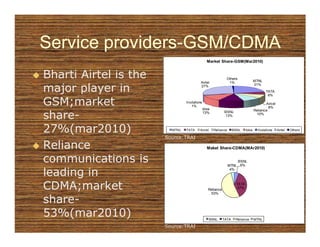

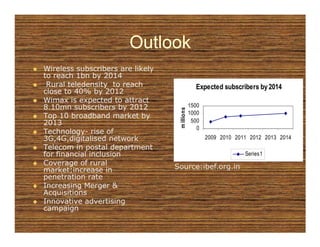

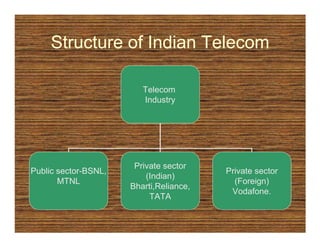

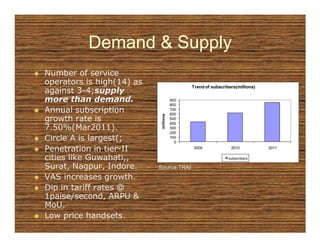

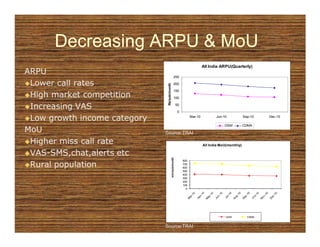

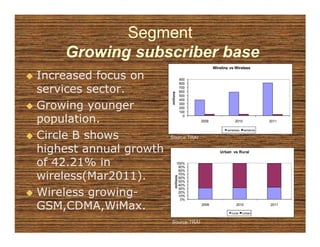

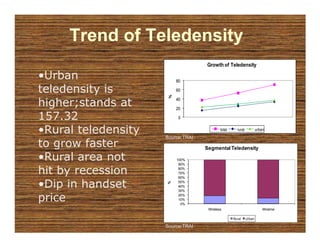

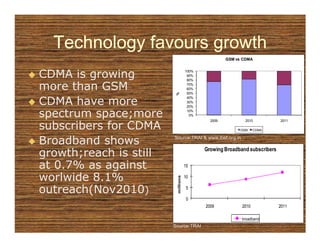

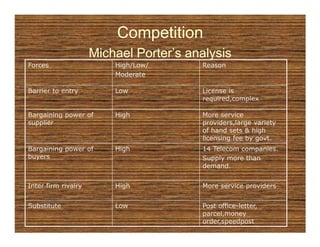

The Indian telecom industry has experienced rapid growth with over 846 million subscribers as of March 2011. It is dominated by private operators who hold 88% of the wireless market share. While demand continues to grow with increasing rural penetration, supply currently exceeds demand due to the large number of service providers. This high competition has led to decreasing revenue metrics like ARPU and MoU. The industry is expected to continue growing driven by technology advancements, lower tariffs, and the shift to value-added services. However, it faces challenges around heavy regulation and maintaining profitability.

![Market Share

Service provider wise market share(Mar2011)

Wireless is larger than

WIRELESS

wireline.

TATA

Bharti Airtel vodafone

11%

Idea

11%

Aircel

dominates wireless 16%

Other

25%

7%

BSNL

11%

others]

market with 19%. reliance

17%

bharti

20%

7%

BSNL is with largest

market share in Source:TRAI

wireline(72%). Service provider wise market share(Mar2011)

WIRELINE

MTNL is present in

Delhi & Mumbai. MTNL

10%

Bharti

9%

Reliance

3%

BSNL

MTNL

BSNL covers the rest TATA

4%

others

Bharti

Reliance

part of country. BSNL

73% Other

5%

1%

TATA

others

source:TRAI](https://image.slidesharecdn.com/telecom-110514021839-phpapp01/85/Telecom-13-320.jpg)