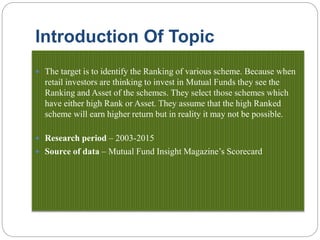

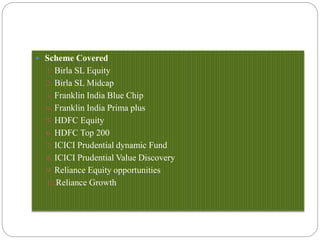

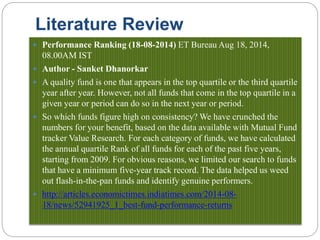

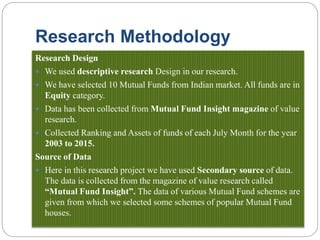

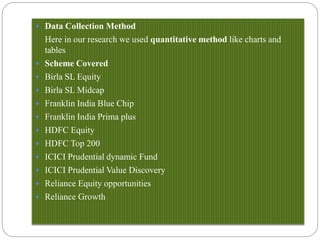

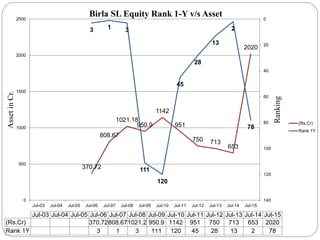

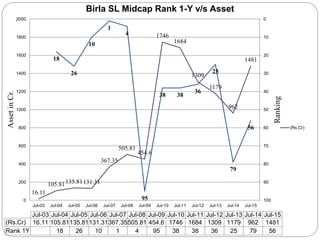

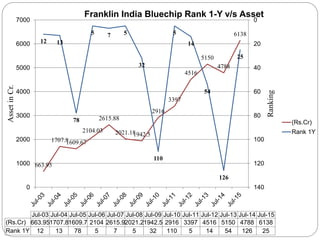

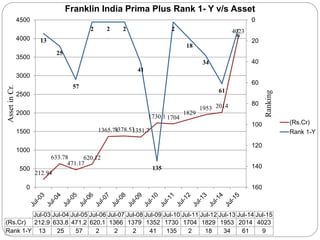

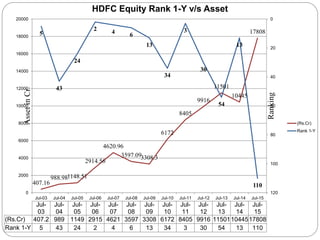

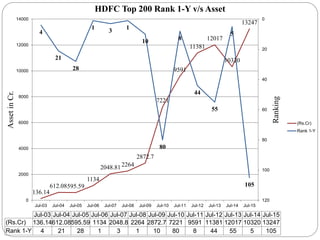

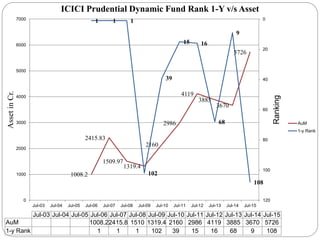

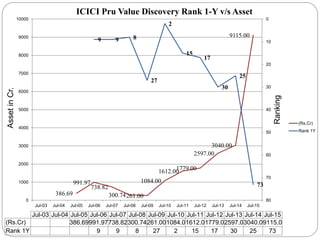

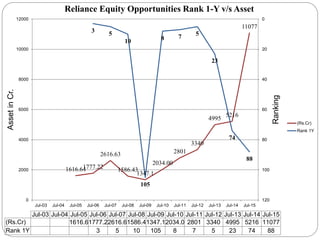

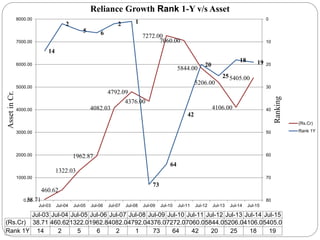

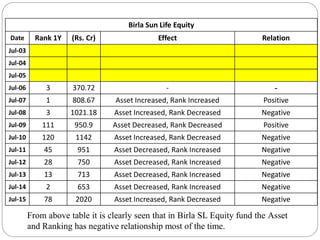

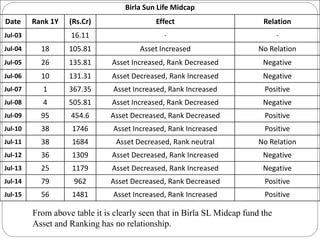

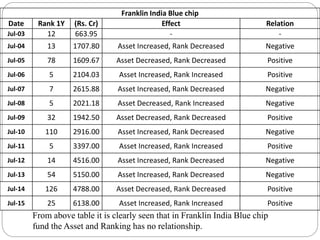

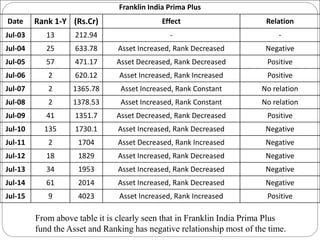

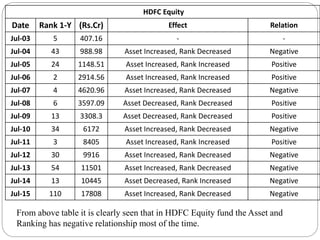

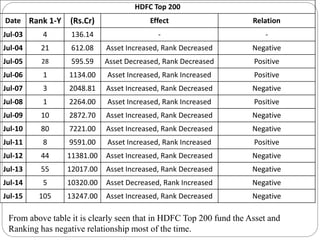

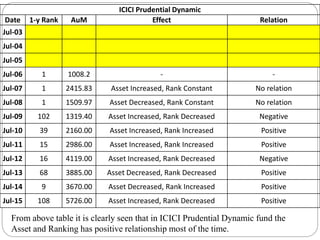

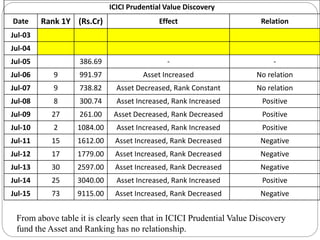

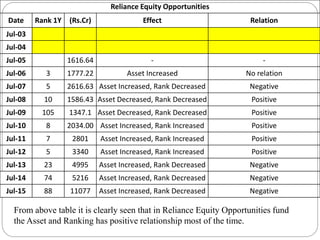

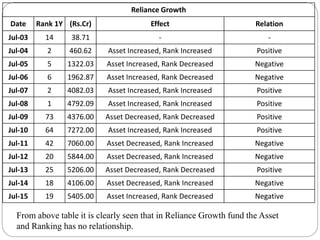

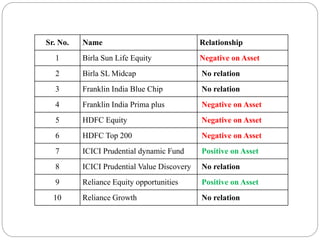

The document is a presentation on a study of selected mutual fund schemes' ranking in relation to their assets under management (AUM) from 2003-2015. It includes an industry overview of mutual funds, summaries of various research papers on mutual fund performance and rankings, and data analysis comparing the annual ranking and AUM of 10 popular mutual fund schemes over the study period. The data shows varying relationships between scheme rankings and AUMs year to year.