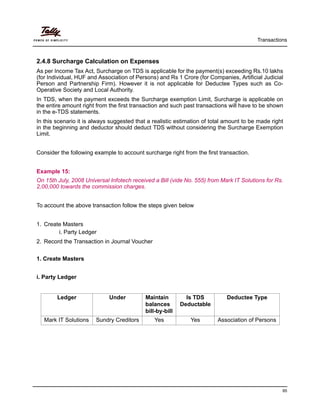

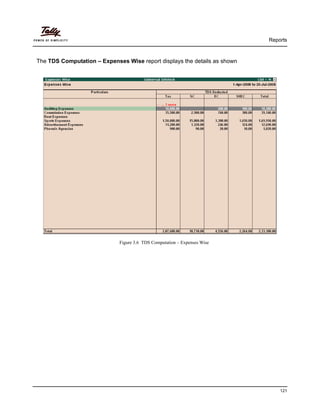

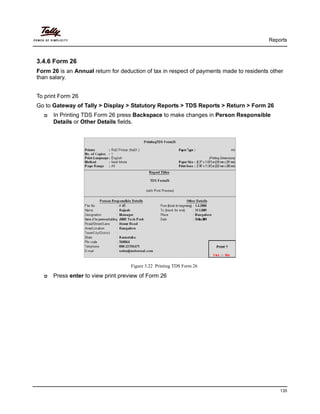

The document provides information about implementing TDS (tax deducted at source) functionality in Tally.ERP 9. It discusses the scope and applicability of TDS, the TDS process including payment and returns filing. It then describes the TDS features available in Tally.ERP 9 and provides step-by-step lessons on enabling TDS, performing TDS transactions for various scenarios, generating TDS reports, and filing e-returns.

![Transactions

71

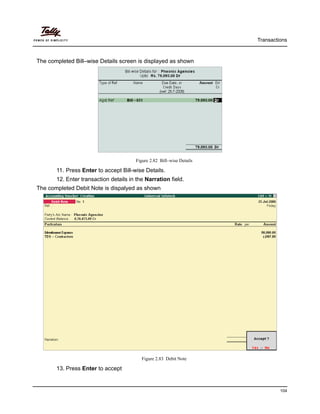

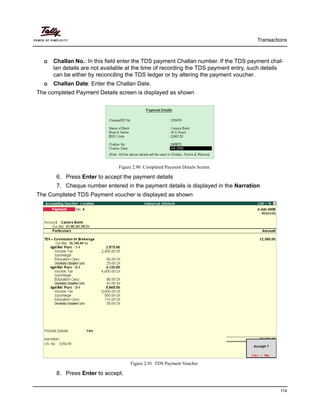

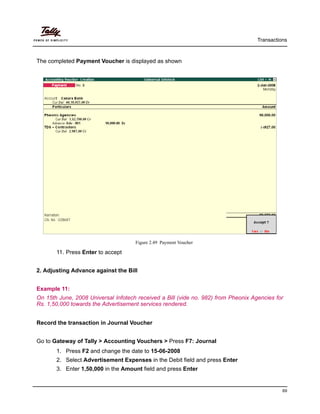

6. Press Enter to accept the TDS details

7. Payable Amount as calculated in the TDS Details screen will be defaulted in the

Party’s Amount (Credit) field. Press Enter to view Bill–wise Details screen.

8. In Bill–wise Details screen,

Select Agst Ref in Type of Ref, to adjust the Advance against the Bill amount.

In the Name field select Adv - 001 from the Pending Bills

In the Amount field, Tally.ERP 9 displays Rs. 90,000, accept the default allocation and

press Enter.

Select New Ref in the Type of Ref field to adjust the Balance amount payable to the

party.

In the Name field enter the Bill name as Bill - 982

Skip the Due Date or Credit Days field

Accept the default amount allocation and Dr/Cr. By default Tally.ERP 9 displays the

Balance Bill amount [1,50,000 – Advance (90,000)] in the amount field as the credit

balance.

Press Enter, select New Ref as Type of Ref and enter Bill name as Bill -982

Skip the Due Date or Credit Days field and accept the default amount allocation and

Dr/Cr. By default Tally.ERP 9 displays the Tax amount in the amount field as the debit

balance.

The completed Bill-wise Details is displayed as shown

Figure 2.51 Bill-wise Details Screen](https://image.slidesharecdn.com/implementationoftdsintallyerp9-090817015459-phpapp02/85/TDS-In-Tally-Erp-9-75-320.jpg)