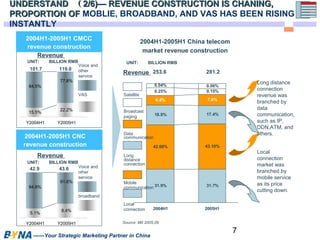

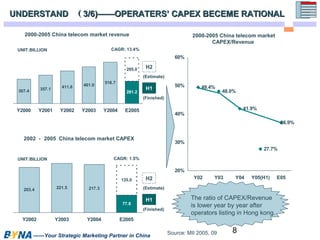

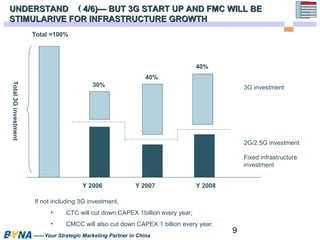

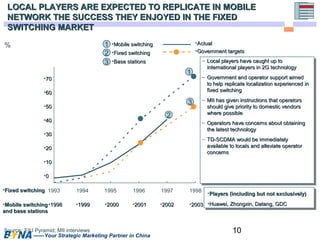

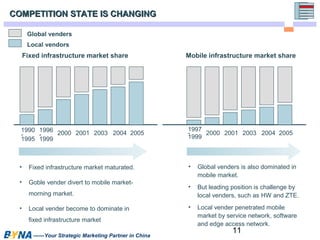

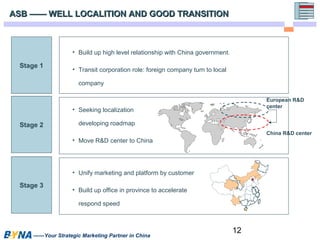

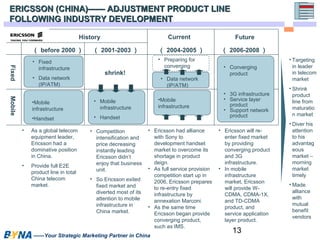

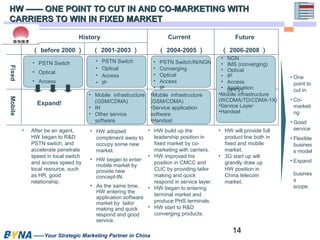

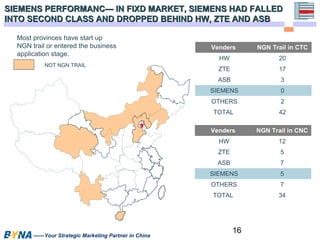

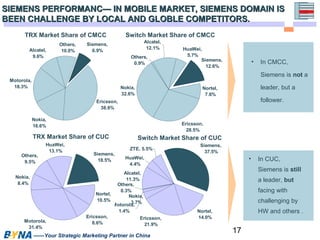

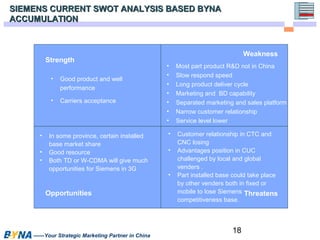

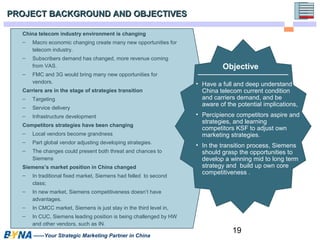

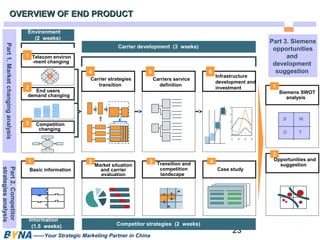

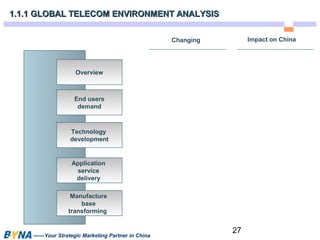

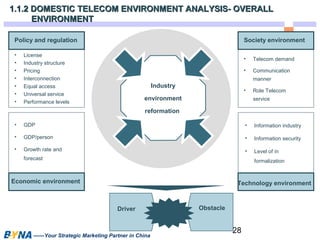

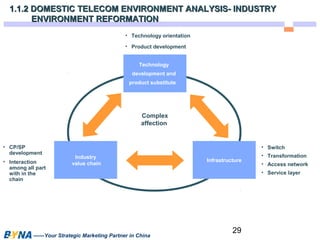

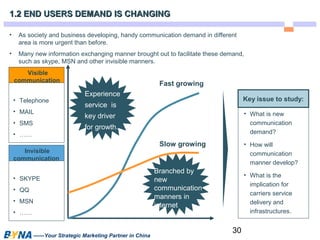

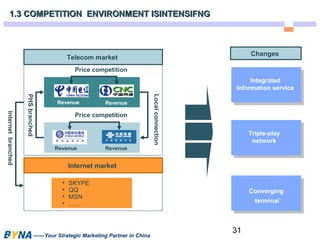

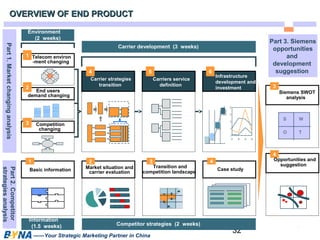

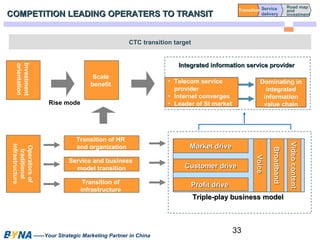

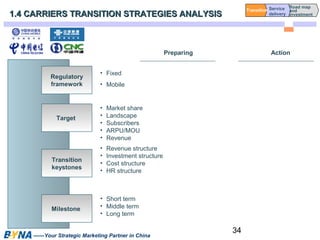

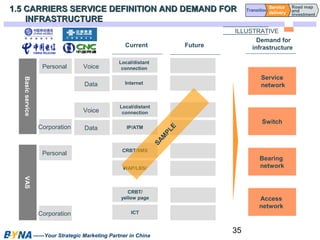

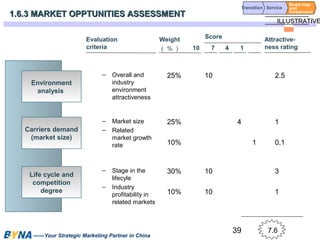

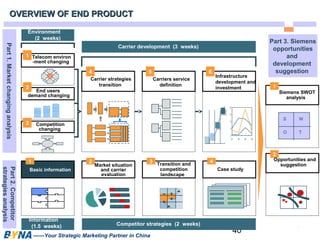

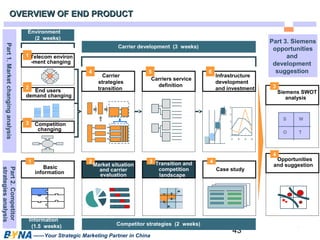

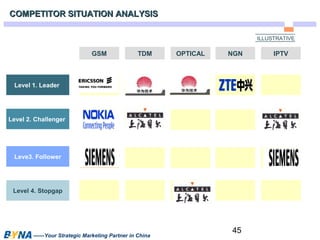

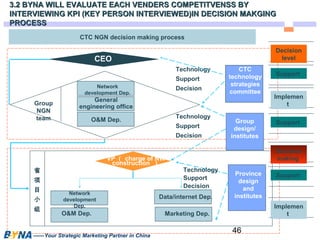

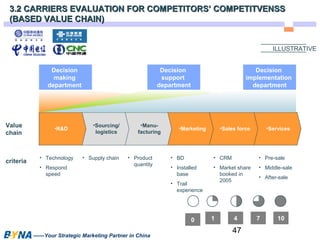

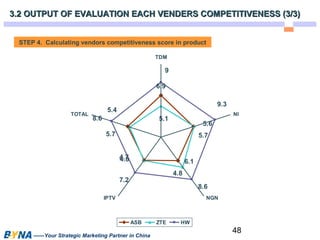

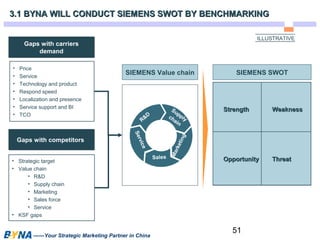

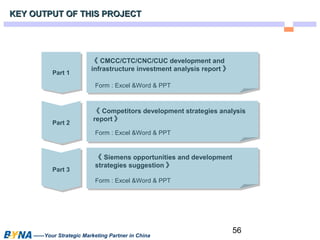

This document provides an overview of the China telecom market and implications for Siemens COM. It analyzes the industry environment, competitors, operator evaluations and Siemens' performance and strengths/weaknesses. Key points include that the market growth rate is declining as it matures, revenue construction is changing with increased proportions from mobile, broadband and VAS, and operators' capex ratios are becoming more rational. Local players are expected to replicate success in mobile networks from fixed networks.