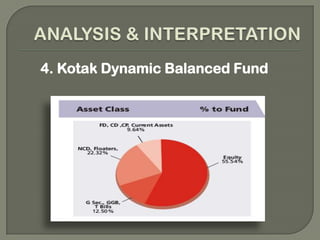

The research report presents a comprehensive study of portfolio management within Kotak Life Insurance, focusing on risk minimization, capital appreciation, and performance analysis of various mutual funds. It highlights the findings that equity-based portfolios generally show negative utility while the Kotak Dynamic Floor Fund delivered a return of 11.32% in the past year. Recommendations emphasize the importance of diversification and analytical approaches in investment strategy for better returns.