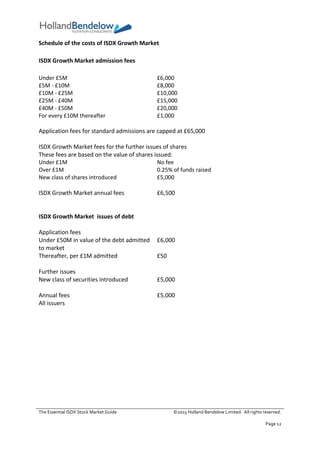

The document serves as a comprehensive guide for companies considering joining the ISDX stock market, detailing its structure, benefits, drawbacks, and procedures for joining. It outlines the ISDX Growth Market as a favorable alternative for SMEs seeking a public listing, offering straightforward admission processes and access to capital, while also highlighting potential challenges such as costs and regulatory responsibilities. The guide also emphasizes the importance of corporate governance and the ongoing obligations for companies post-admission.