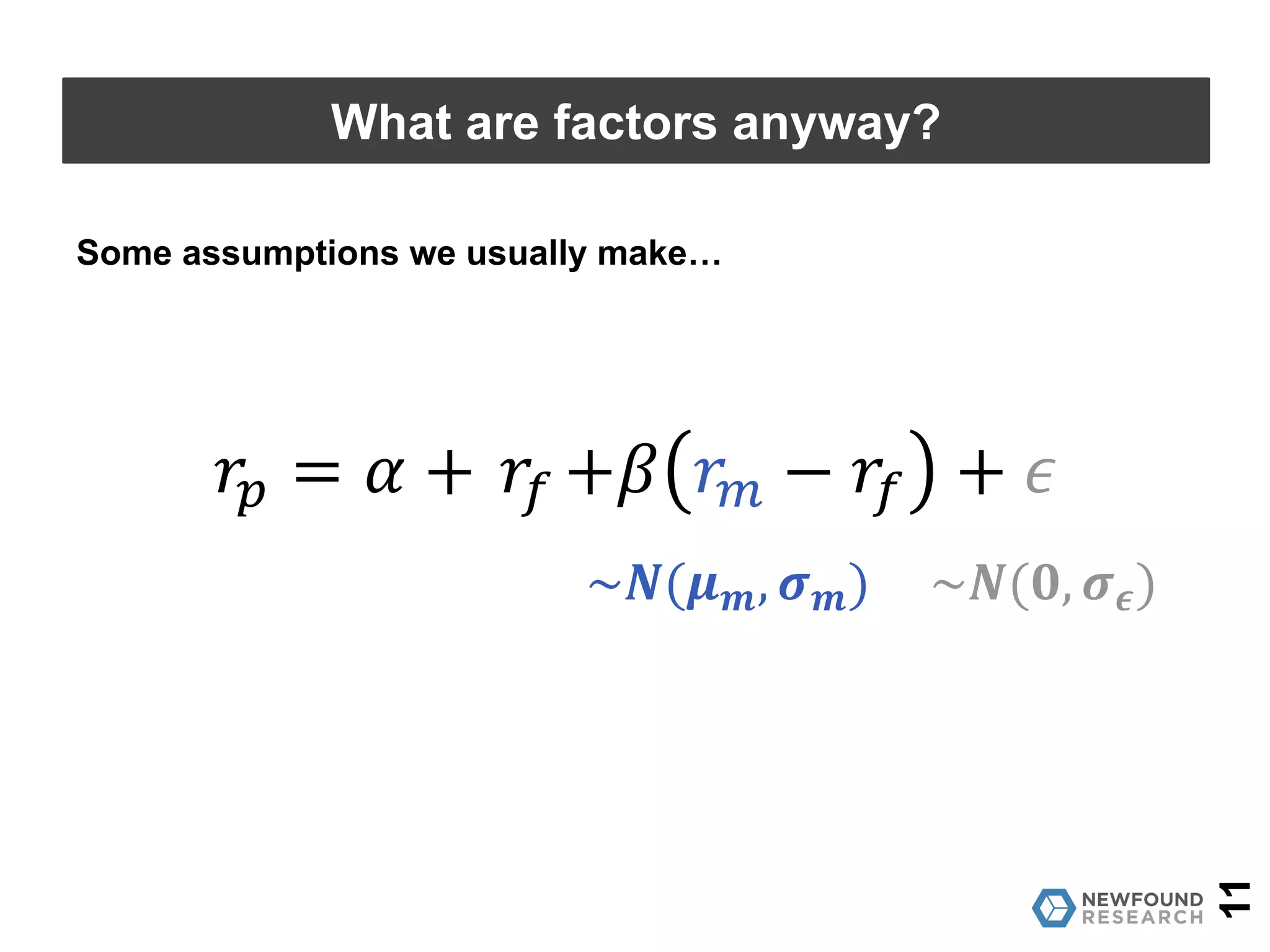

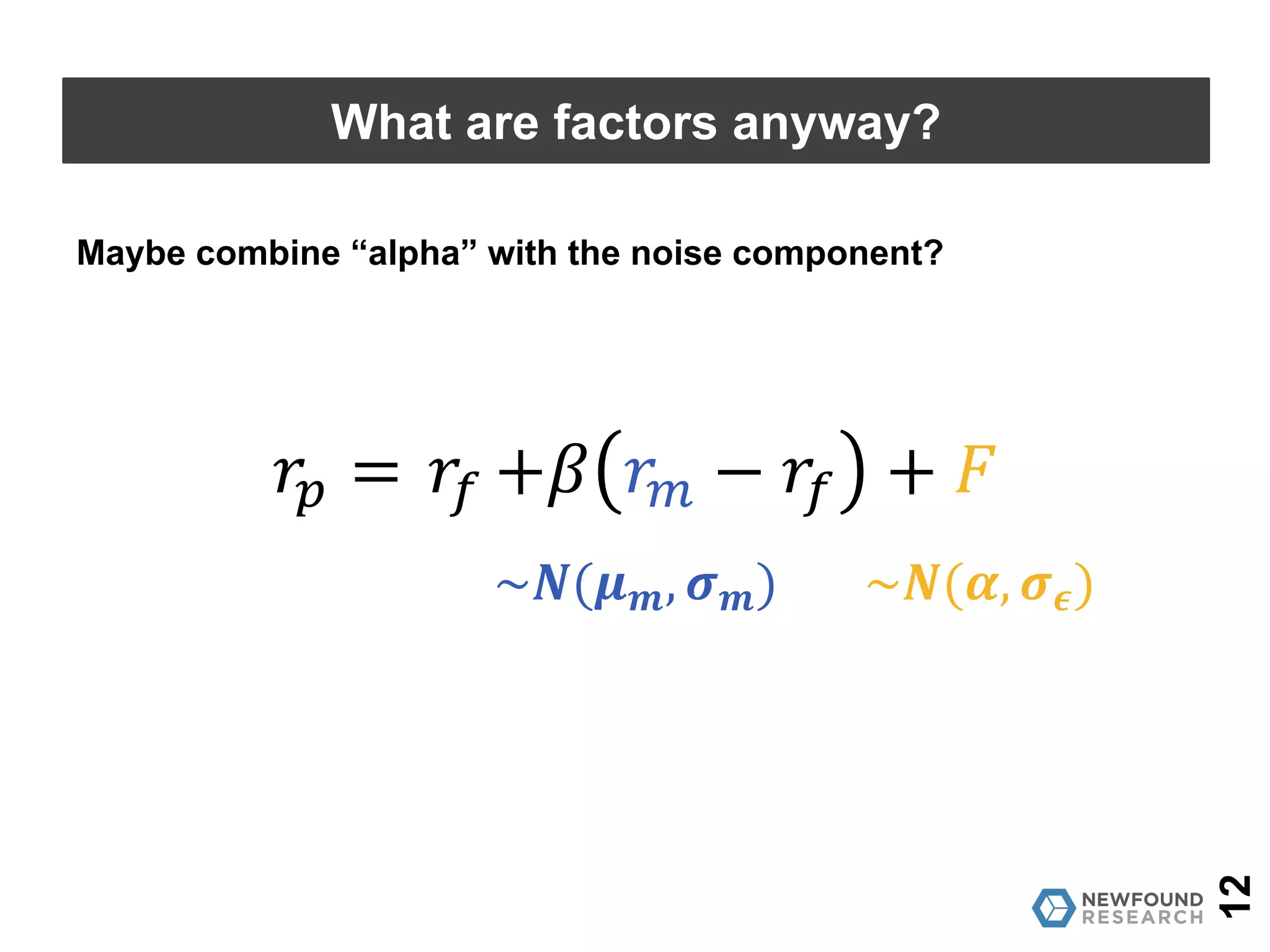

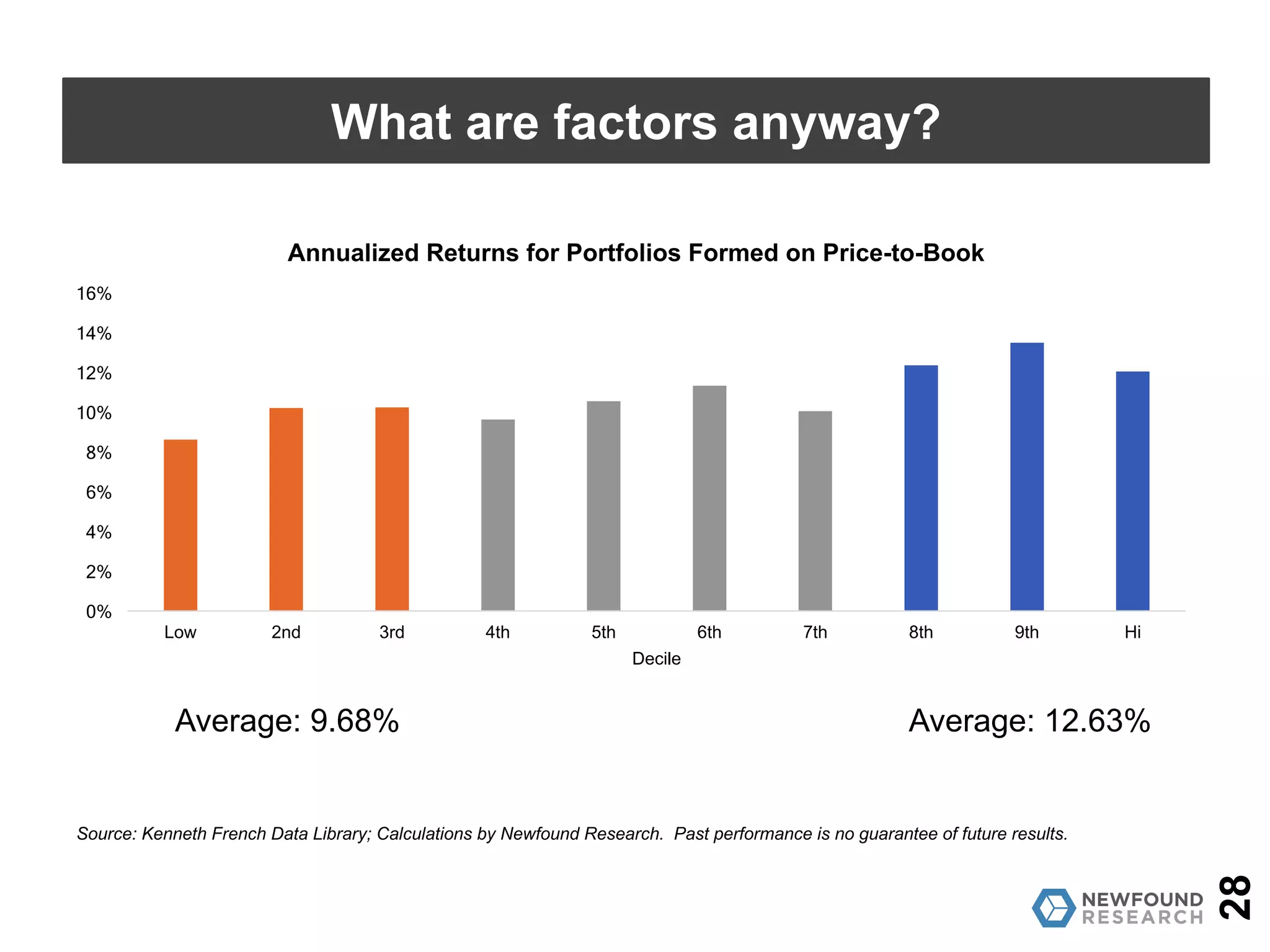

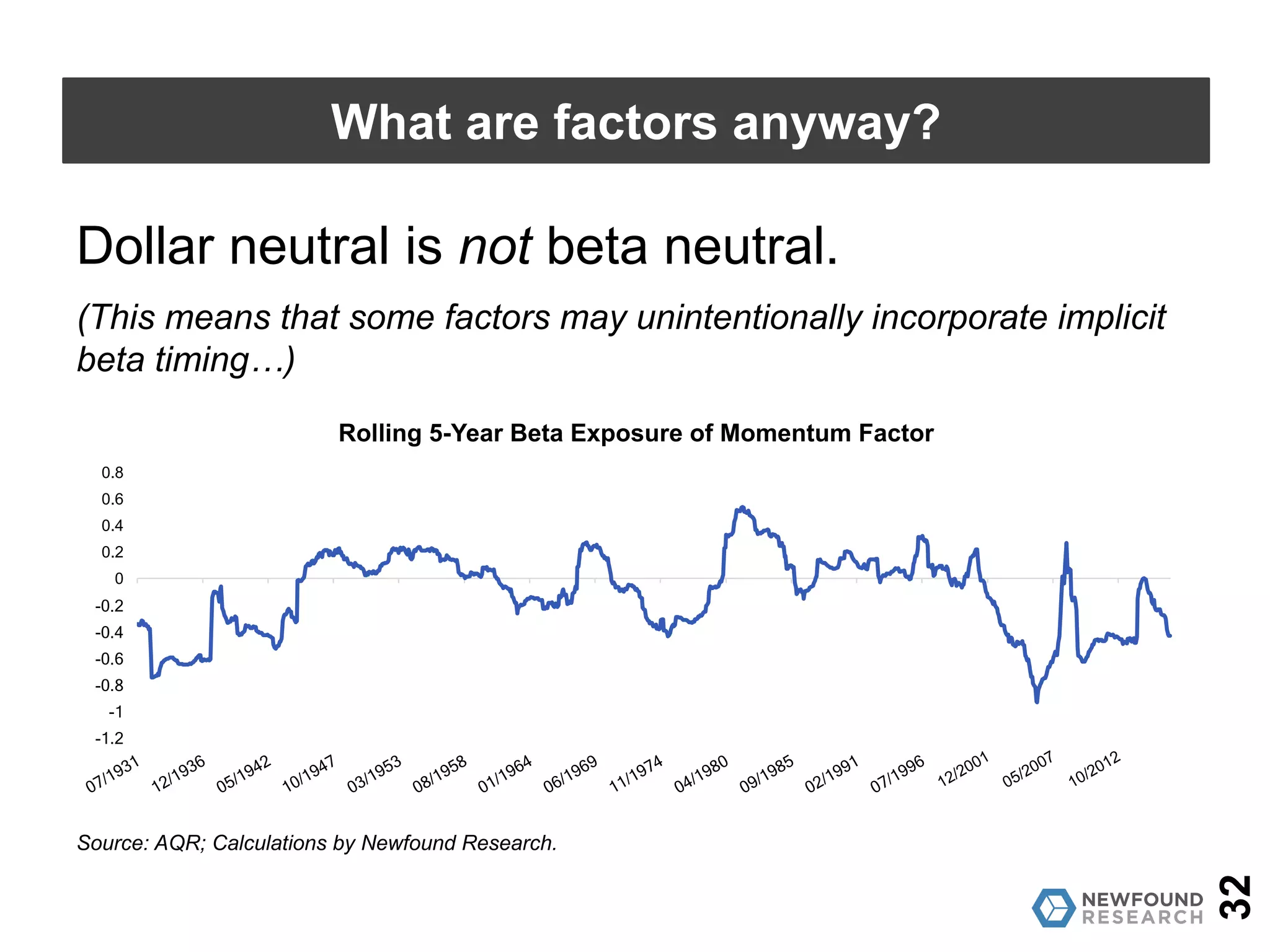

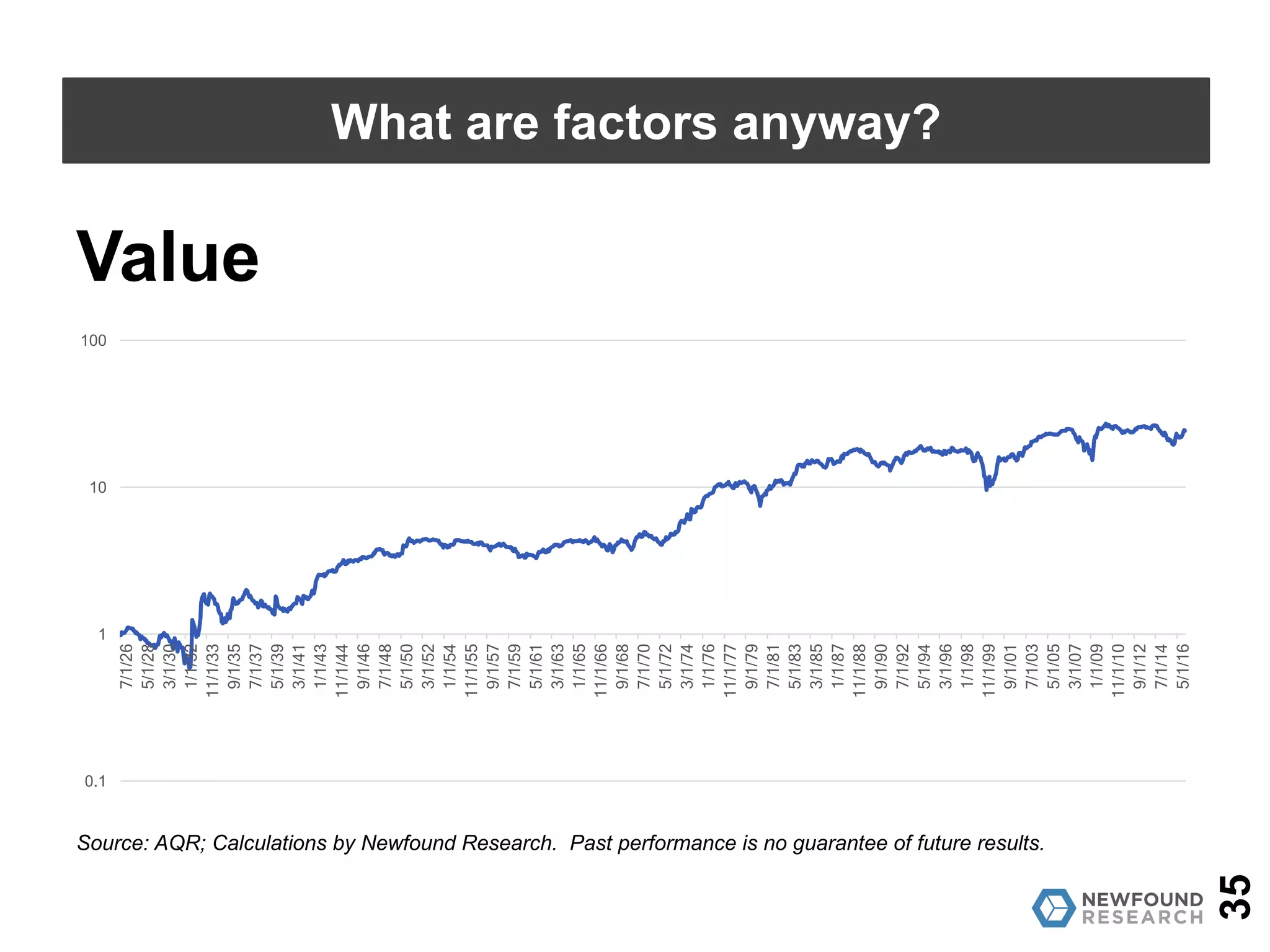

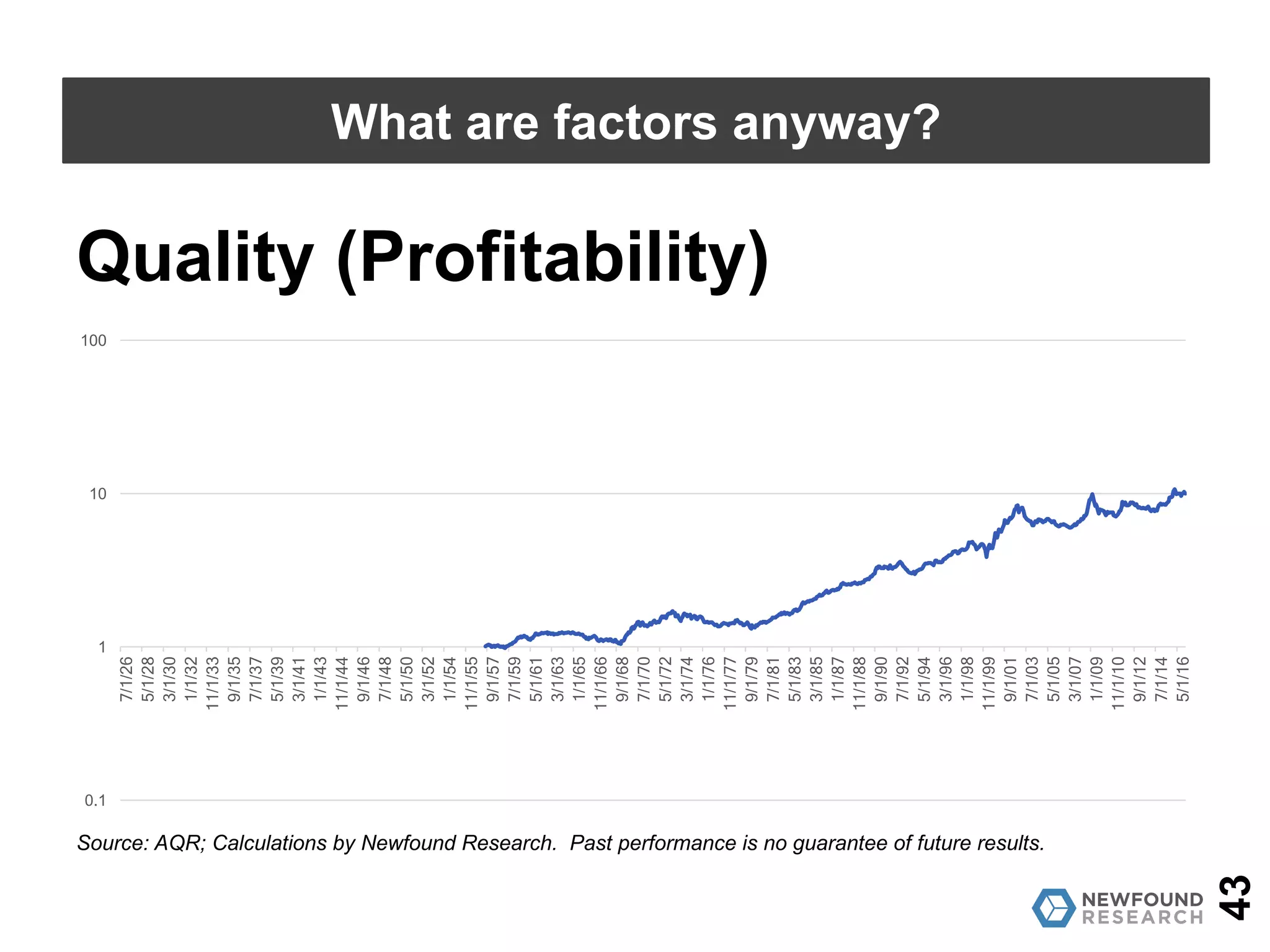

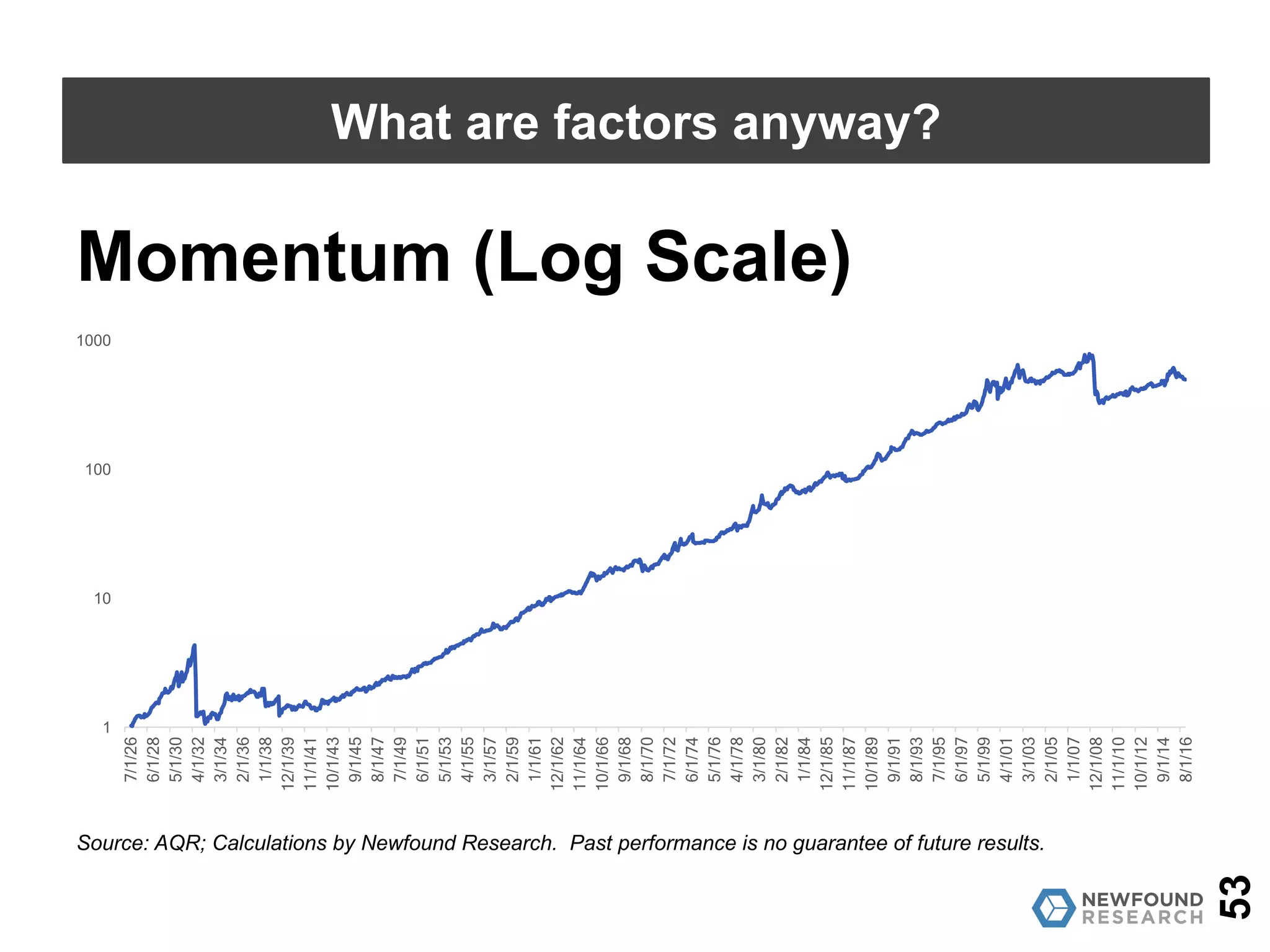

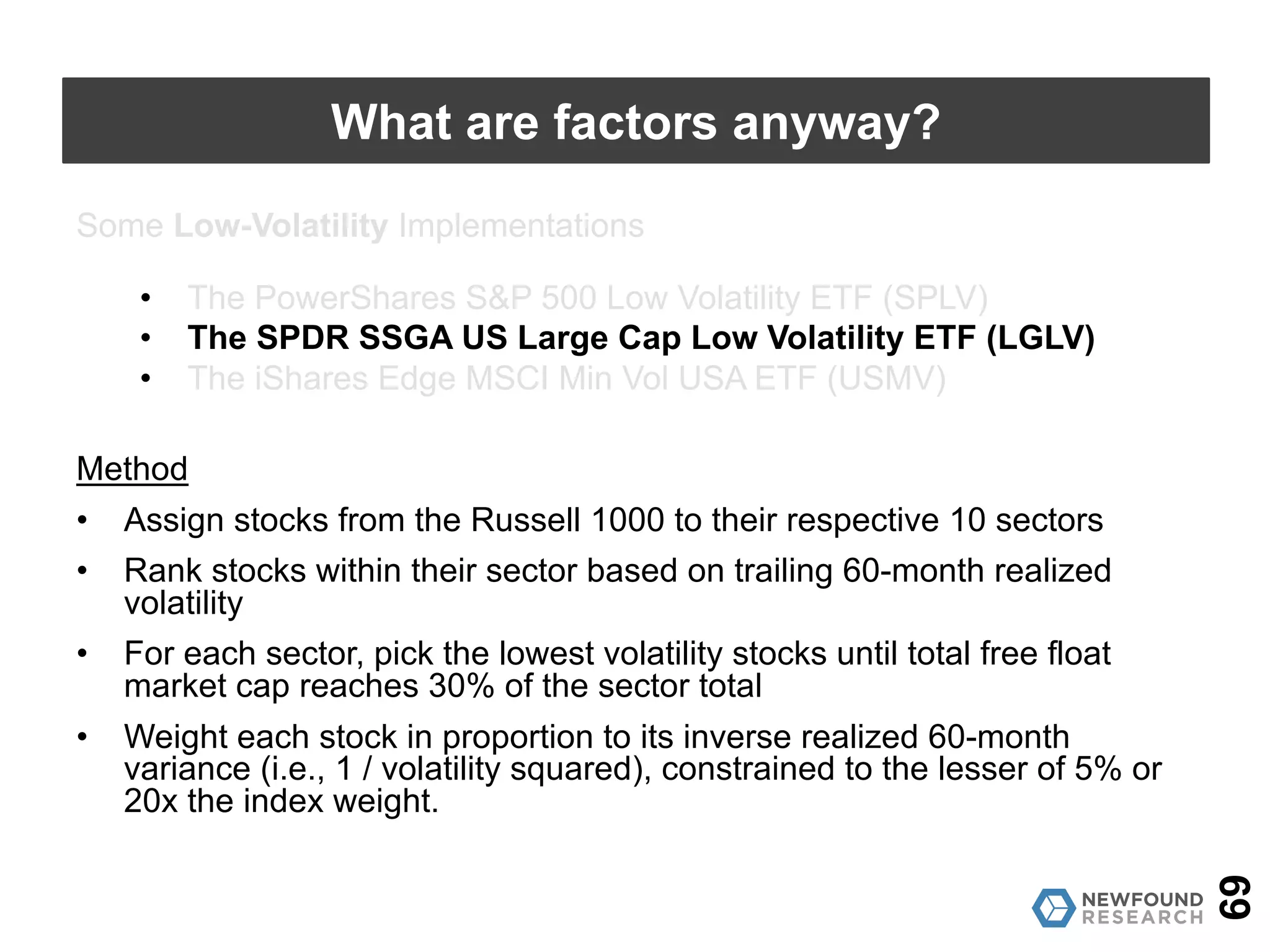

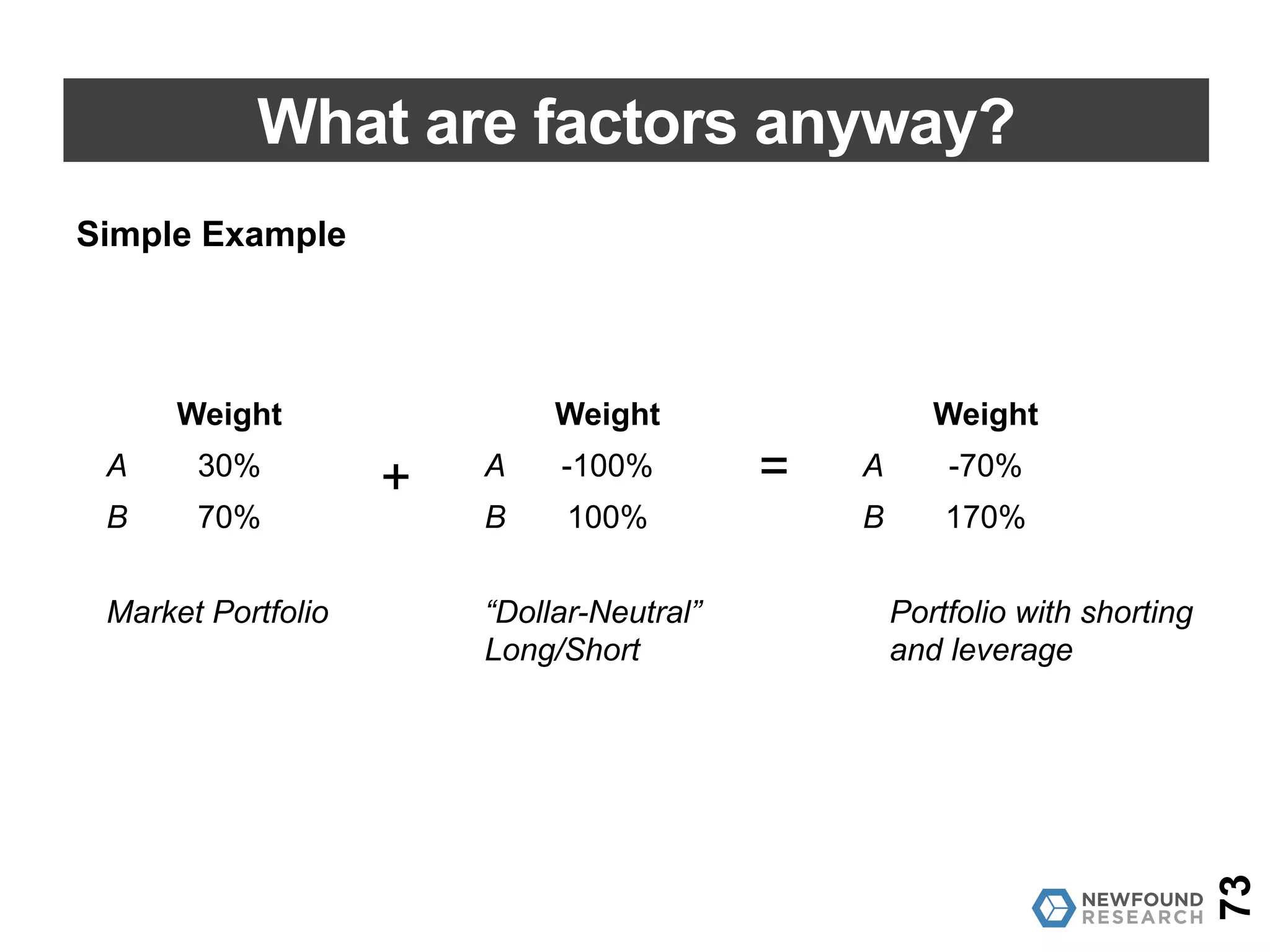

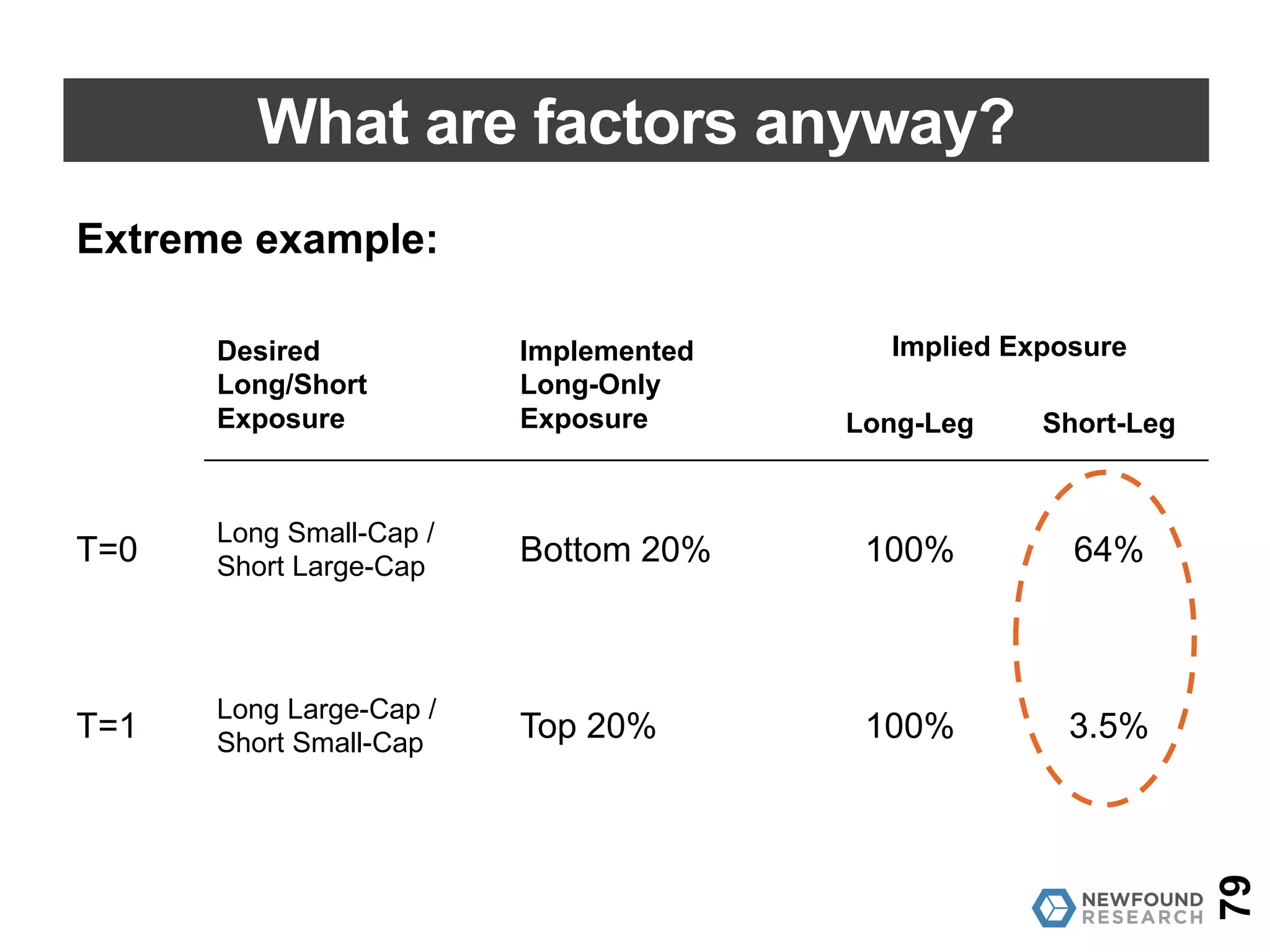

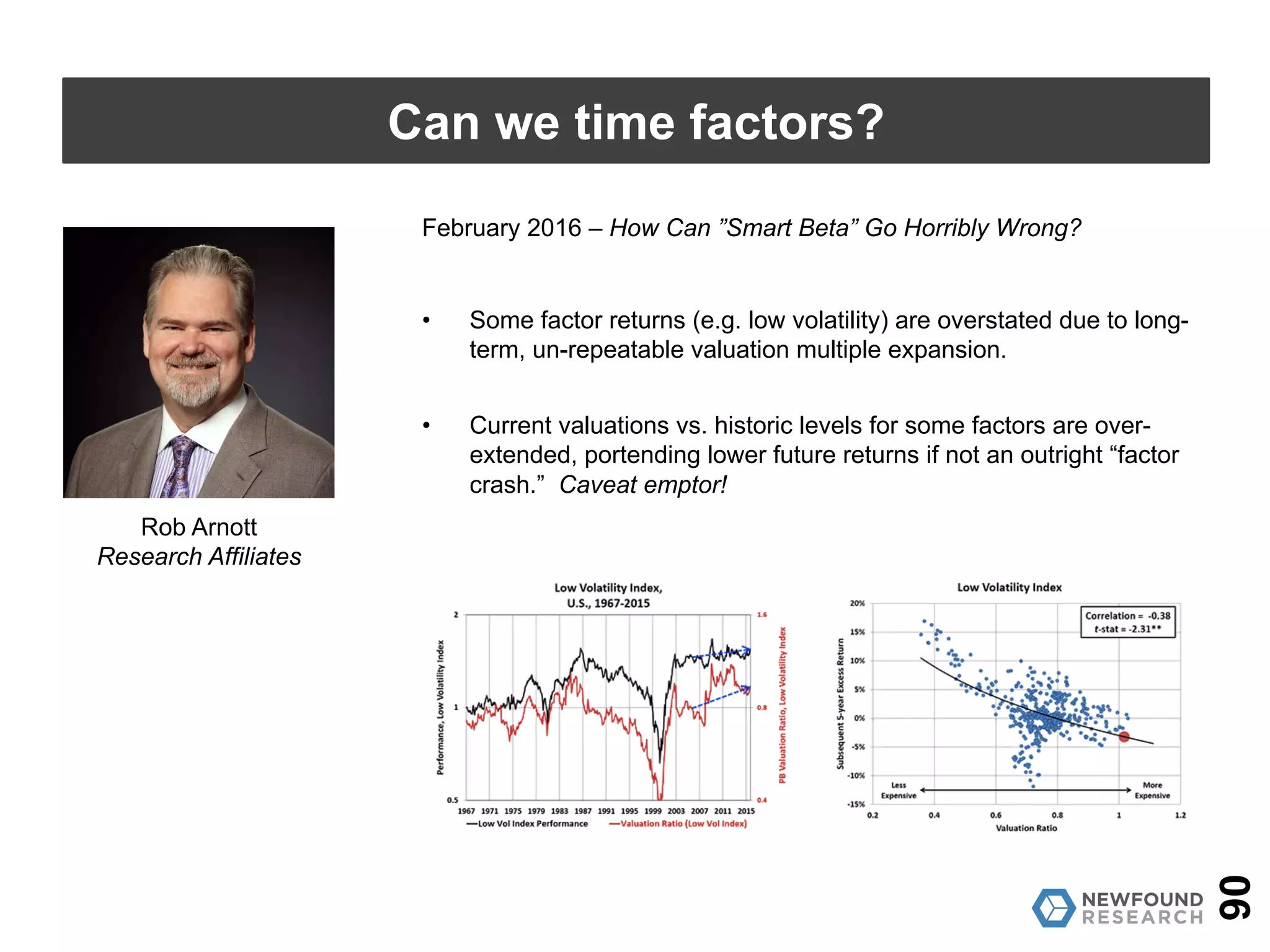

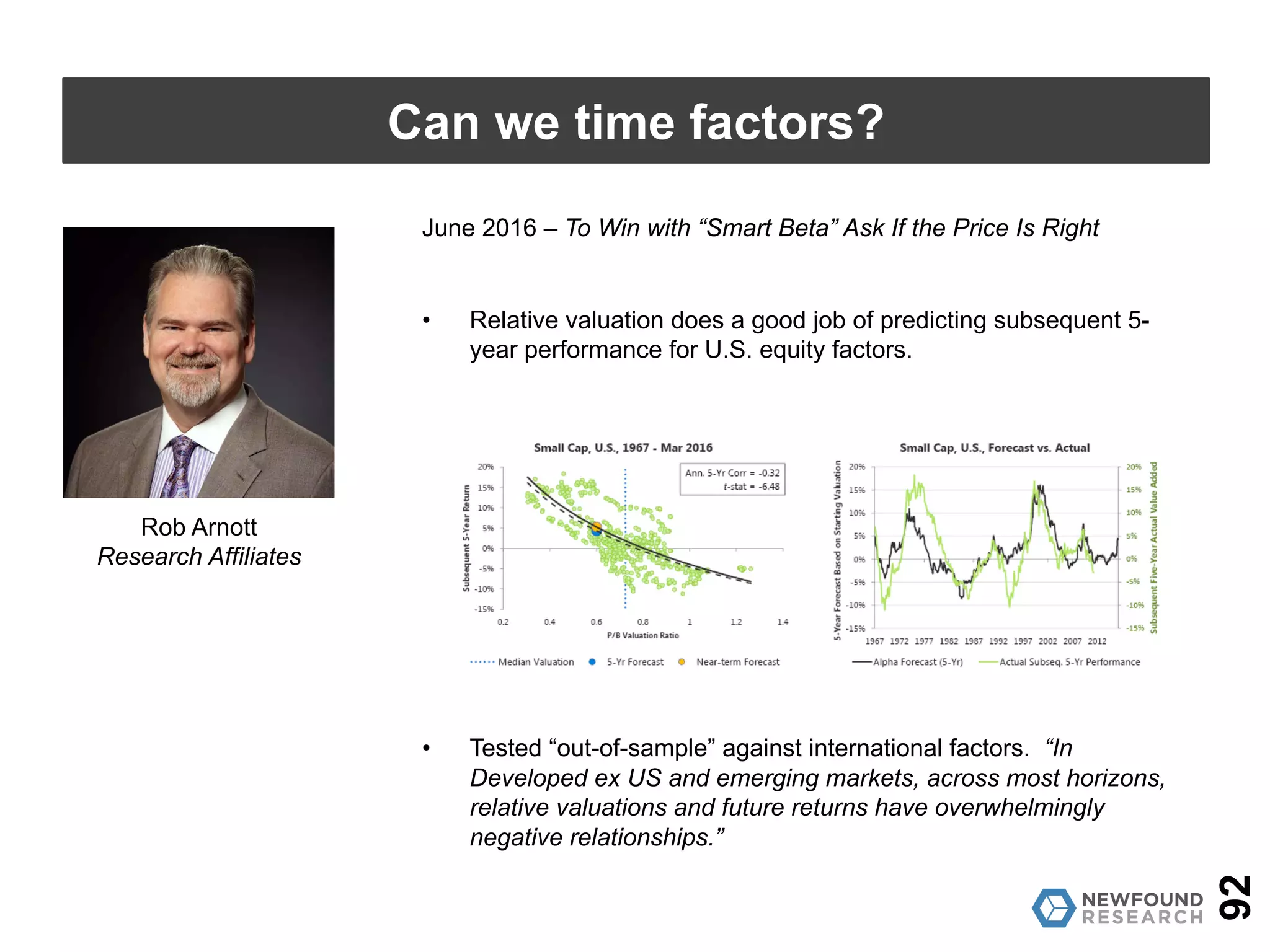

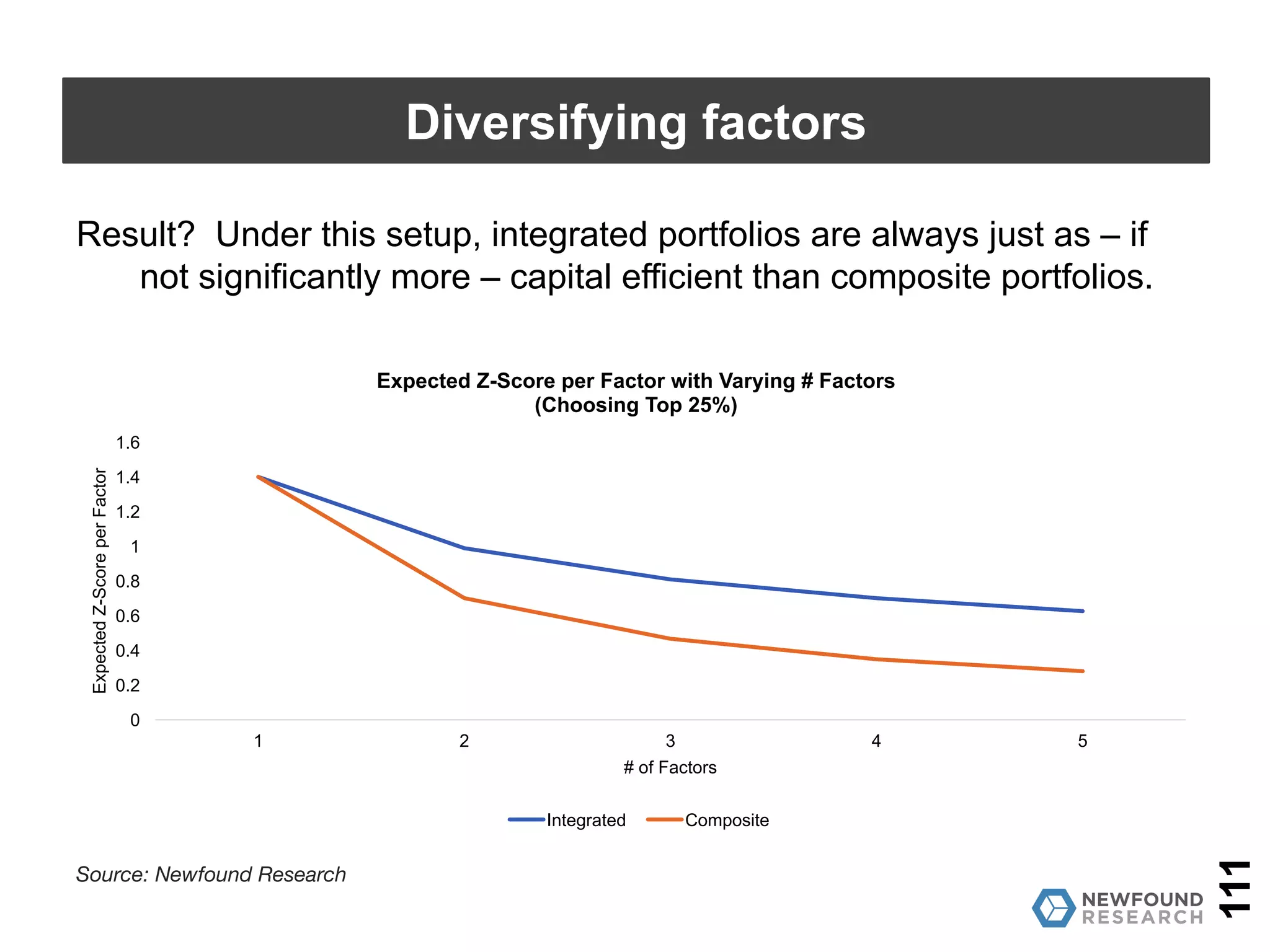

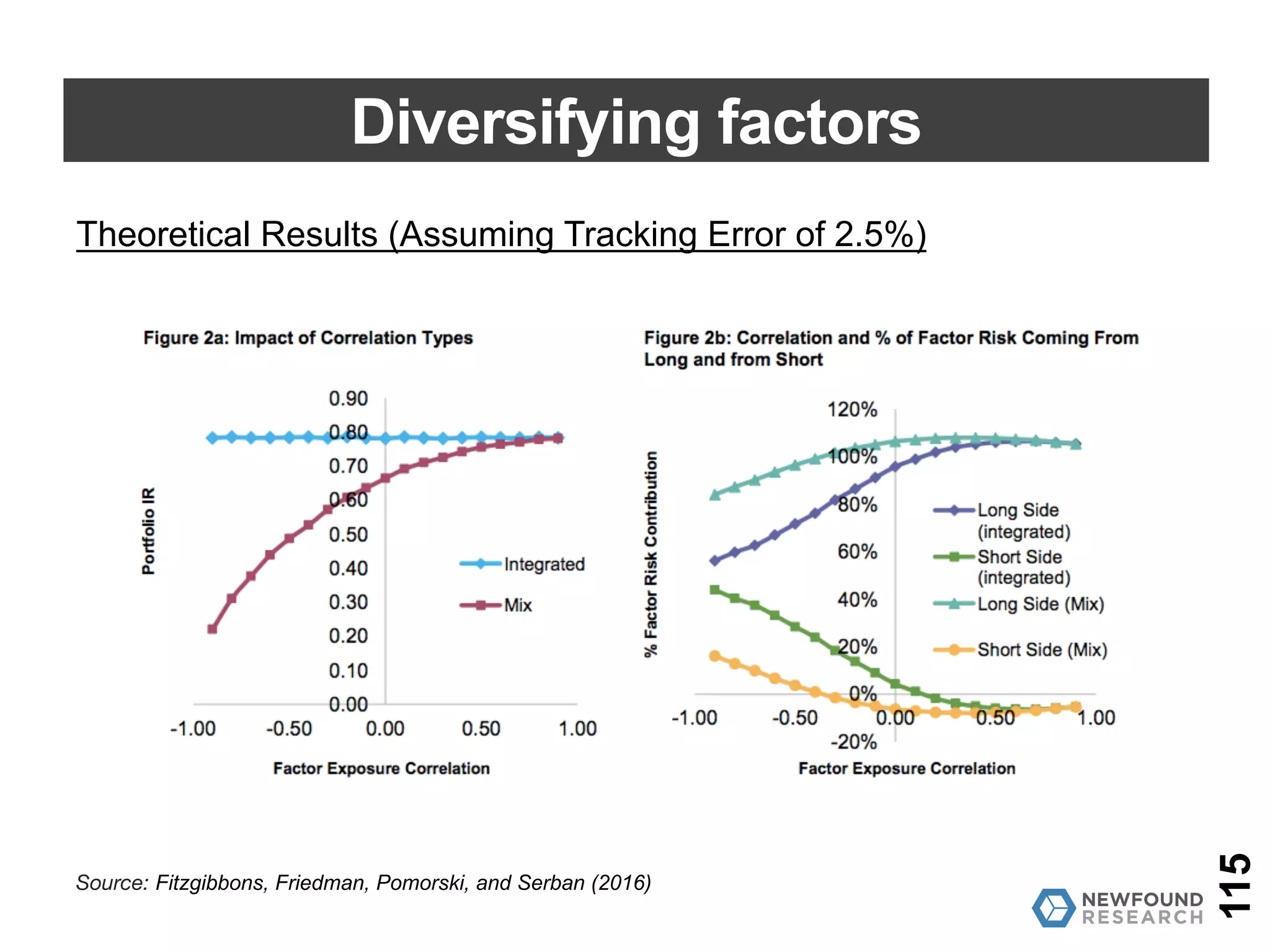

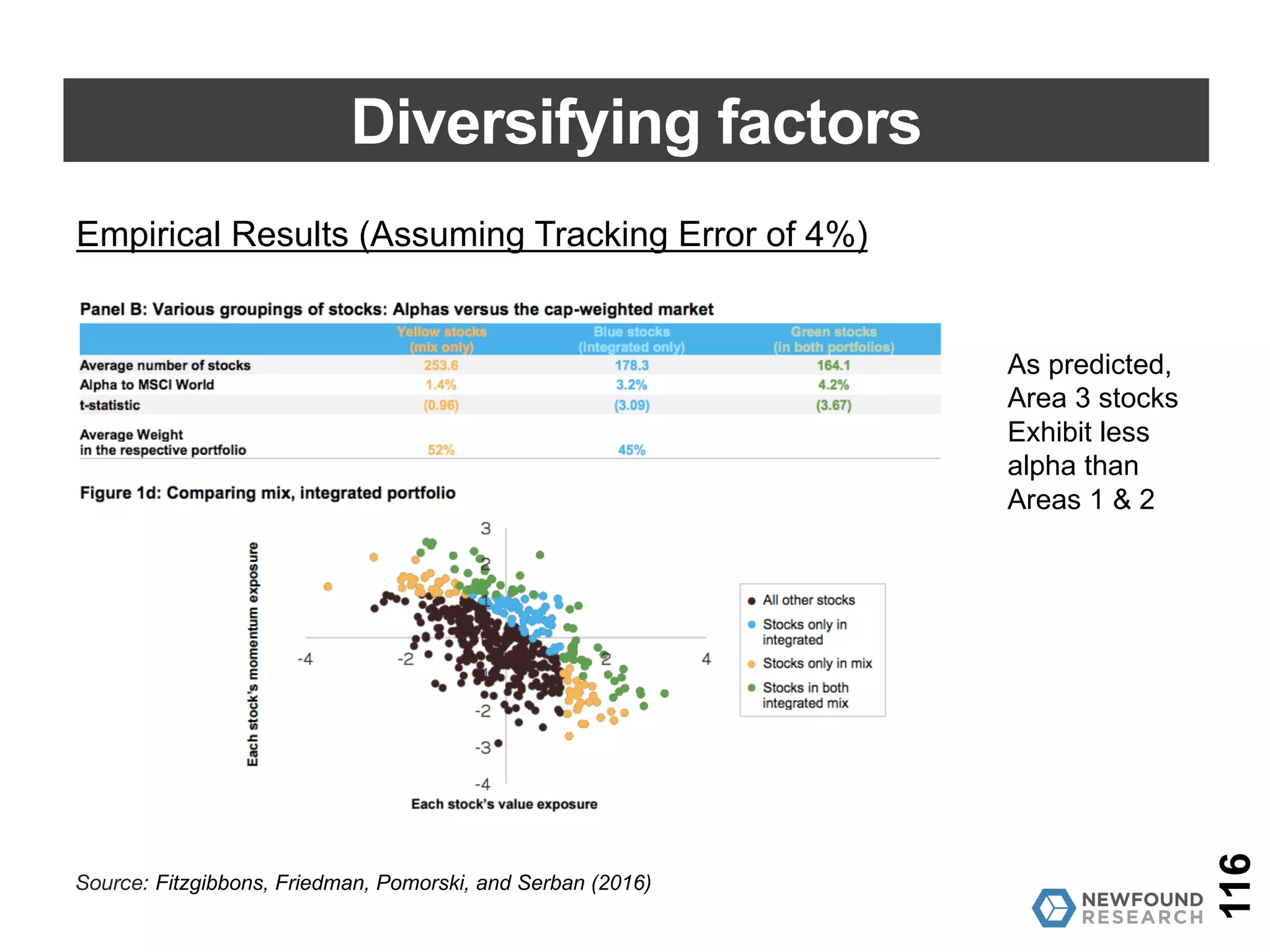

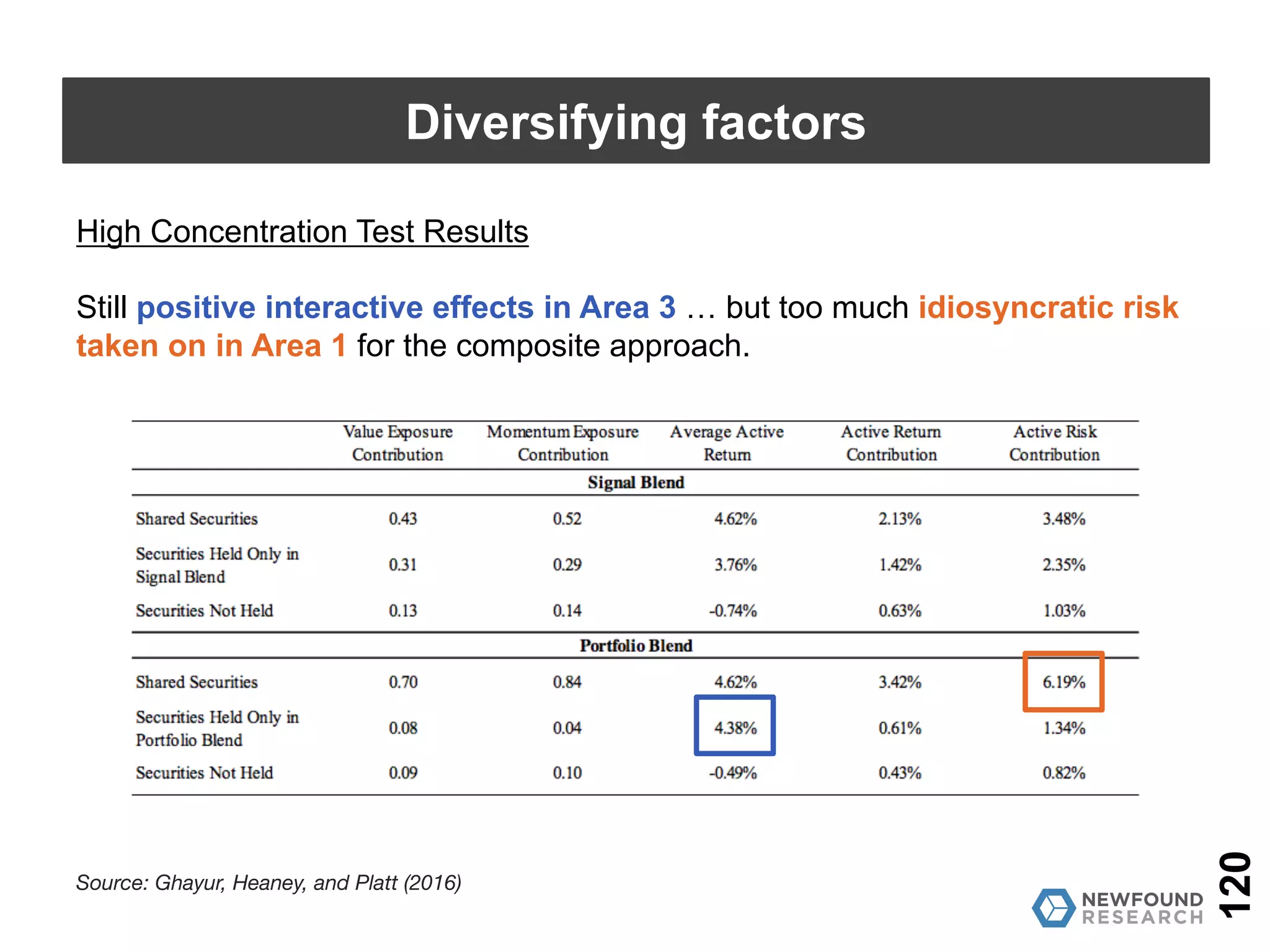

The document discusses factors in quantitative investing and how they can be managed in a portfolio, focusing on risk, behavioral biases, and market structure. It explains how factors like value, size, momentum, low-volatility, and quality are selected and implemented for potential active returns. Additionally, it highlights challenges in factor investing, including data mining concerns and the sustainability of observed factors over time.