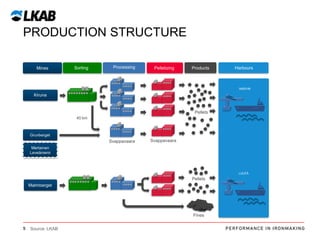

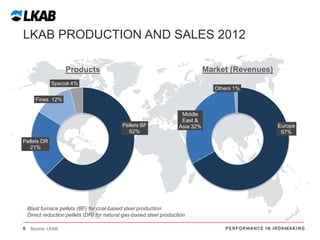

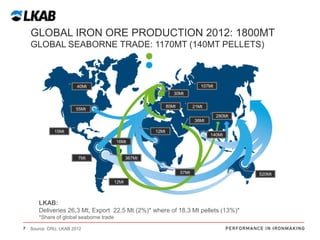

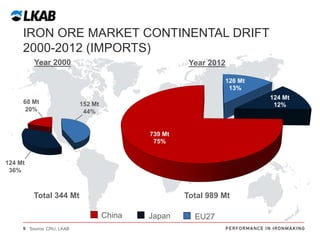

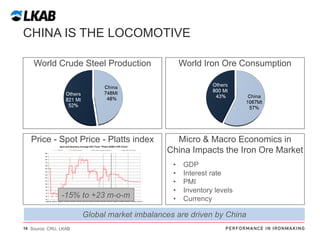

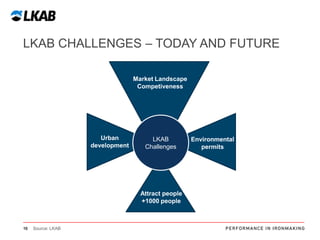

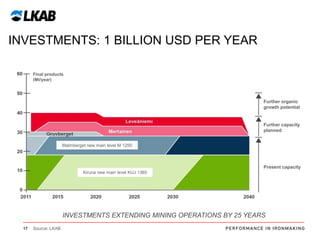

The document summarizes LKAB's position in the global iron ore industry and the challenges it faces. It notes that China accounts for over half of global iron ore demand and the top four producers control over 60% of the market. This has led to price pressure. It also discusses LKAB's investments of 1 billion USD per year to extend mining operations by 25 years at its Kiruna, Malmberget, Svappavara, and Narvik mines. Finally, it outlines LKAB's marketing and sales strategies to respond to rapid changes in the volatile iron ore market through measures like product portfolio management, quality control, customer relationships, and risk management.