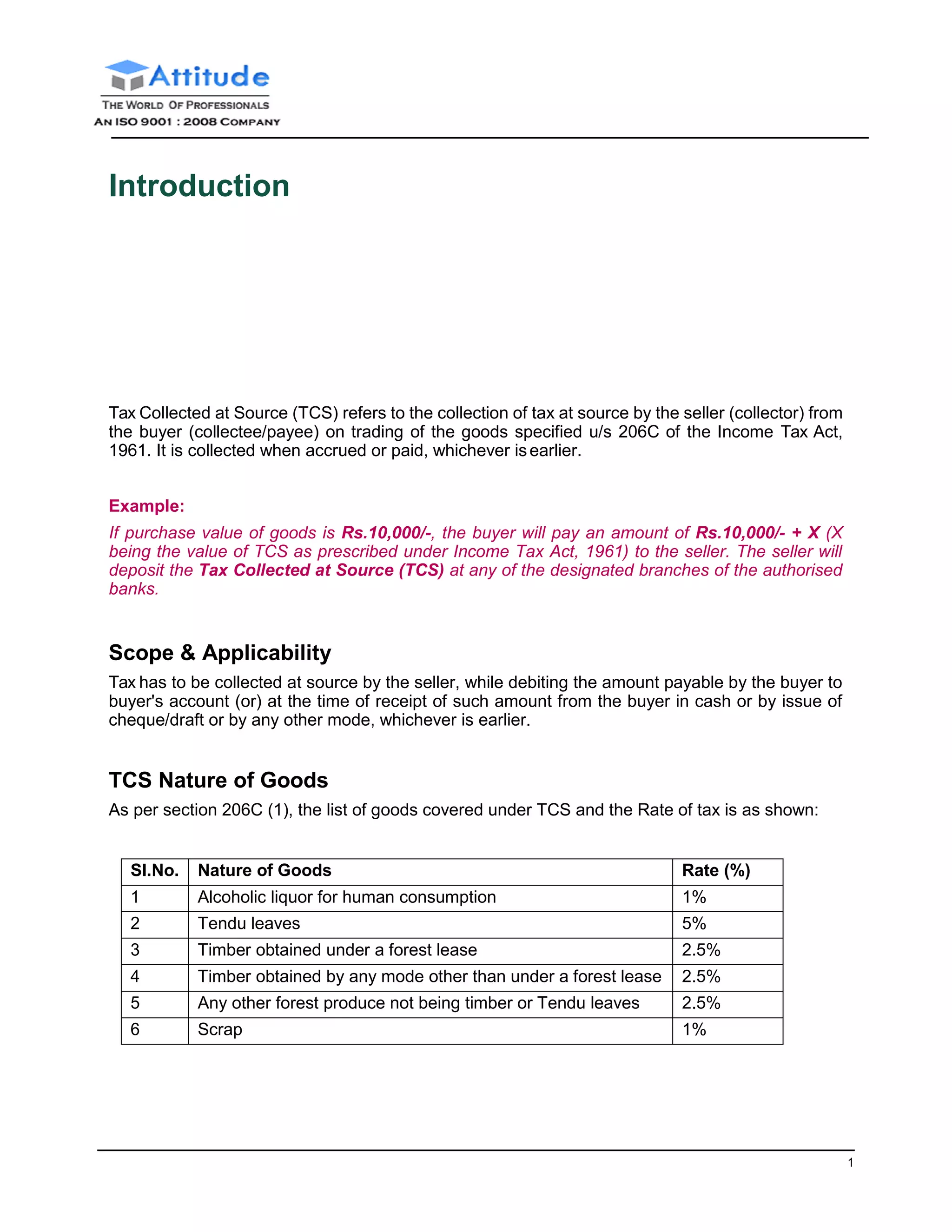

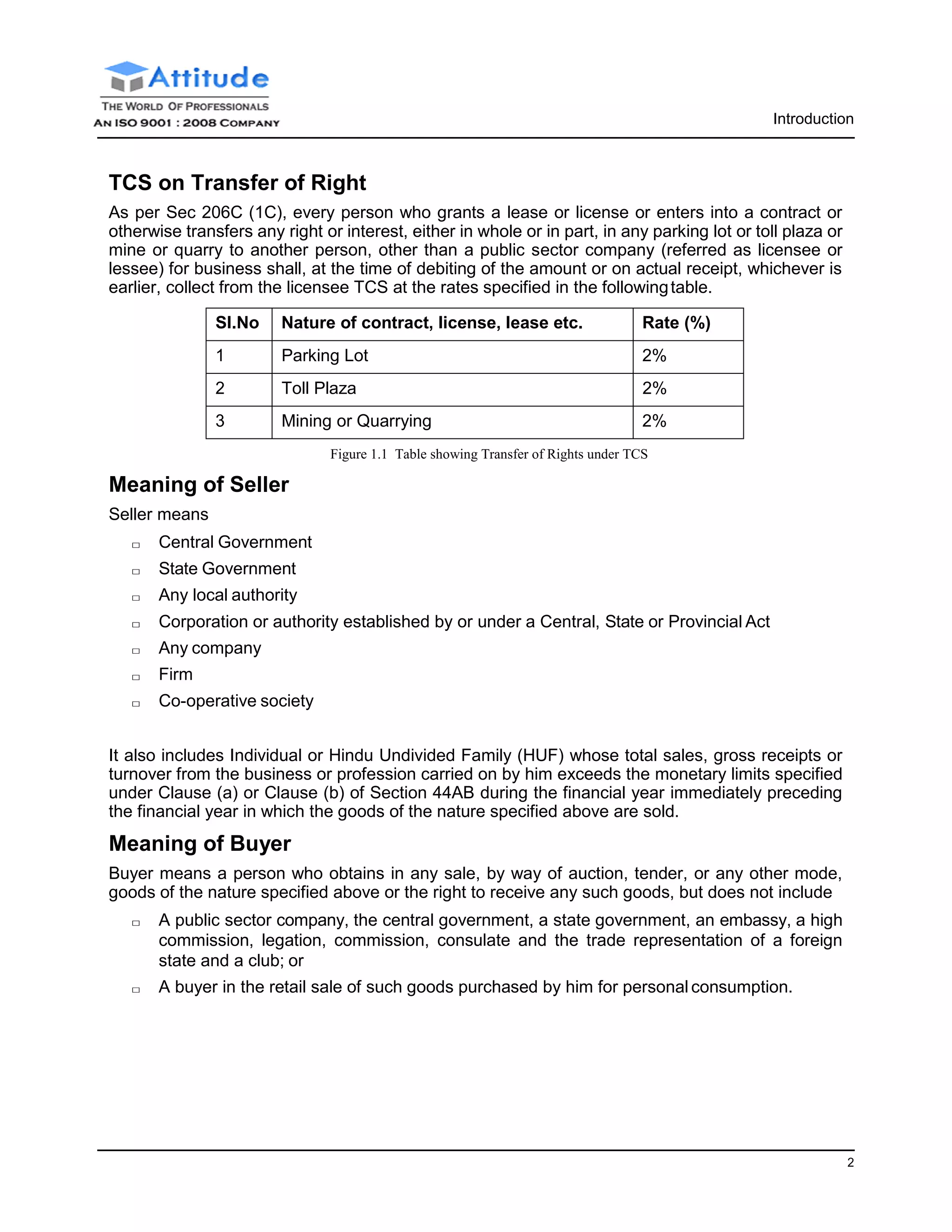

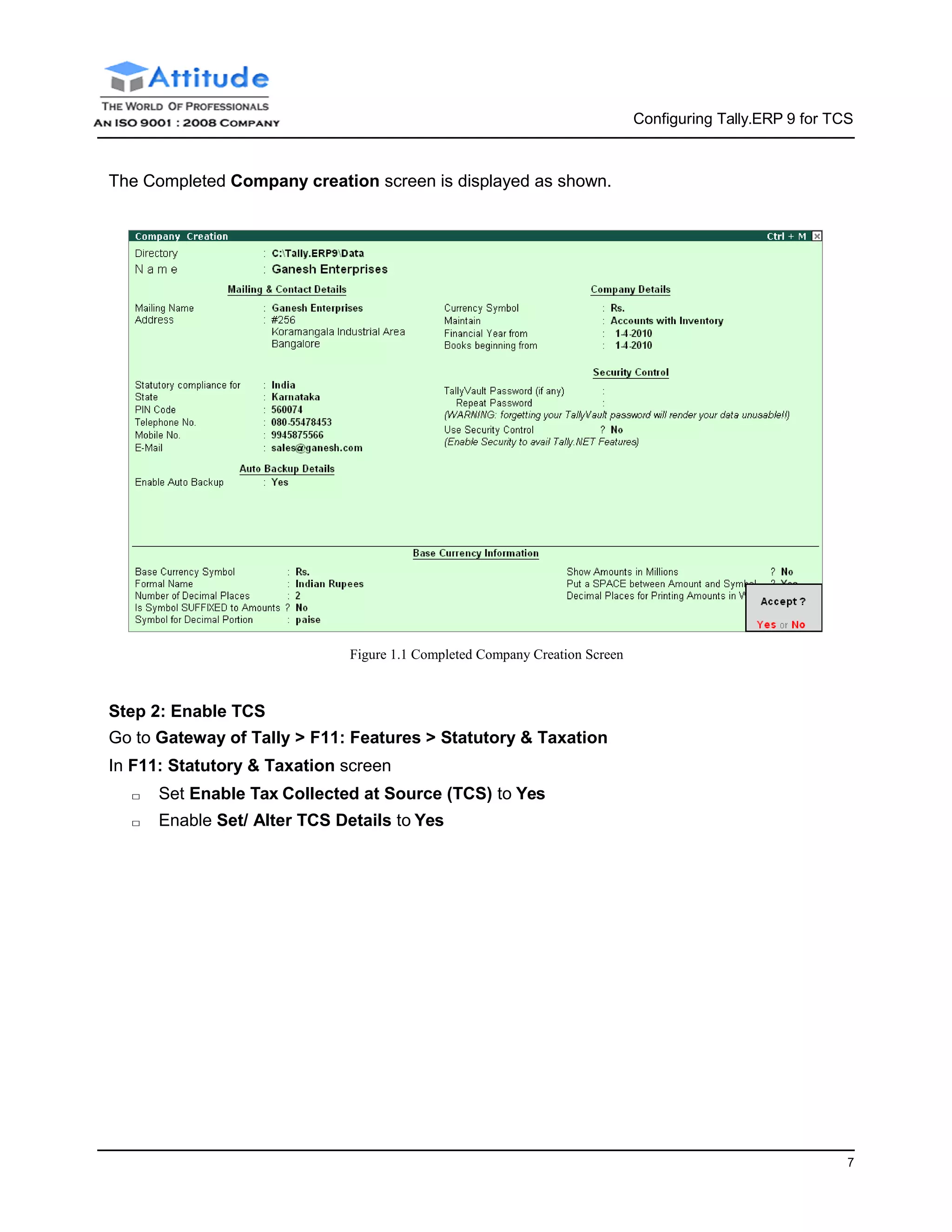

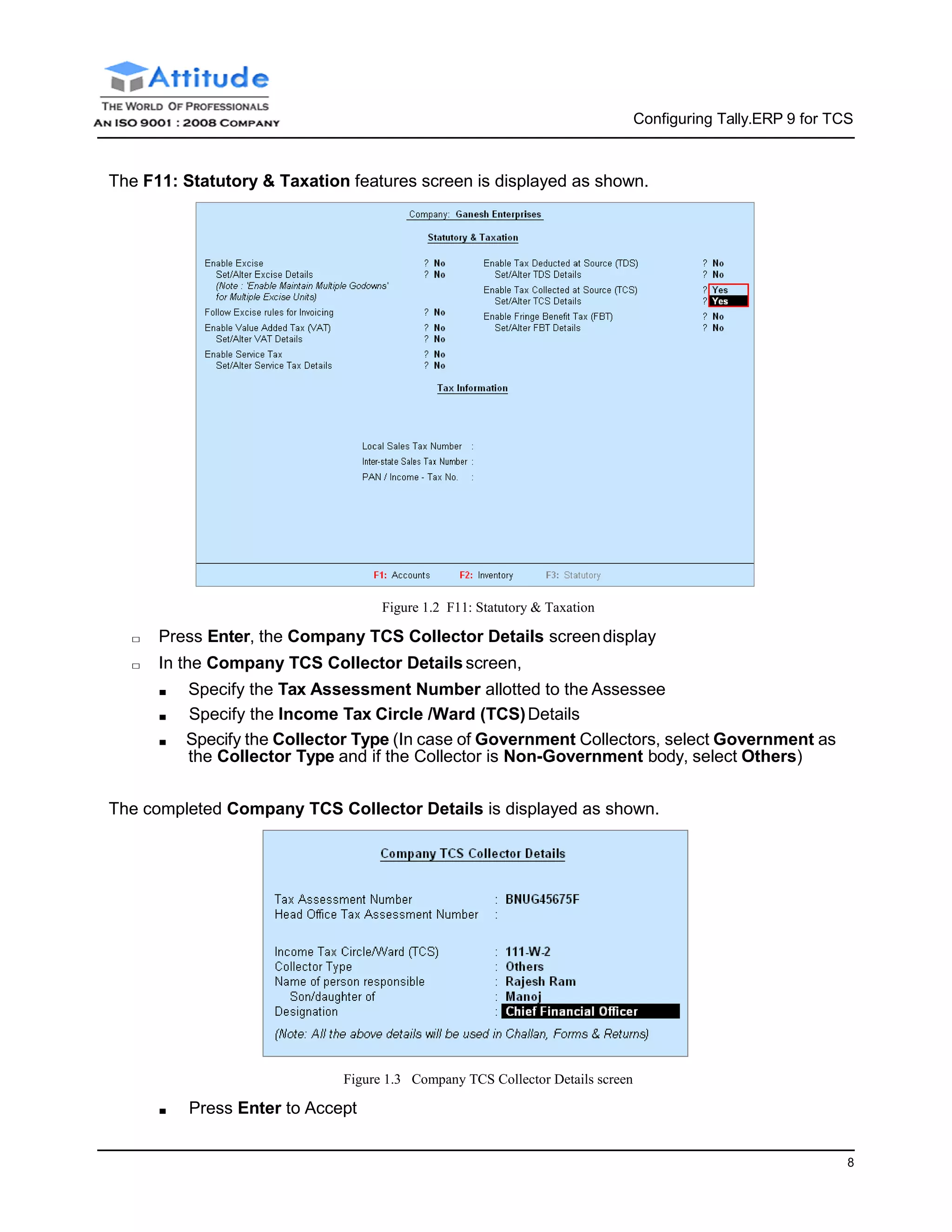

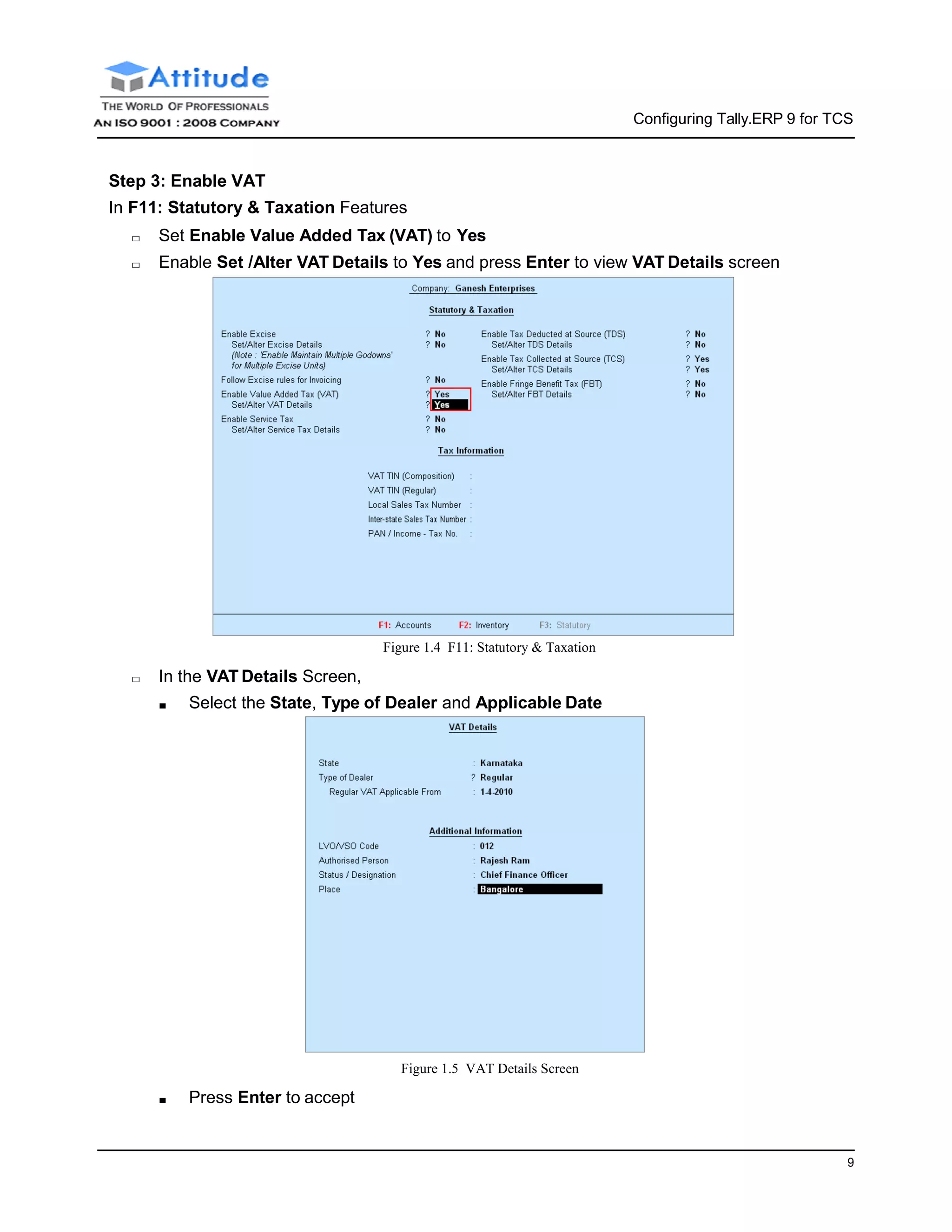

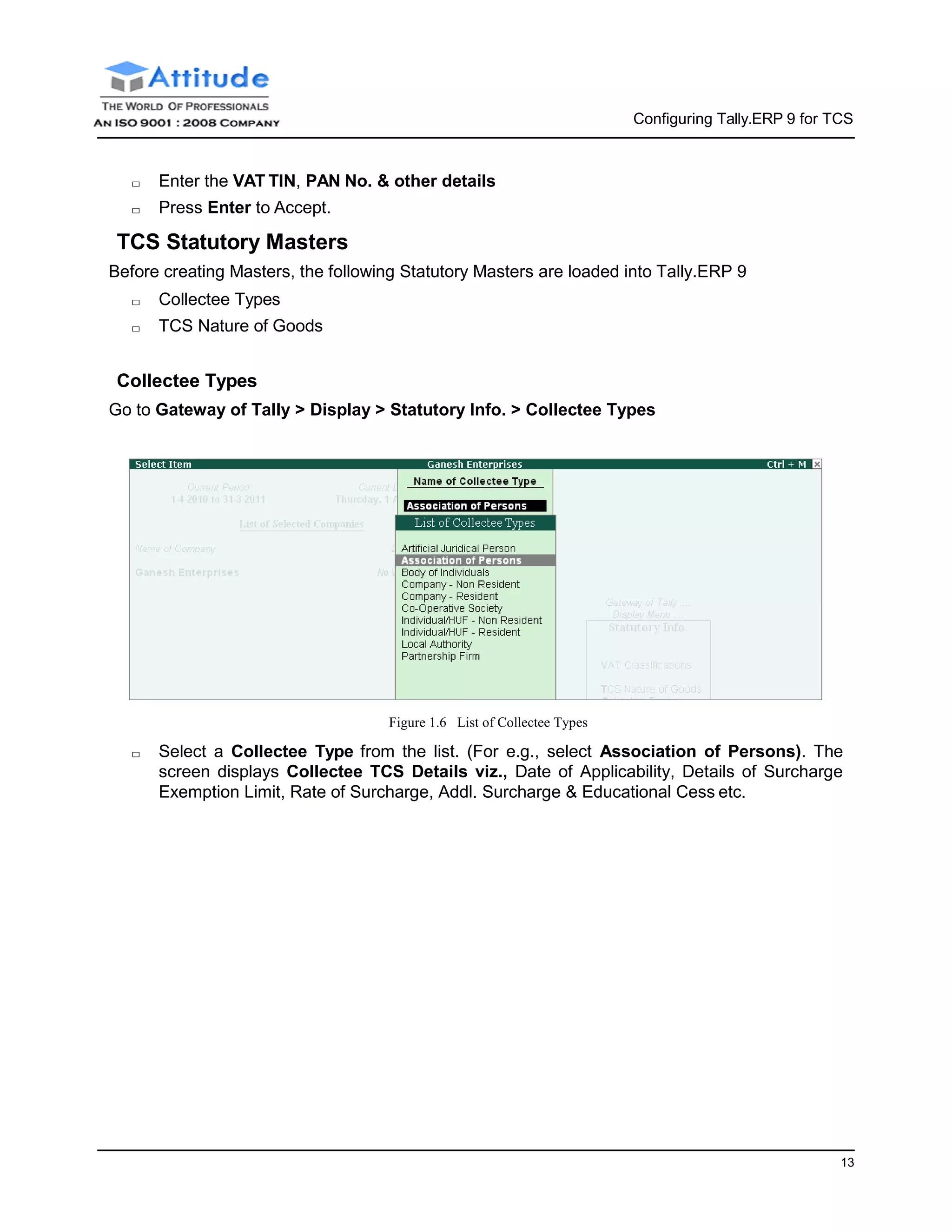

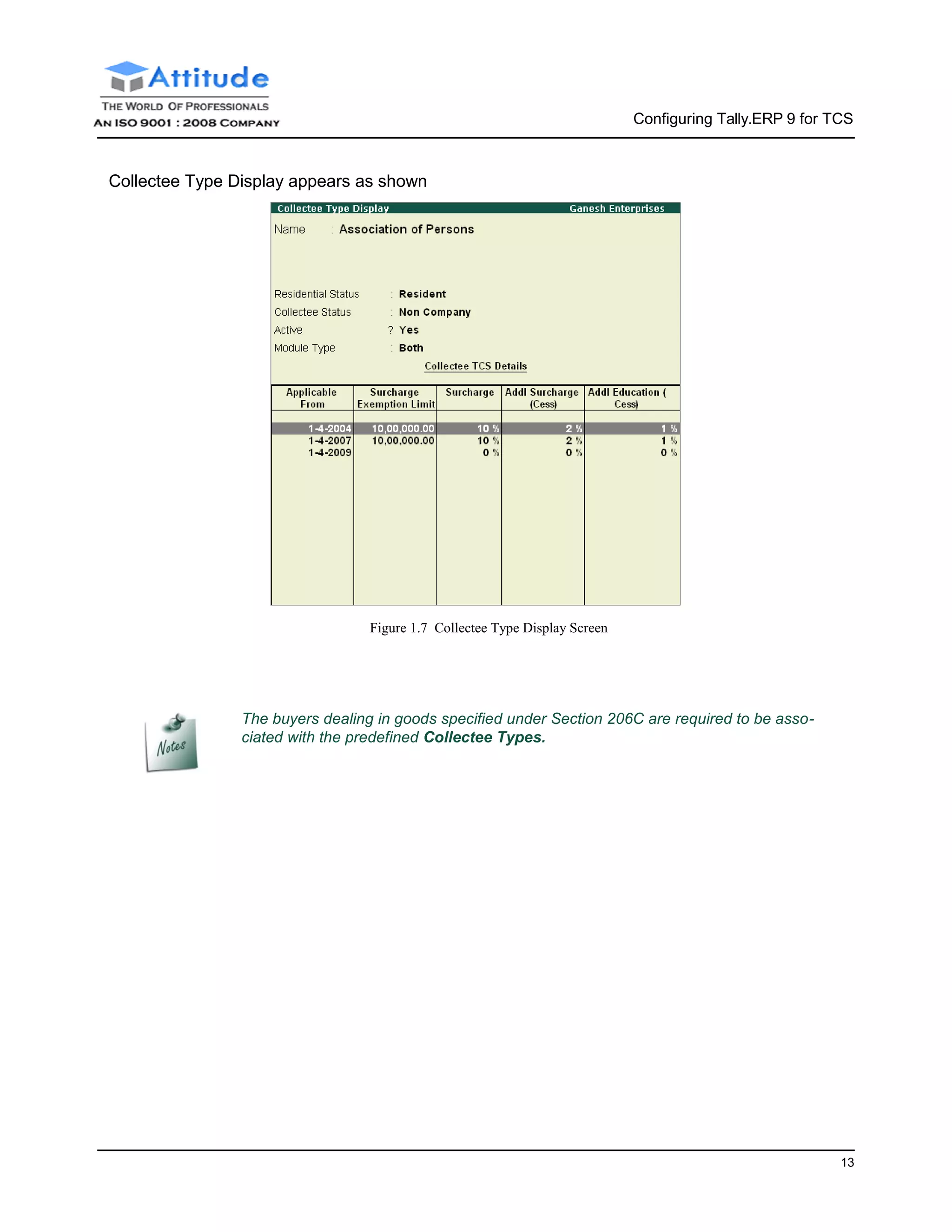

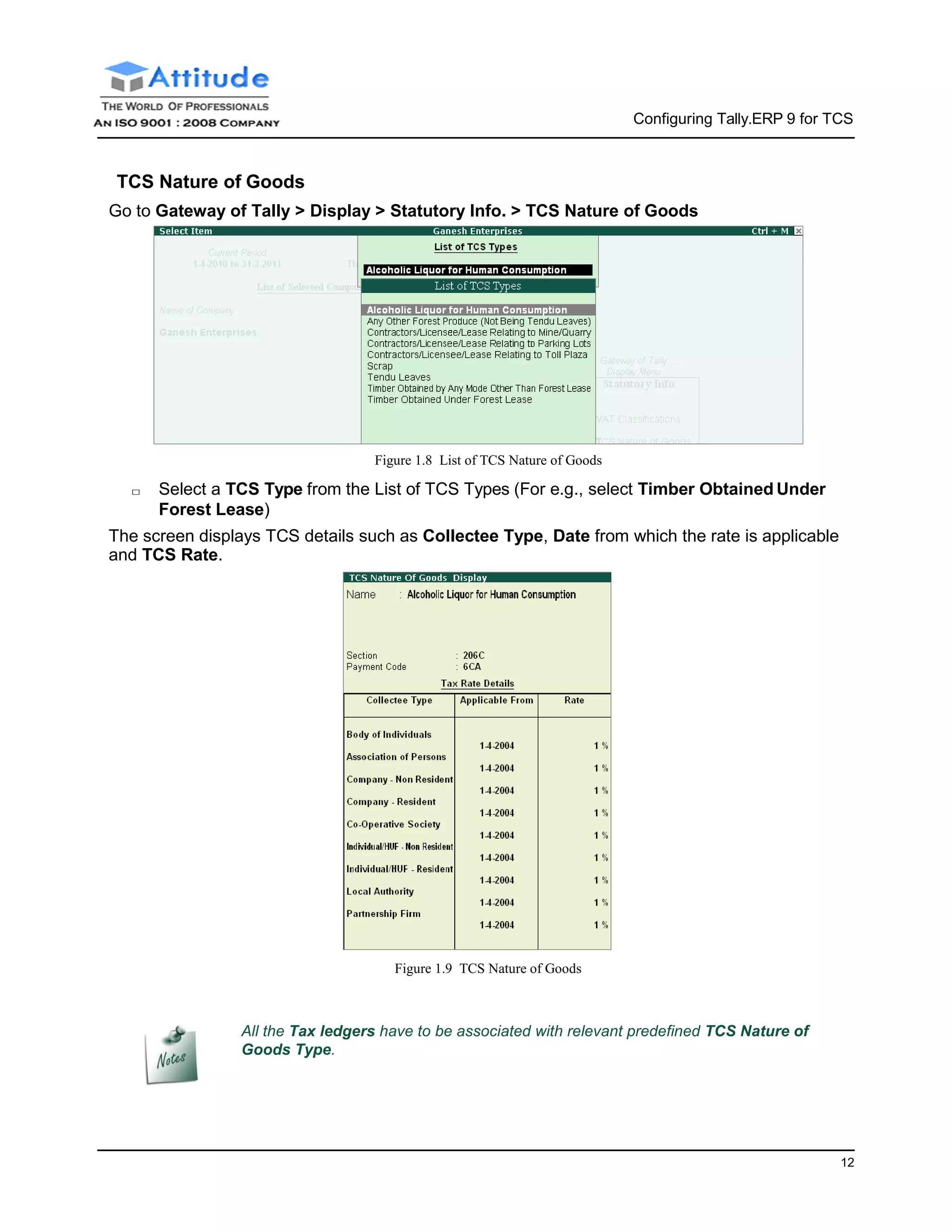

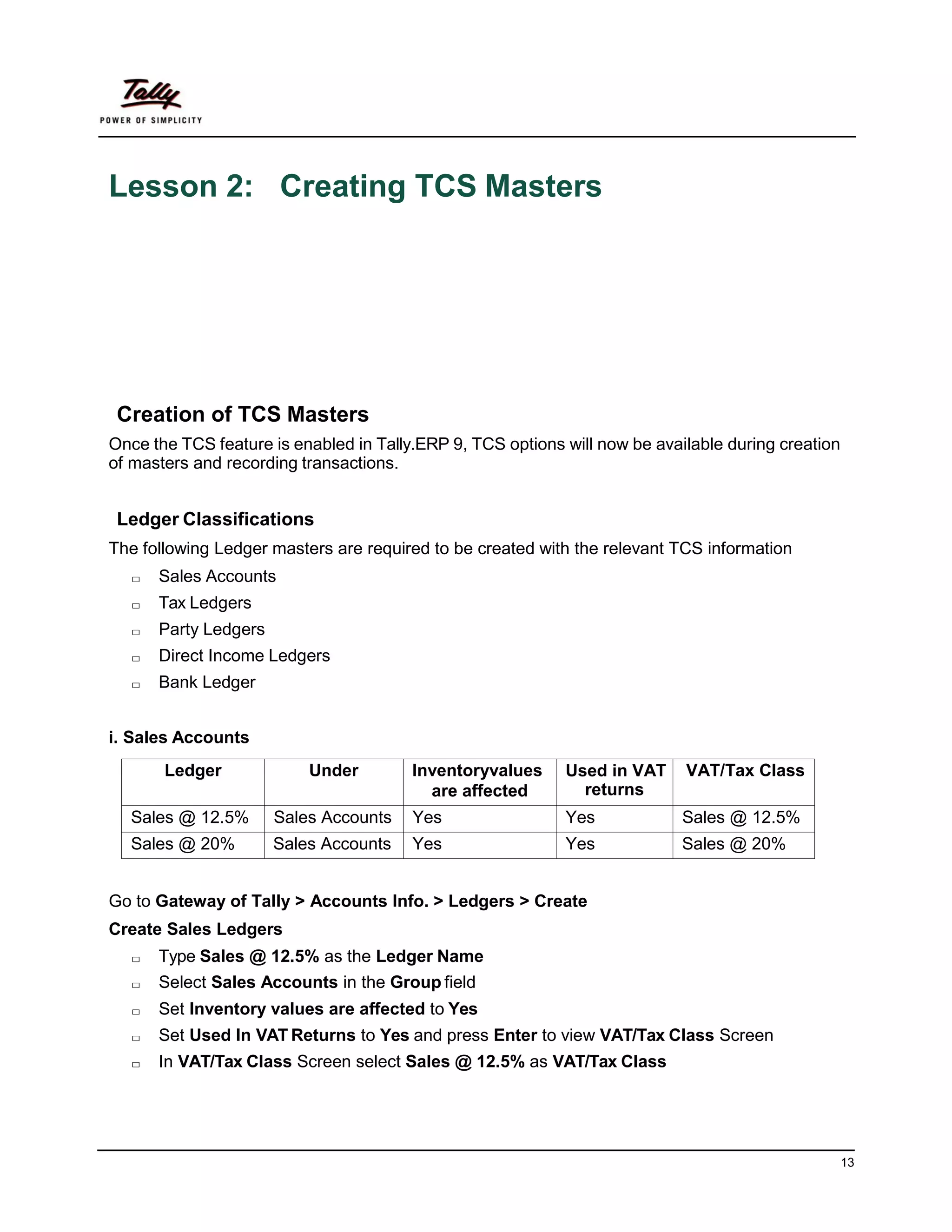

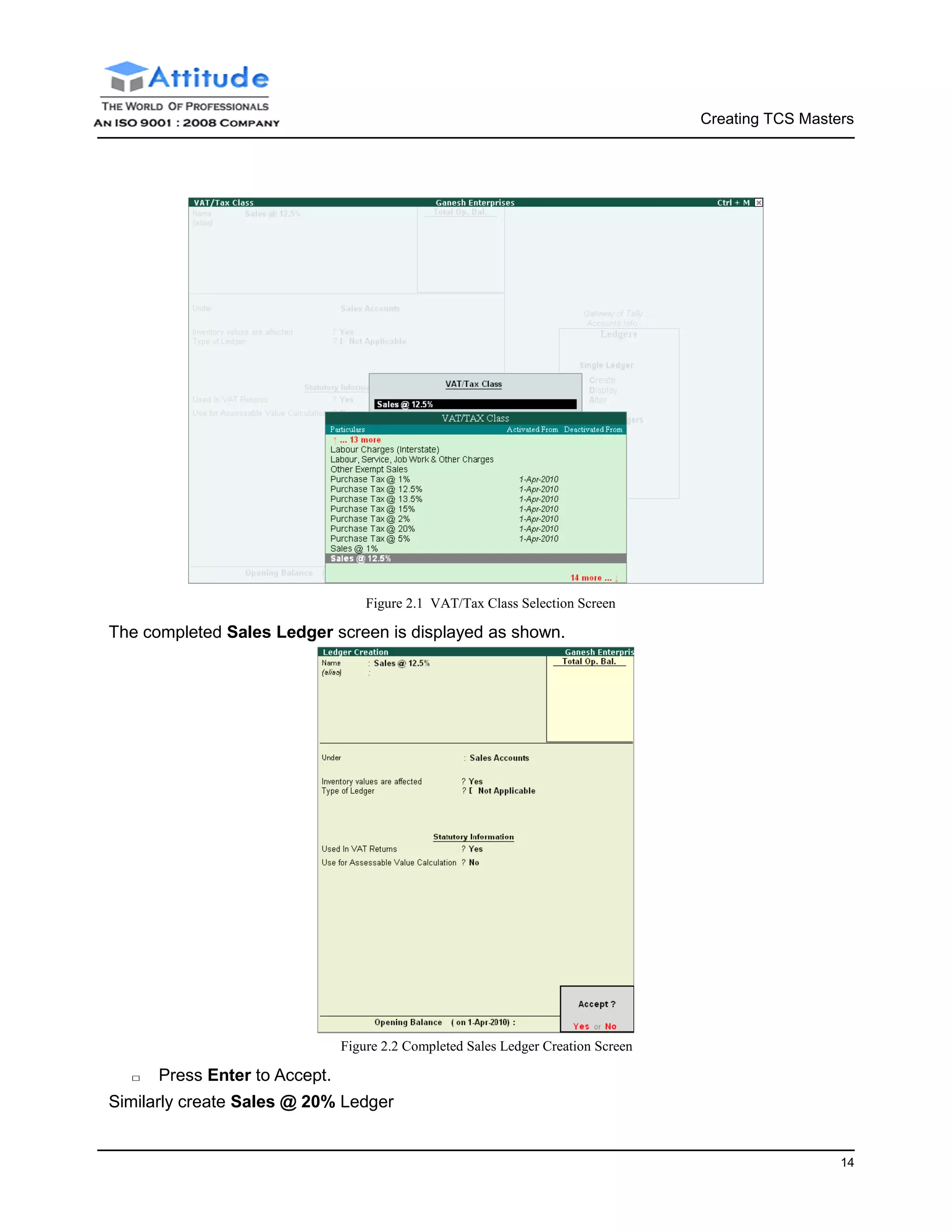

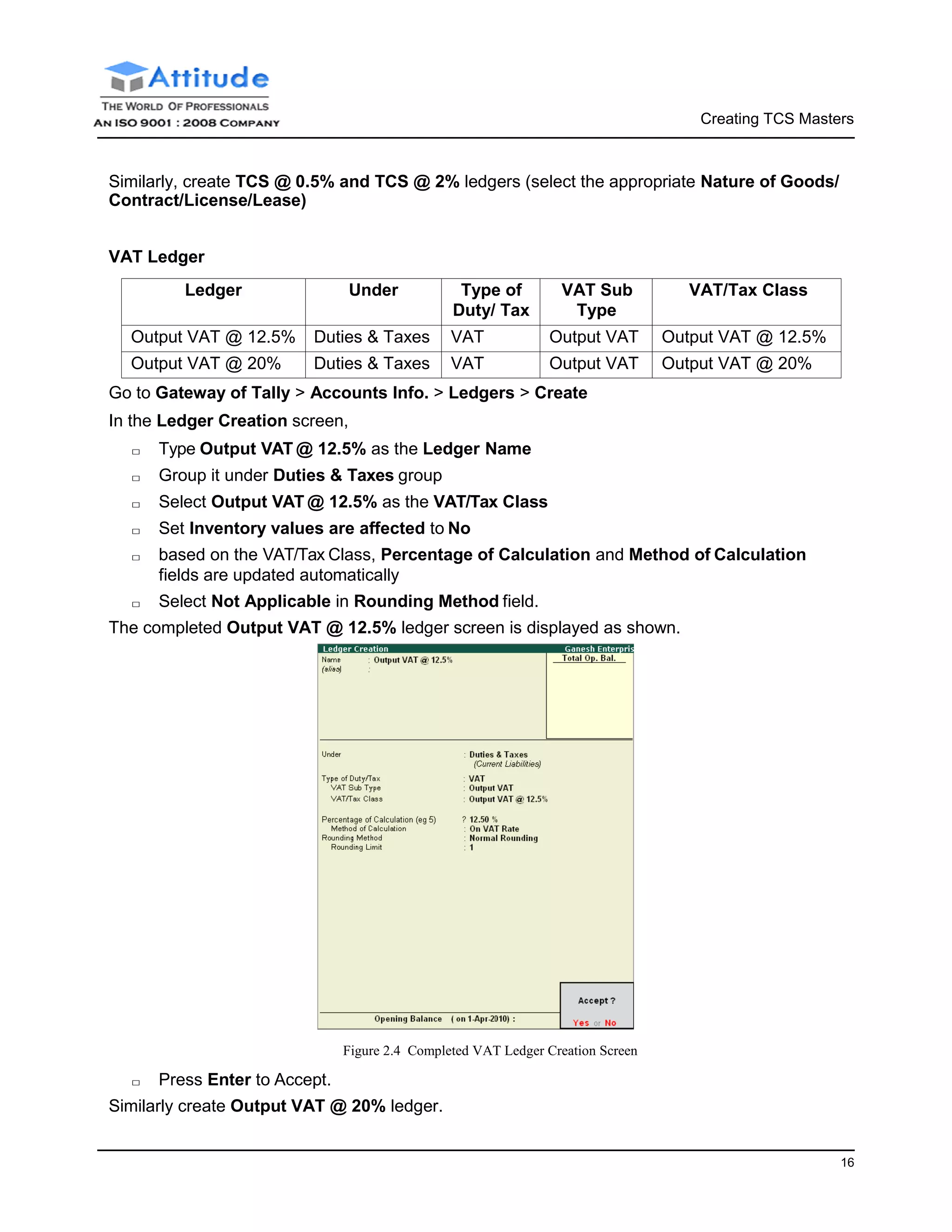

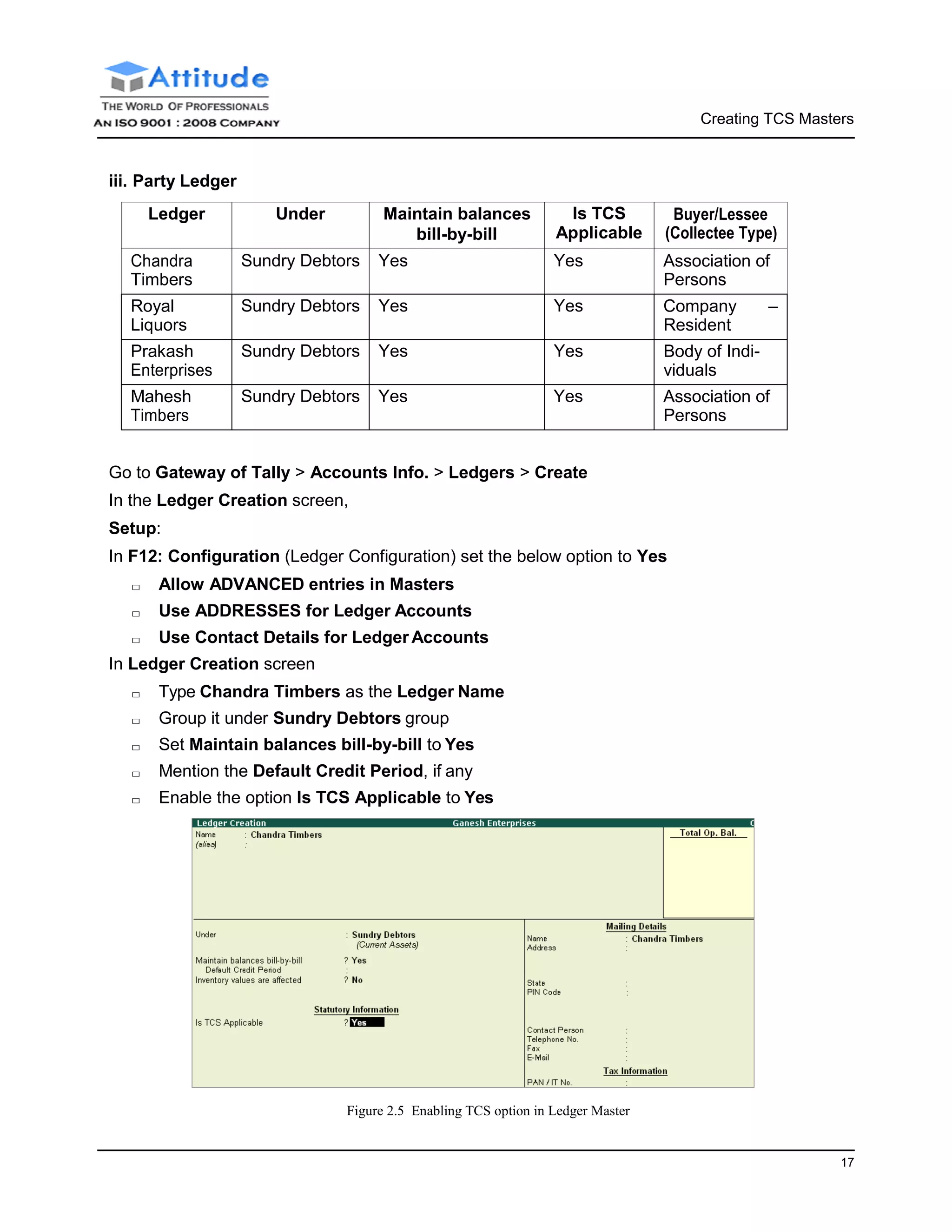

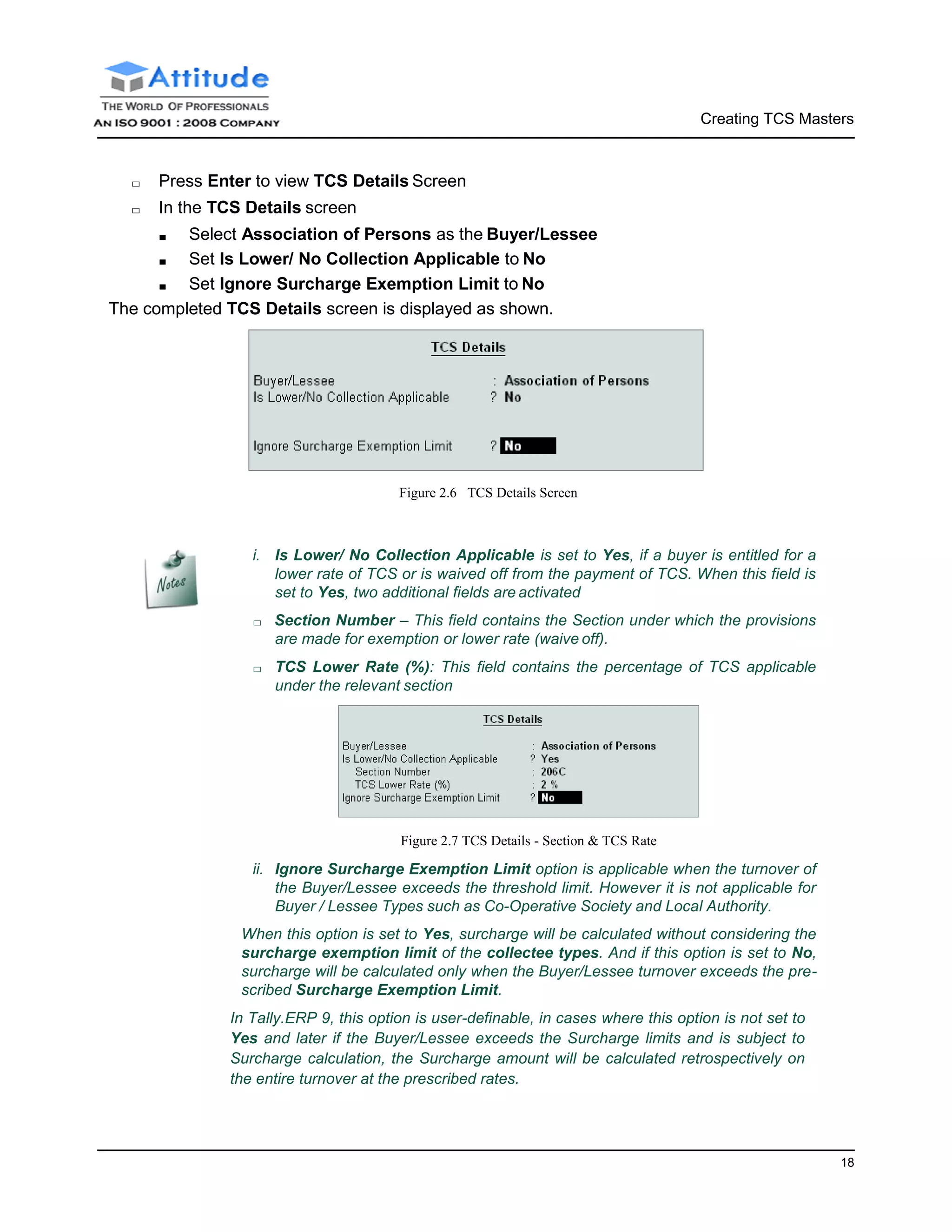

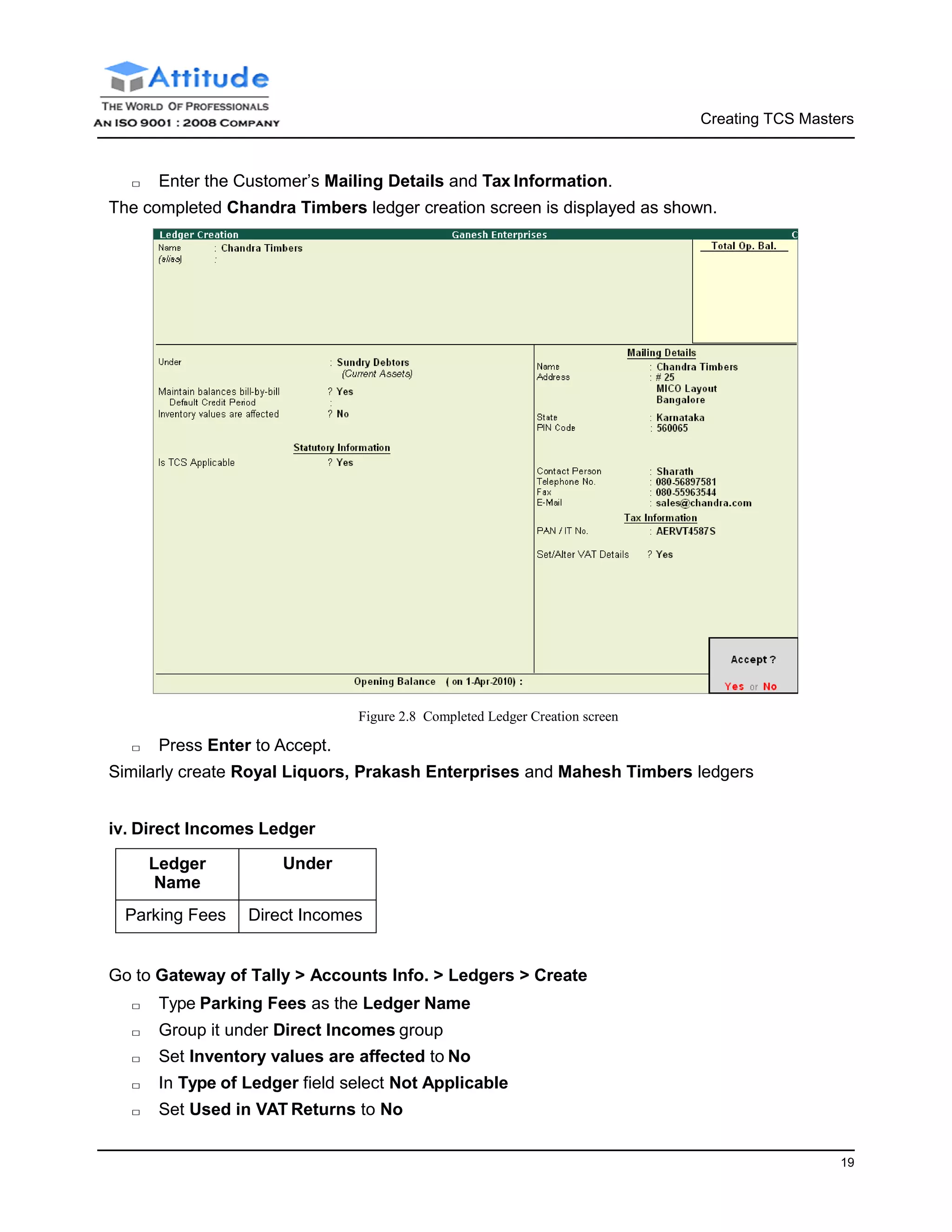

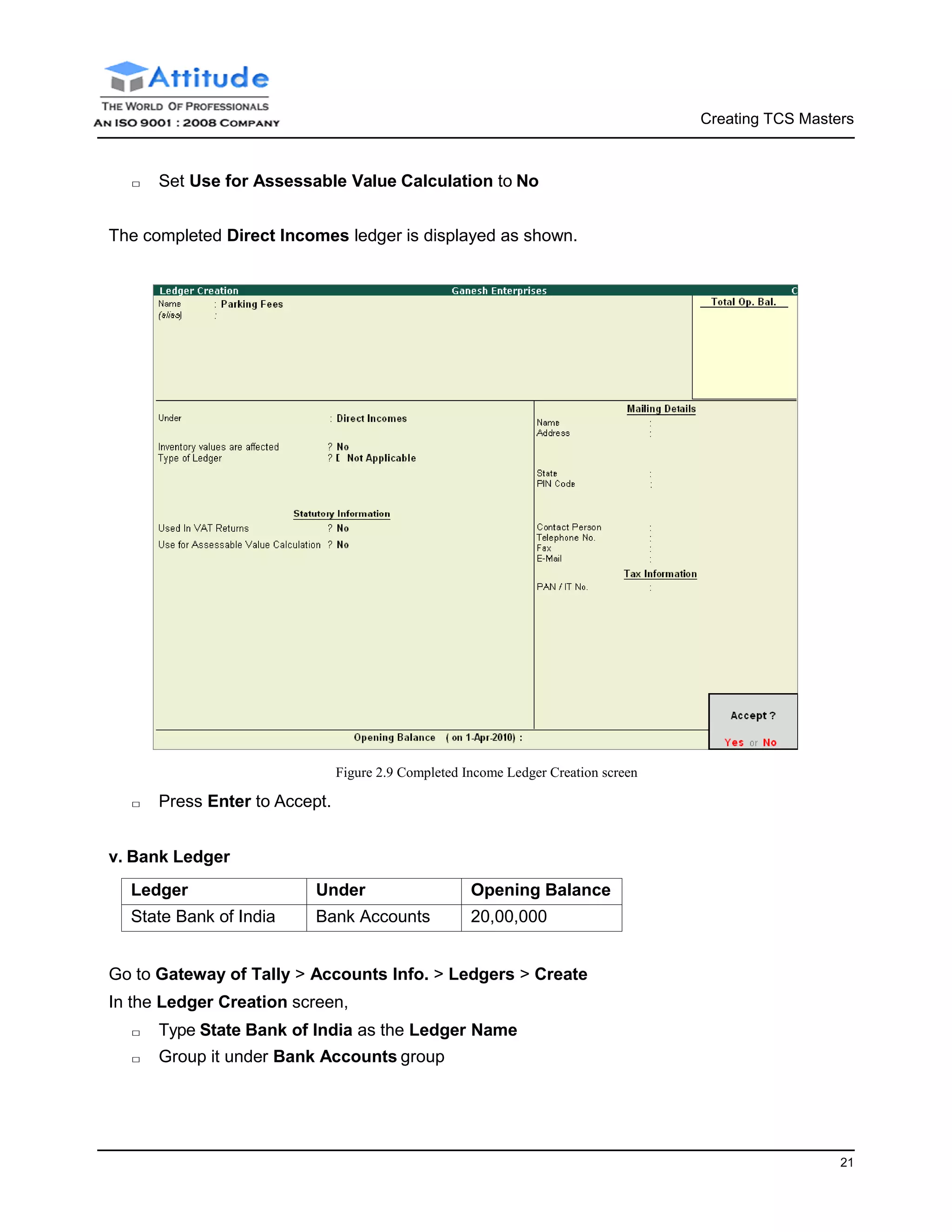

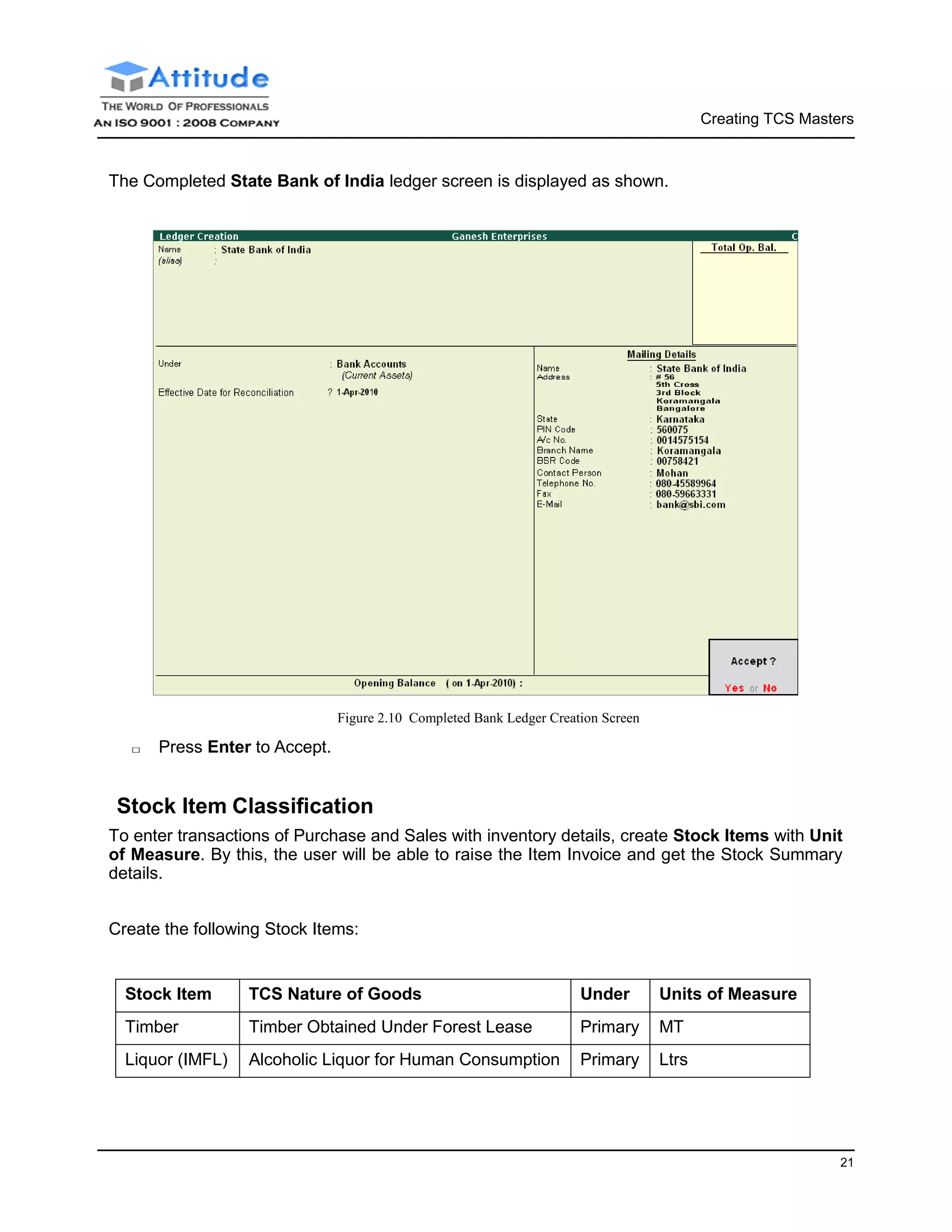

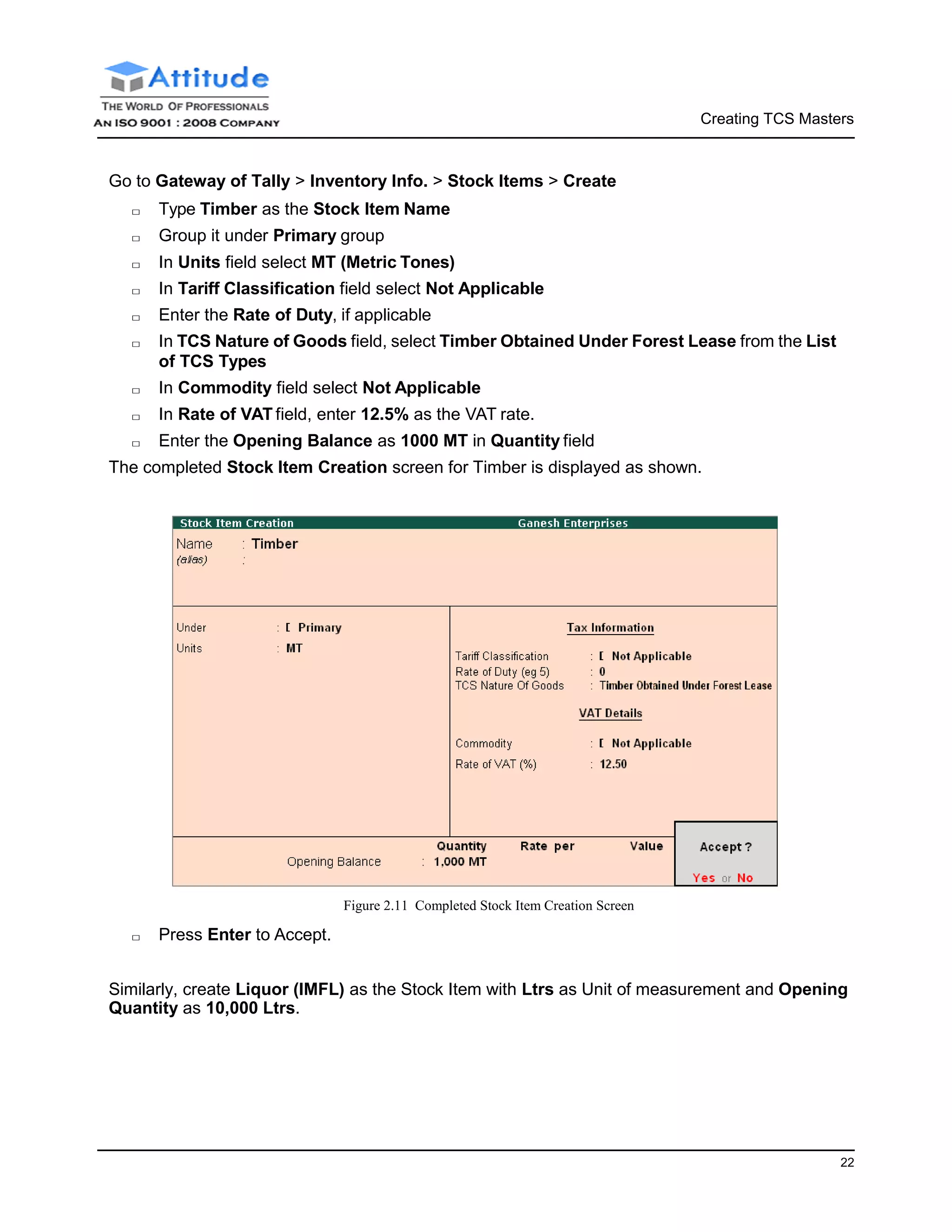

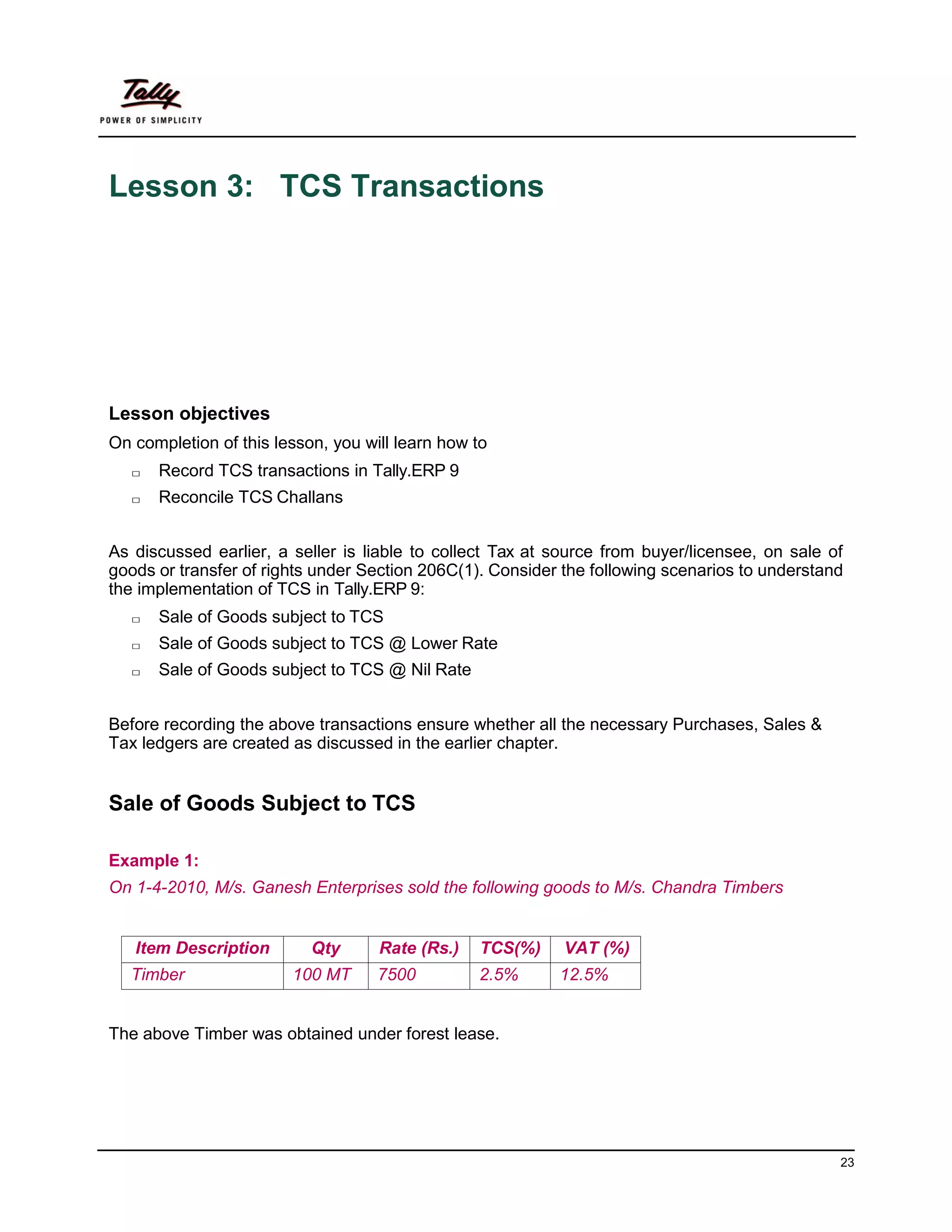

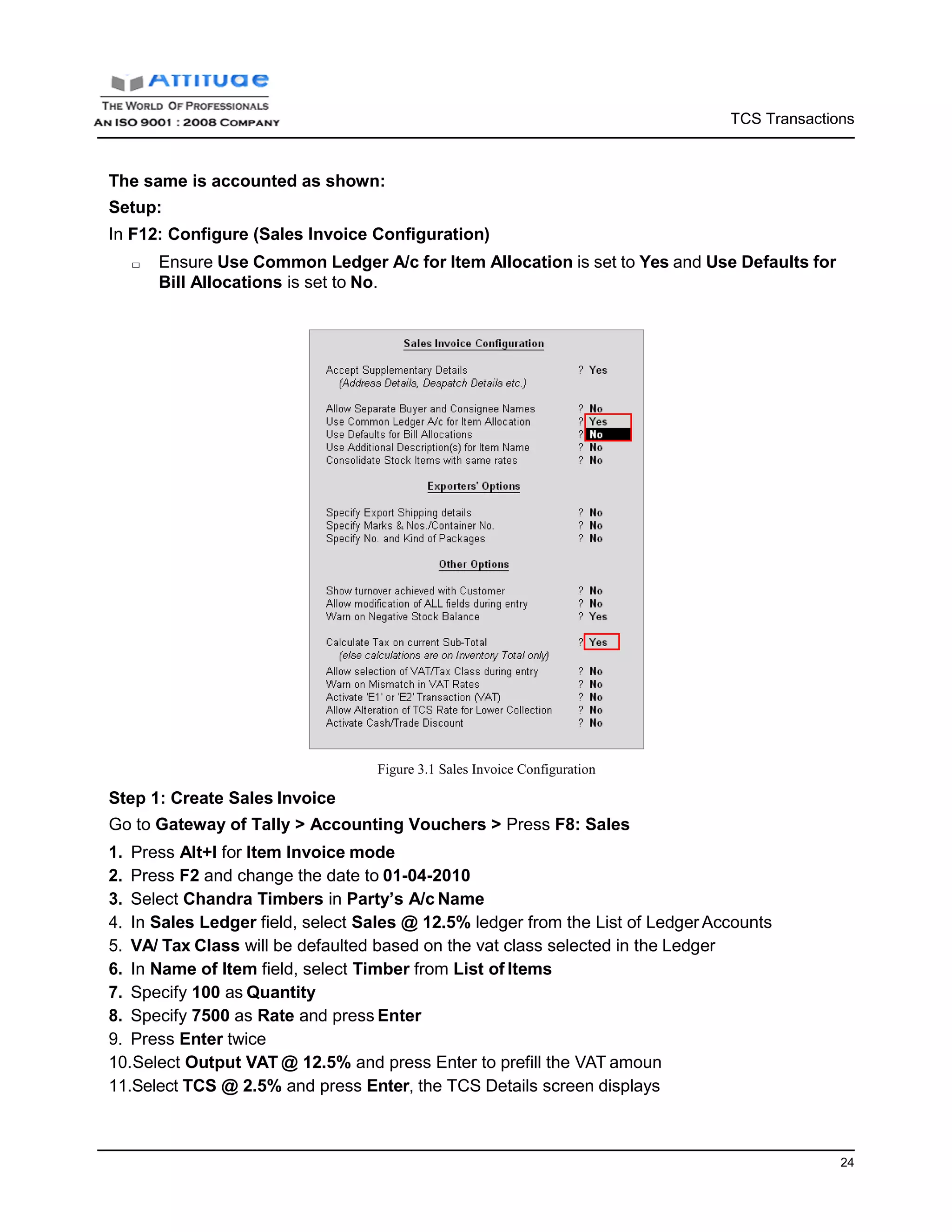

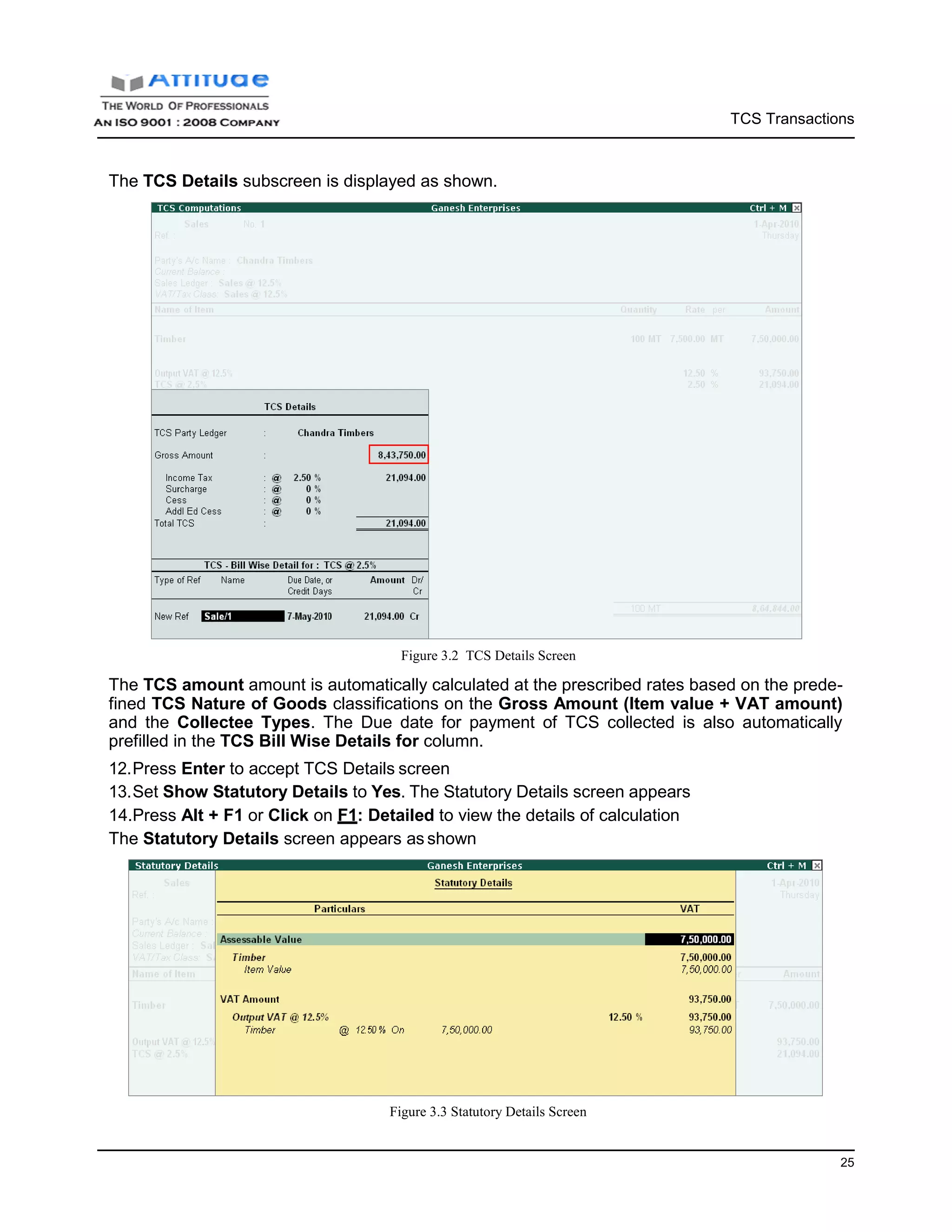

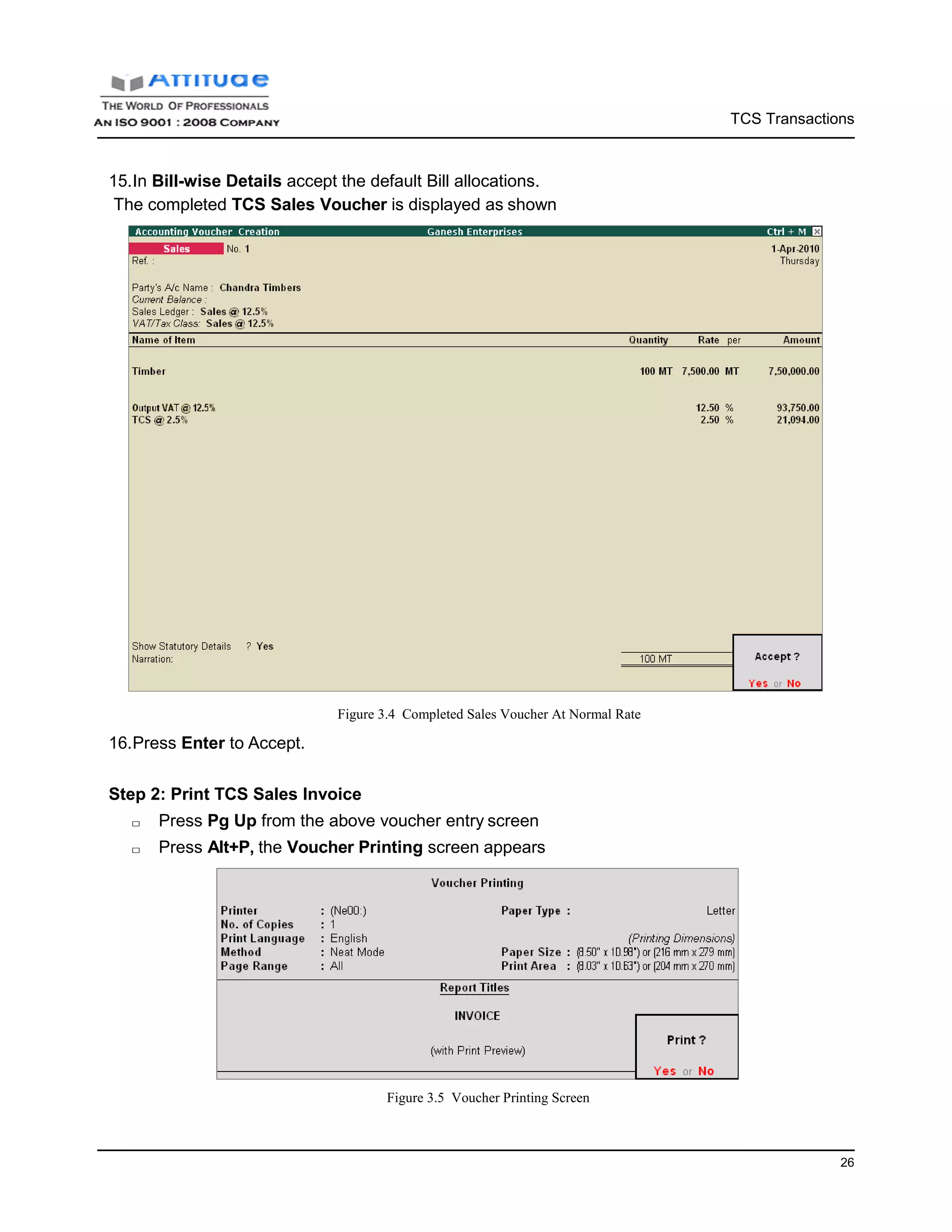

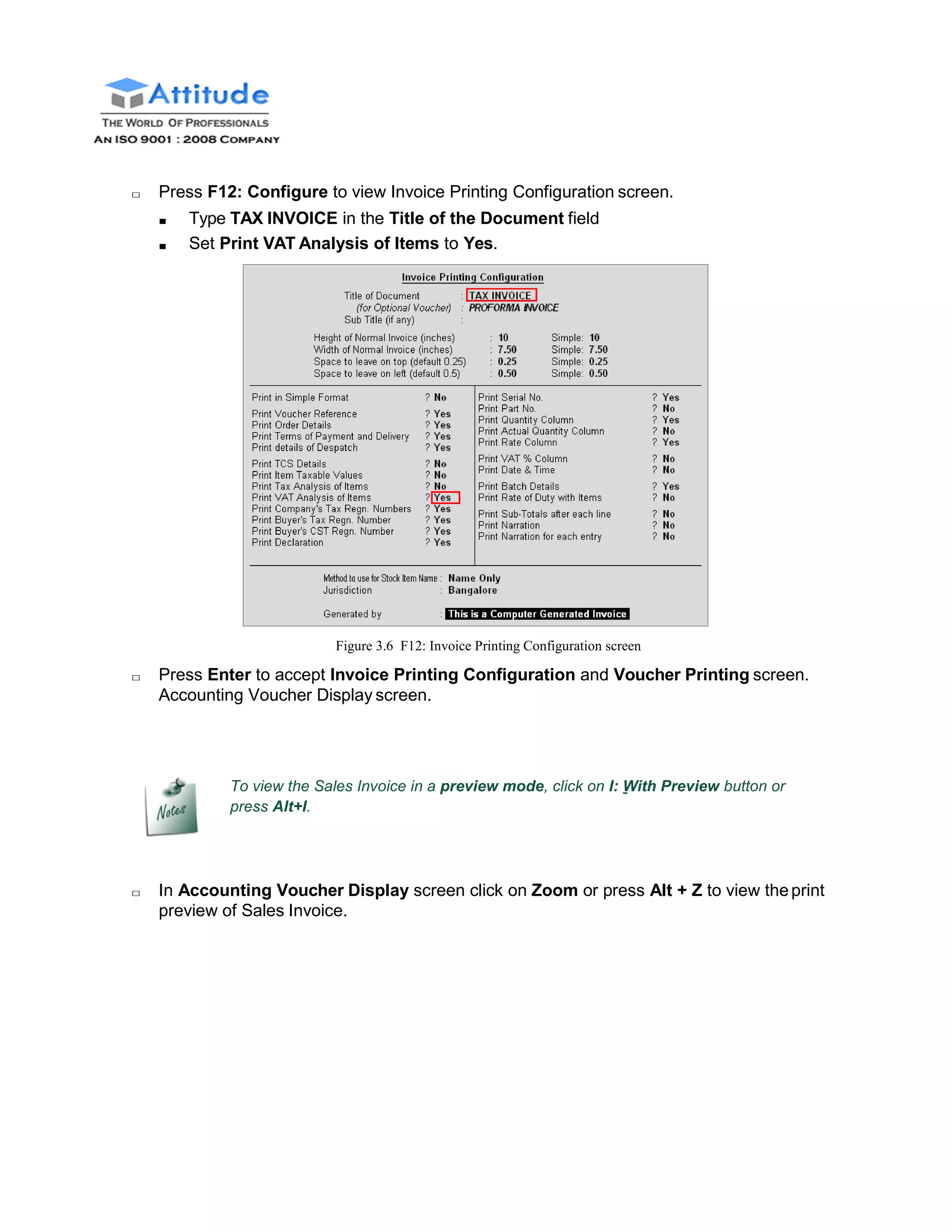

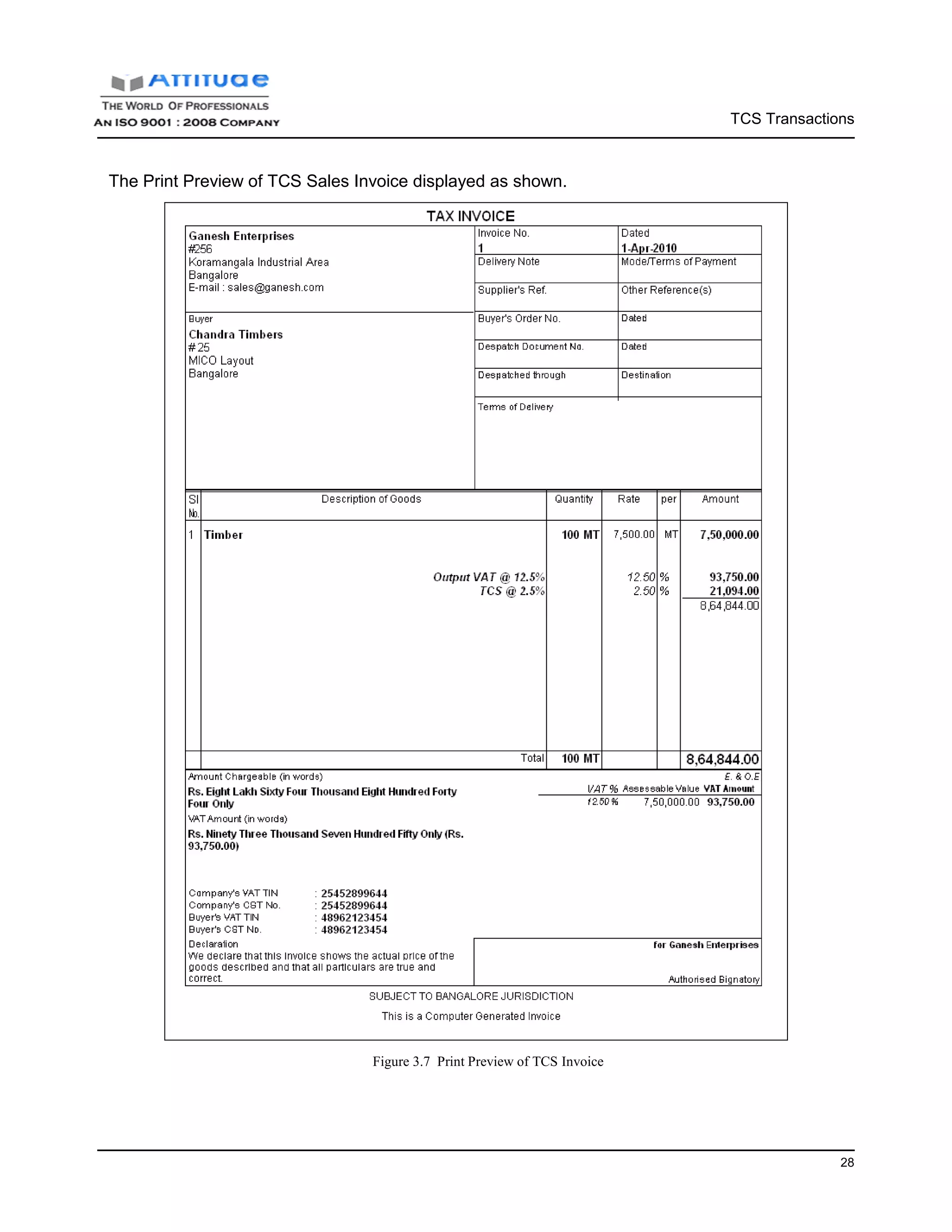

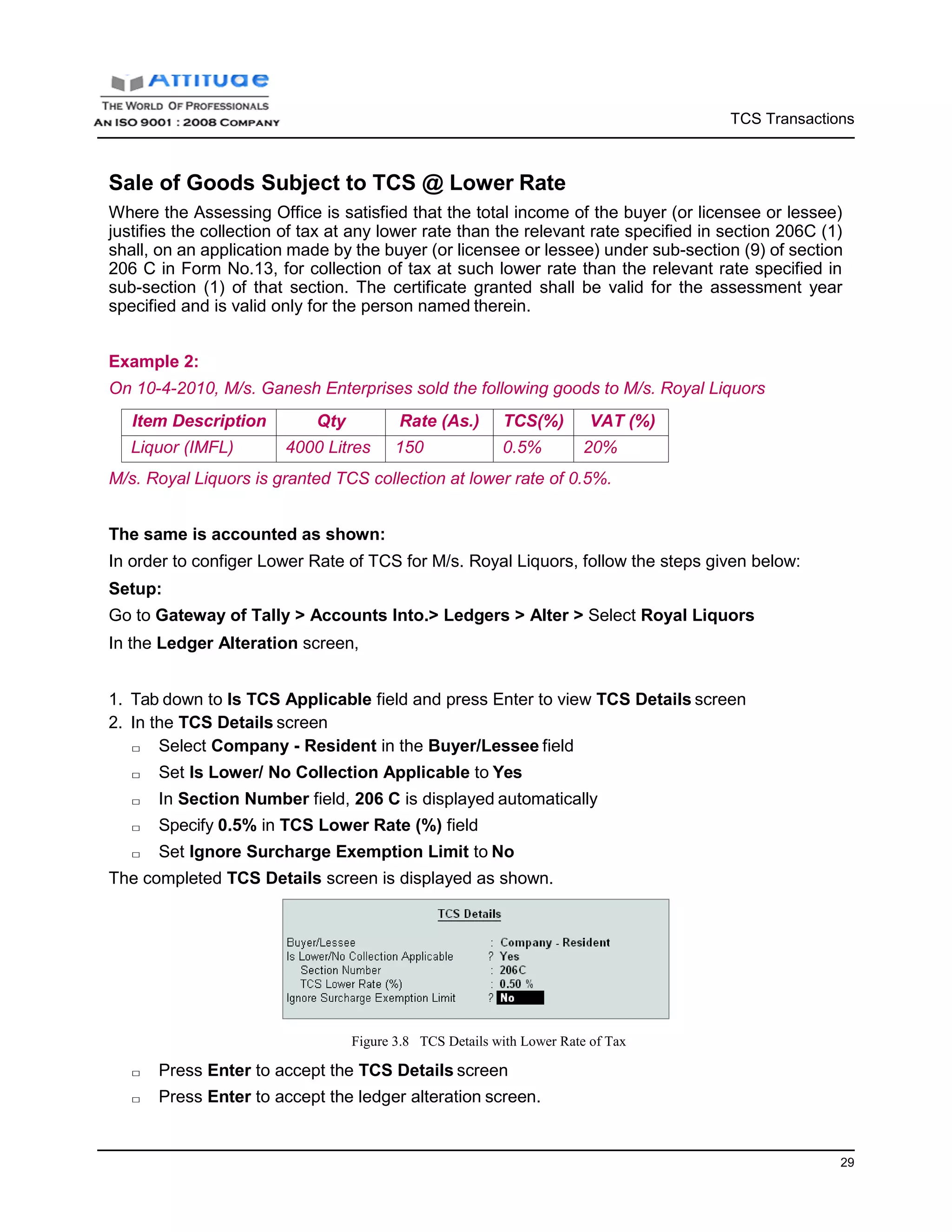

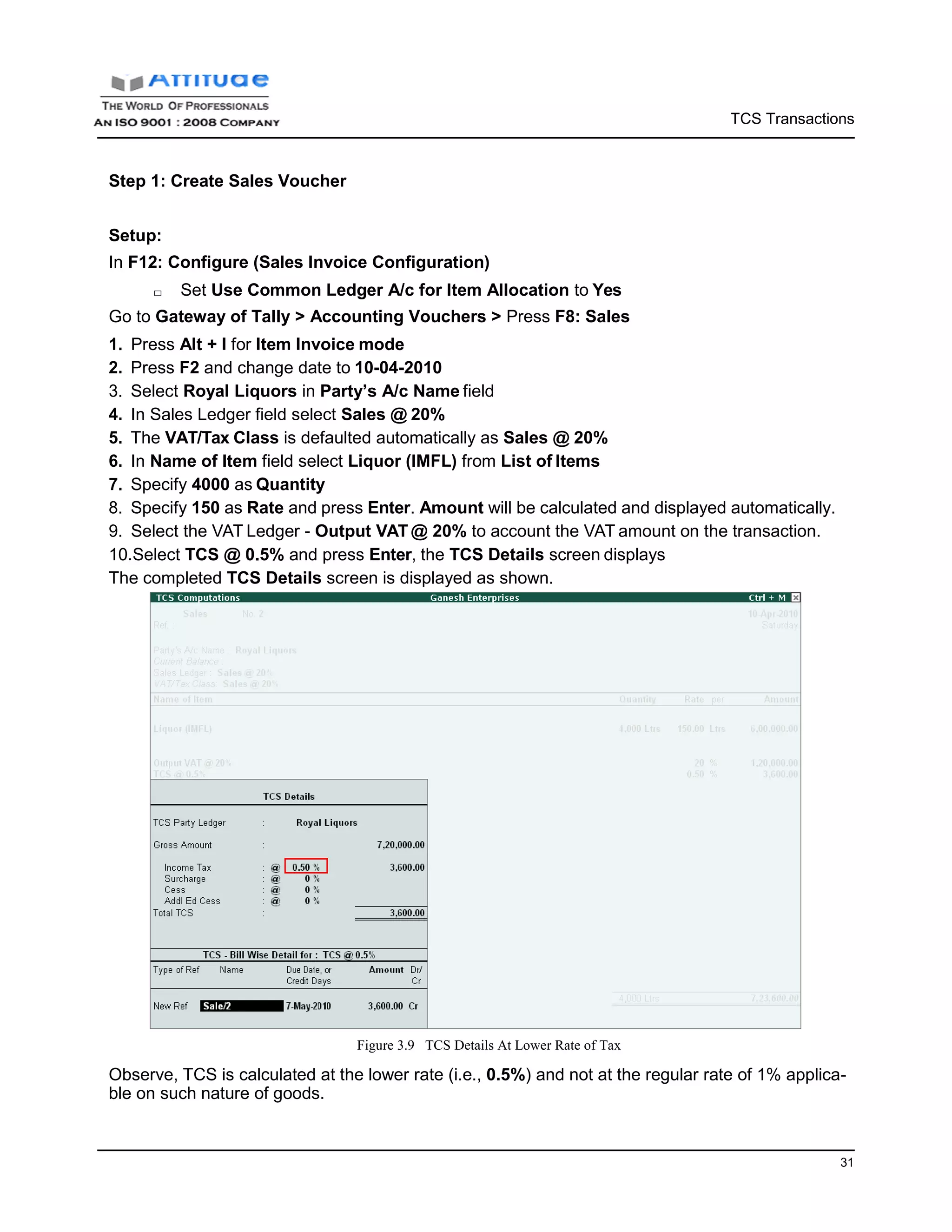

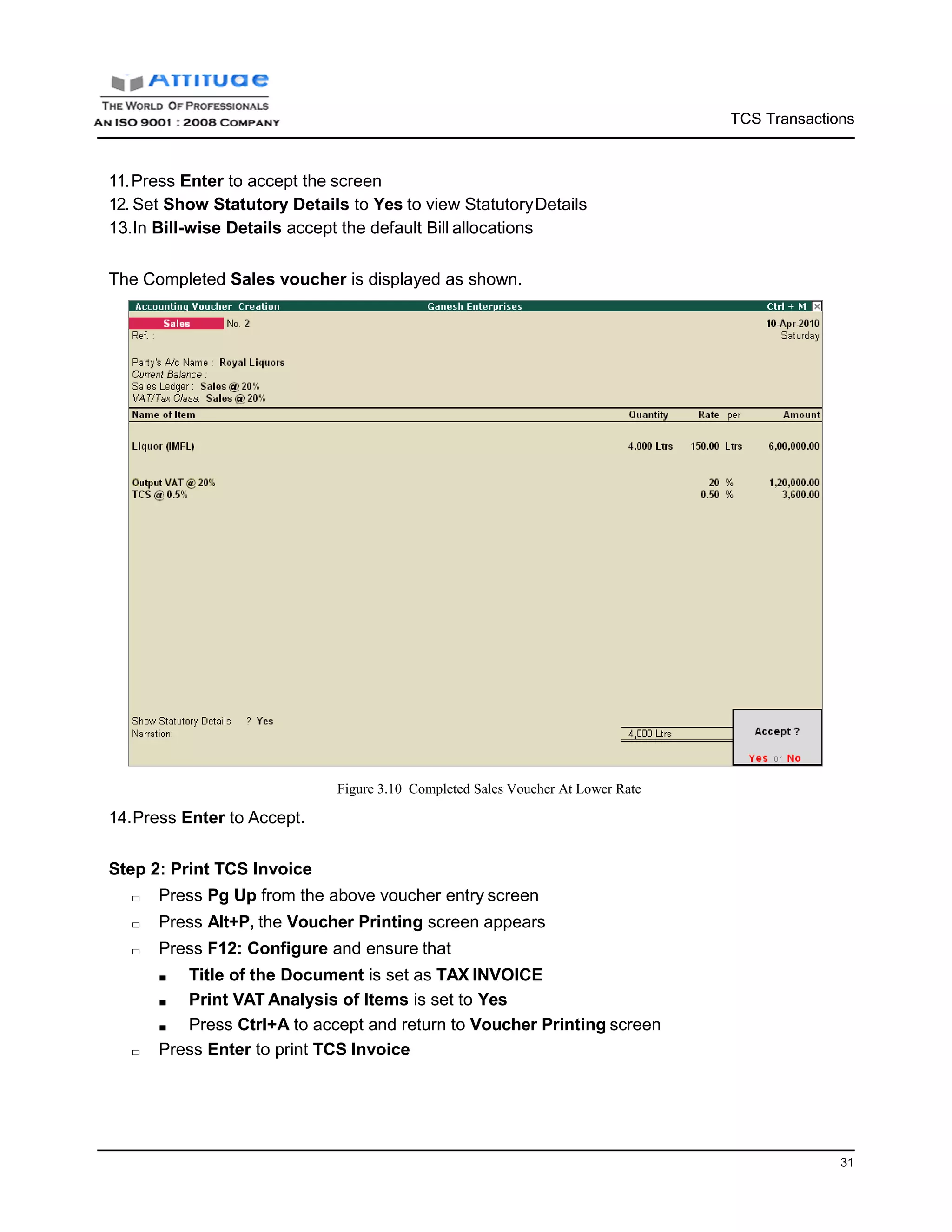

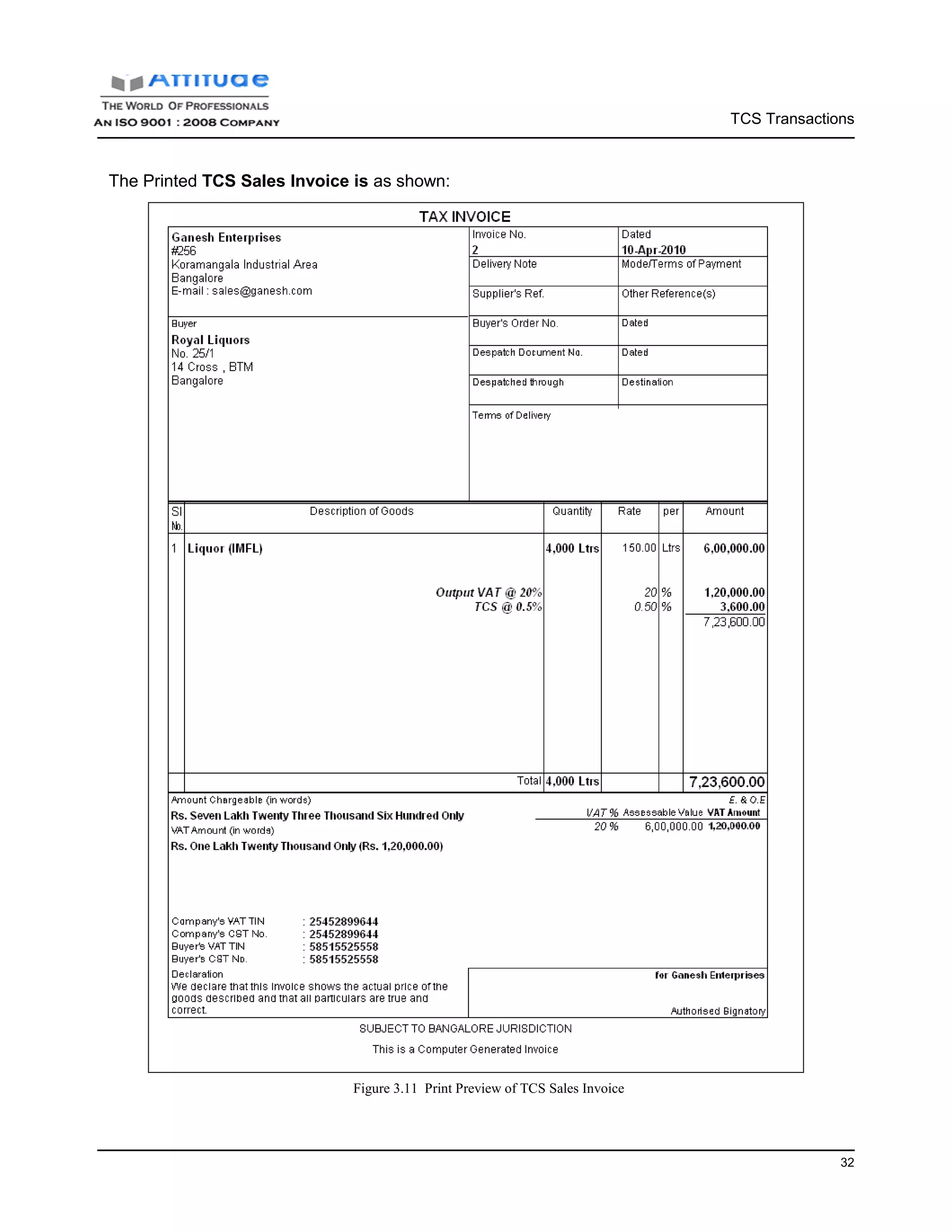

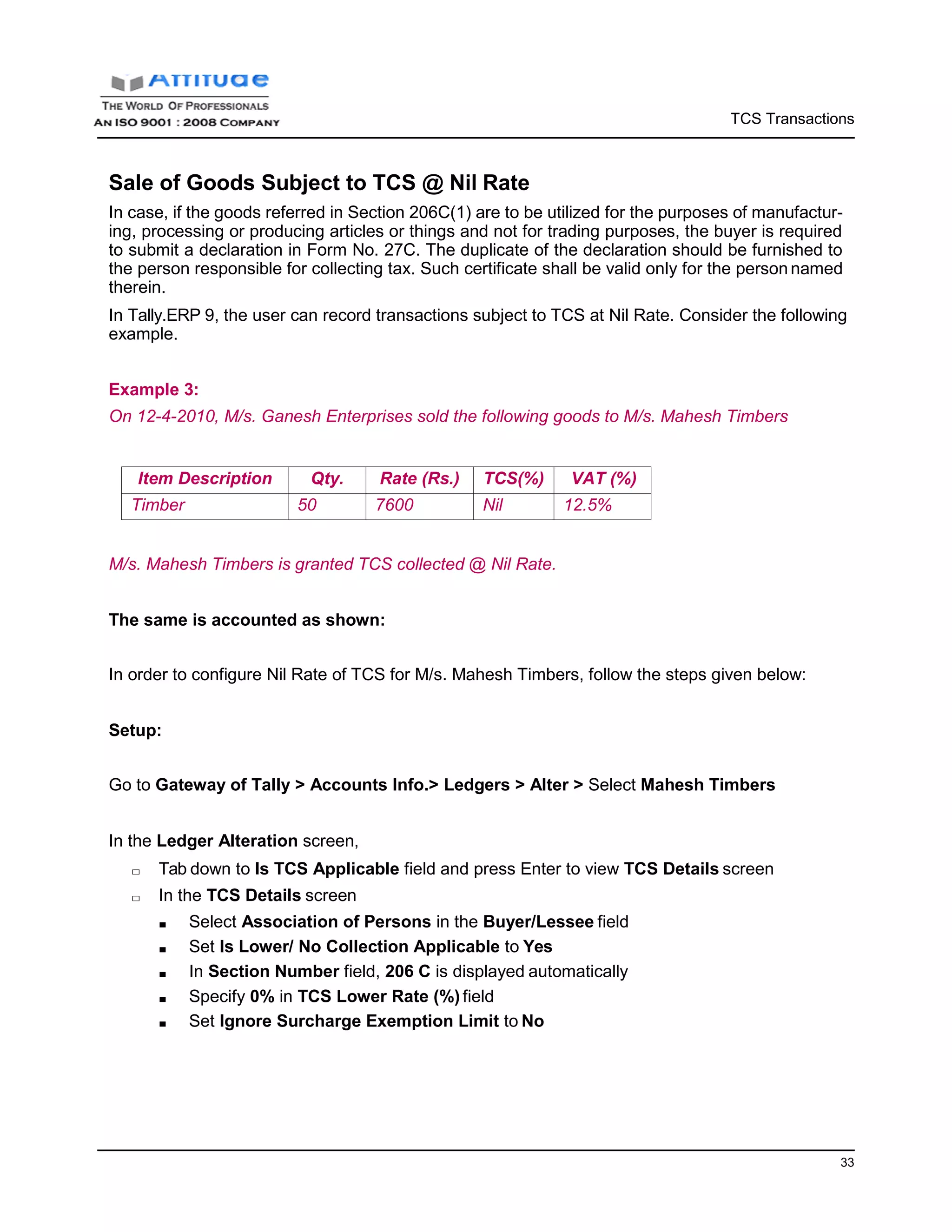

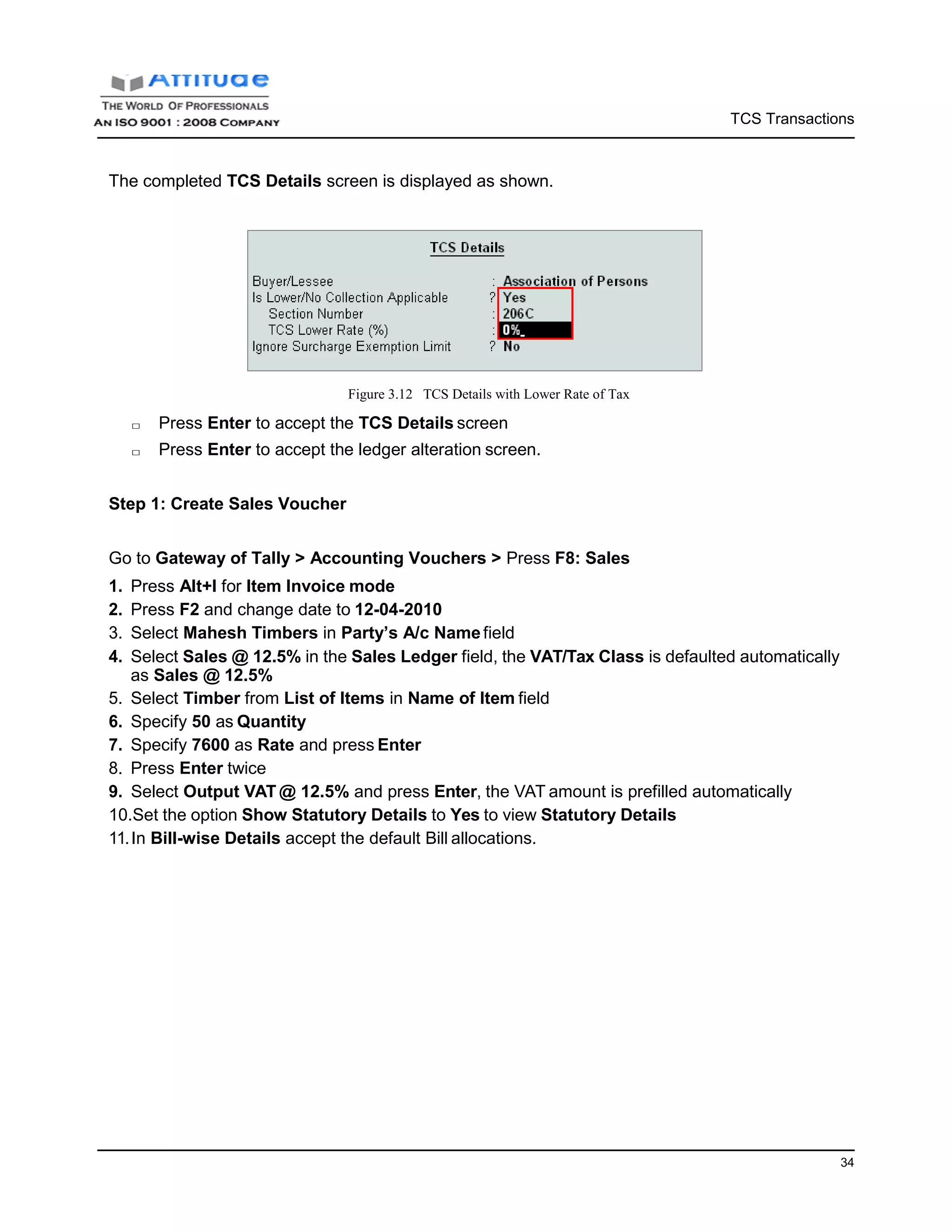

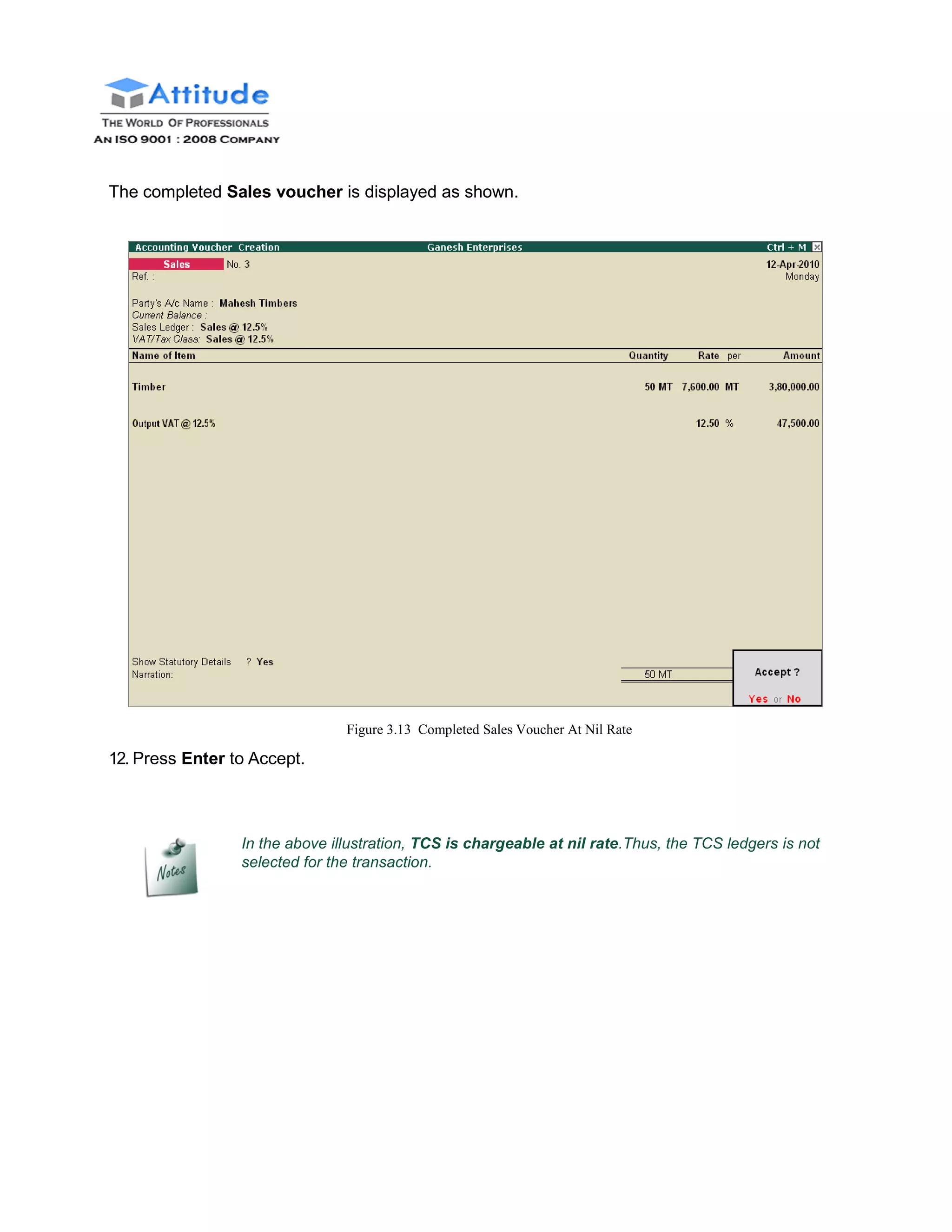

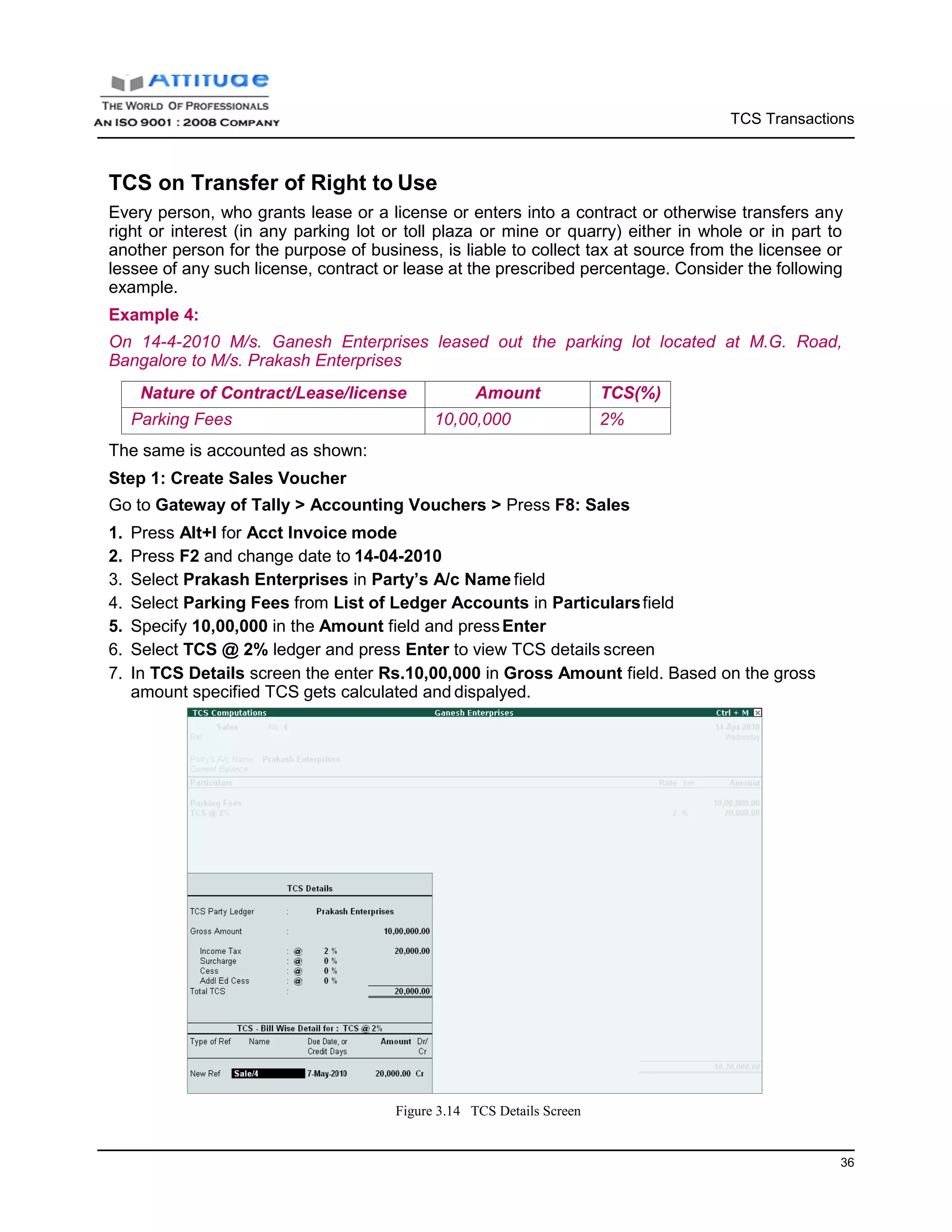

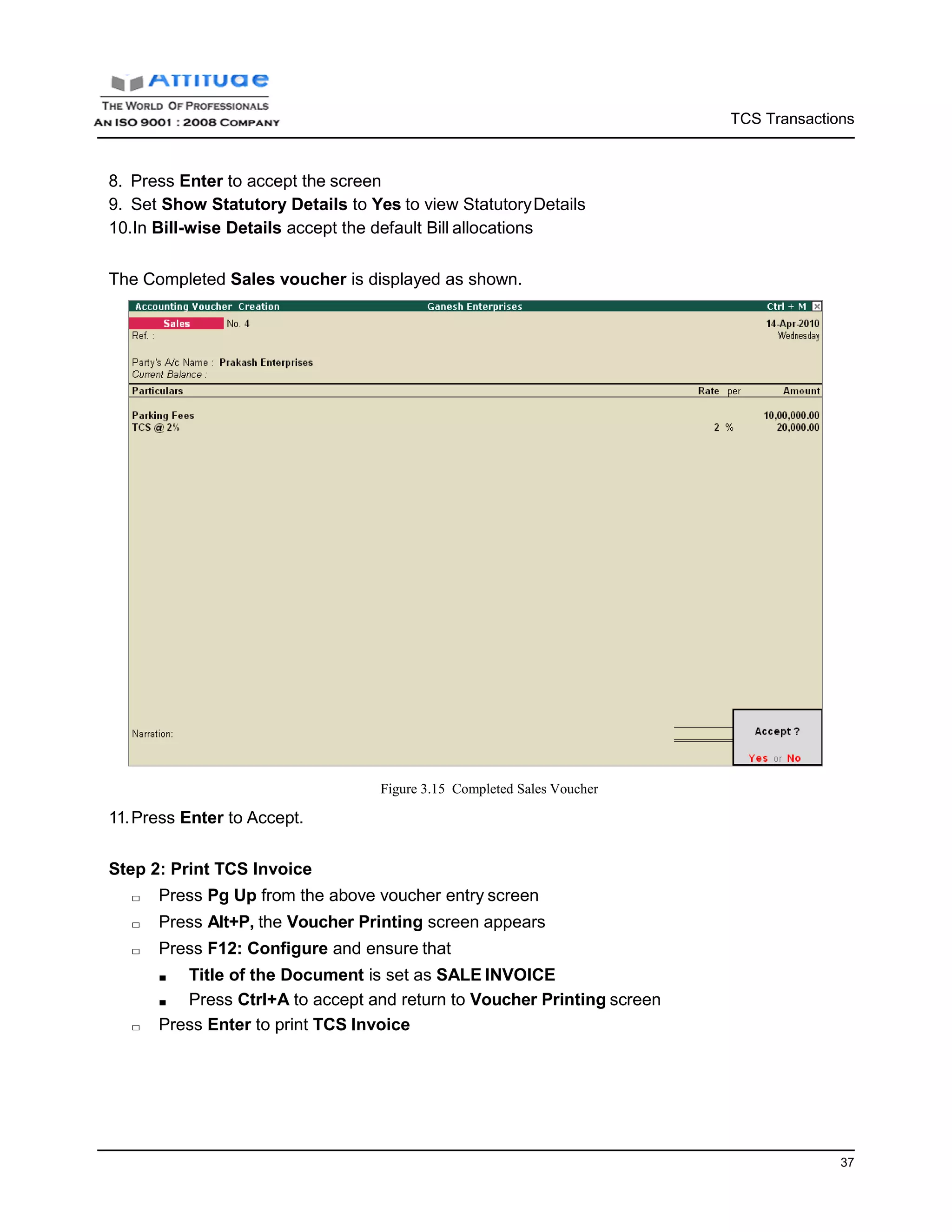

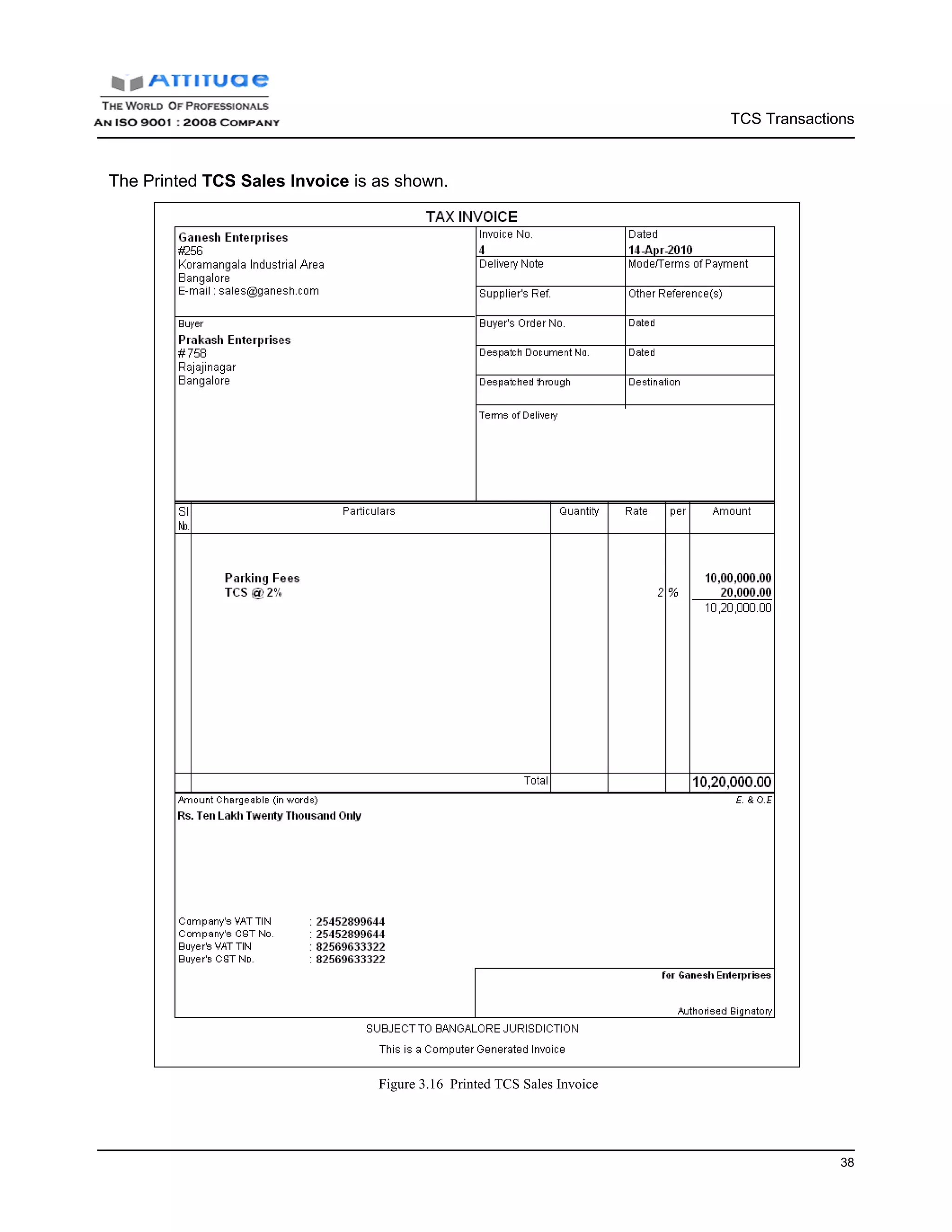

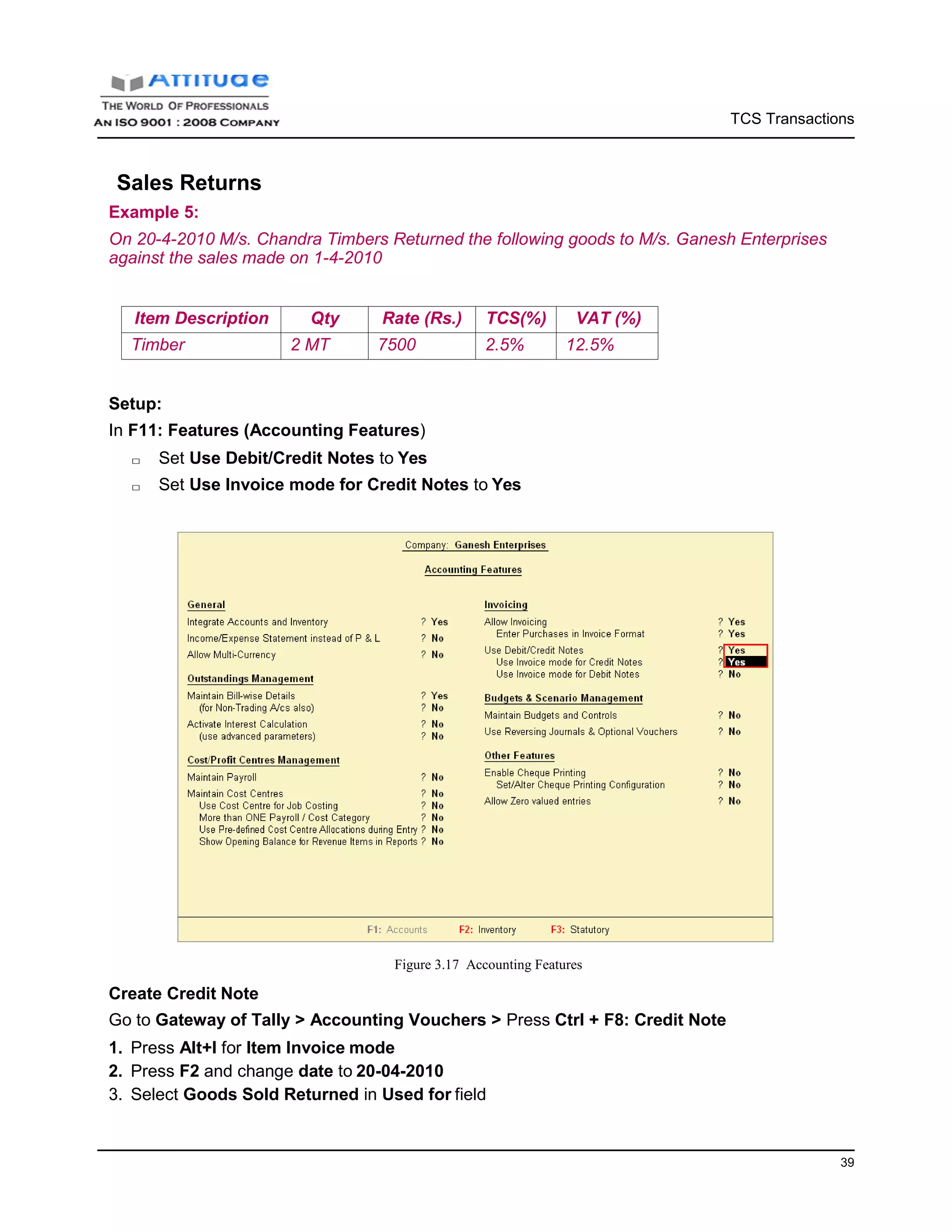

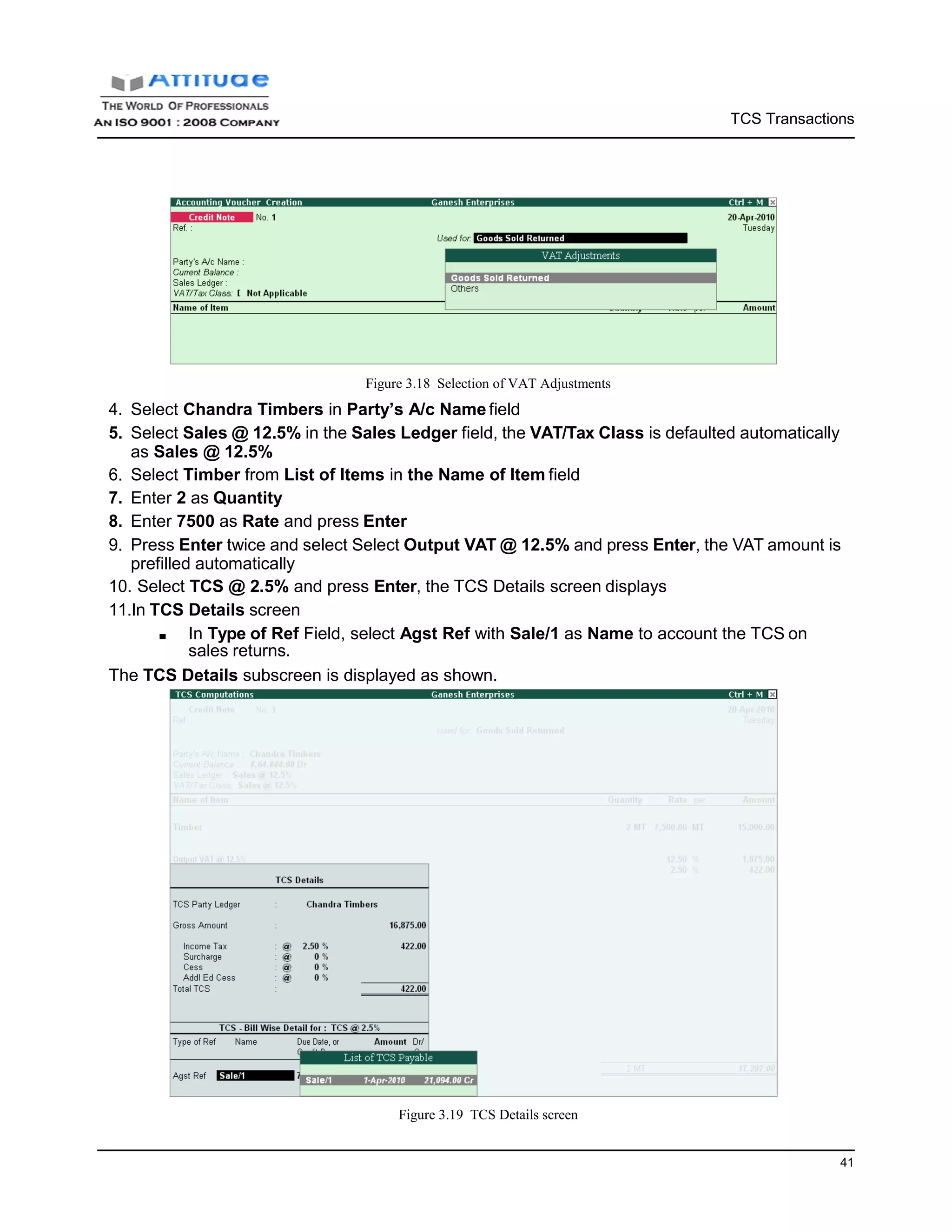

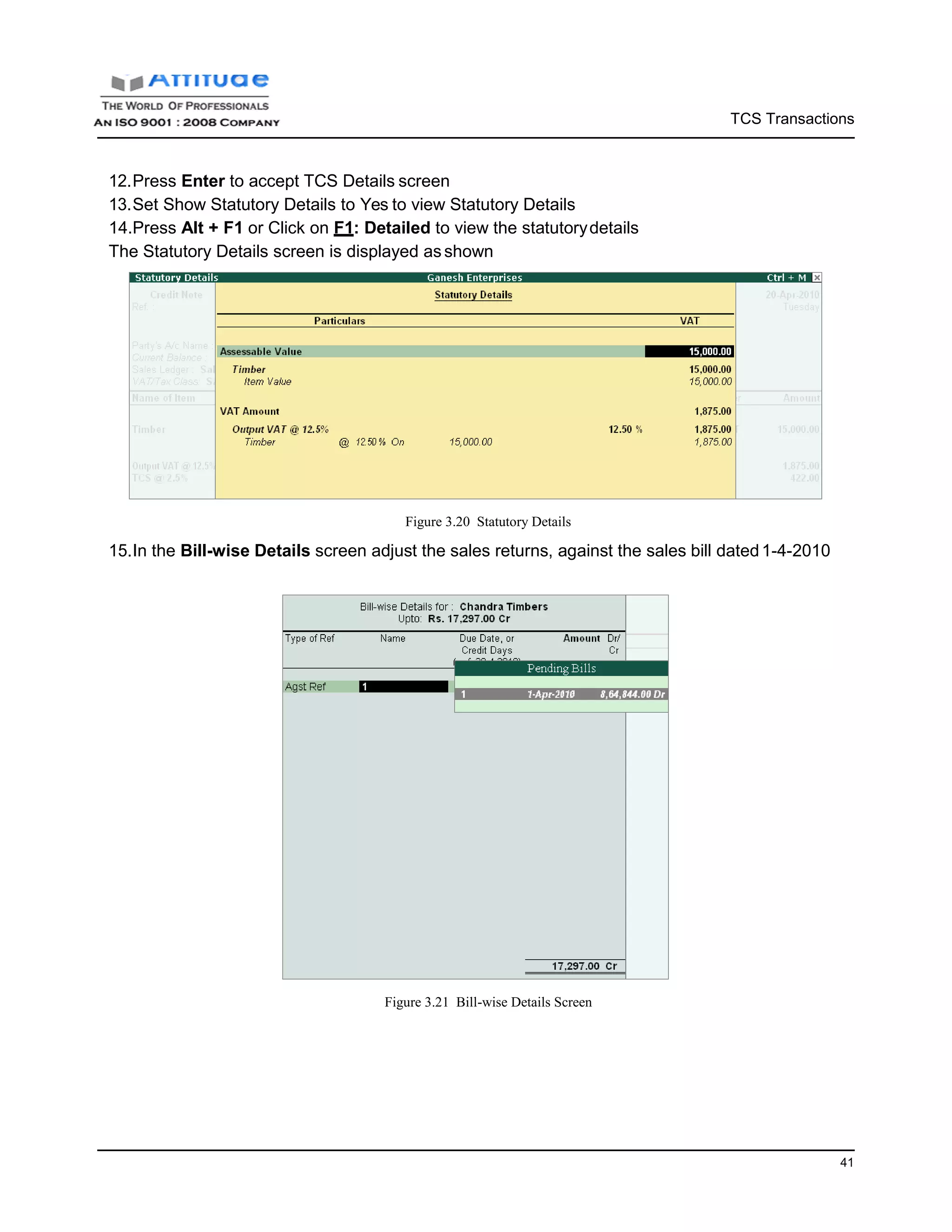

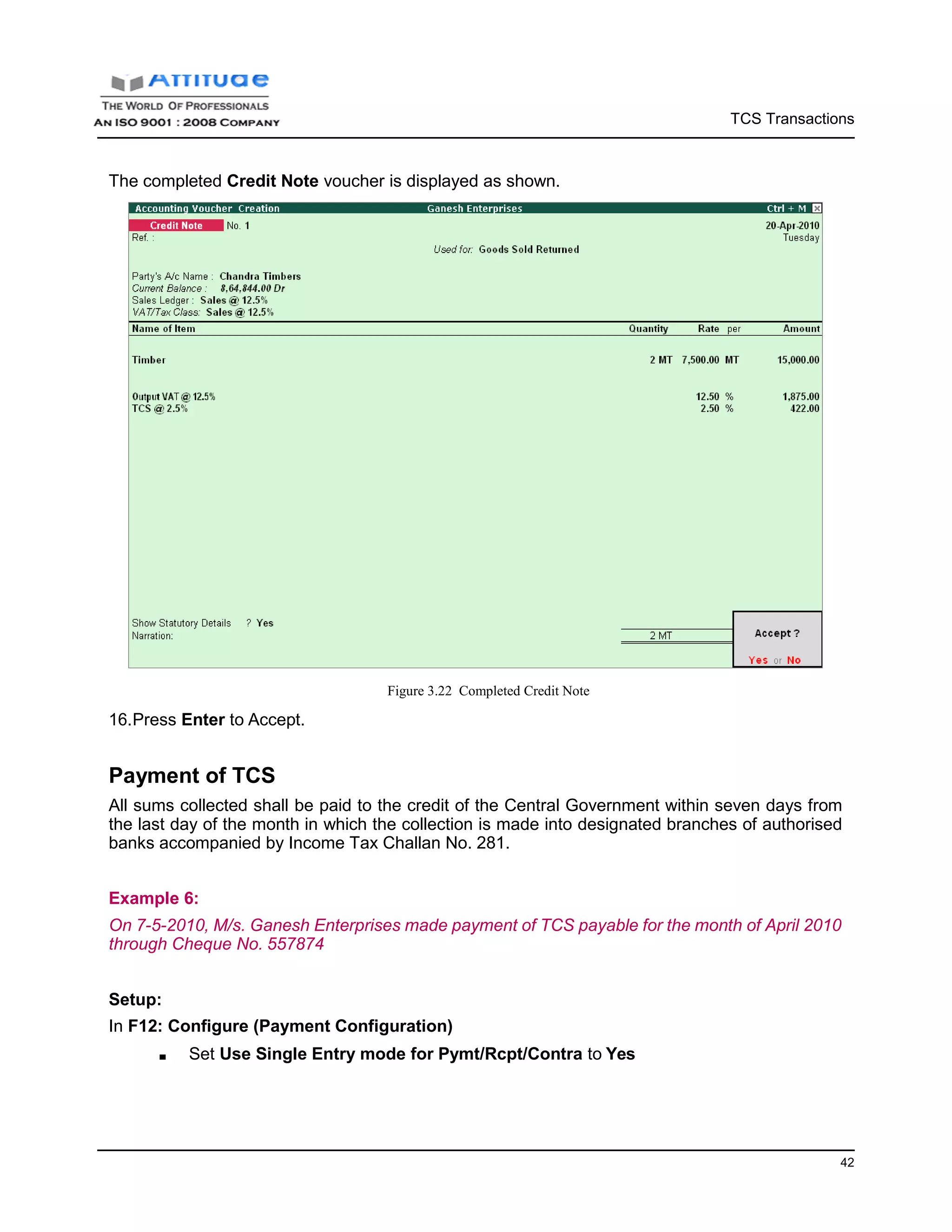

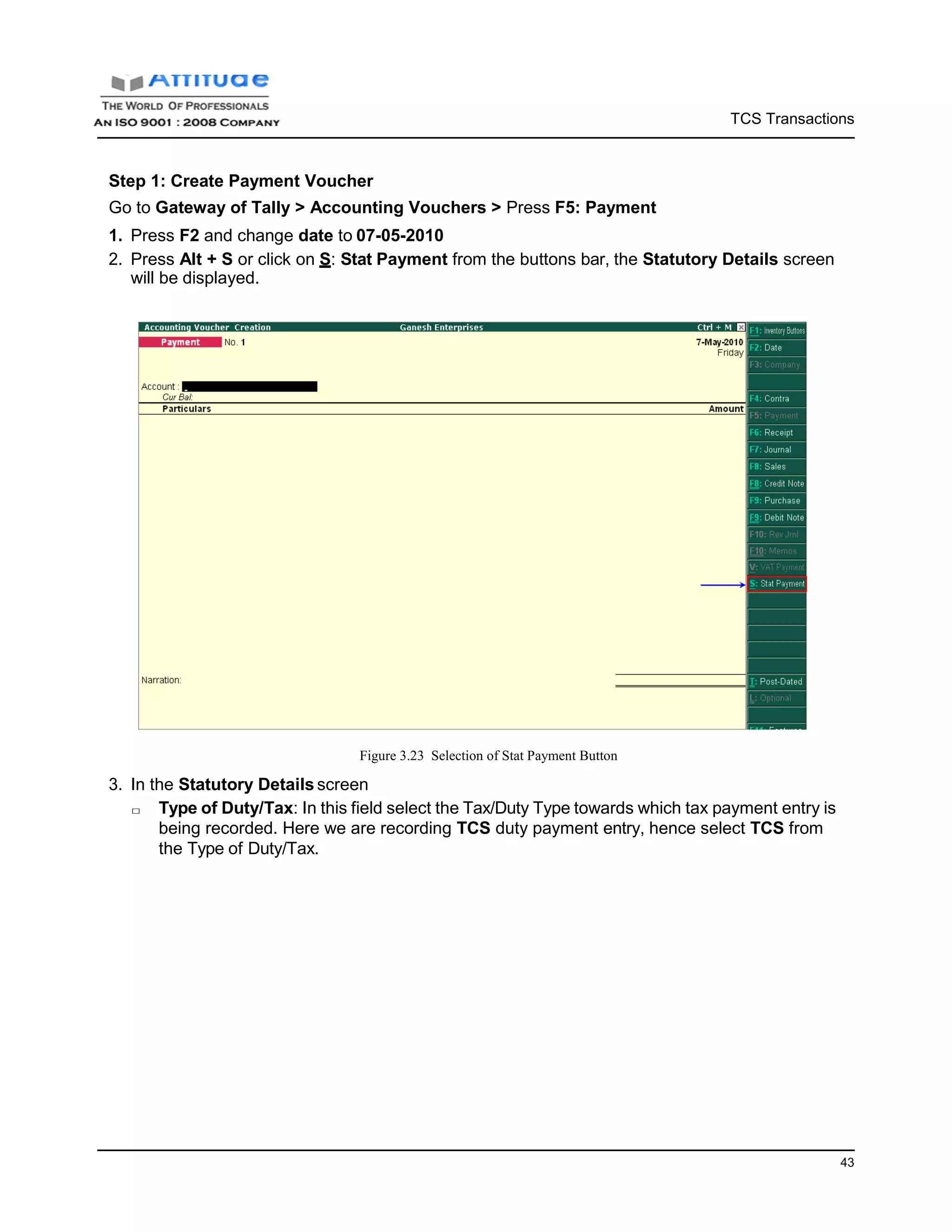

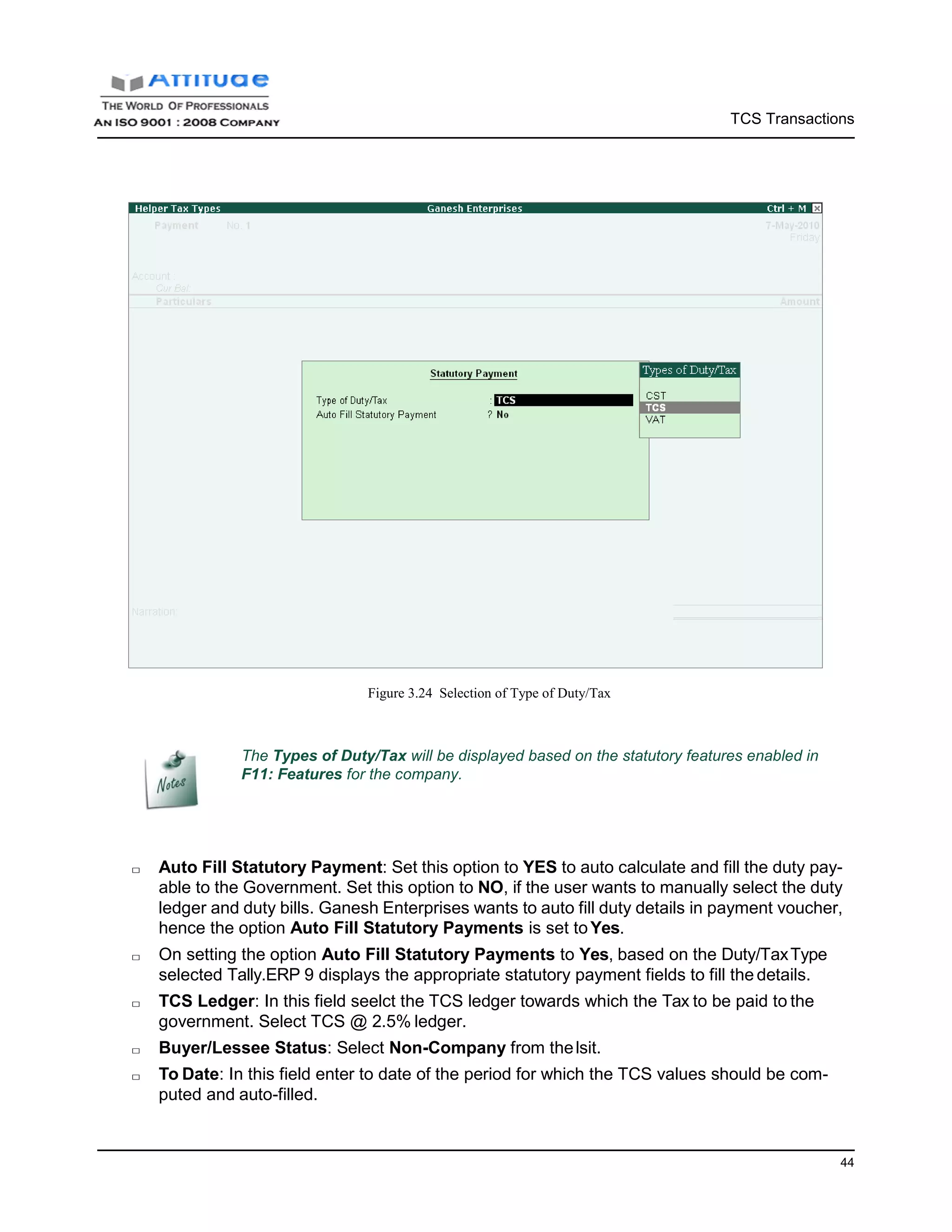

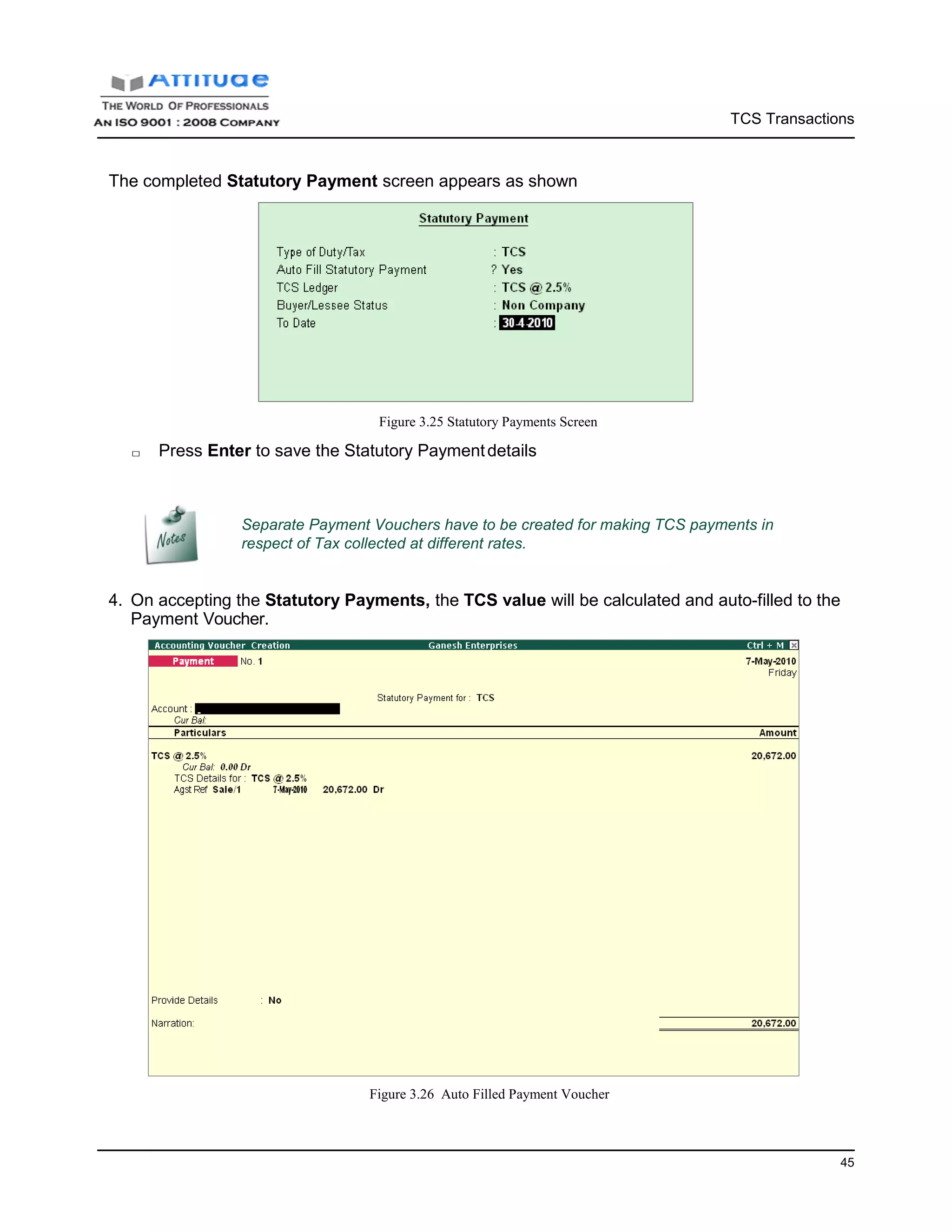

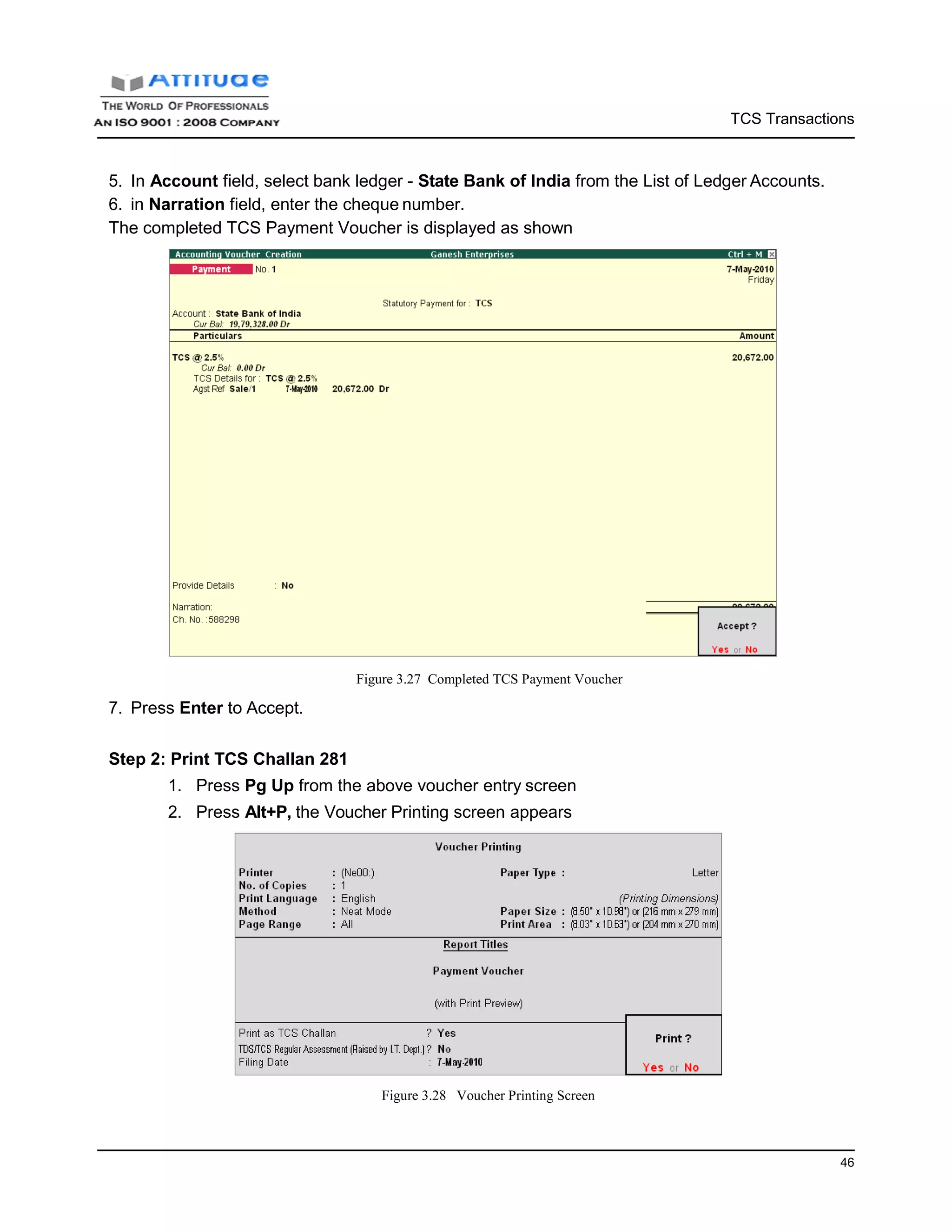

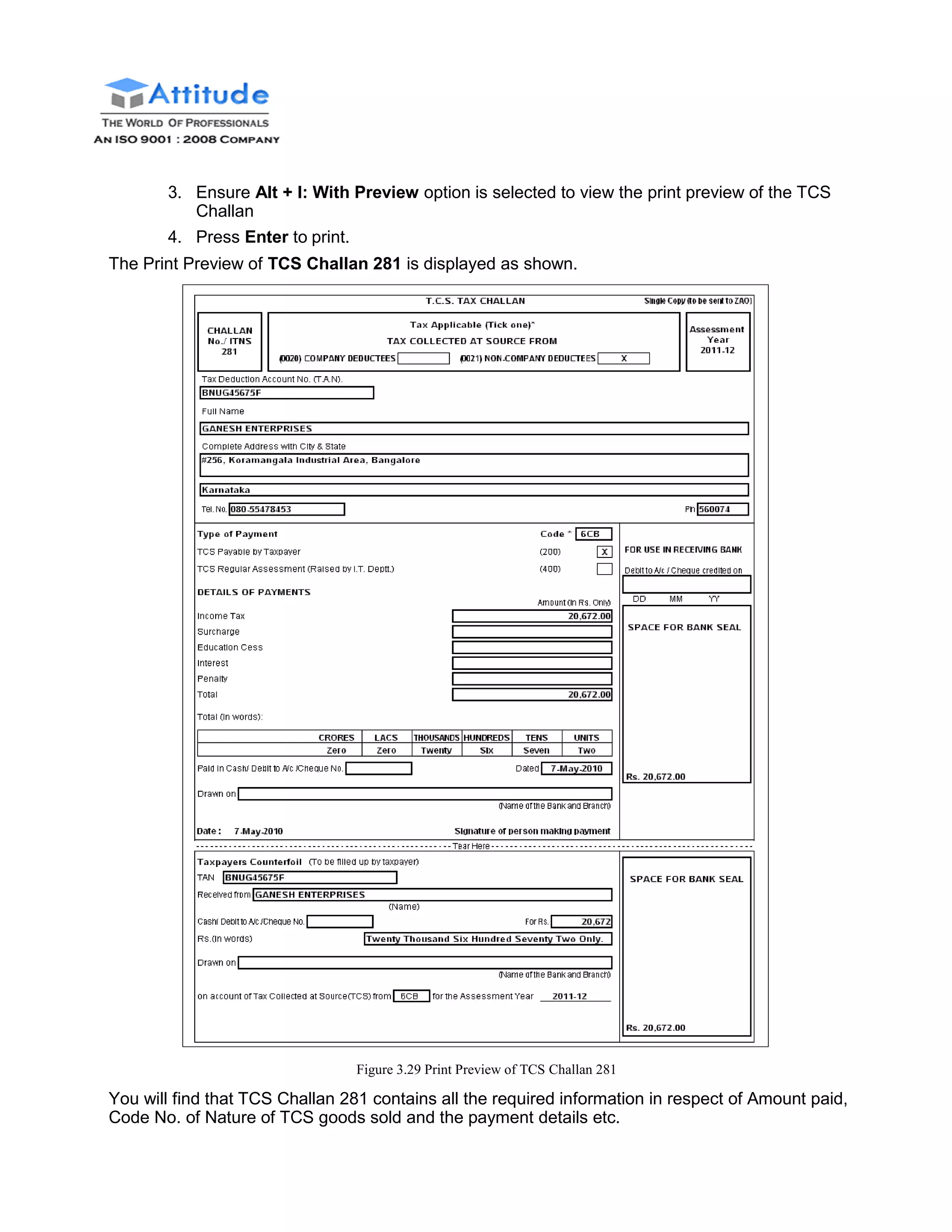

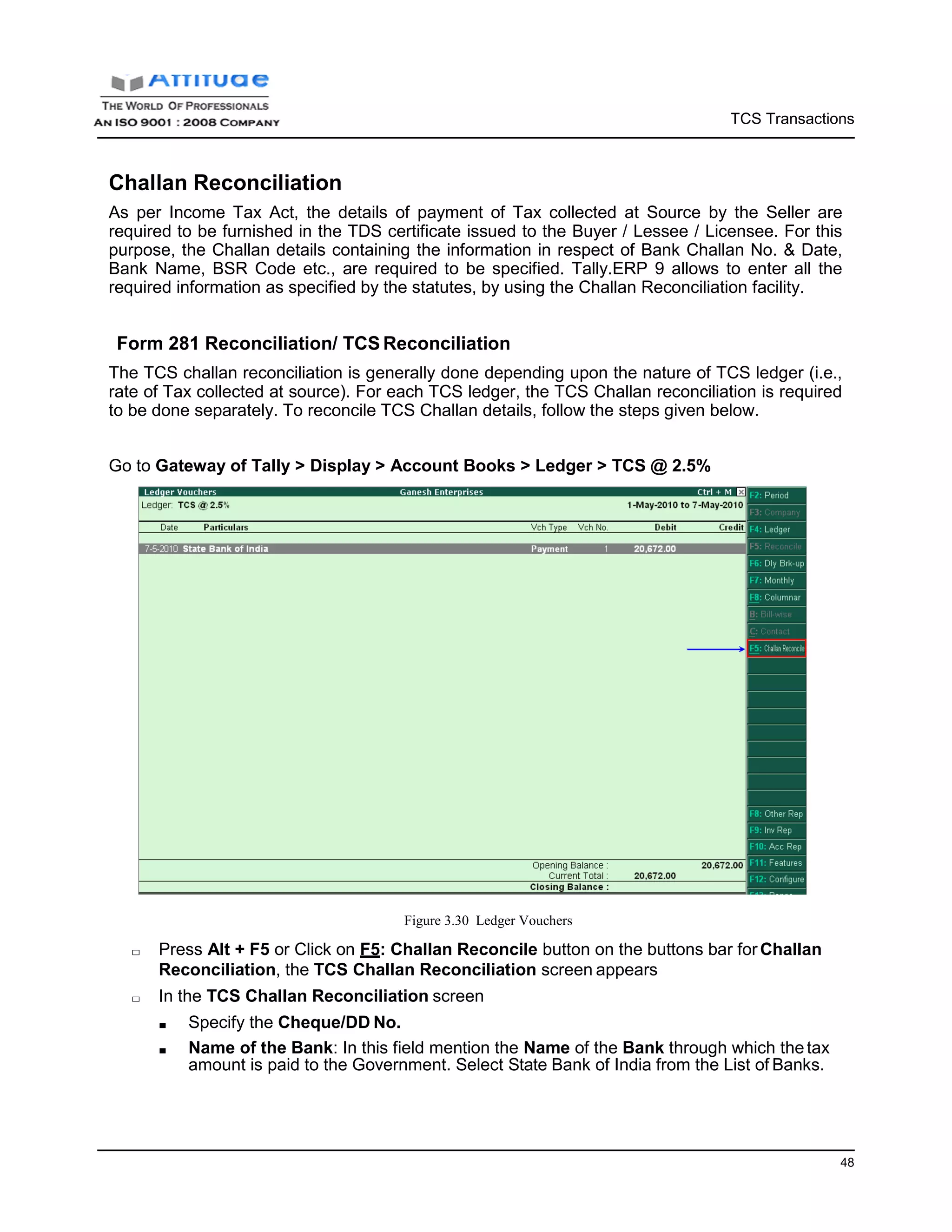

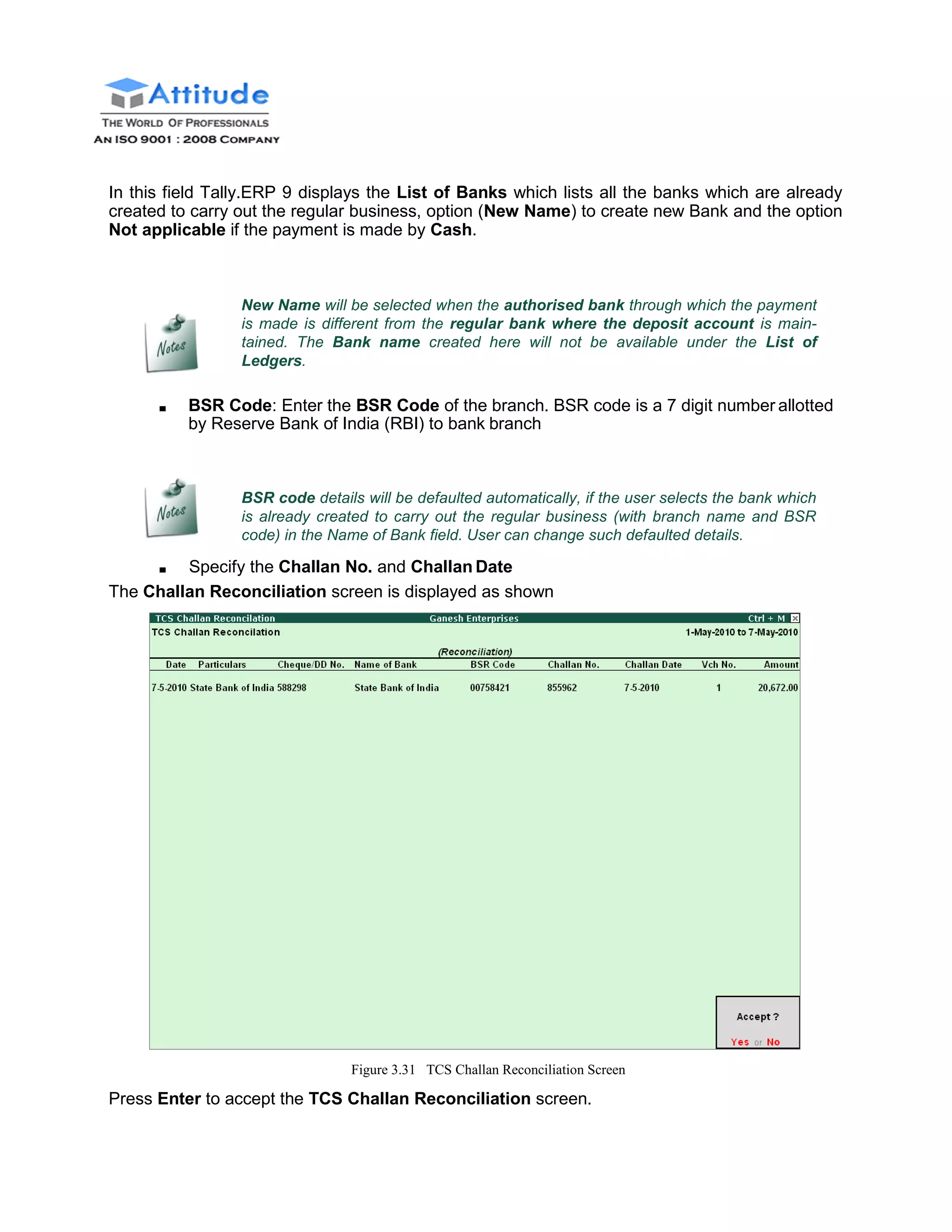

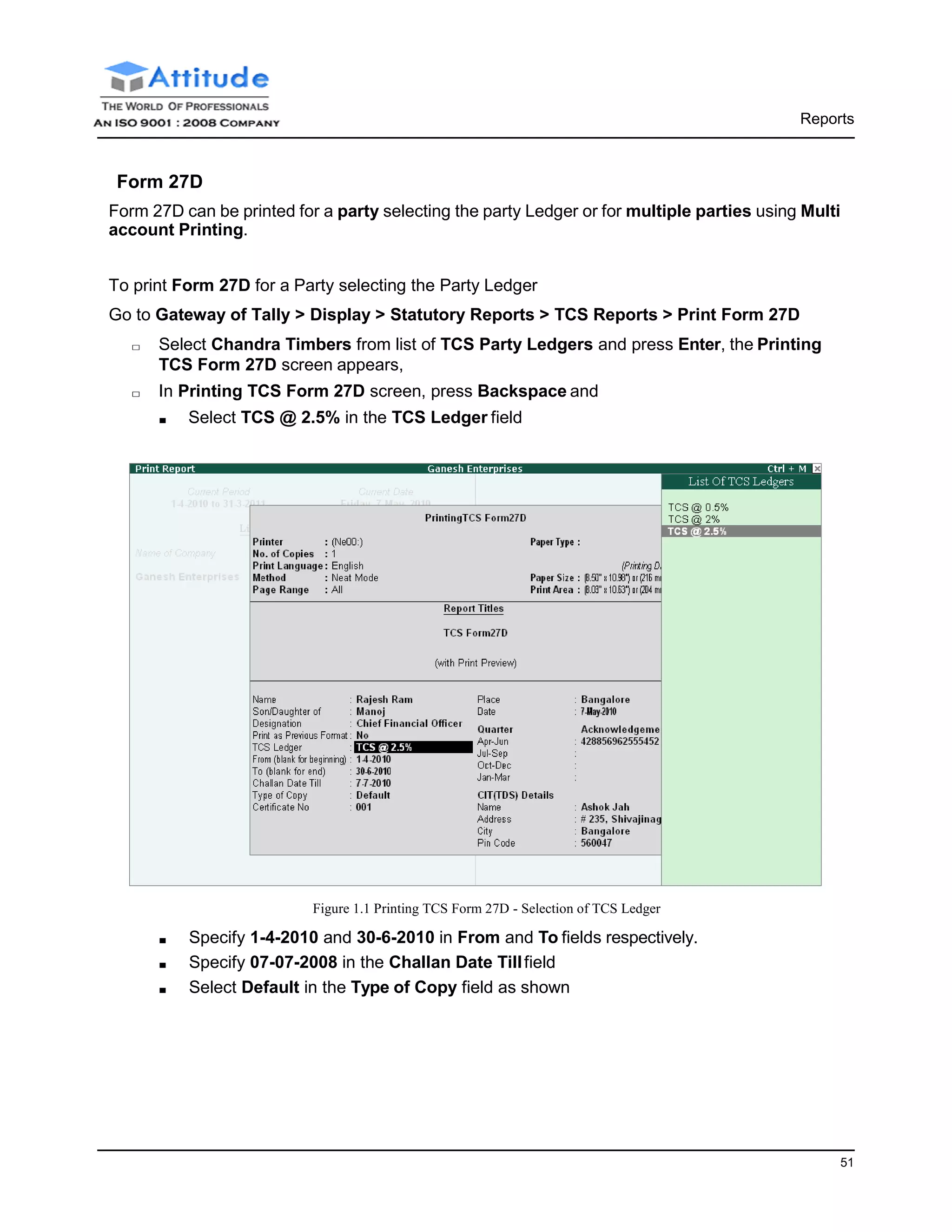

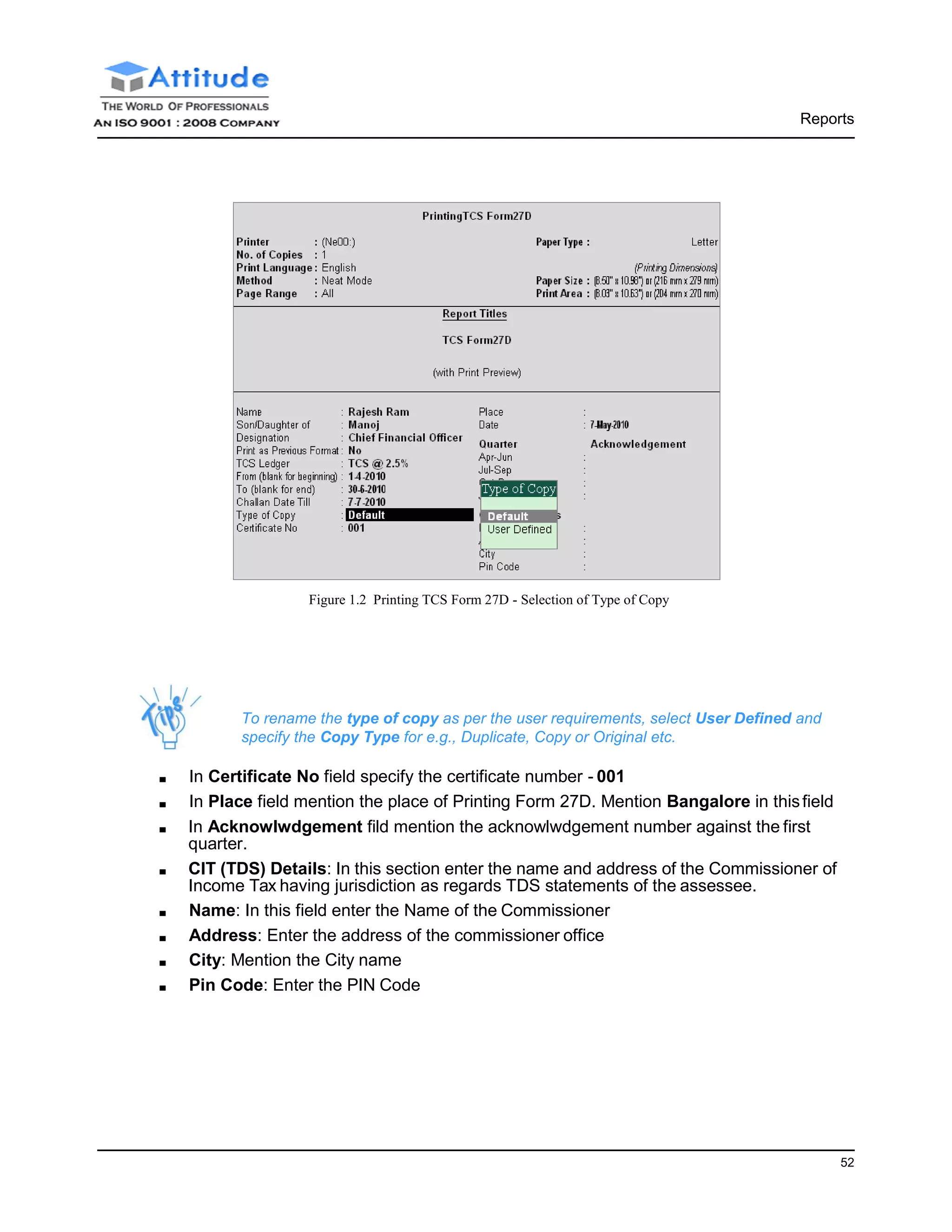

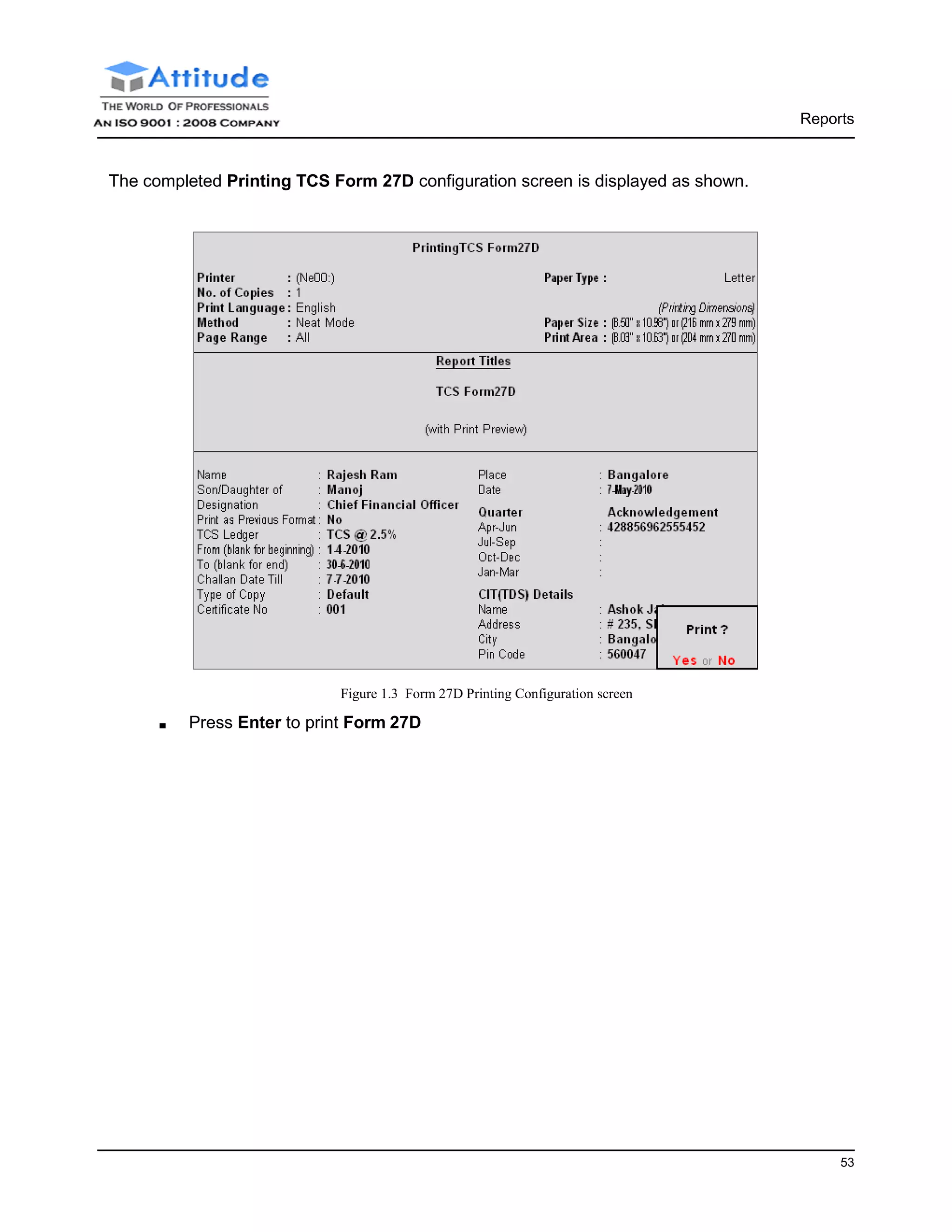

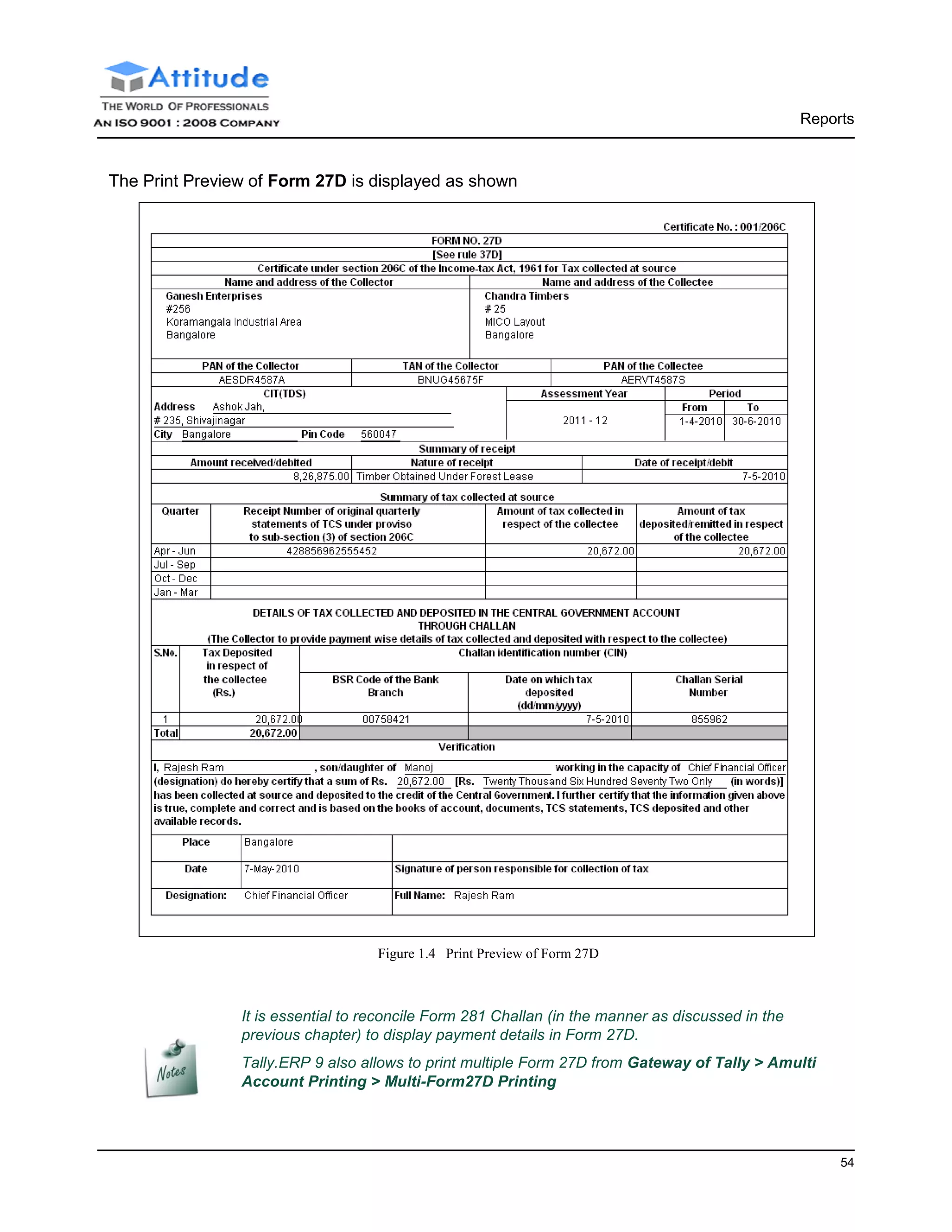

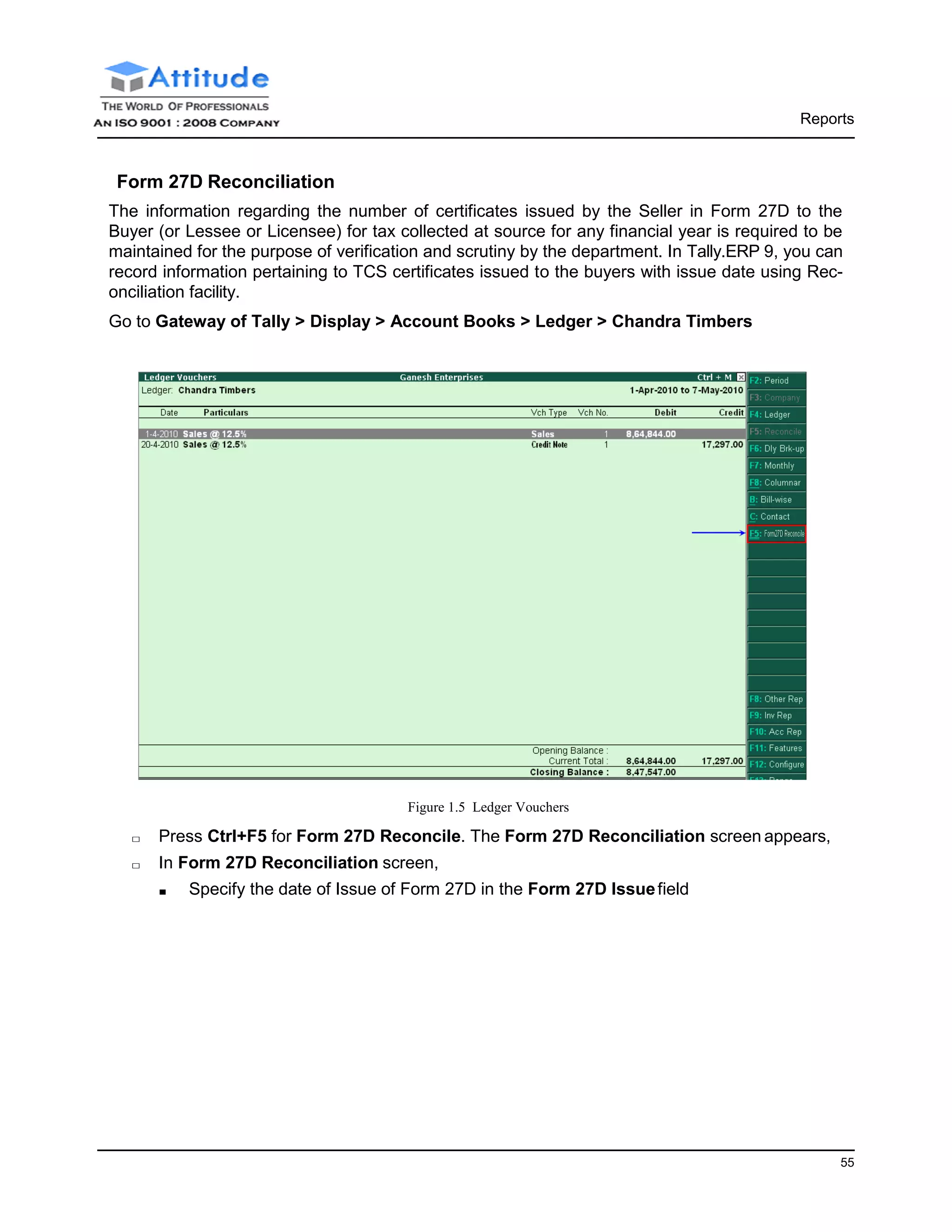

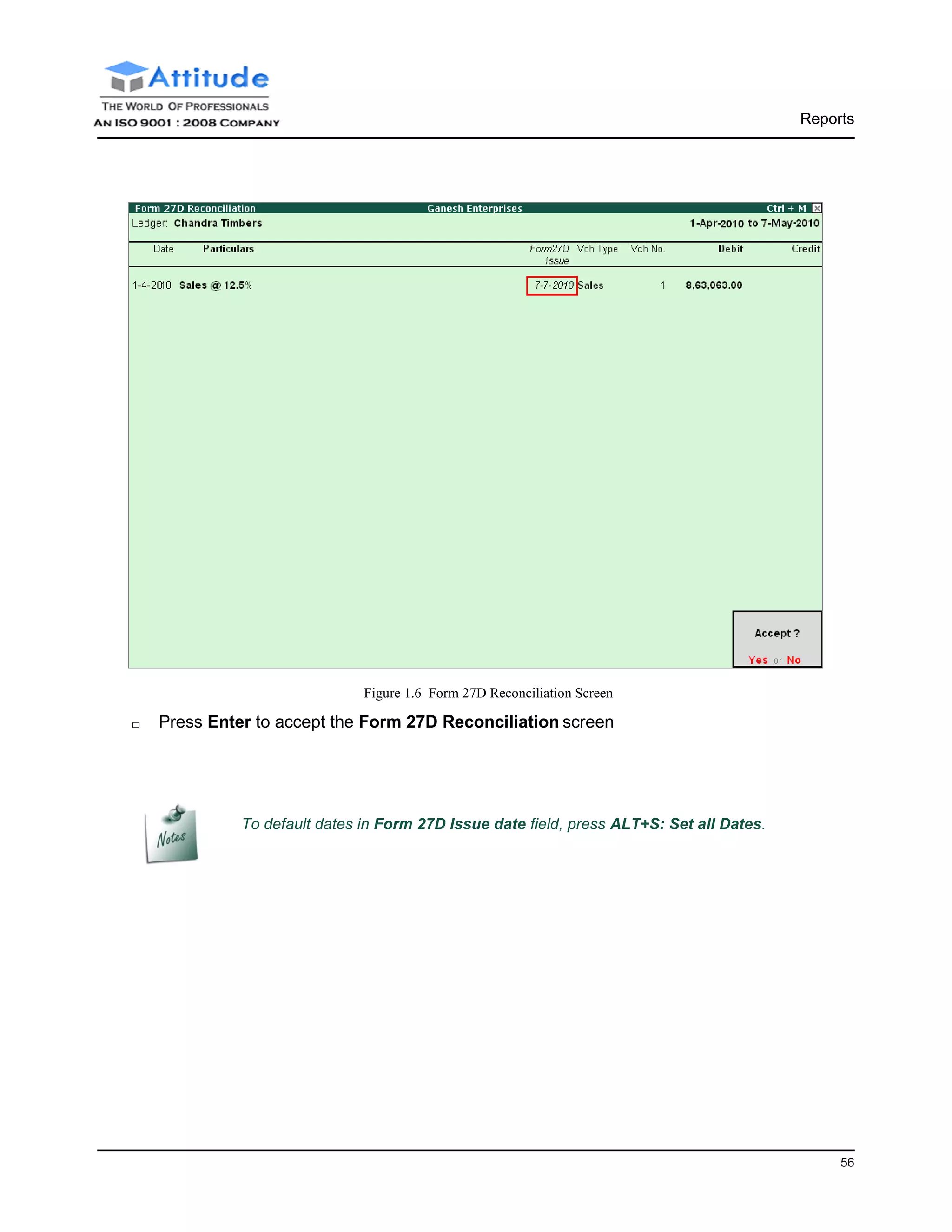

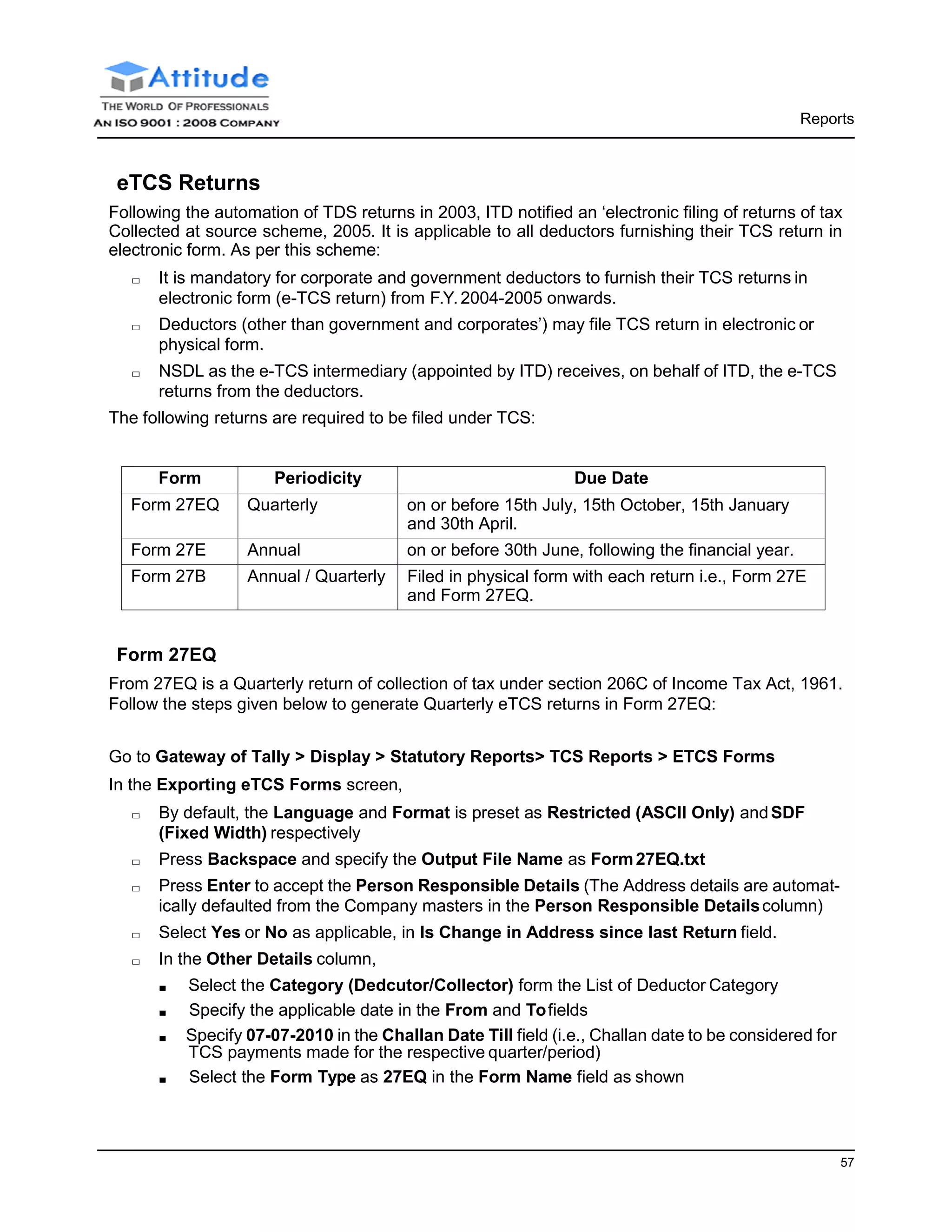

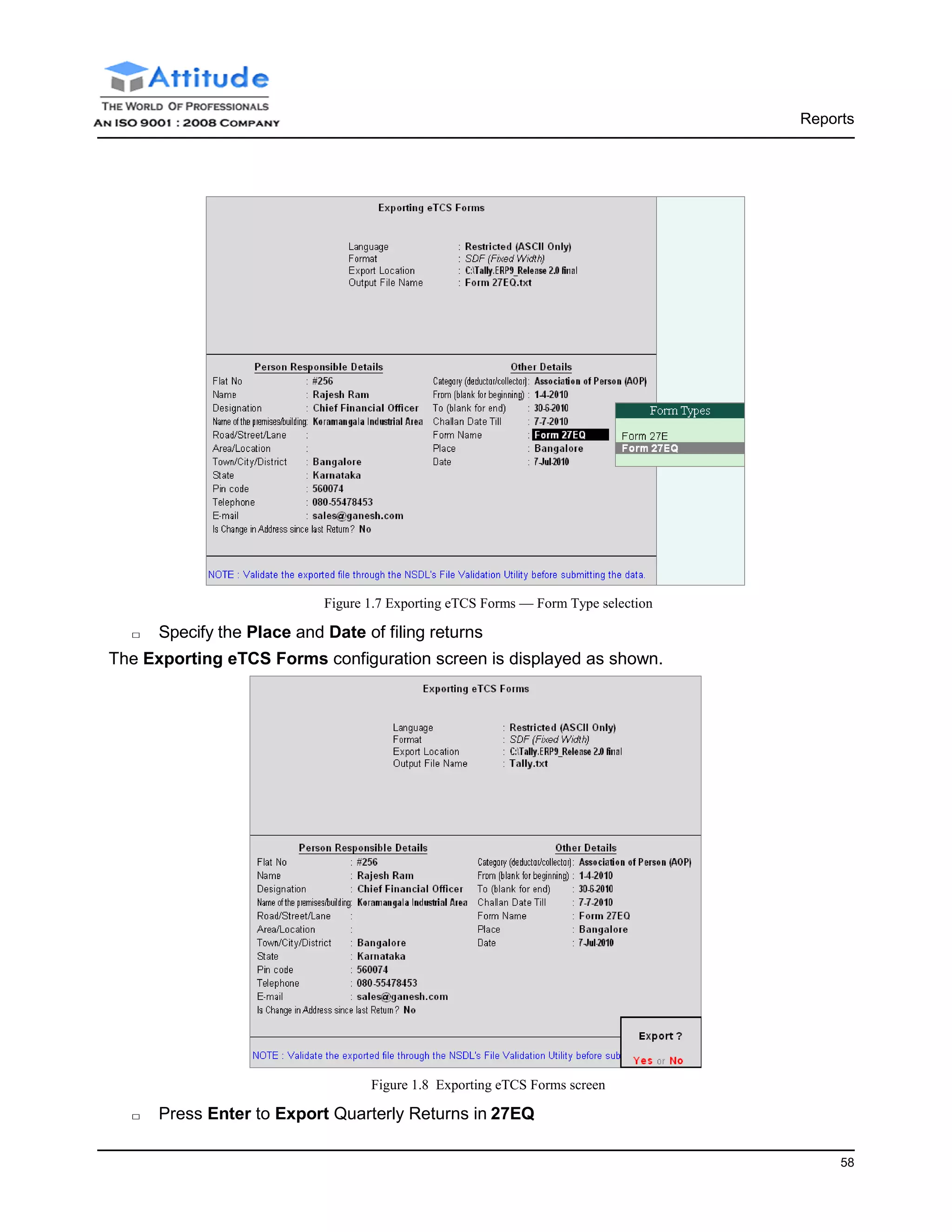

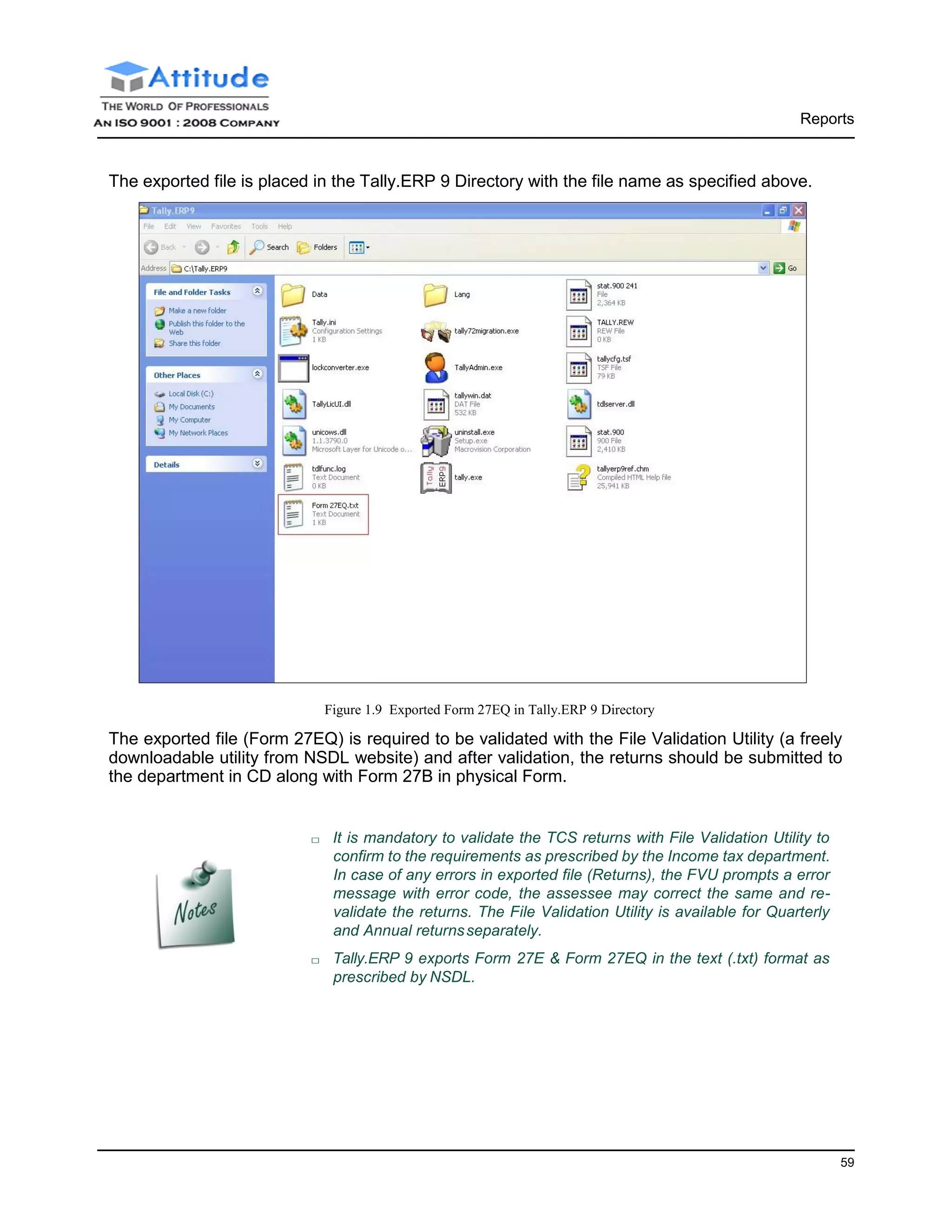

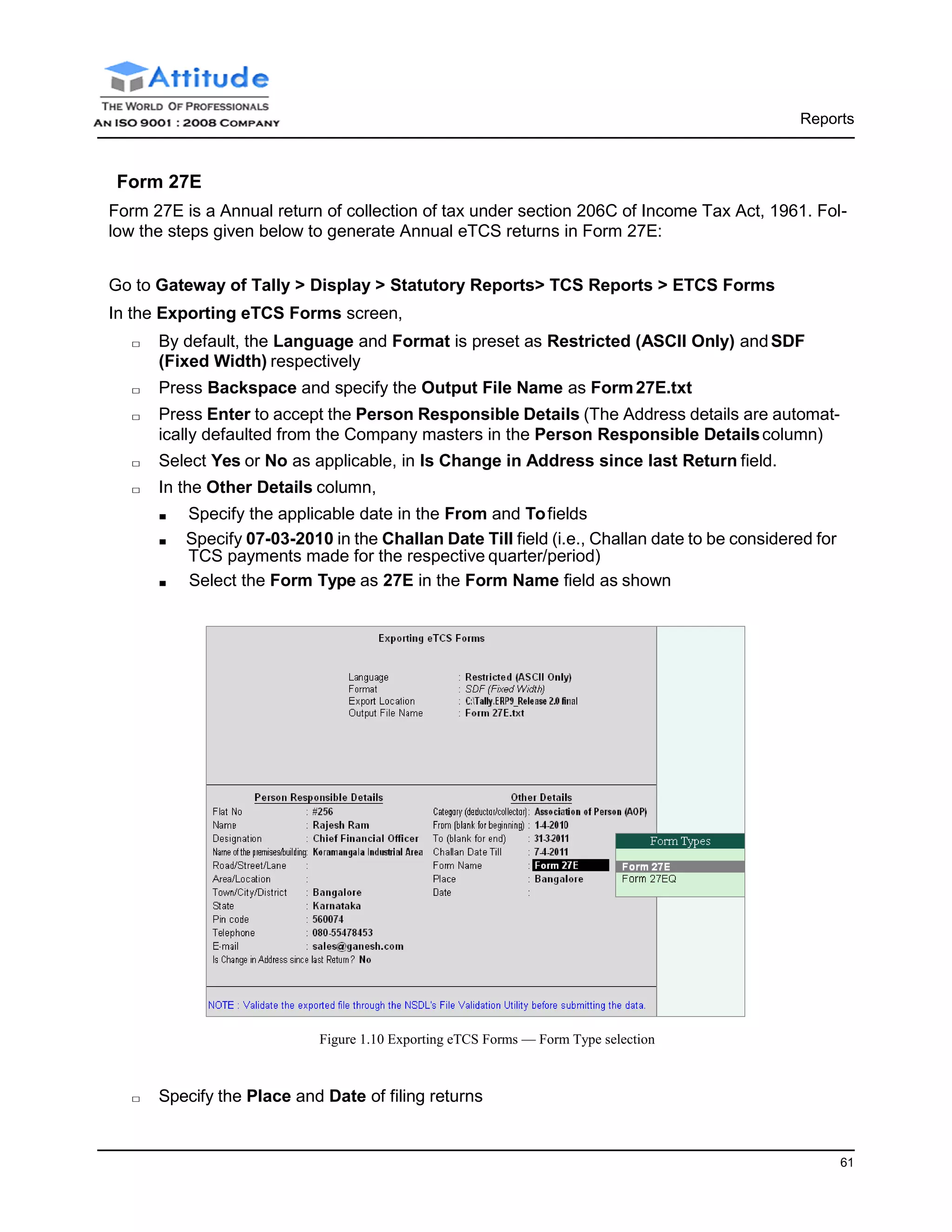

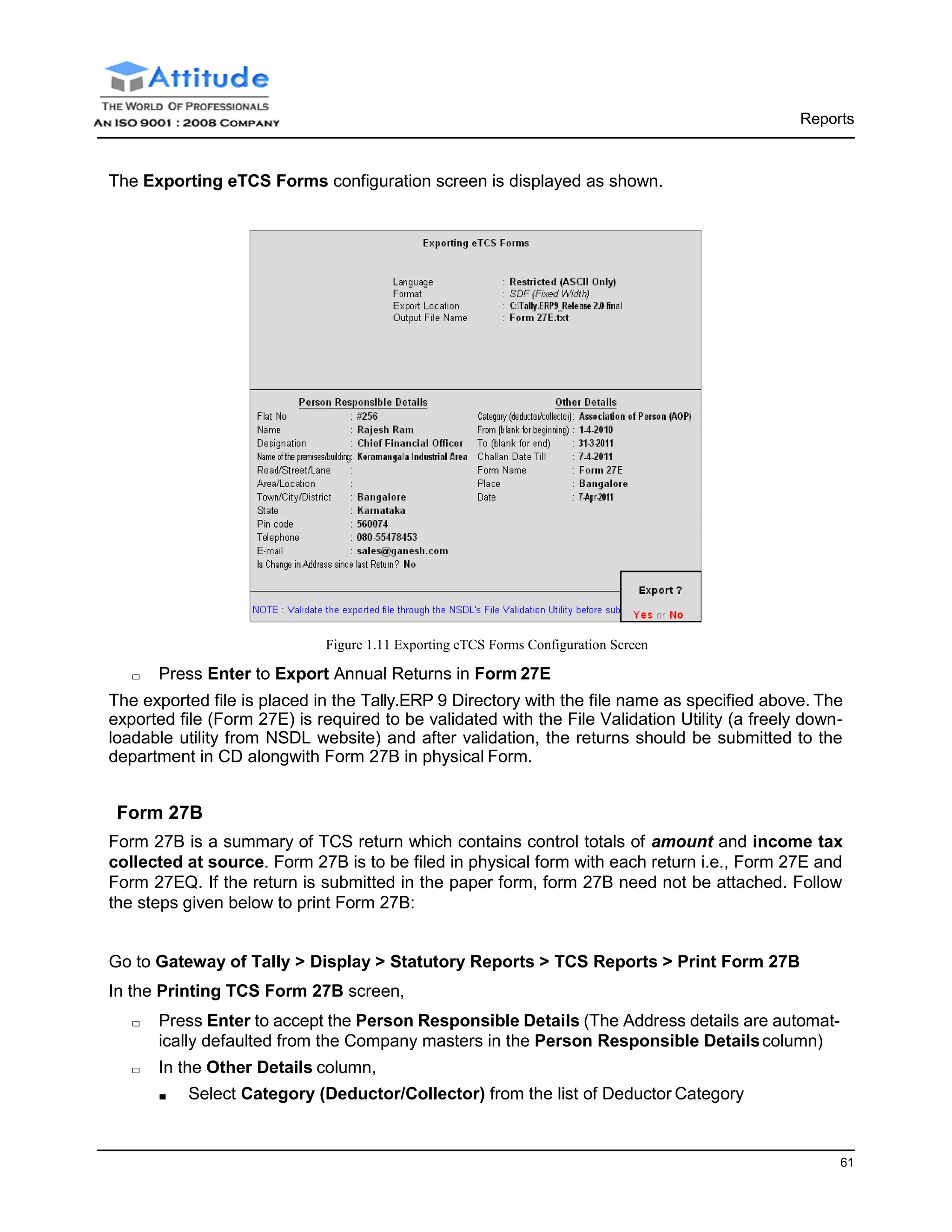

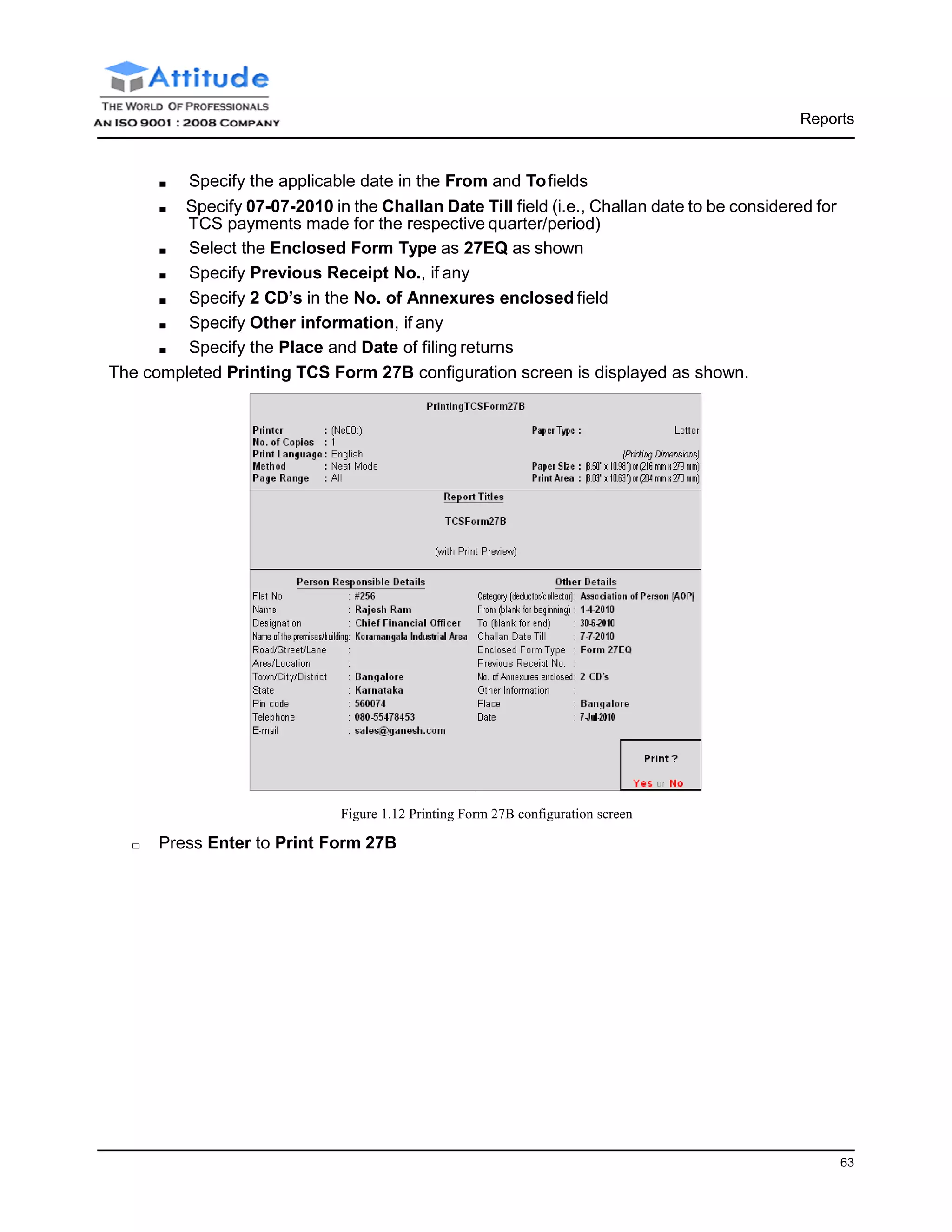

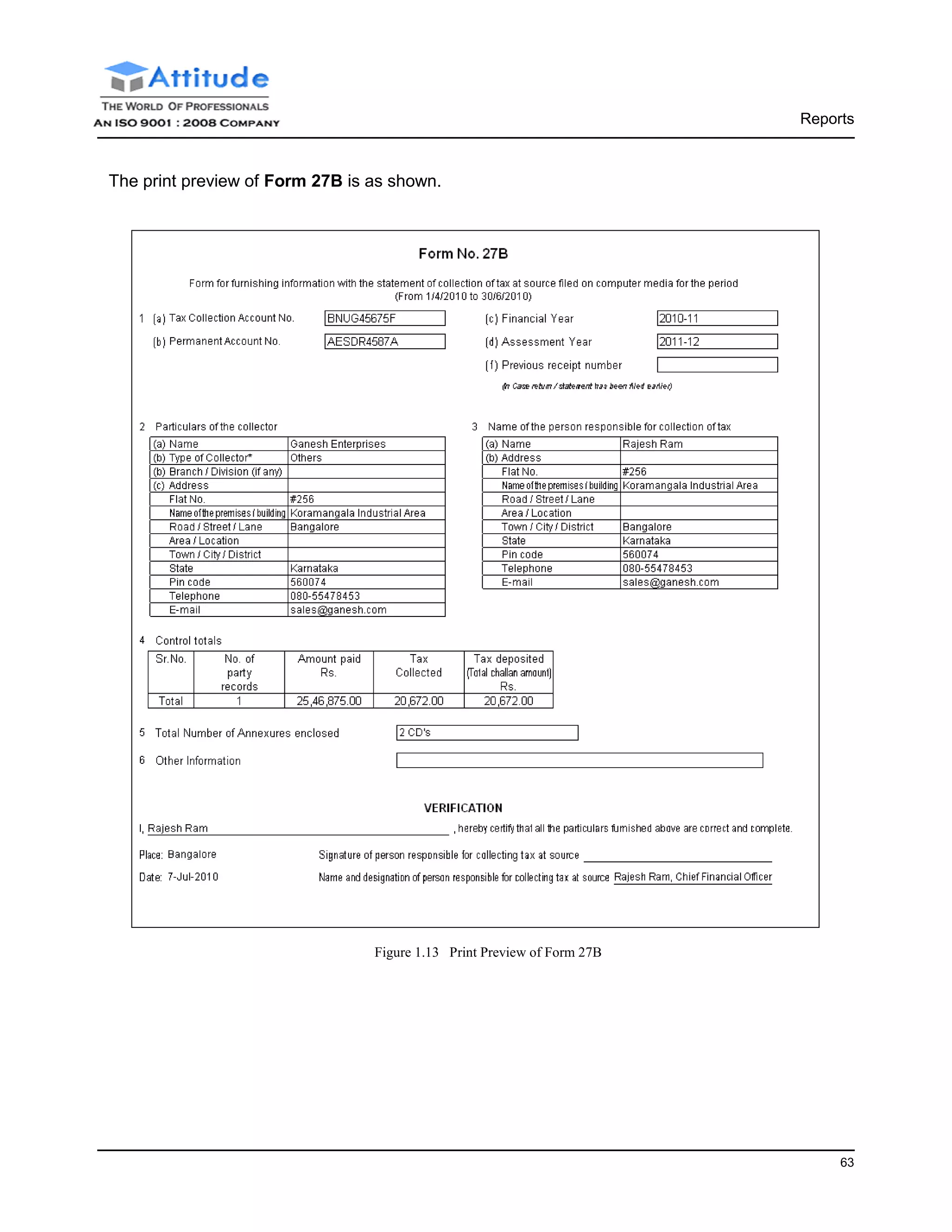

The document details the implementation of Tax Collected at Source (TCS) in Tally.ERP 9, outlining its features, functionality, and compliance requirements under the Income Tax Act of 1961. It includes guidance on configuration, transaction recording, report generation, and e-filing of TCS returns, alongside definitions of key terms such as seller and buyer, and the applicable rates for various goods.