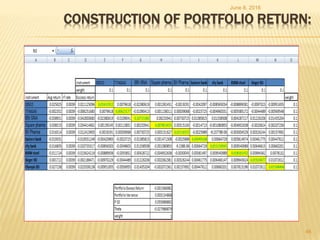

This document discusses efficient portfolio construction. It begins by outlining the objectives of constructing a diversified portfolio to maximize returns while minimizing risks. It then describes the 8 steps to calculate portfolio weights using different methods, including maximizing returns for a given risk and minimizing risk for a given return with and without allowing short selling. The document provides background on portfolio management and selection criteria for sectors and shares to include in the efficient portfolio. The goal is to select stocks that optimize the portfolio's excess return per unit of risk.