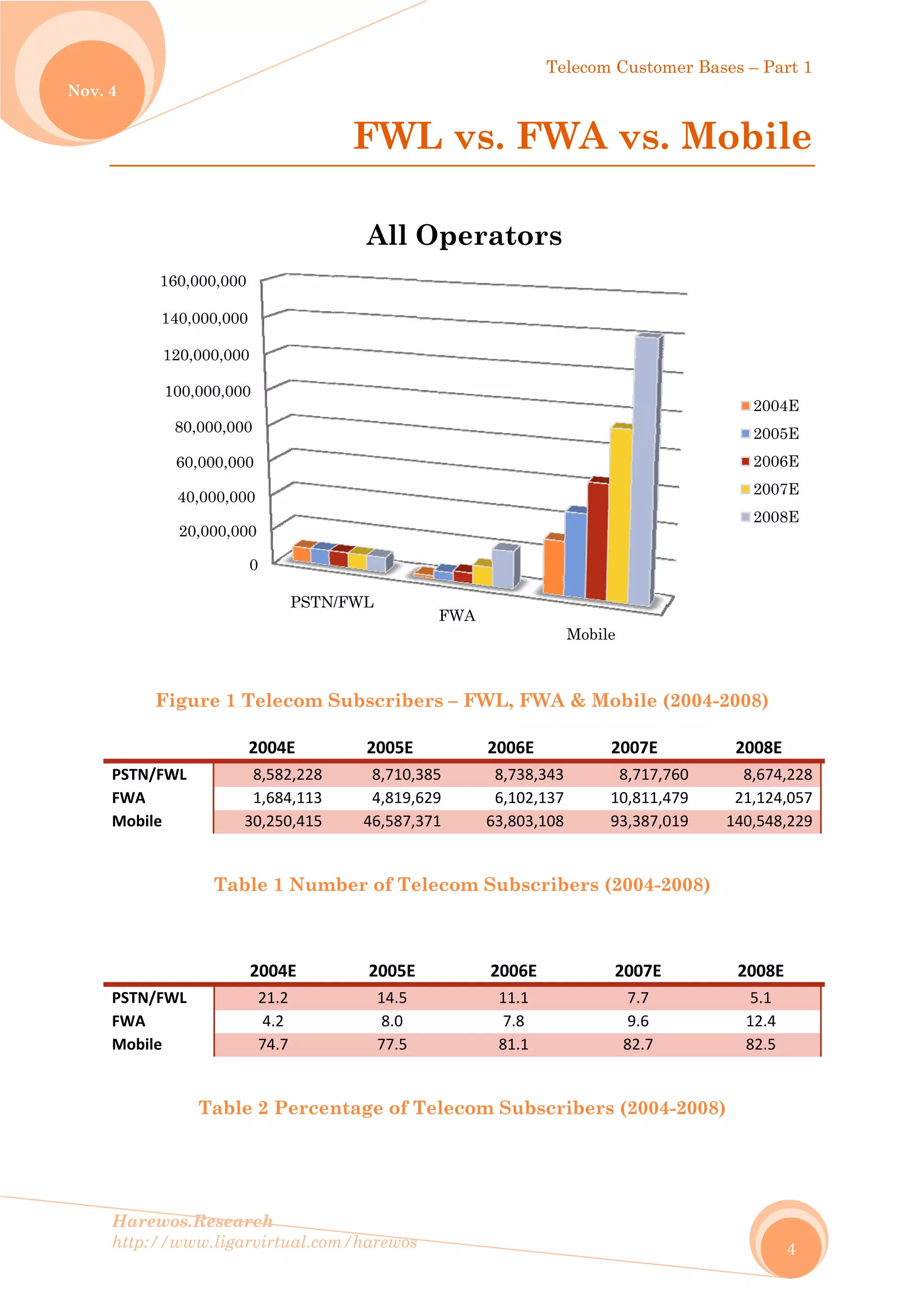

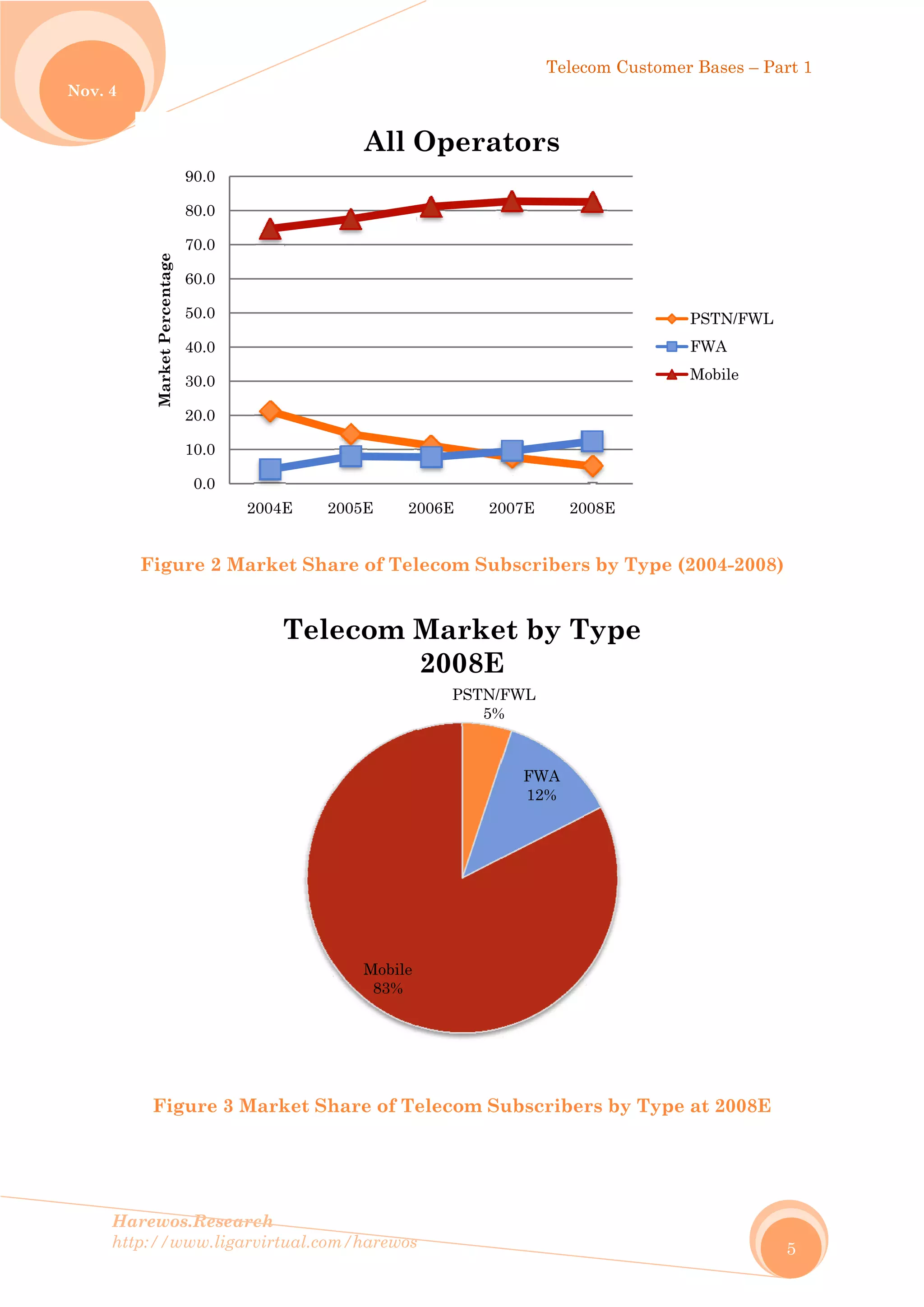

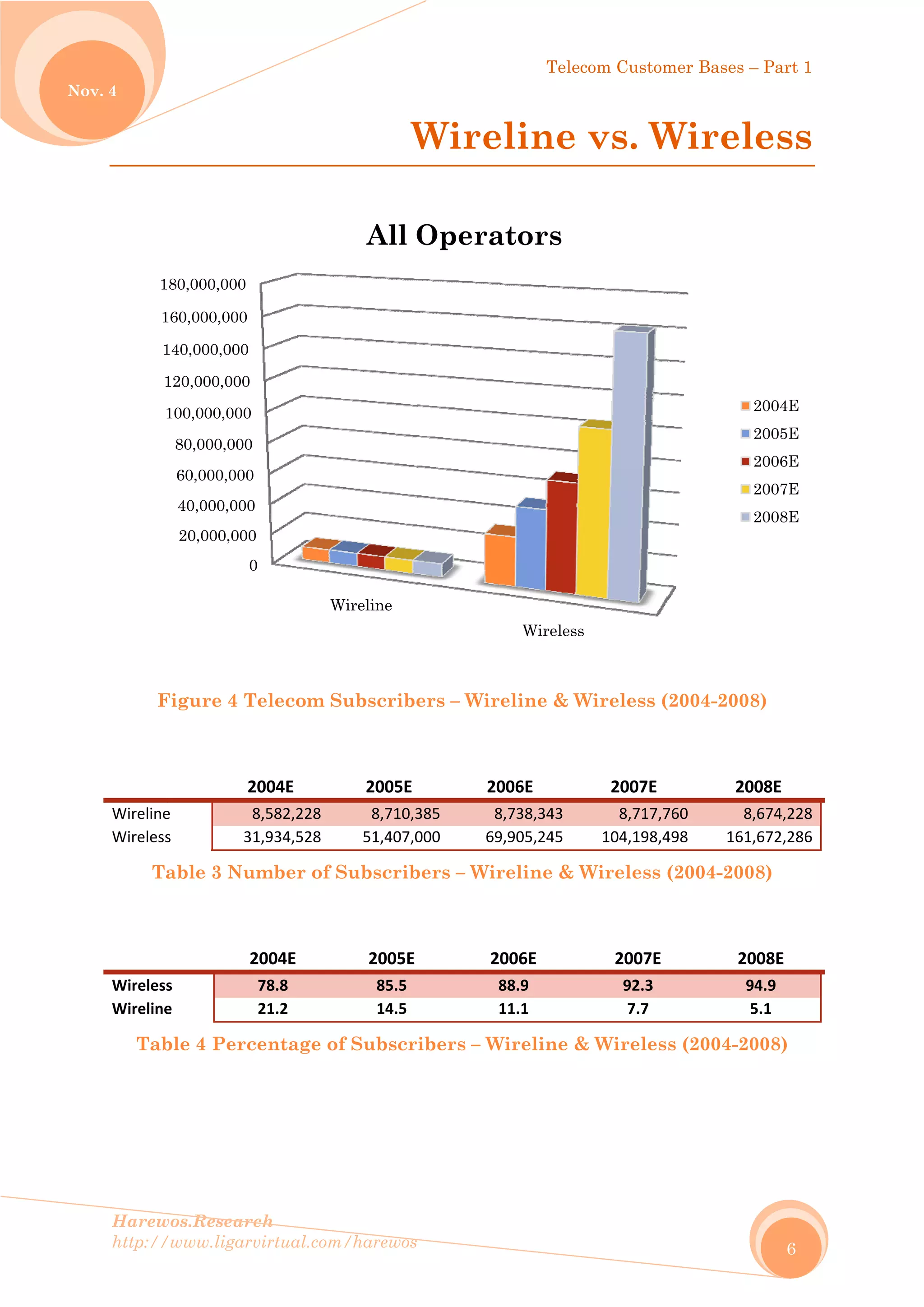

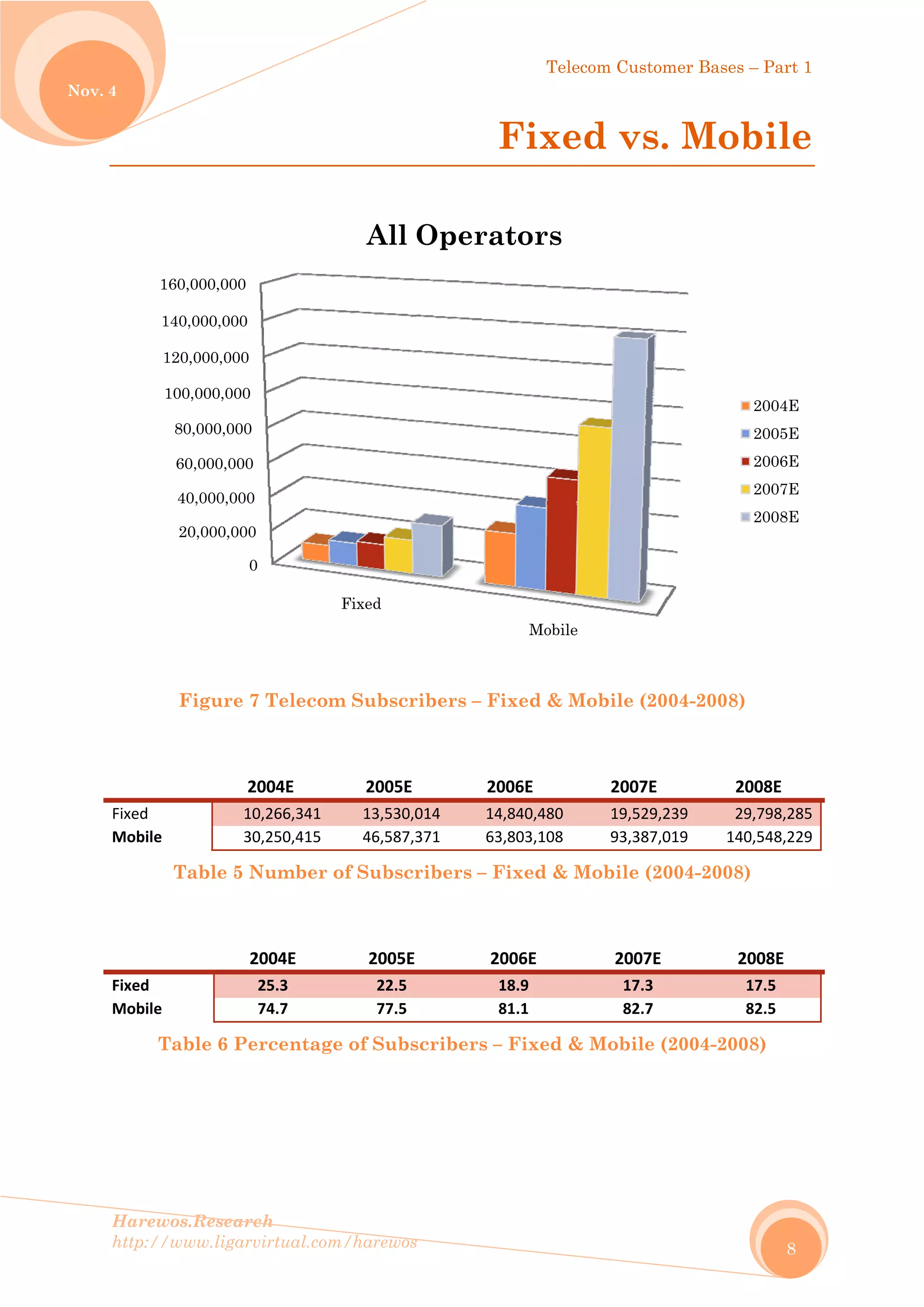

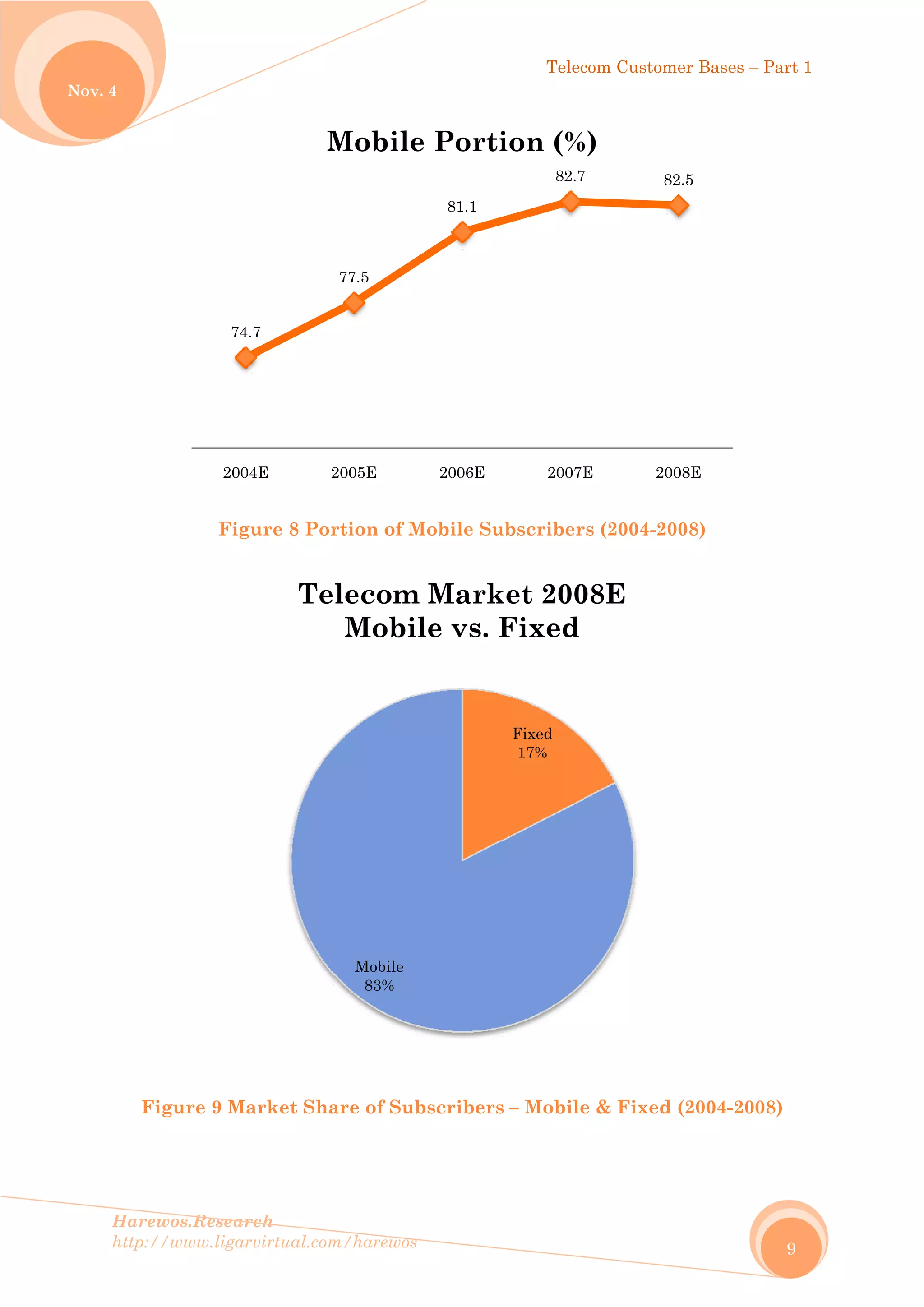

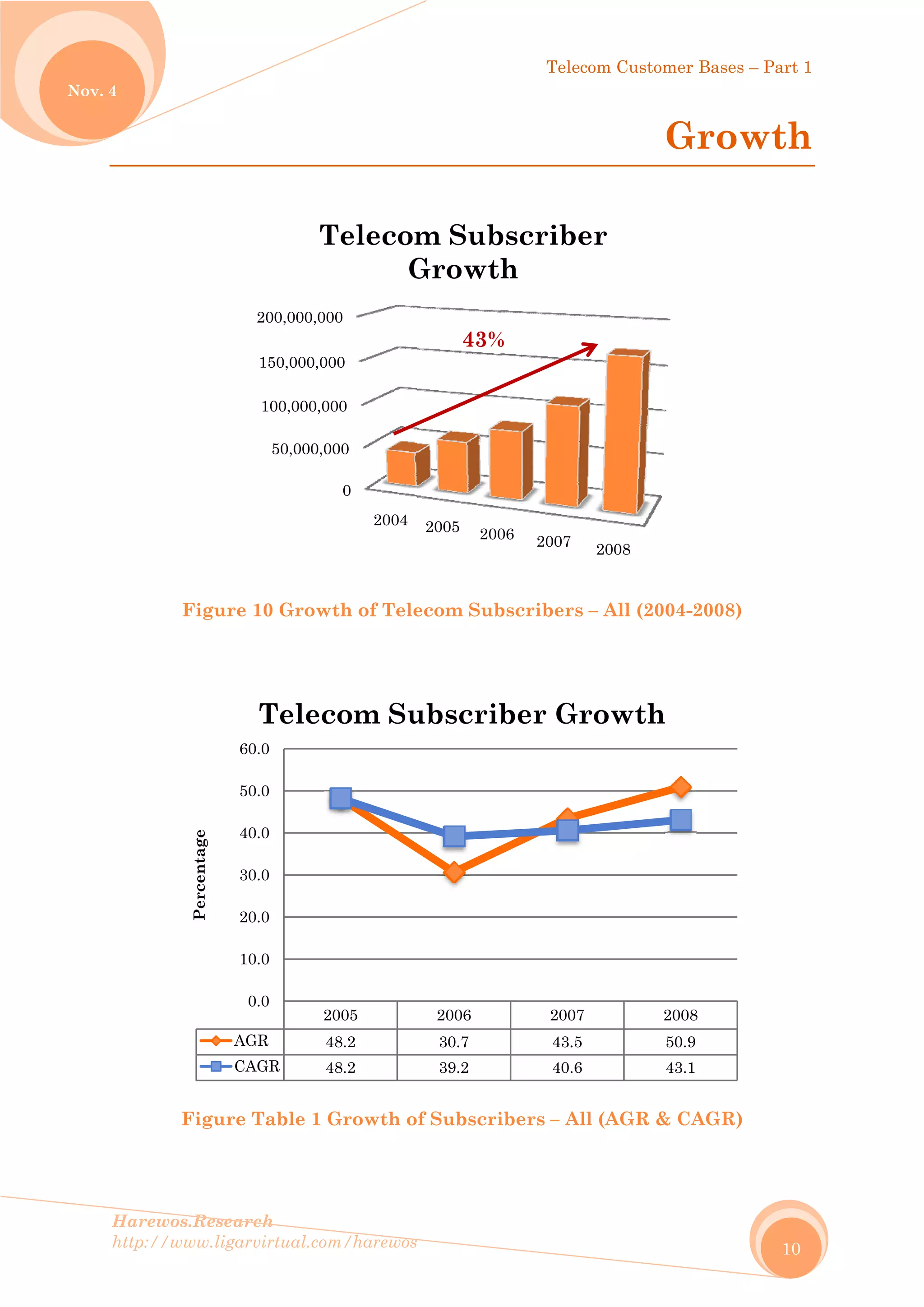

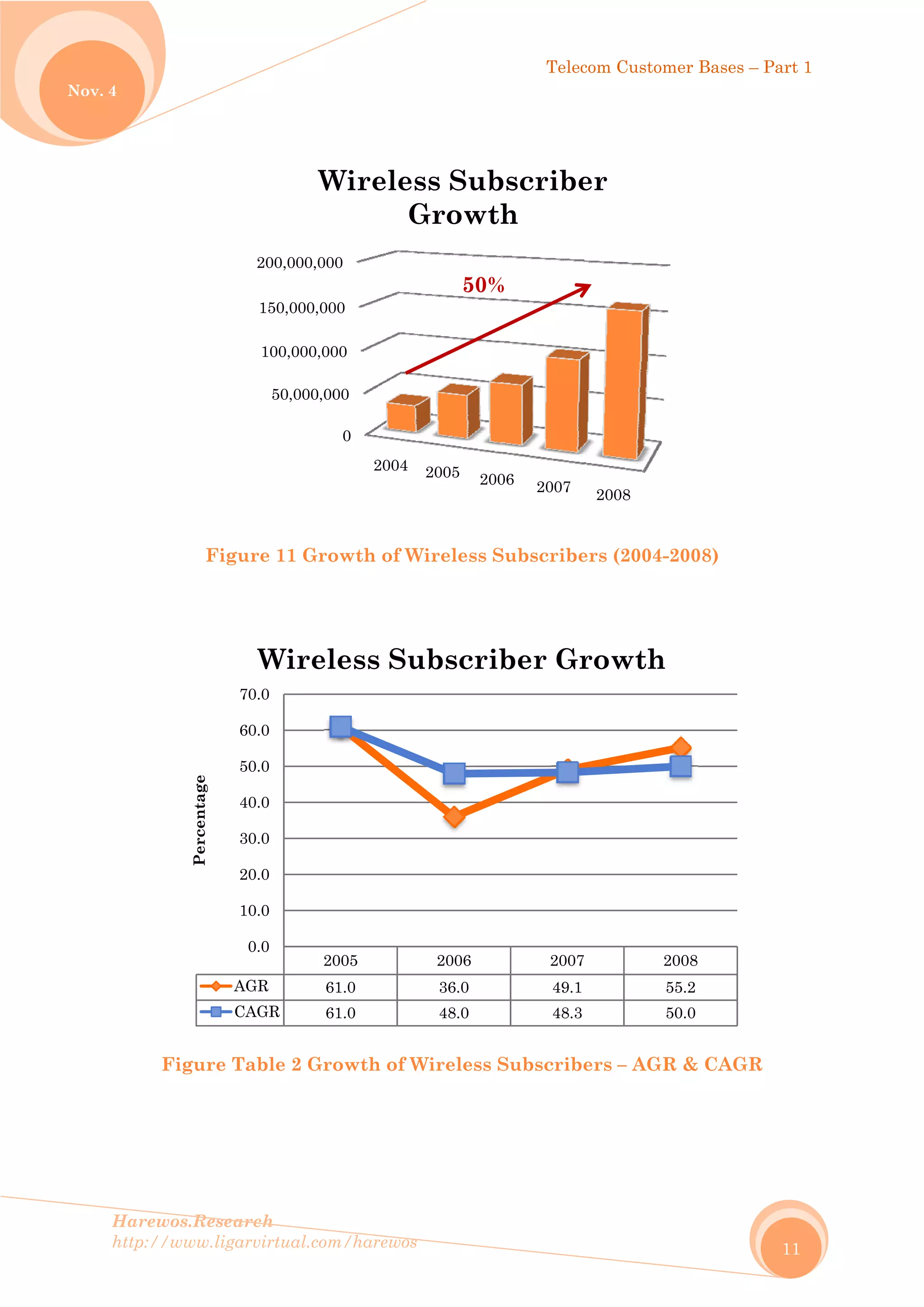

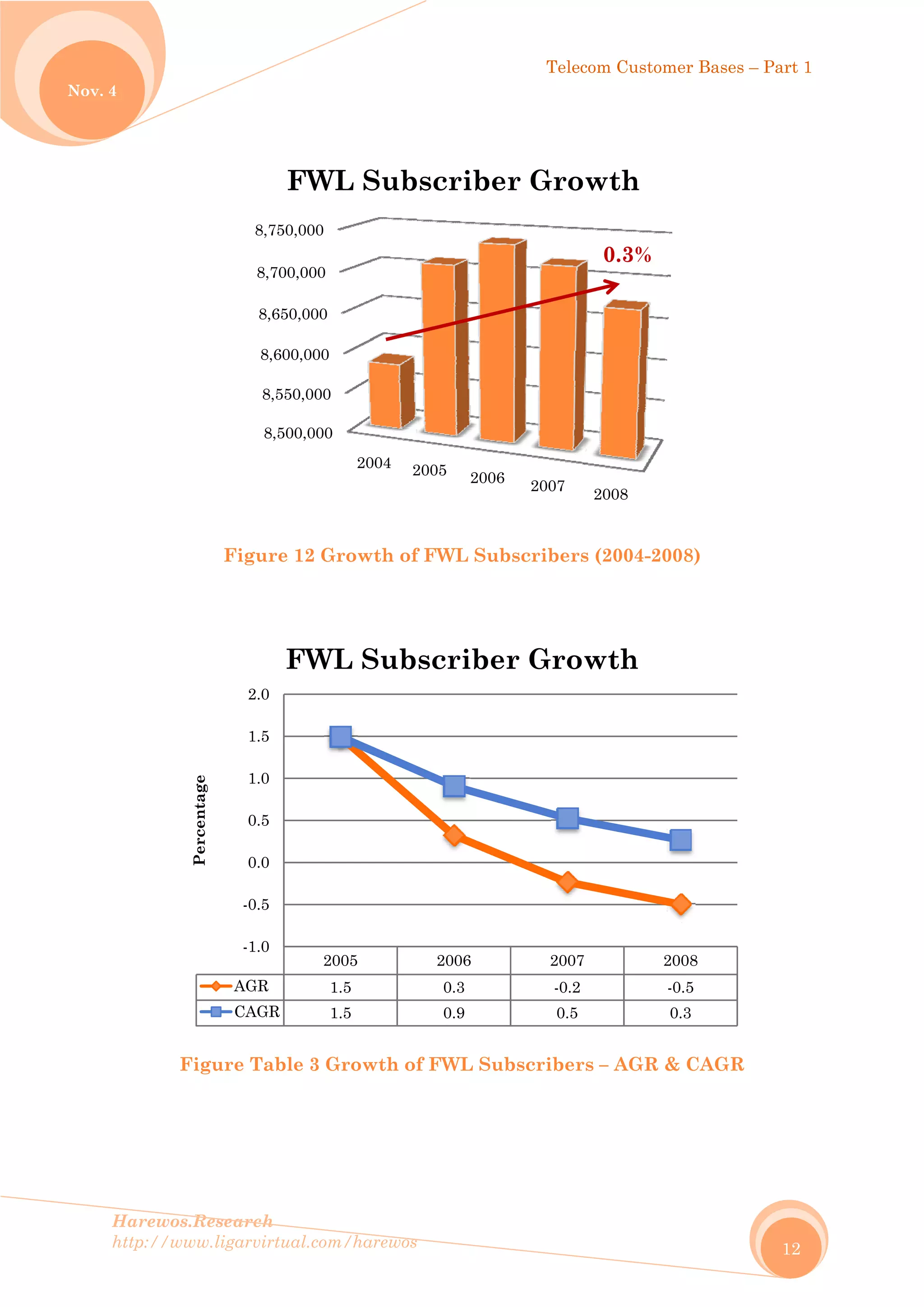

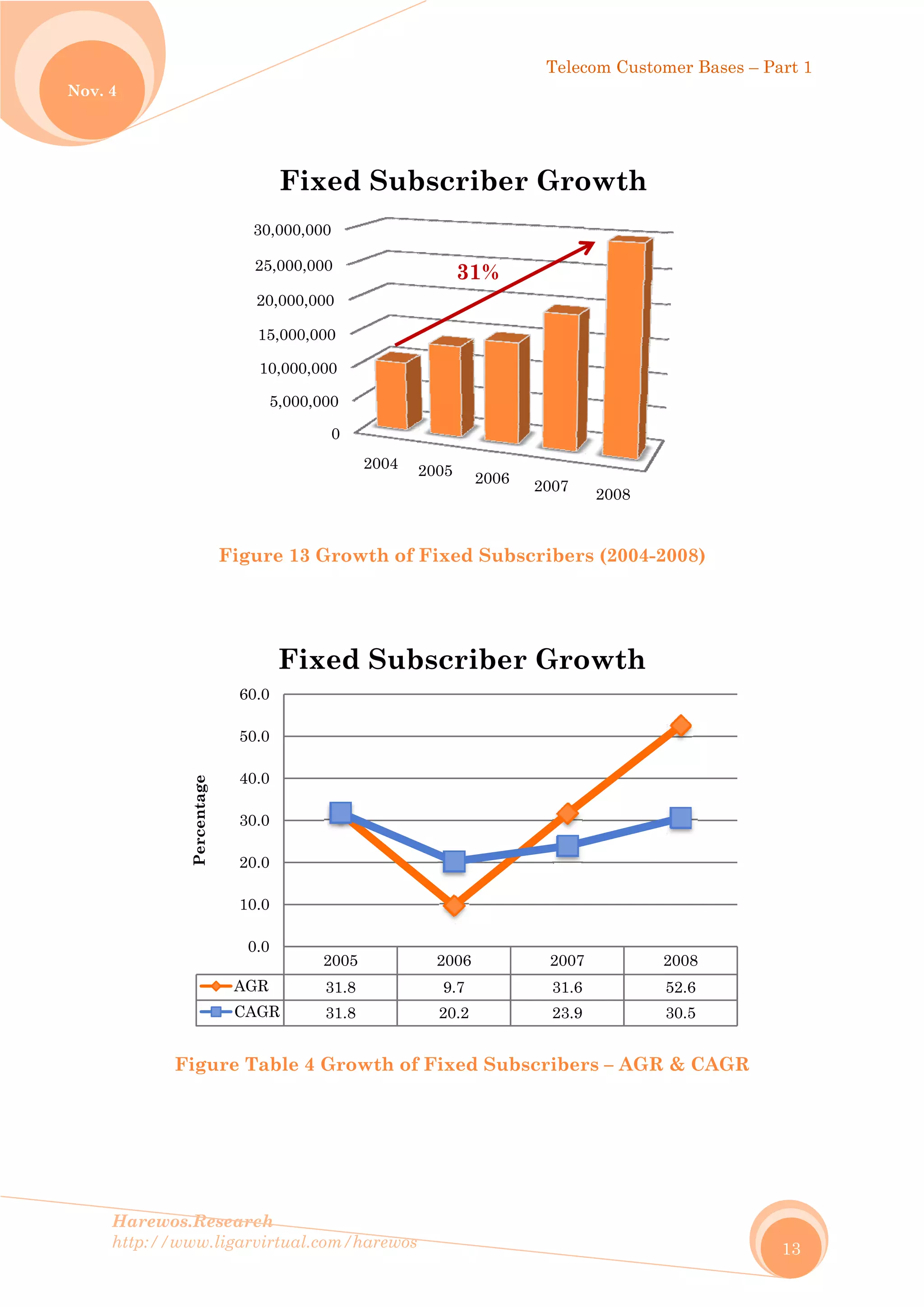

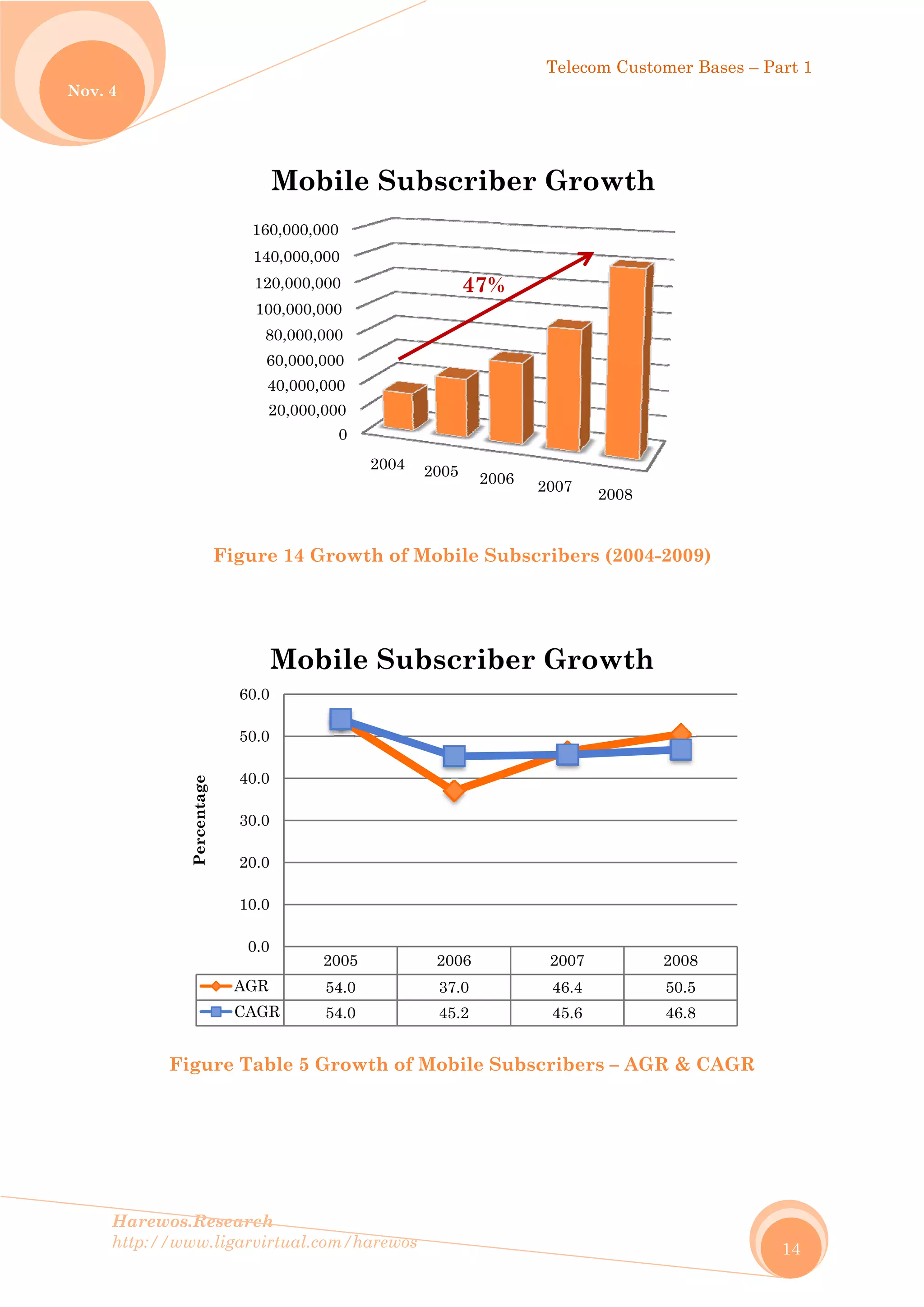

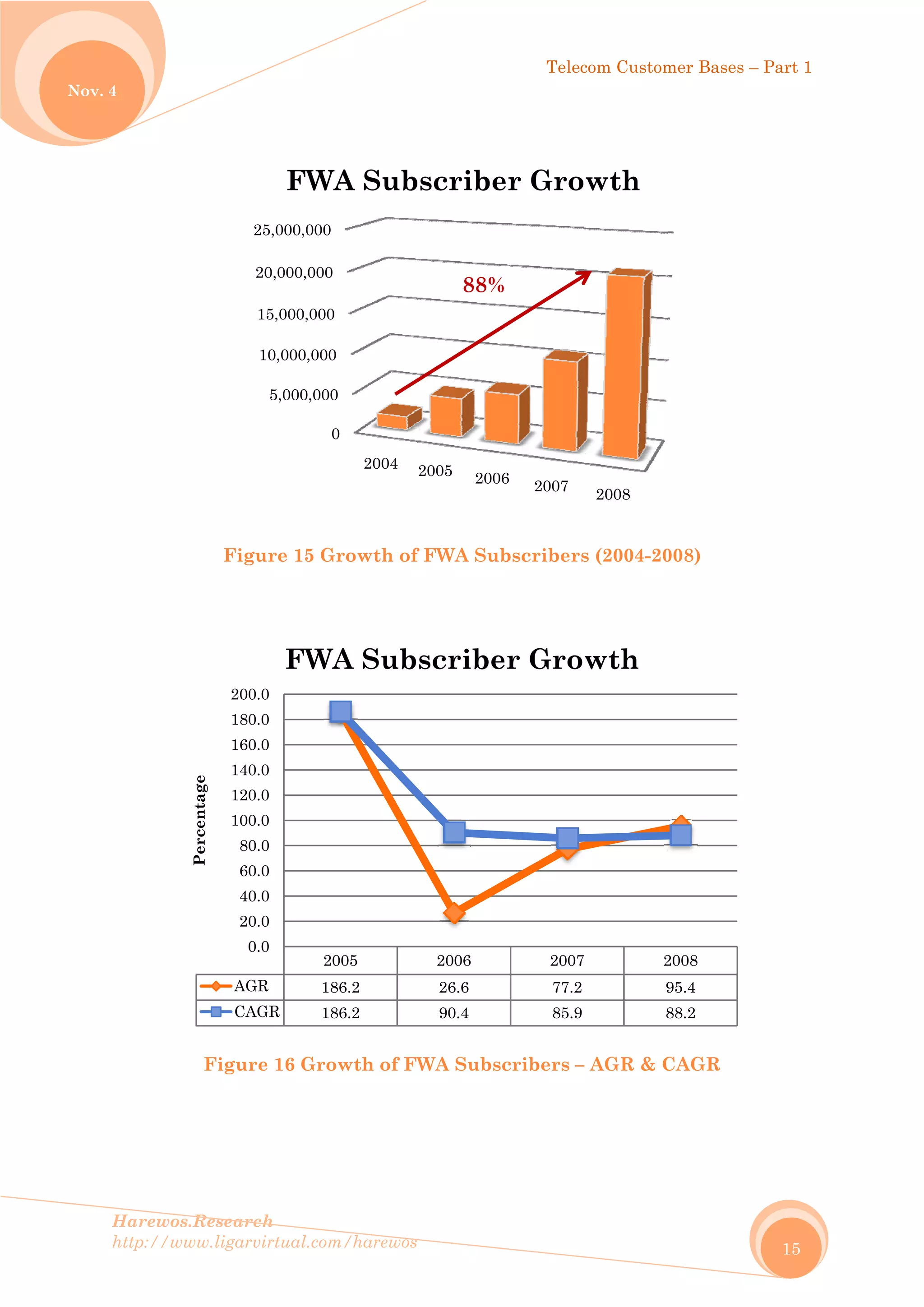

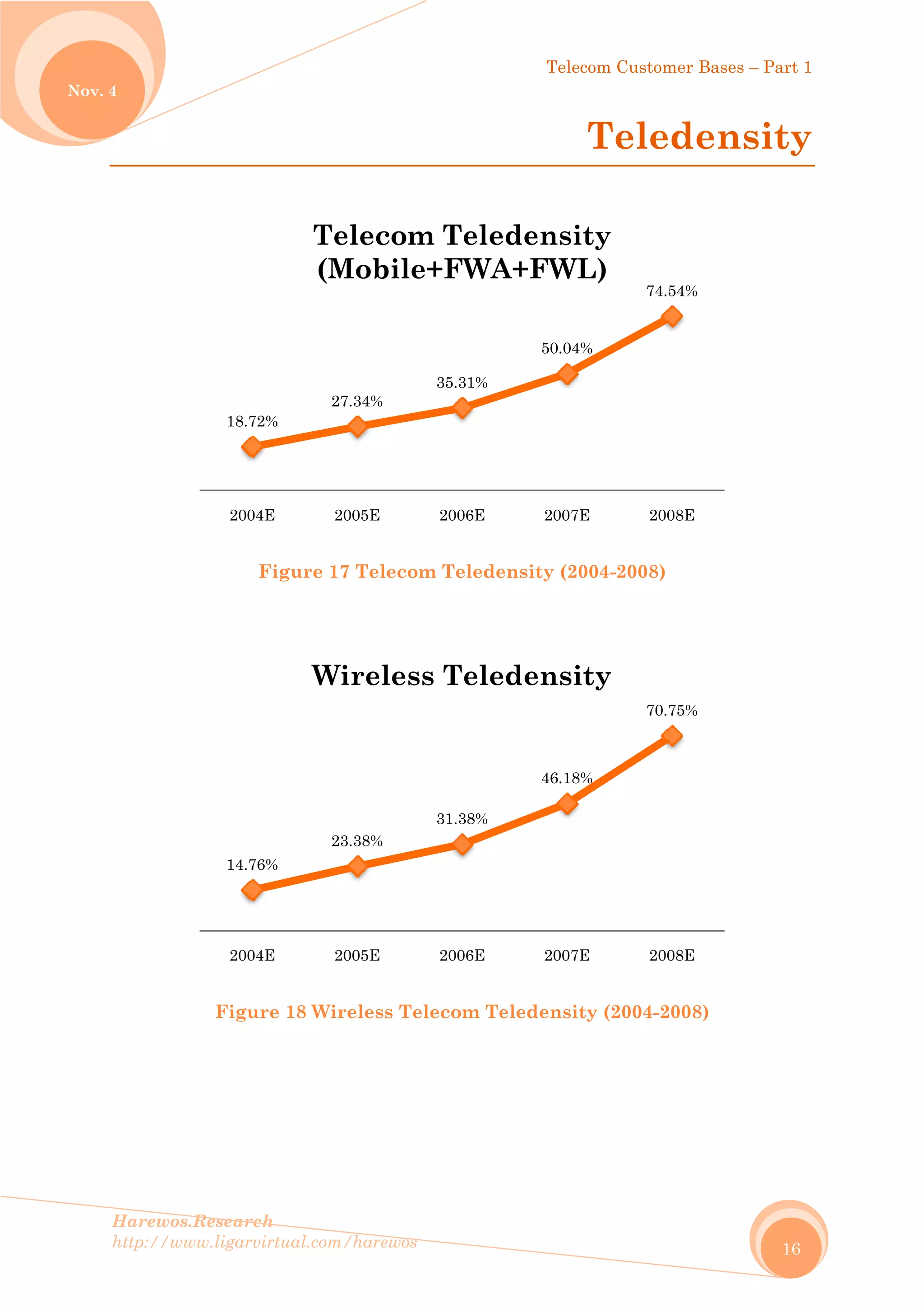

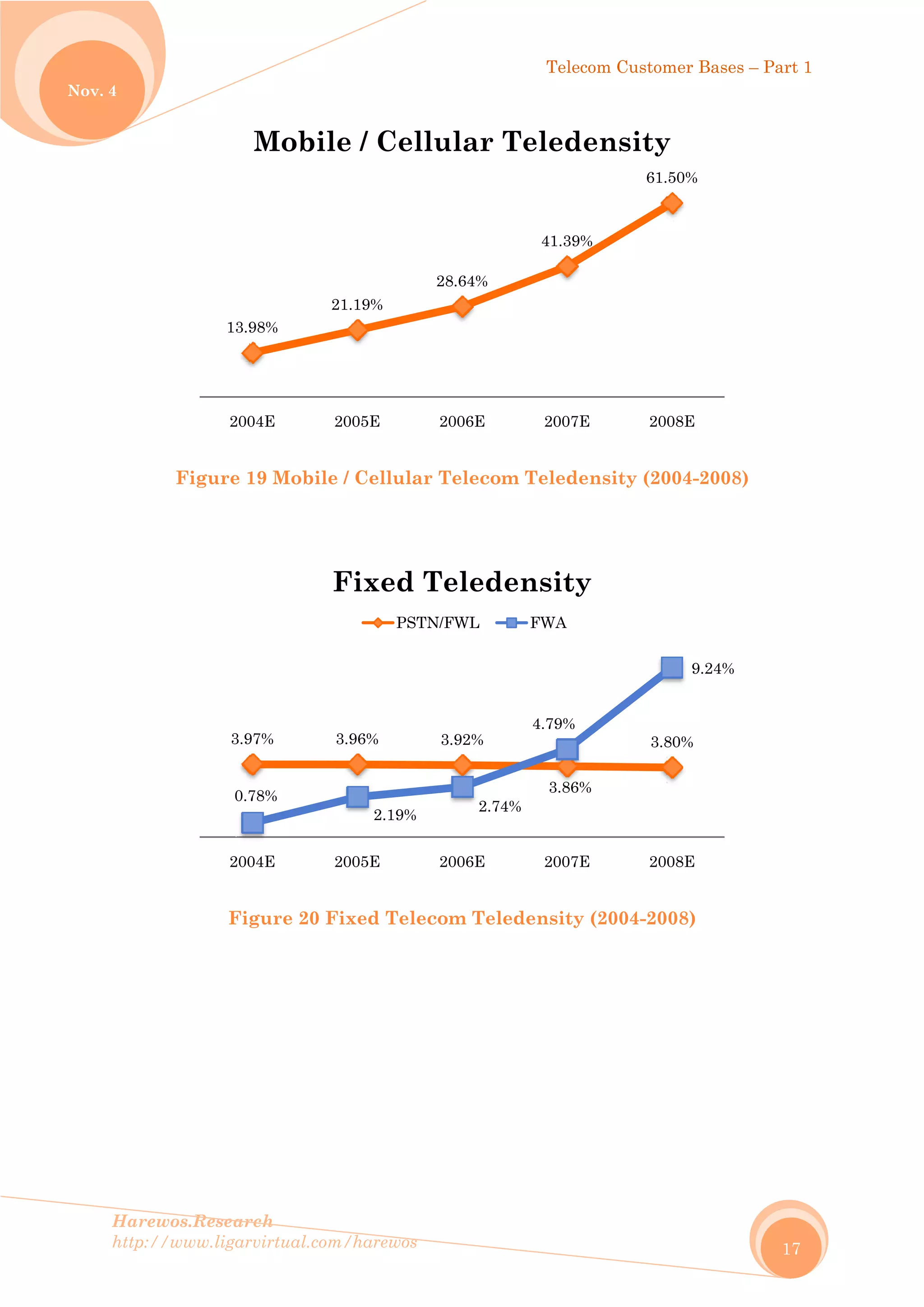

This document provides charts and tables summarizing telecom subscriber numbers and growth in Indonesia from 2004-2008. It includes data on fixed wireline, fixed wireless access, and mobile subscribers as well as breakdowns of wireline vs wireless and fixed vs mobile connections. Growth rates for total telecom subscribers and for specific types of connections like wireless and mobile are presented. Market shares of different connection types are shown in pie charts. Teledensity for total telecom and for wireless/mobile/fixed segments are also included.

![Telecom Customer

Bases – Part 1

Indonesian Telecom Market Facts and

Numbers: Charts & Tables

2004-2008

[HR.CTD001.V1U1-2009]

Dr.-Ing. Eueung Mulyana @ Harewos Research

11/4/2009

http://www.ligarvirtual.com/harewos](https://image.slidesharecdn.com/hr-170112043721/75/Telecom-Customer-Bases-Part-1-1-2048.jpg)