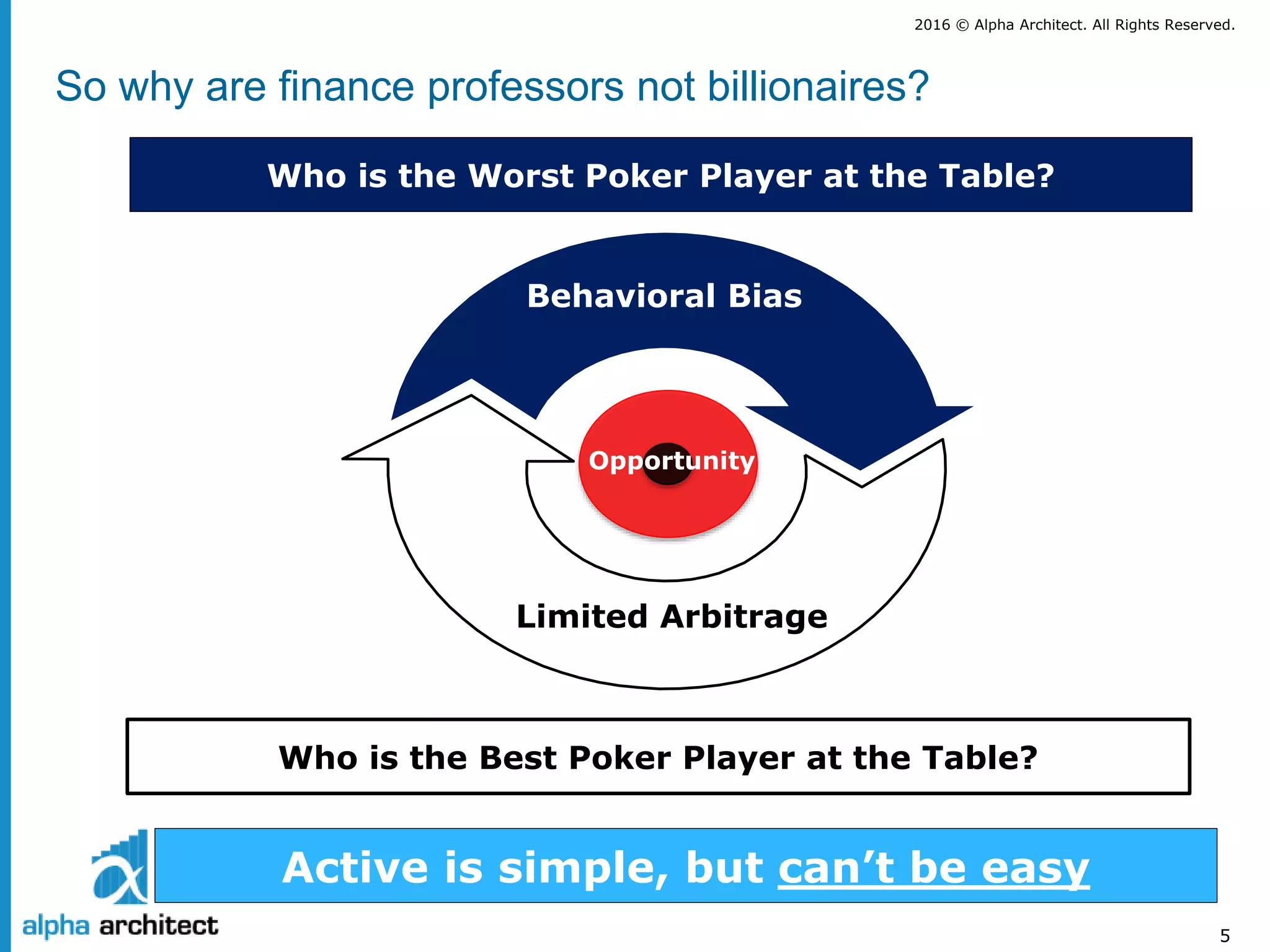

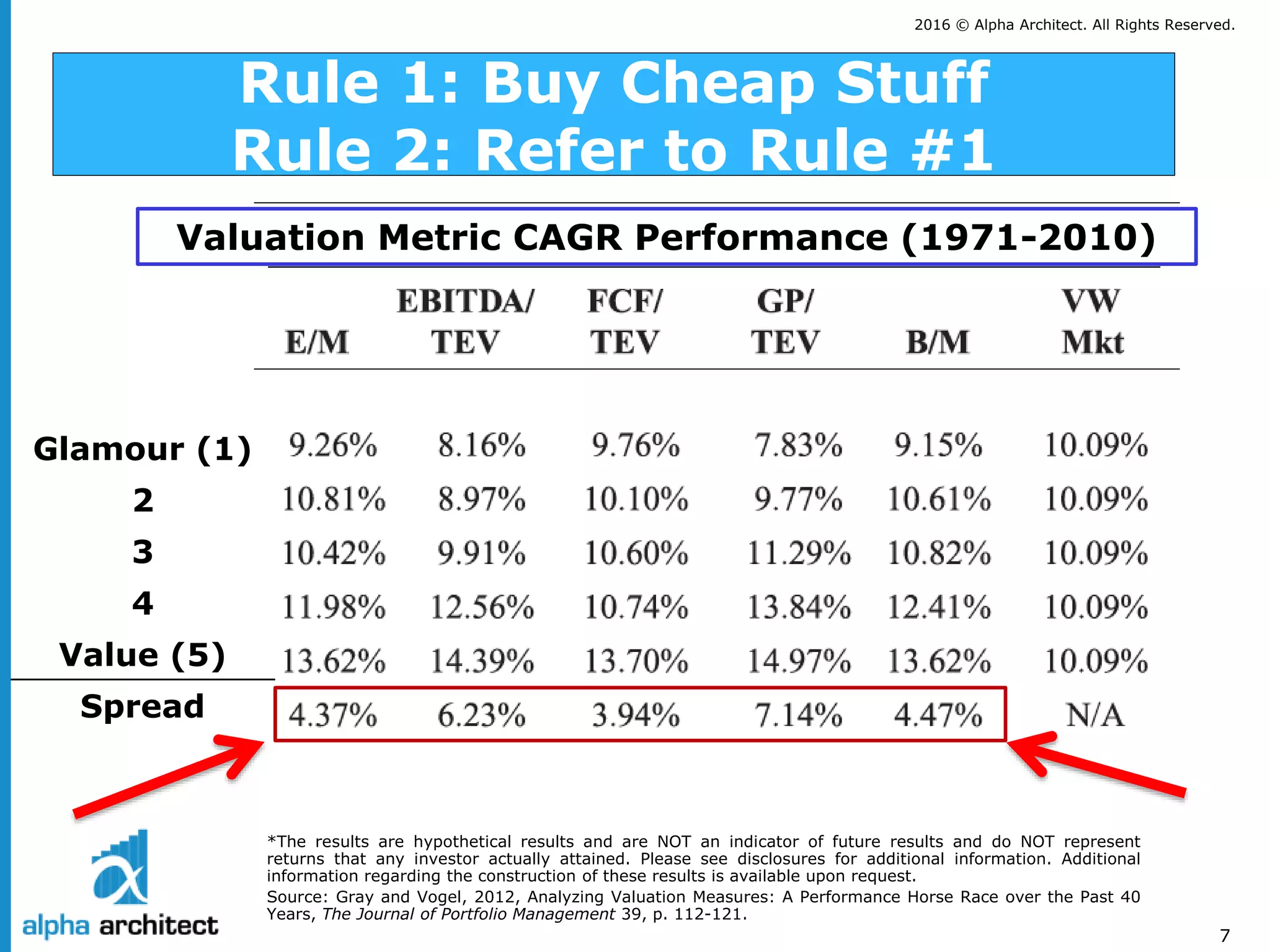

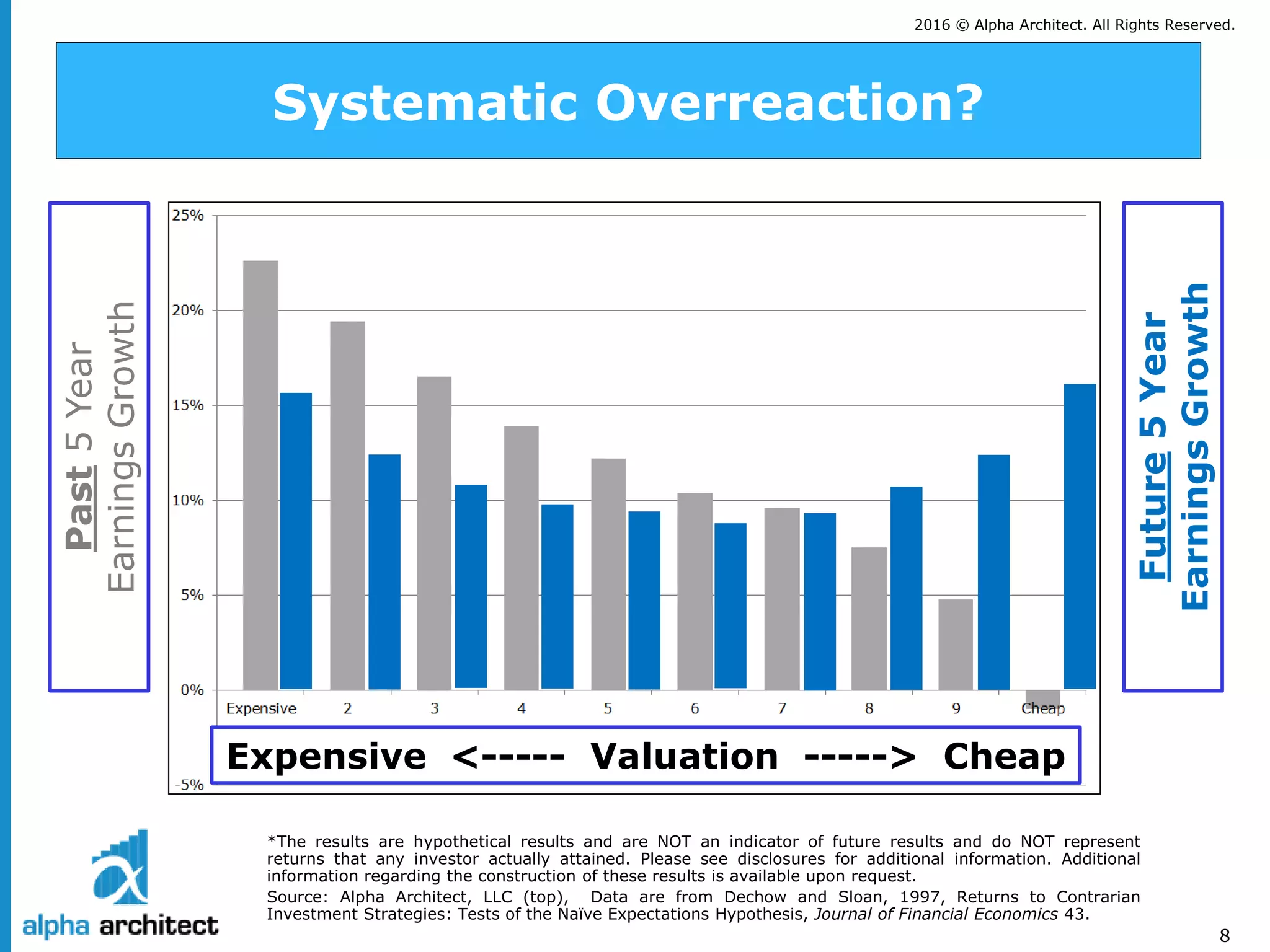

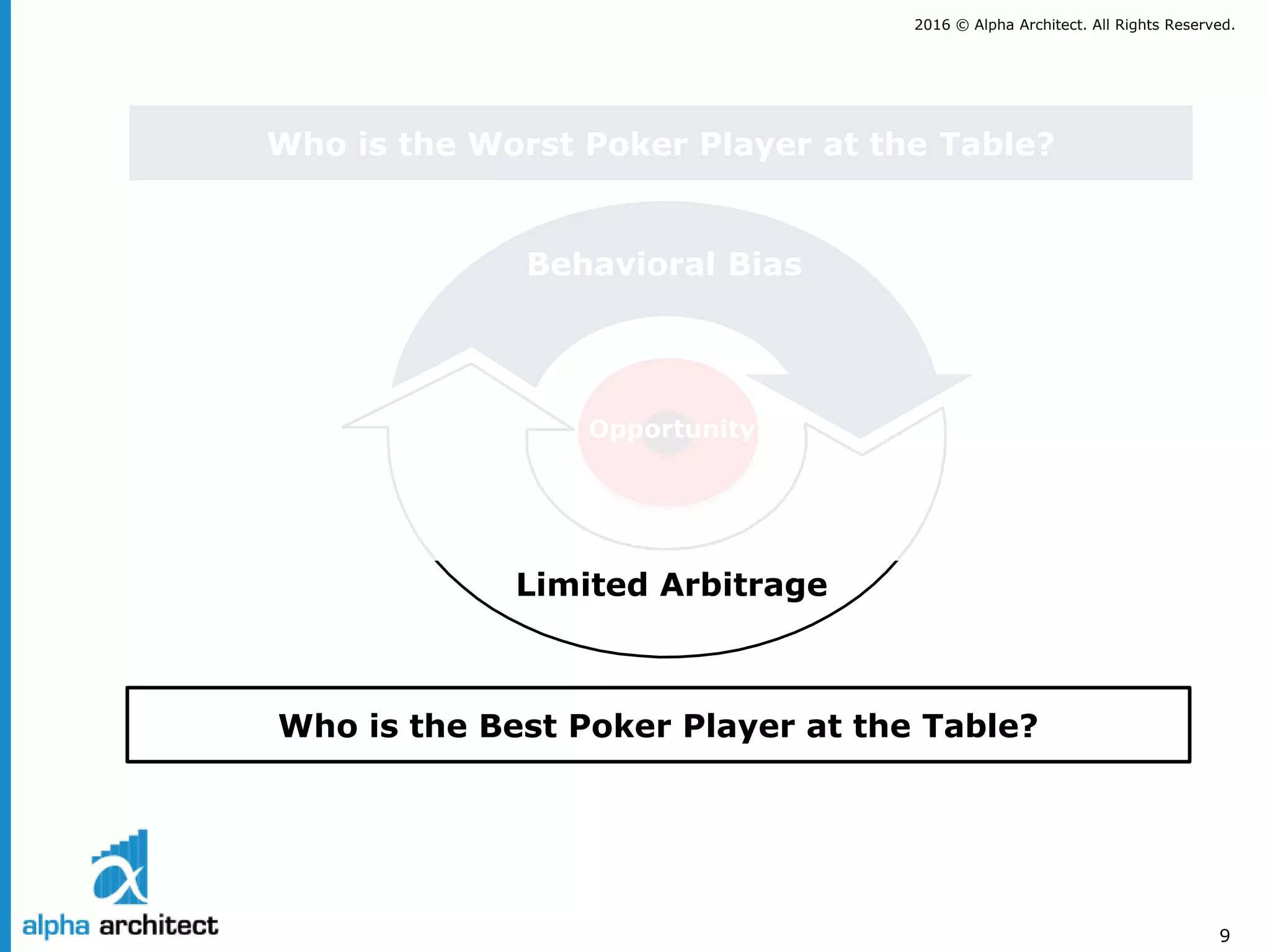

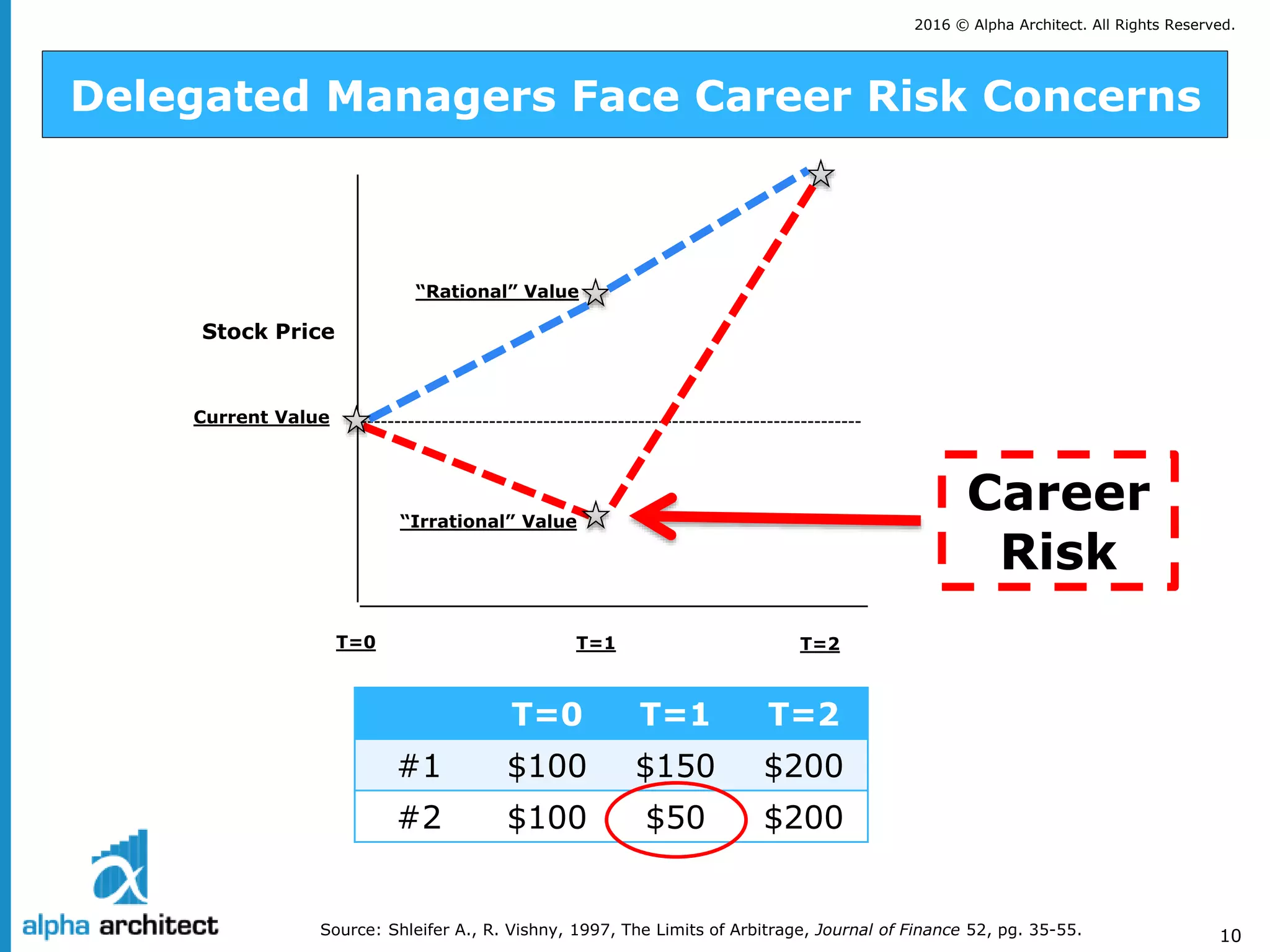

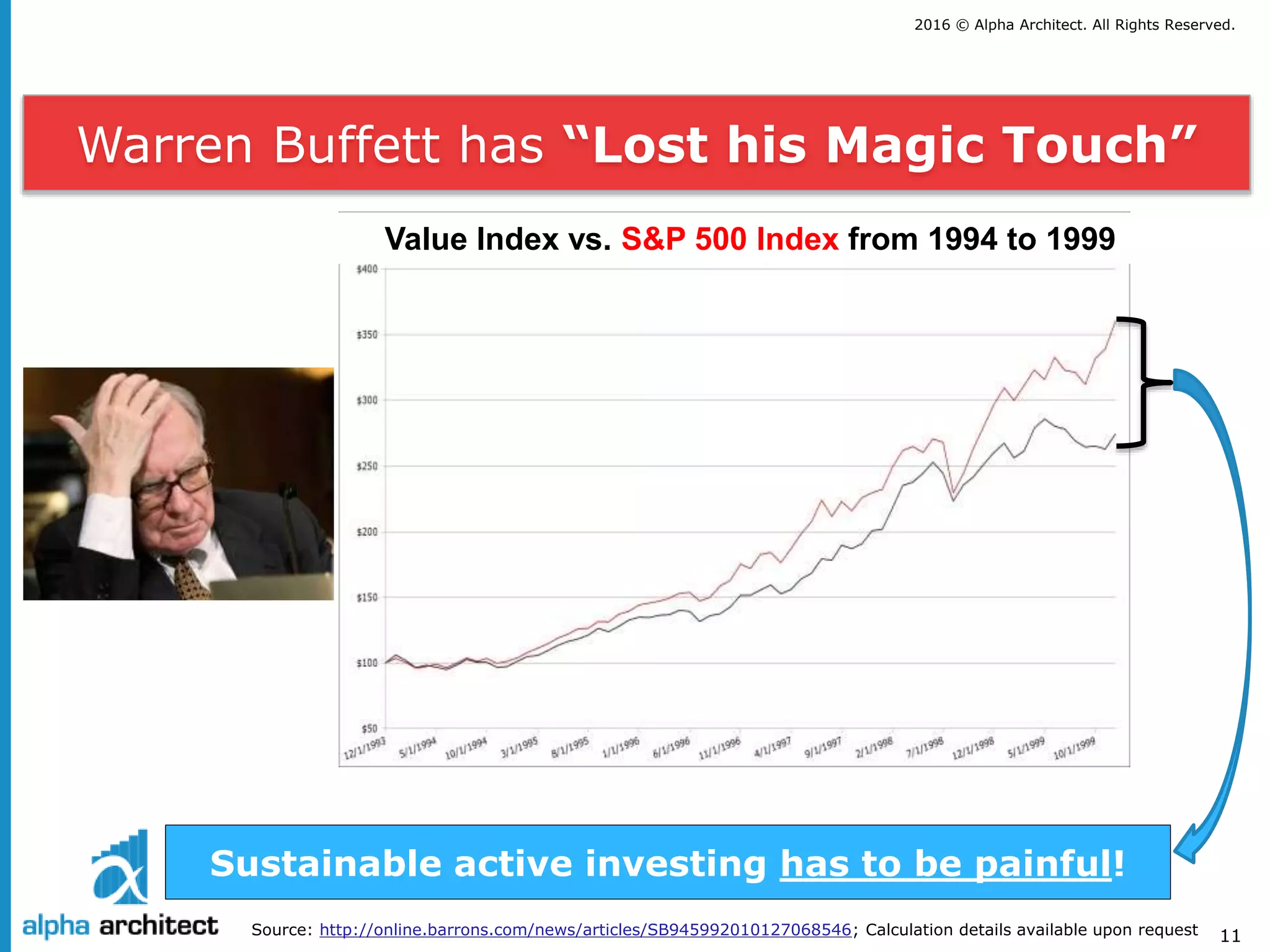

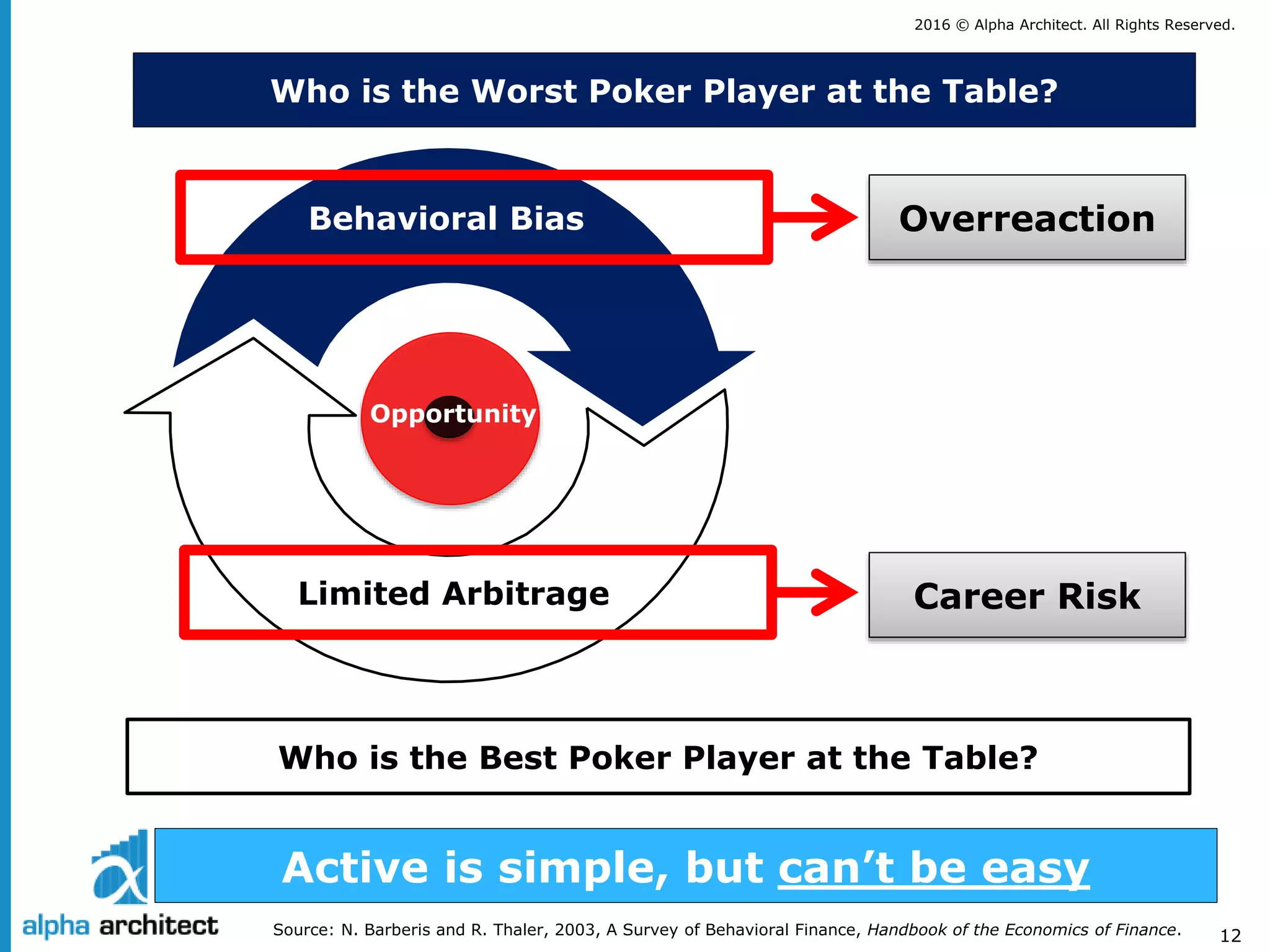

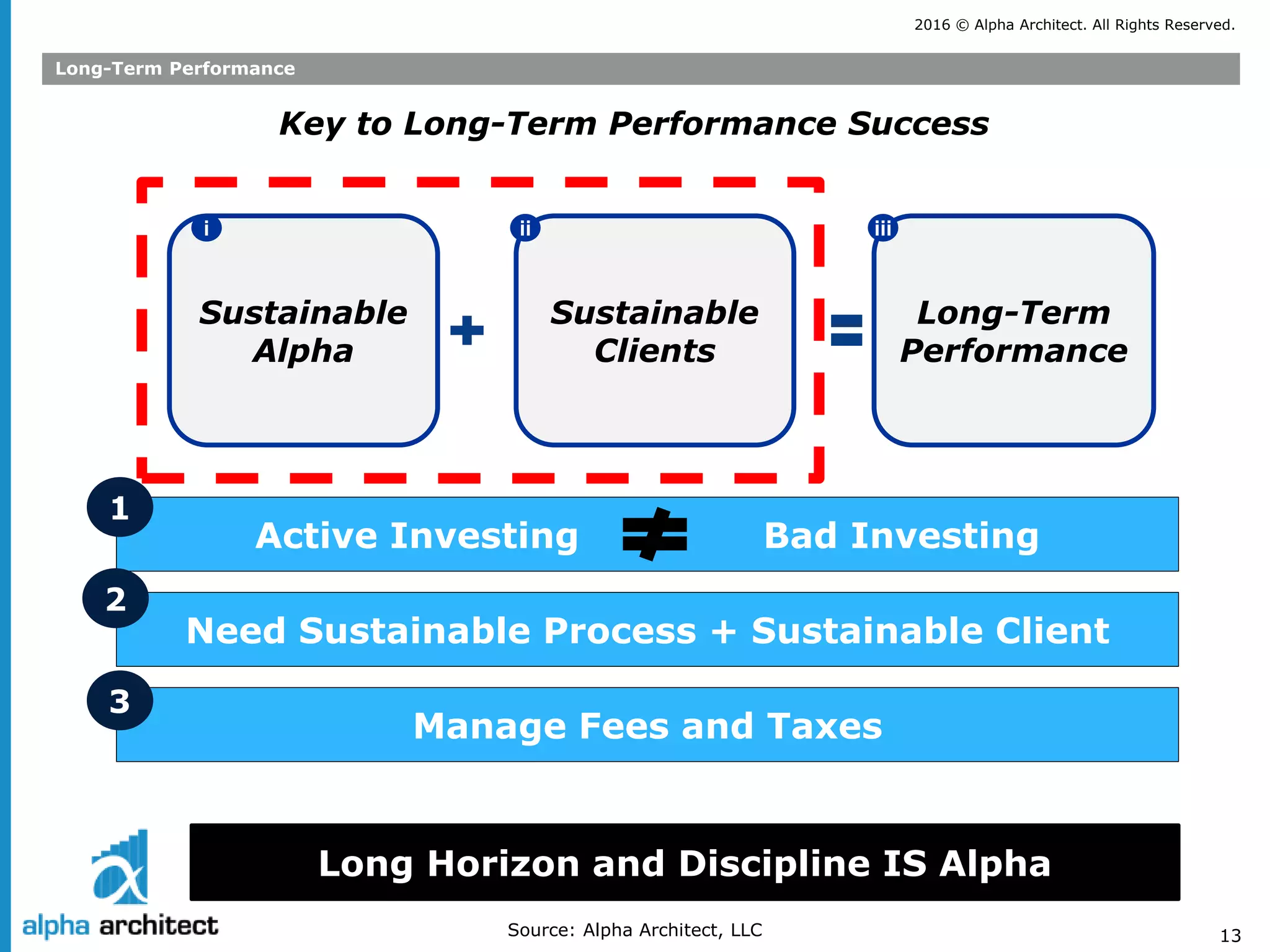

The document discusses the principles of active investing, emphasizing that while it may seem straightforward, it is complicated by human behavioral biases and market inefficiencies. It includes insights on effective strategies, such as focusing on undervalued stocks and the importance of managing investor emotions. Additionally, it warns that hypothetical performance results do not guarantee future success and investors must consider their risk tolerance.