This document provides an overview of implementing TDS in Tally.ERP 9. It discusses the key aspects of the TDS process such as the scope, applicable payments, timeline for payment and issuing certificates. It also outlines the TDS features available in Tally.ERP 9 for enabling TDS, performing various TDS transactions, generating reports for computation, returns and reconciliation. The document is intended to guide users on using Tally's TDS functionality for accounting and compliance with Indian TDS regulations.

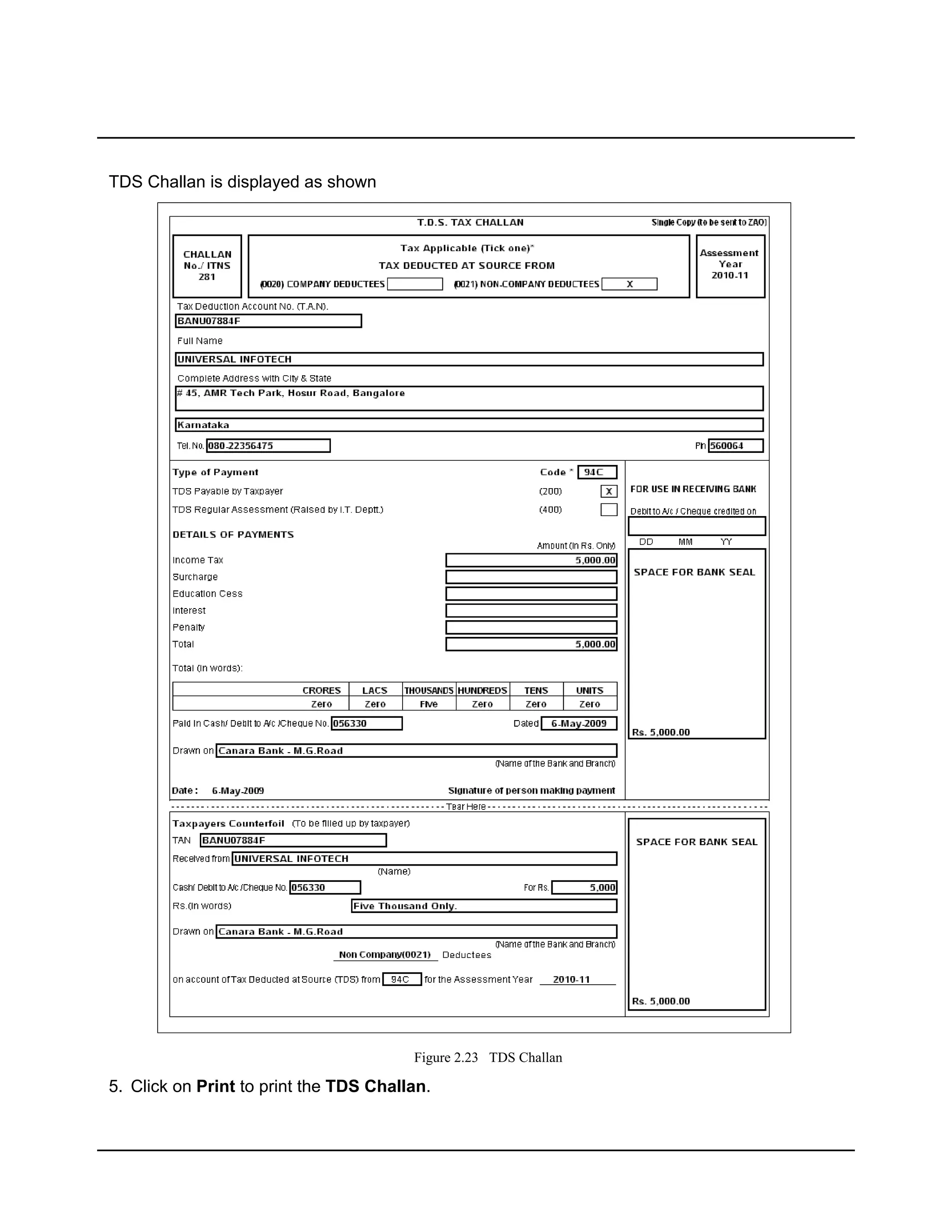

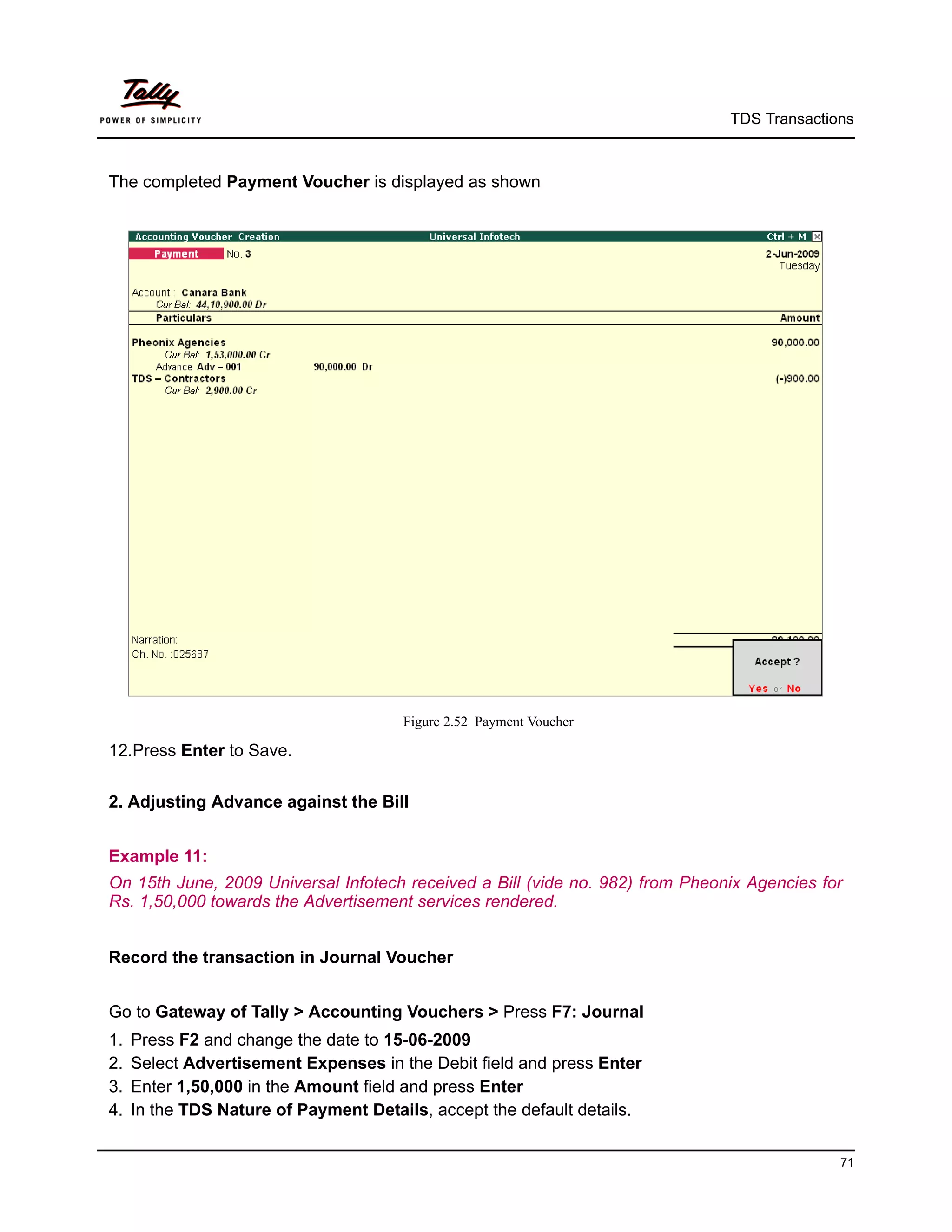

![TDS Transactions

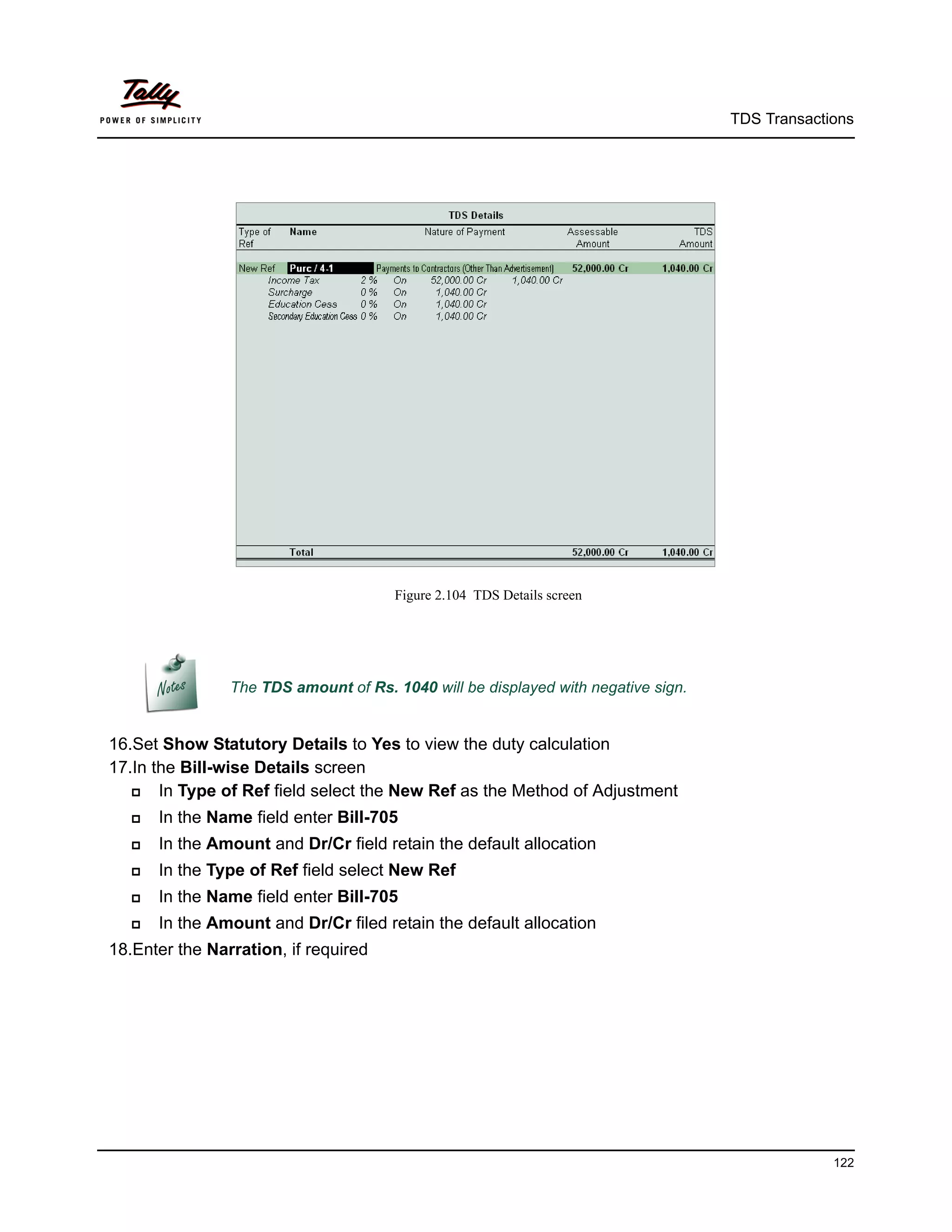

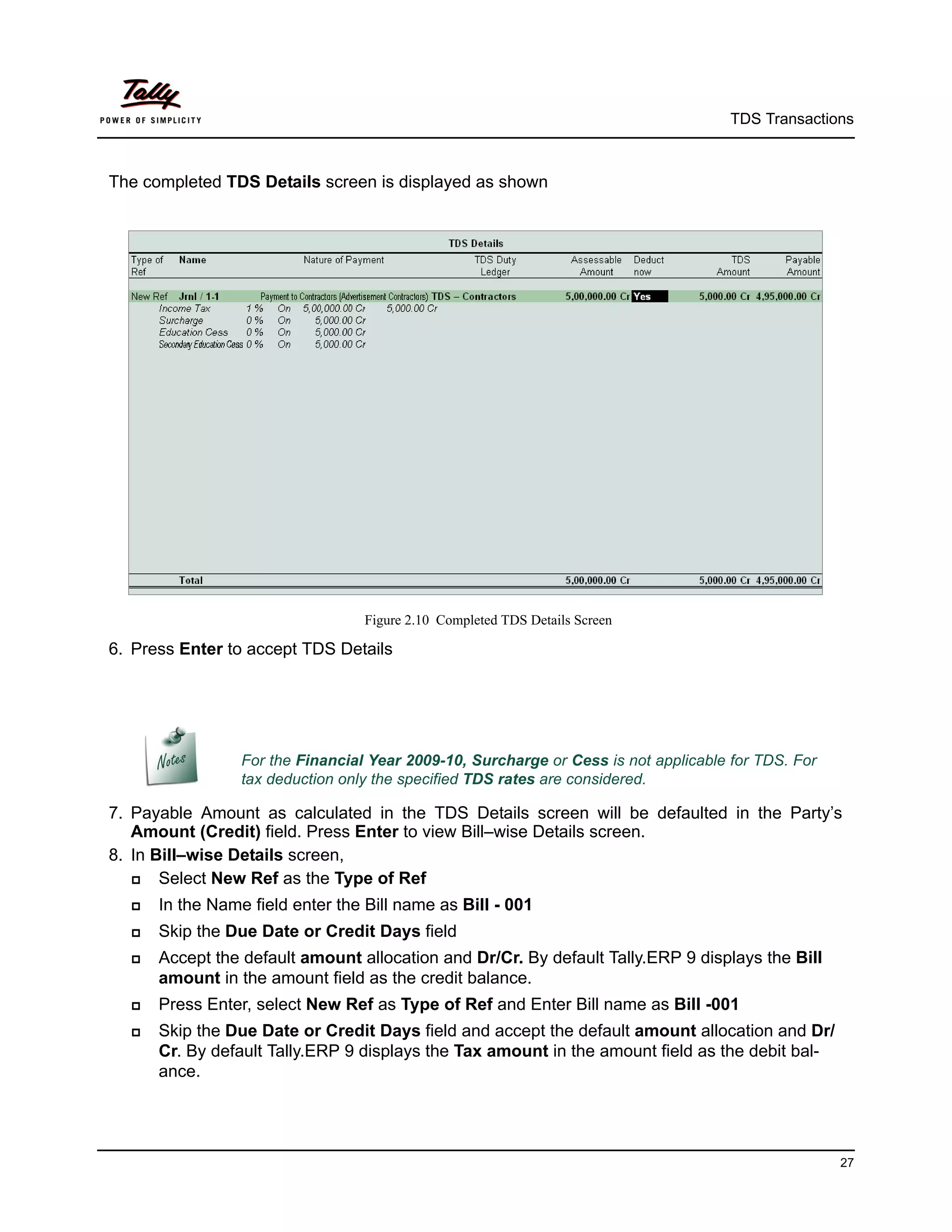

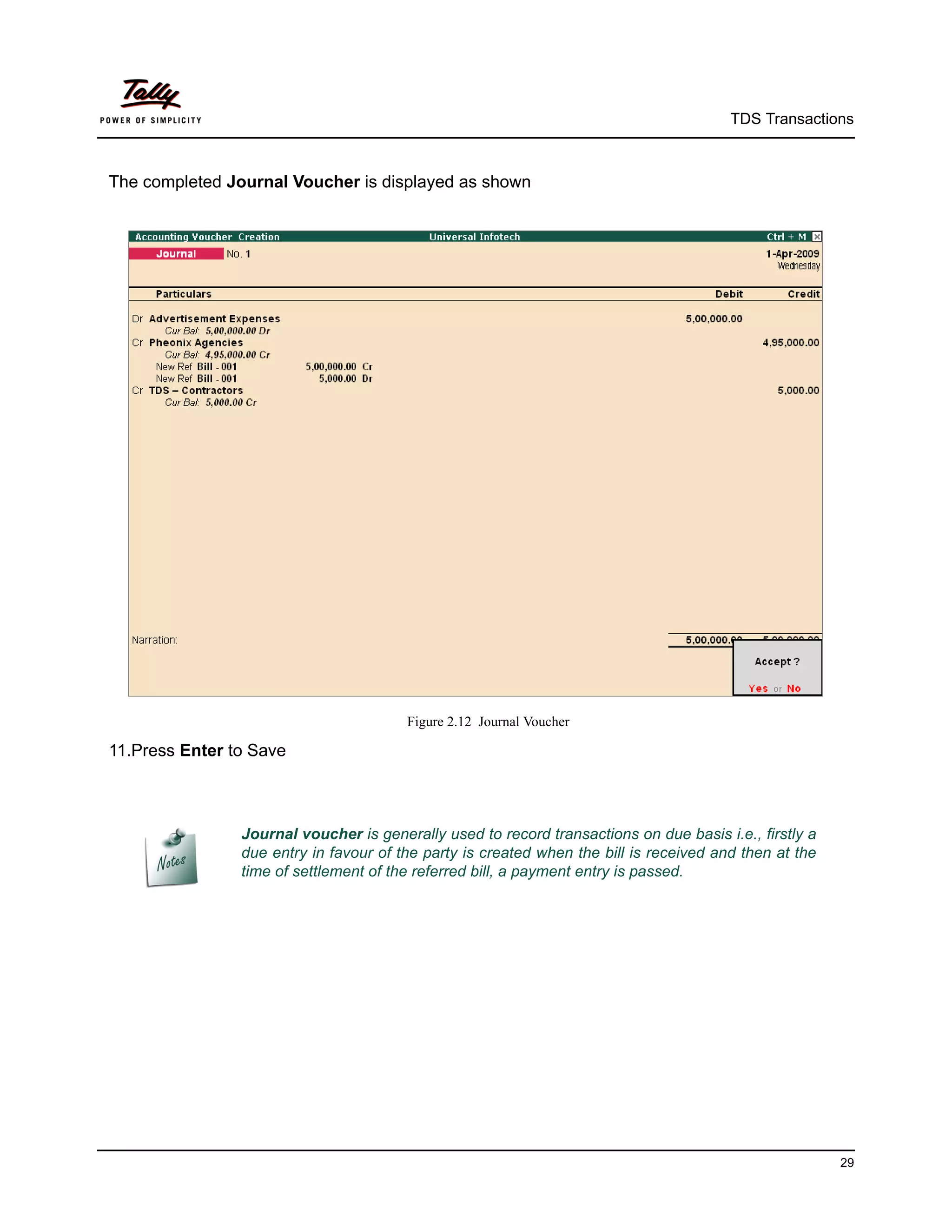

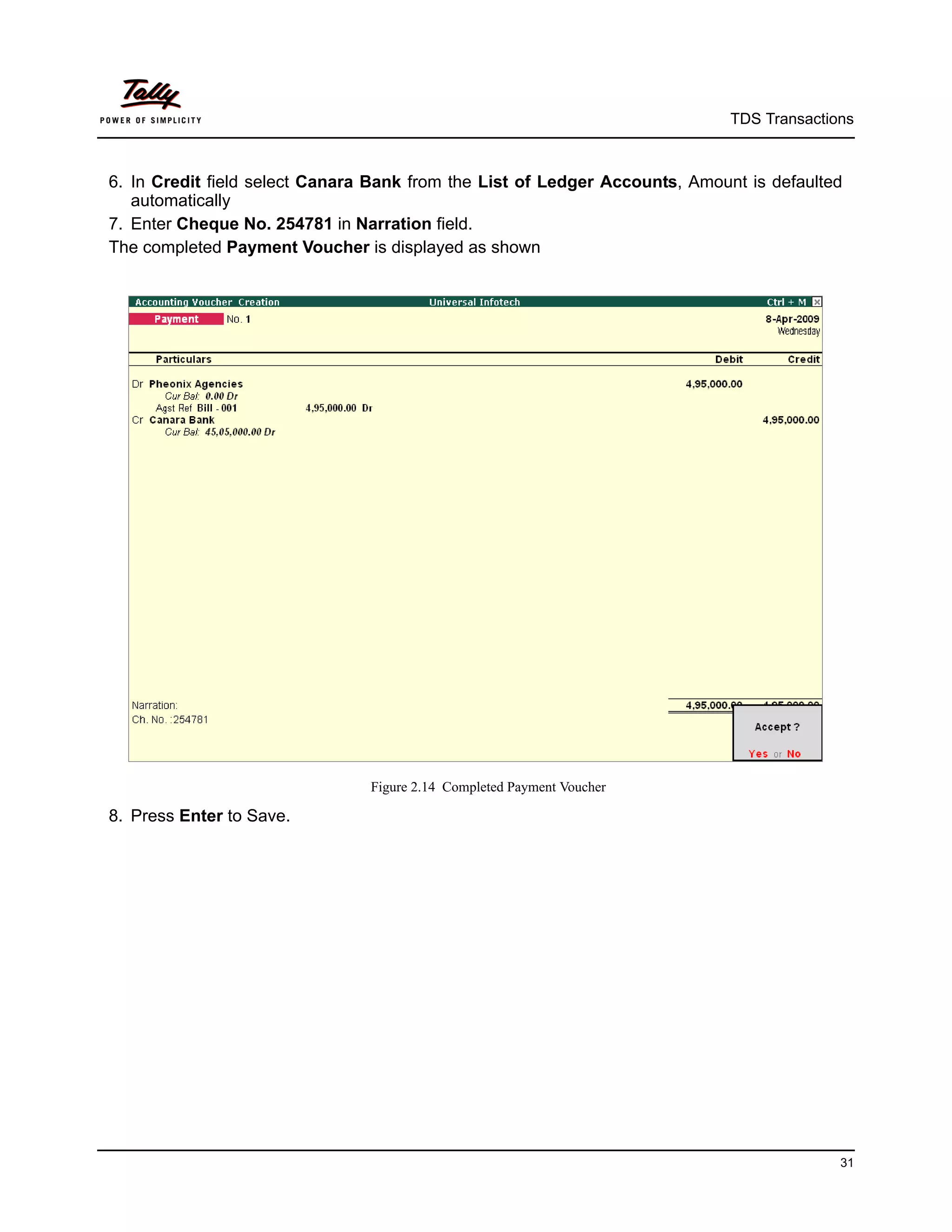

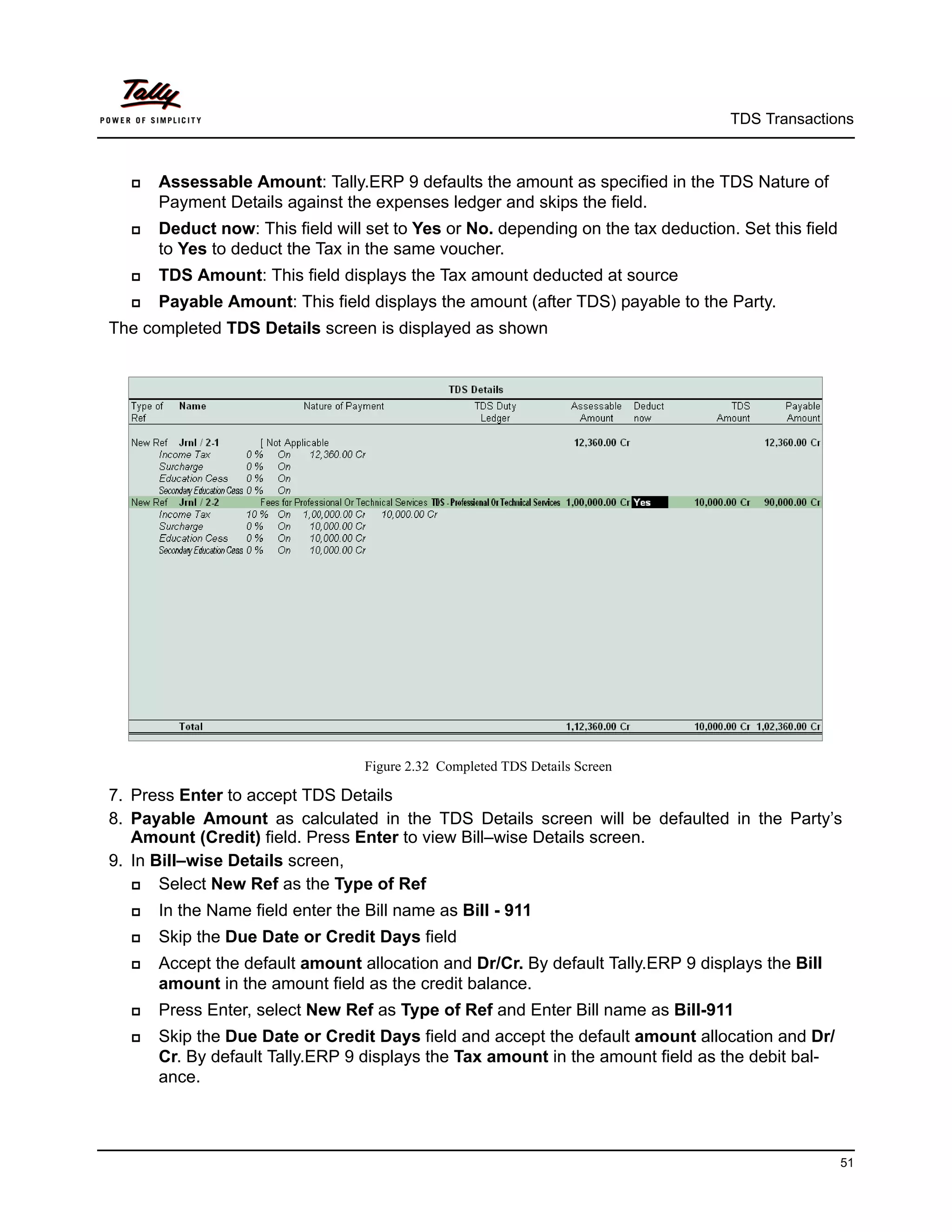

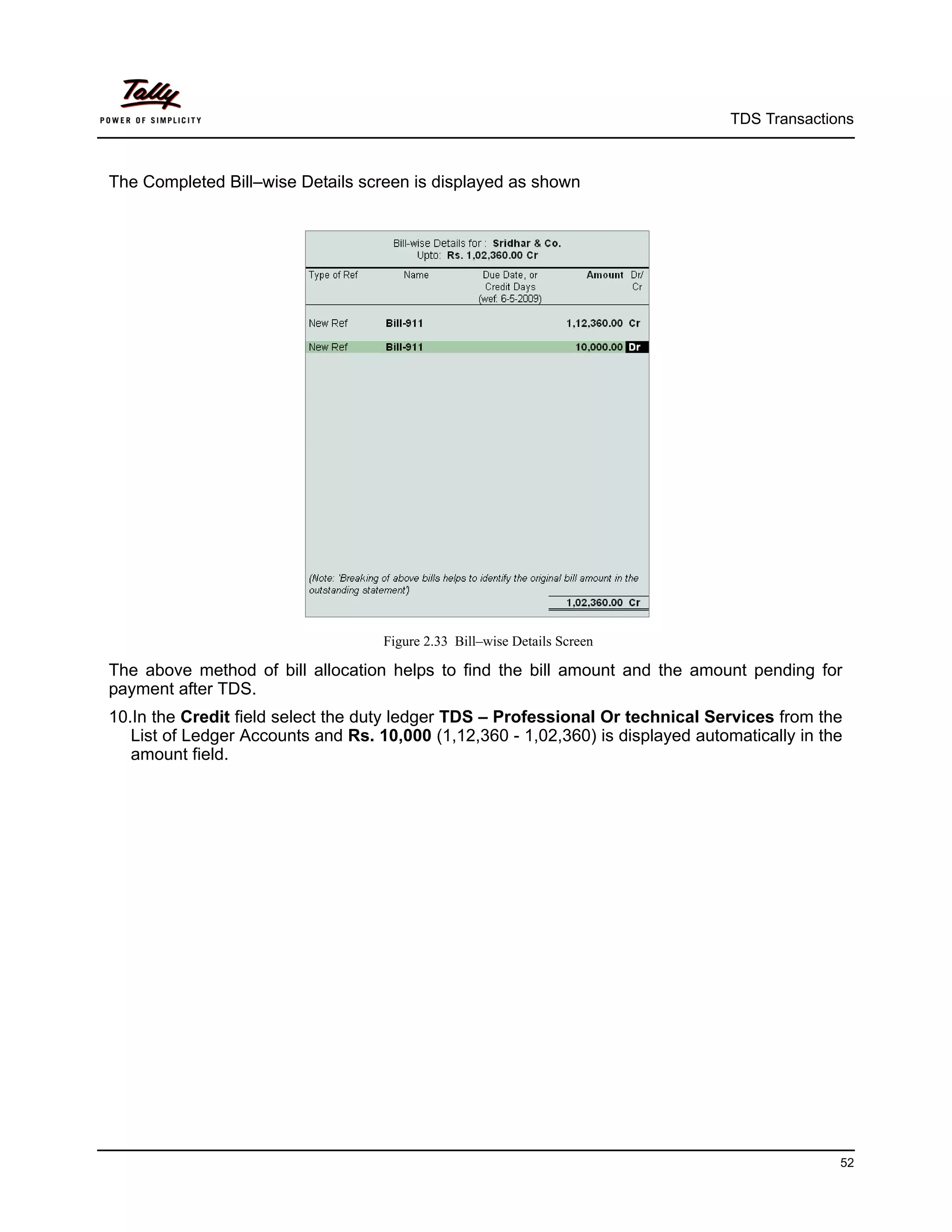

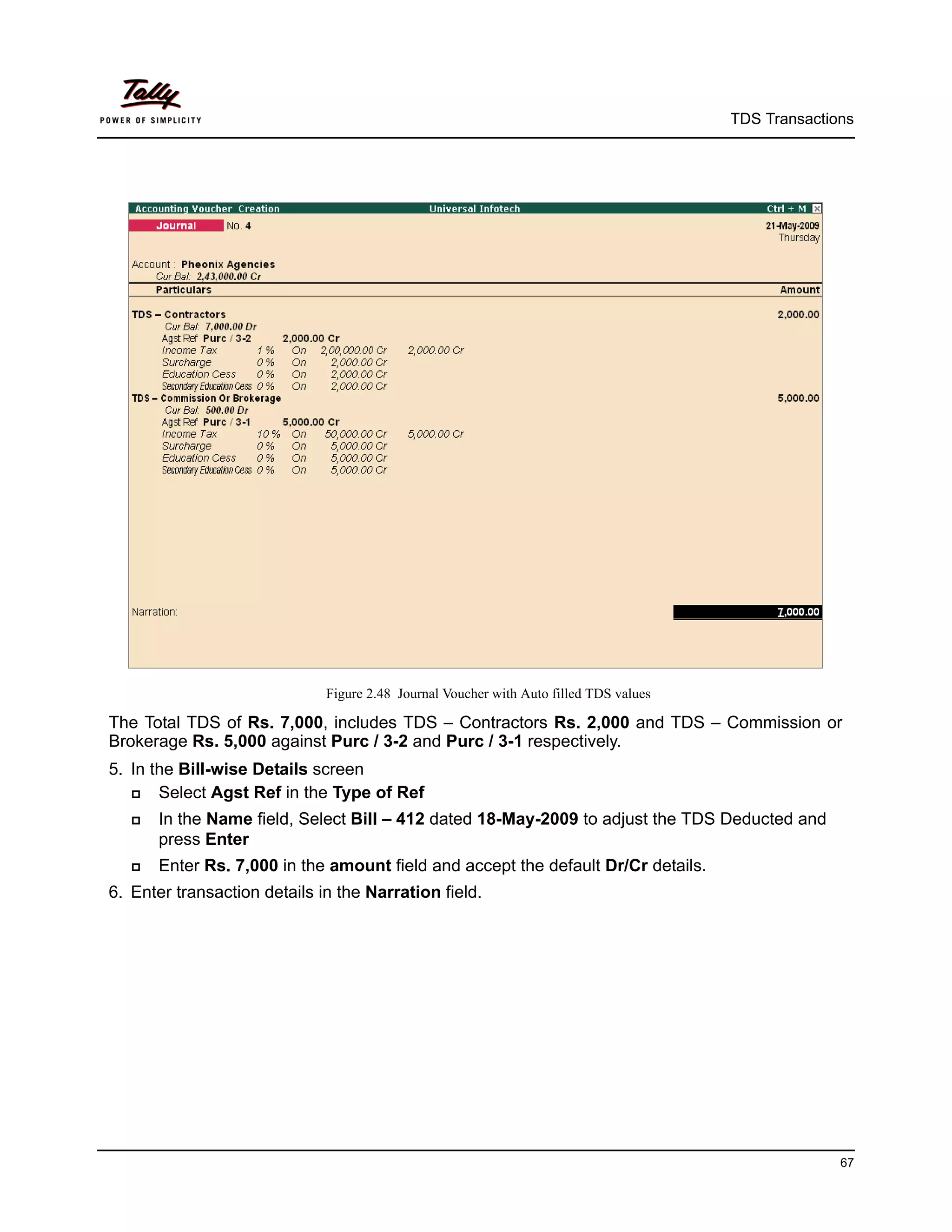

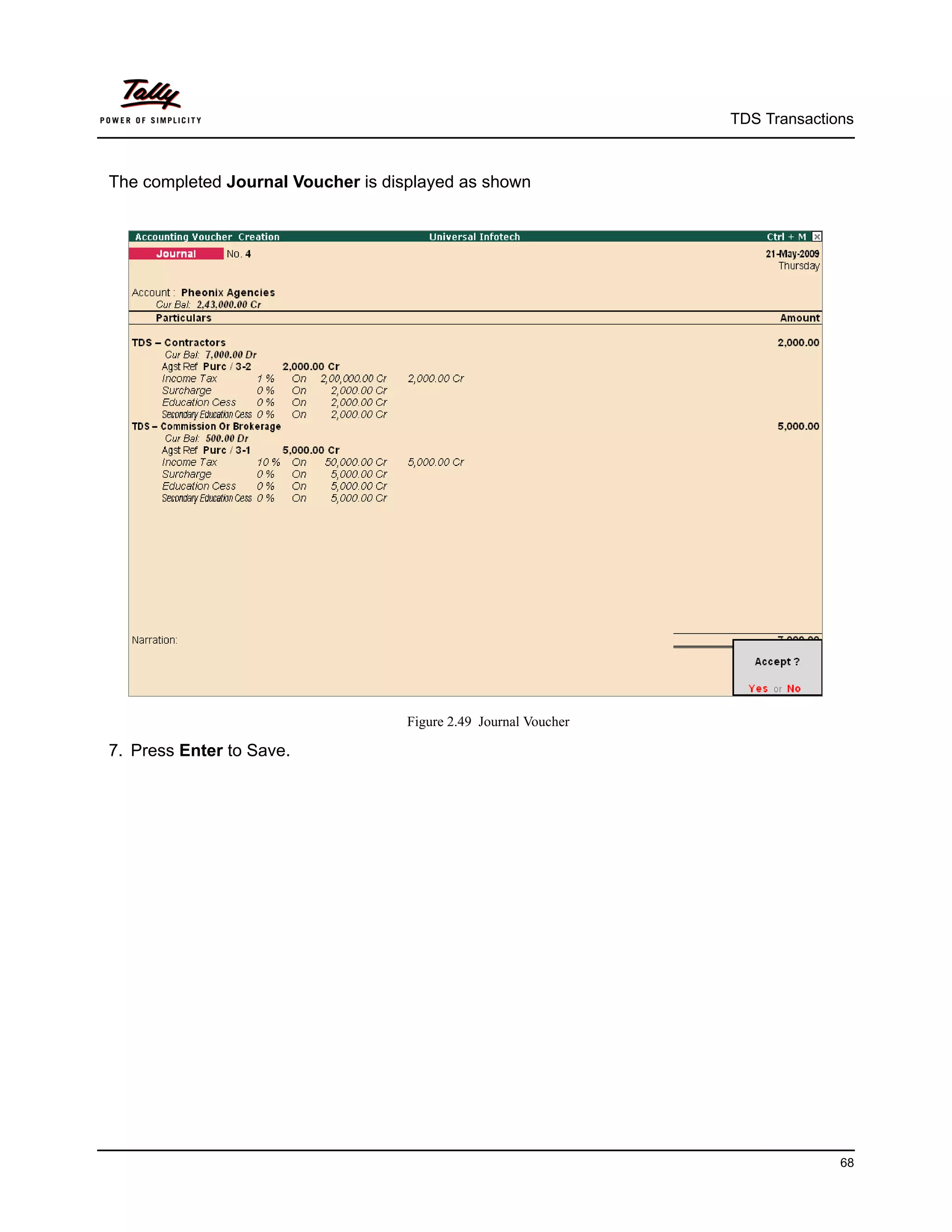

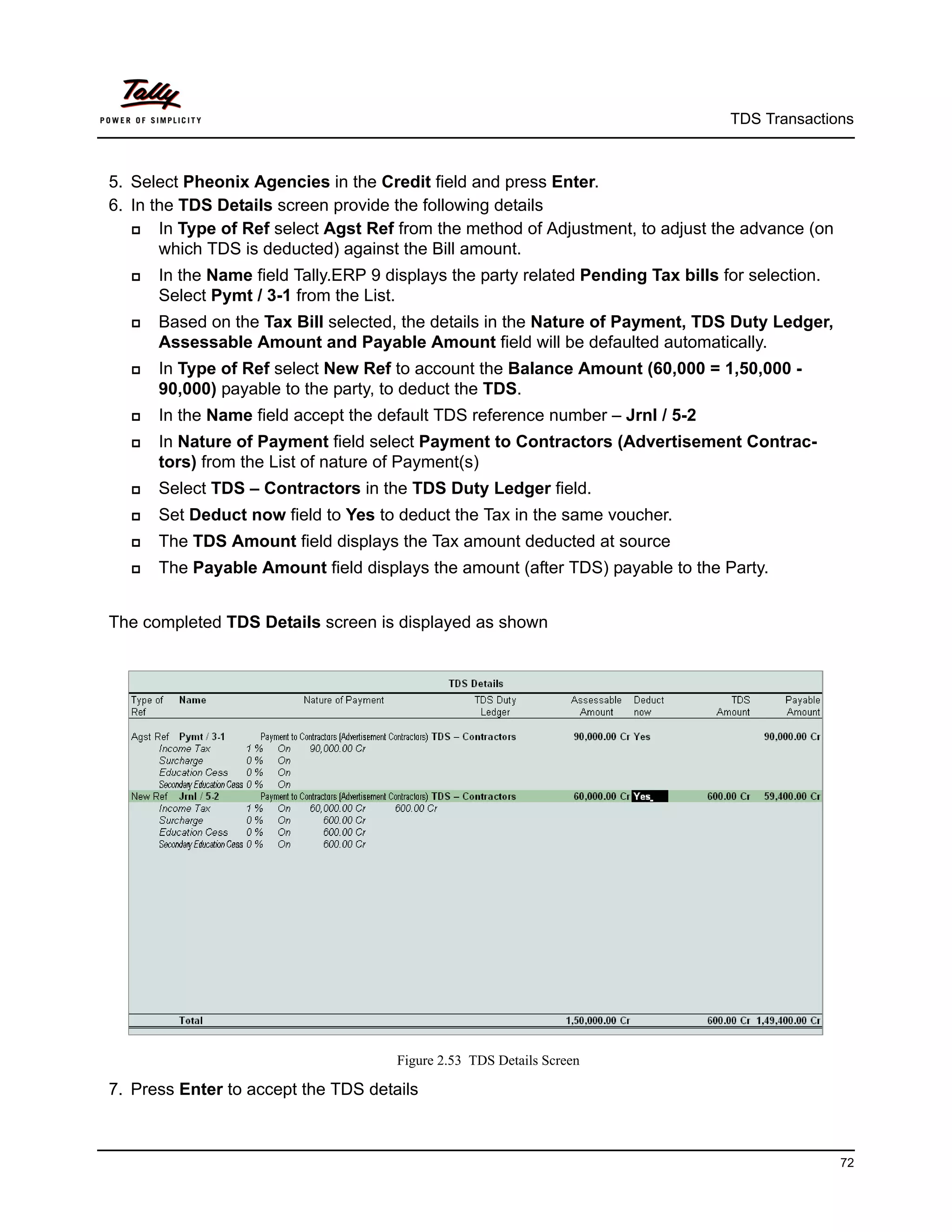

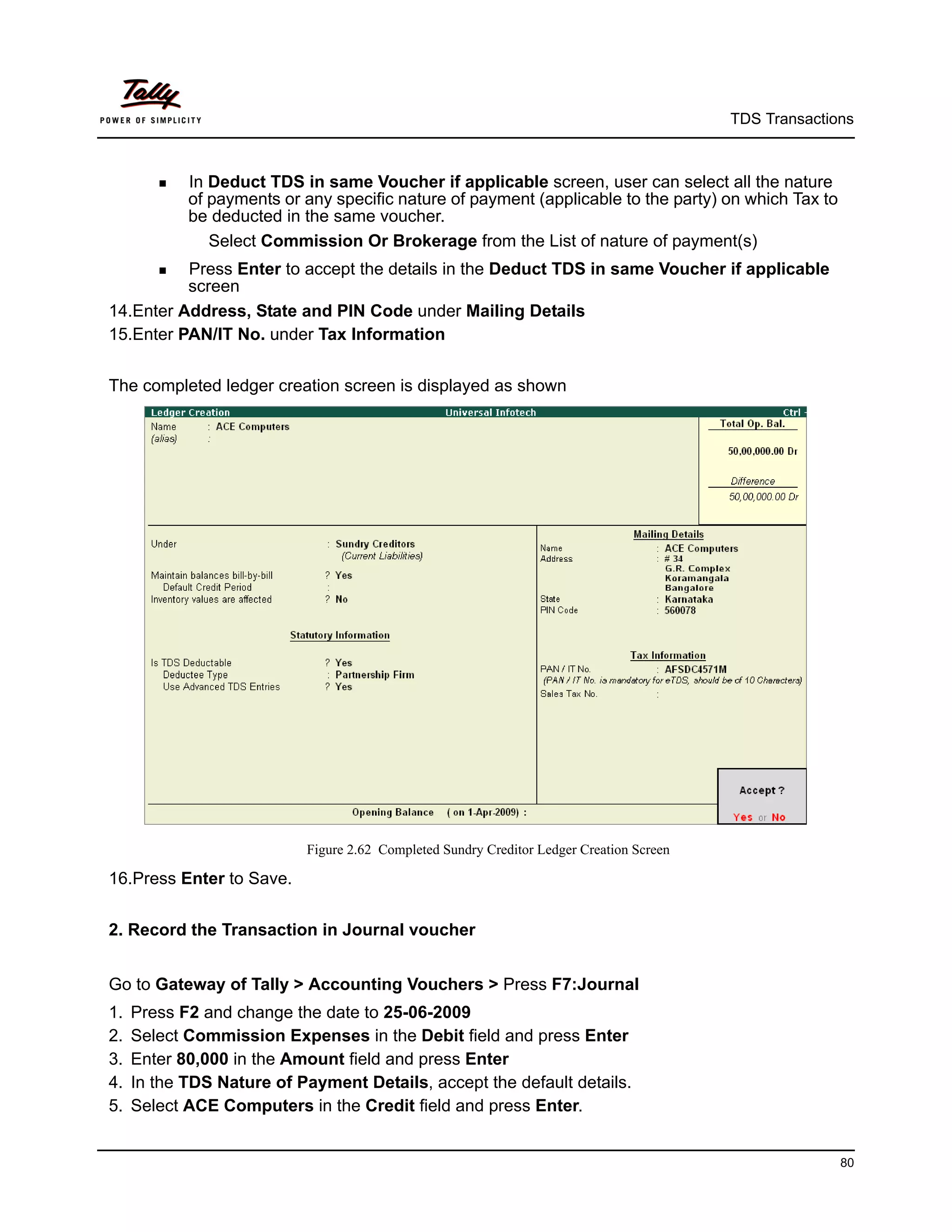

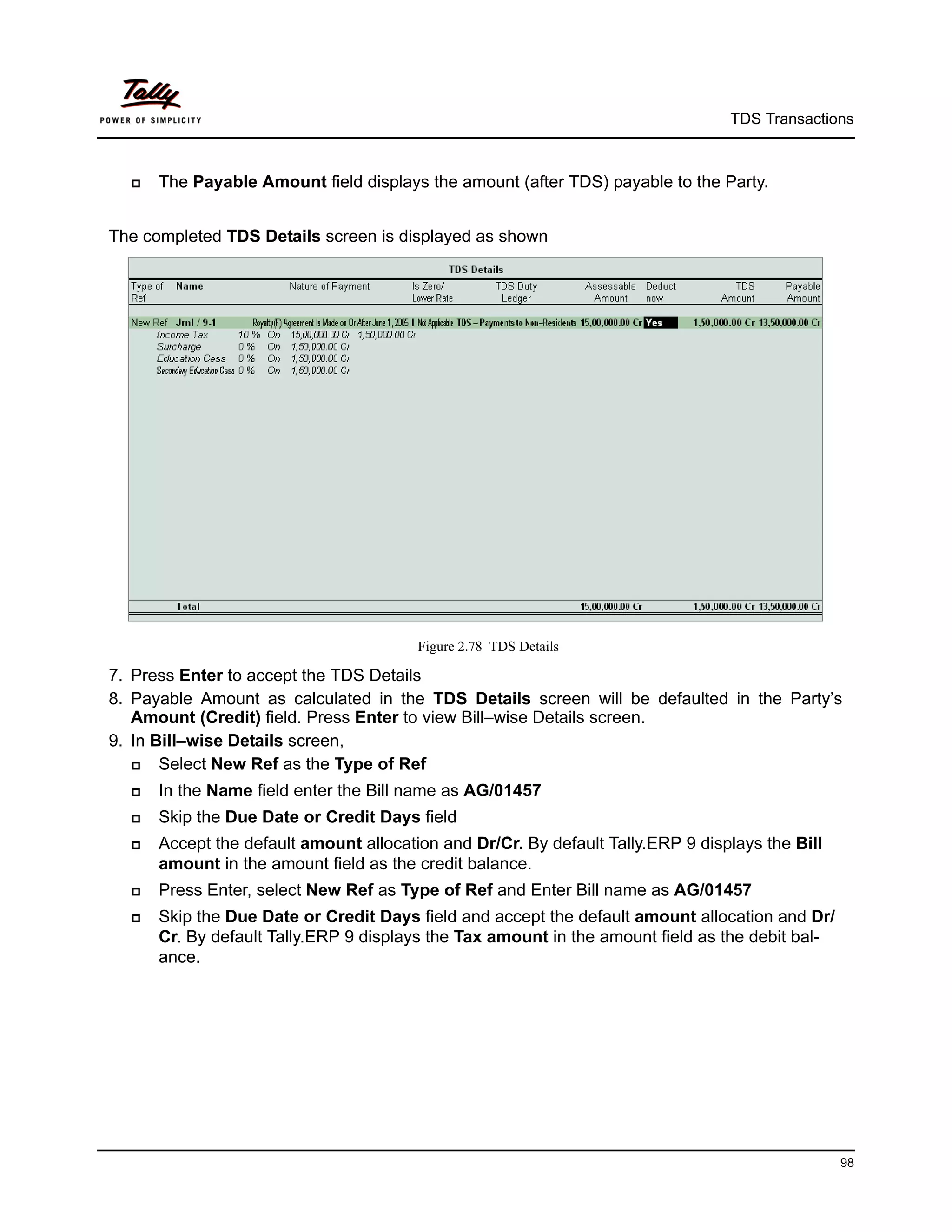

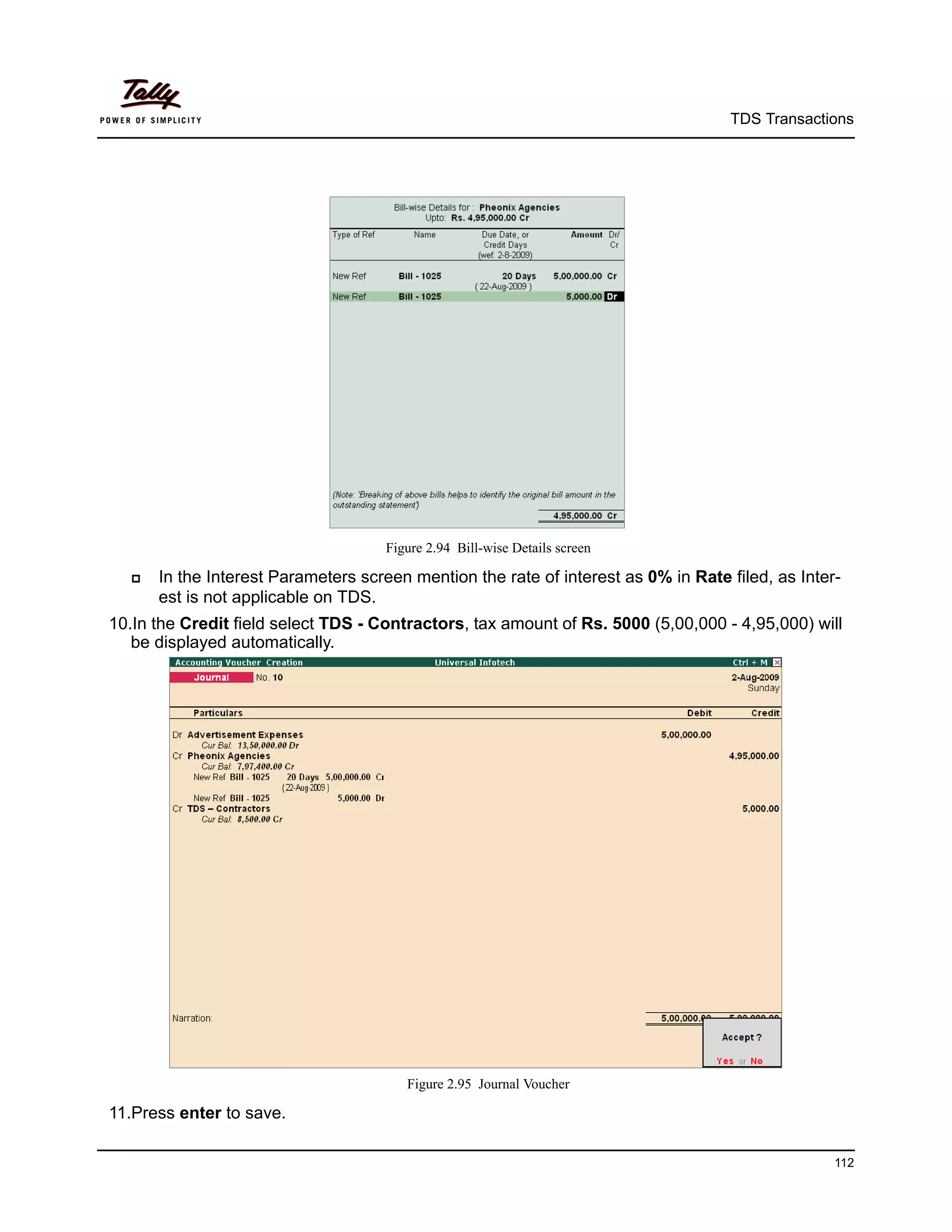

8. Payable Amount as calculated in the TDS Details screen will be defaulted in the Party’s

Amount (Credit) field. Press Enter to view Bill–wise Details screen.

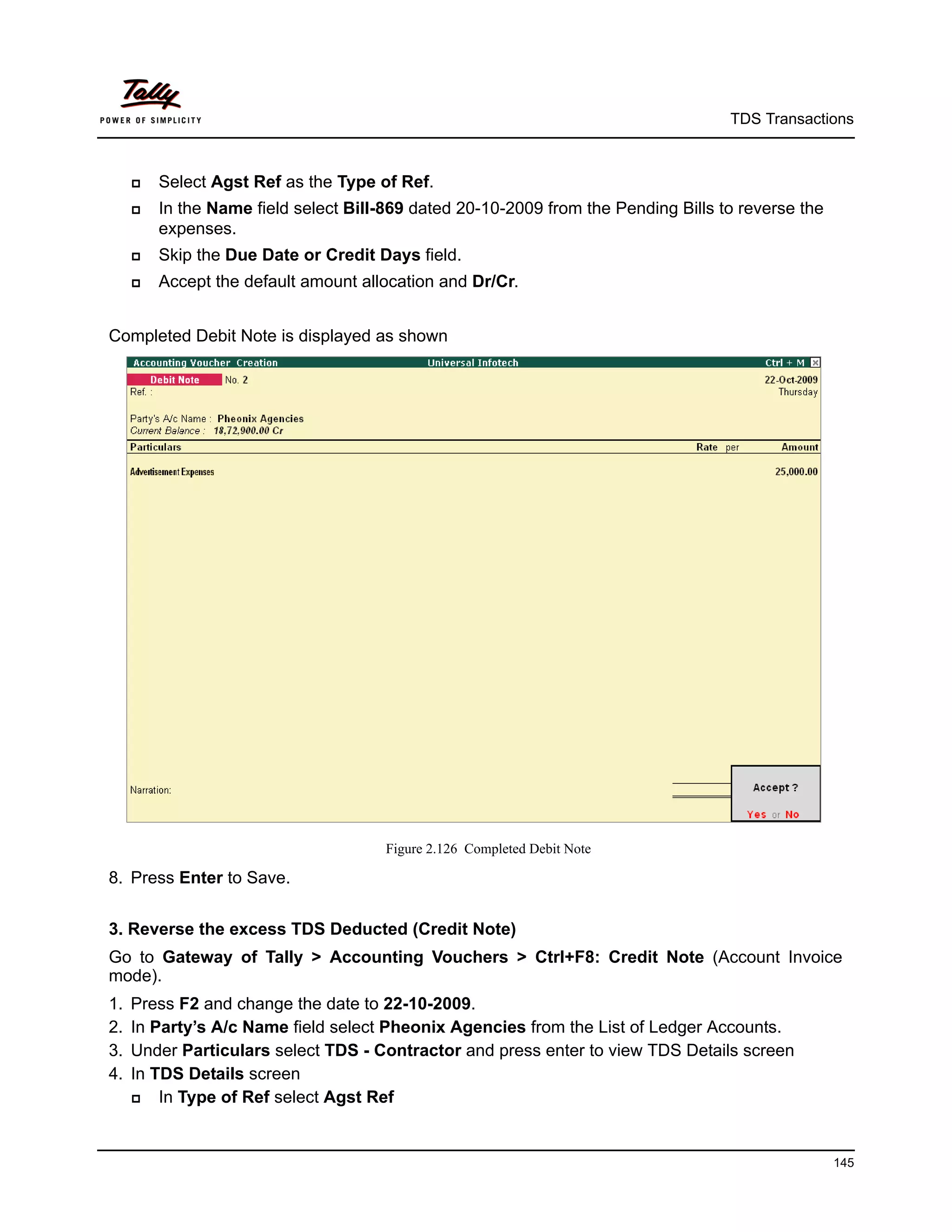

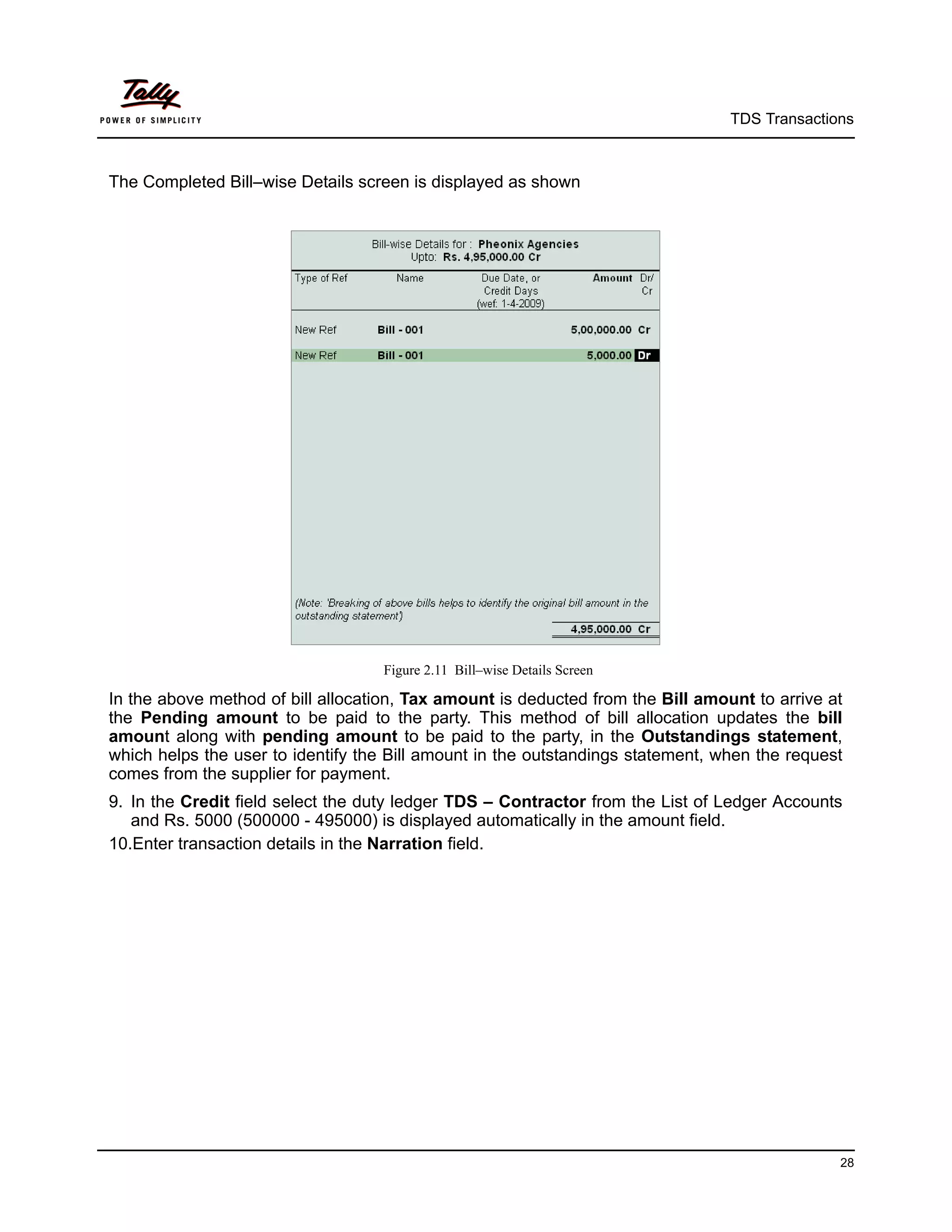

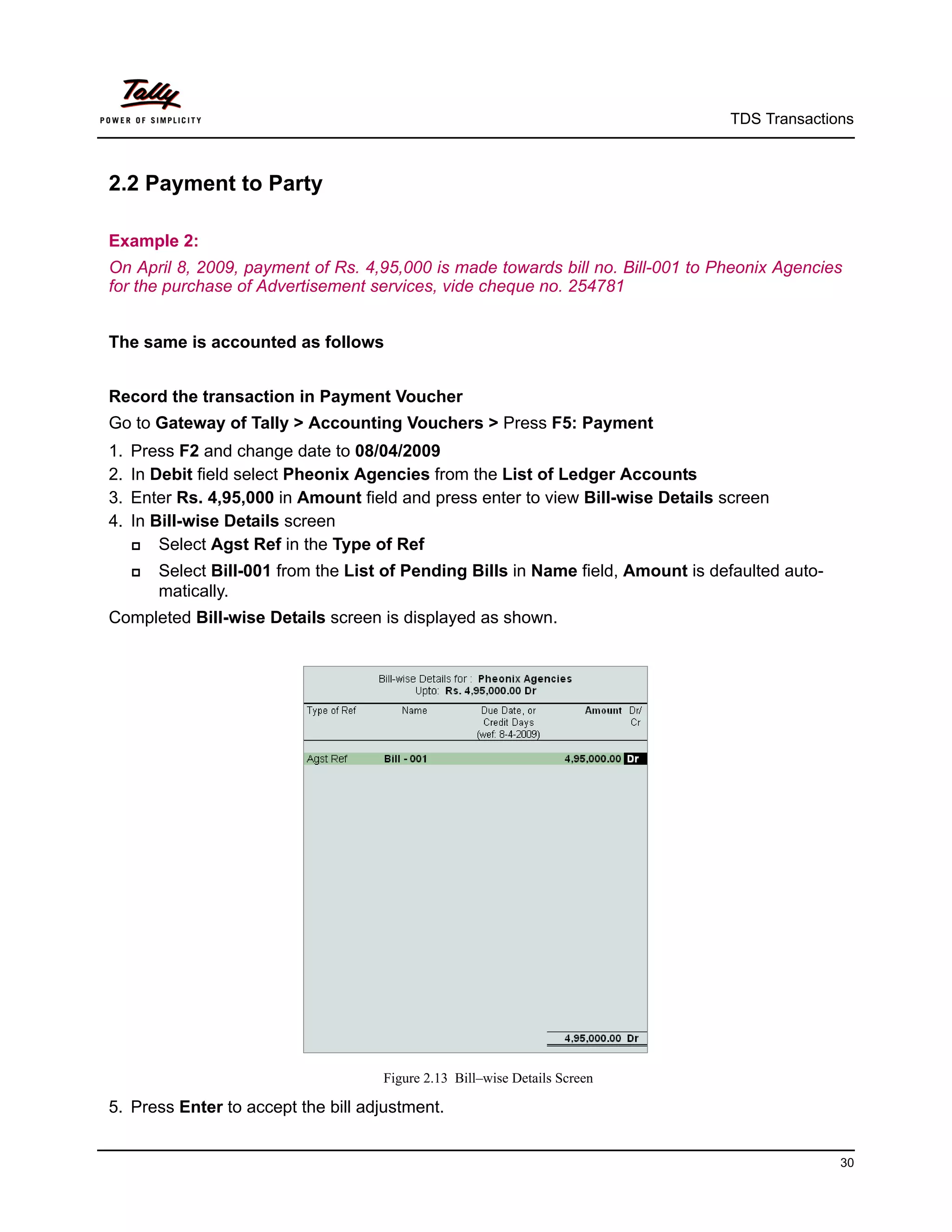

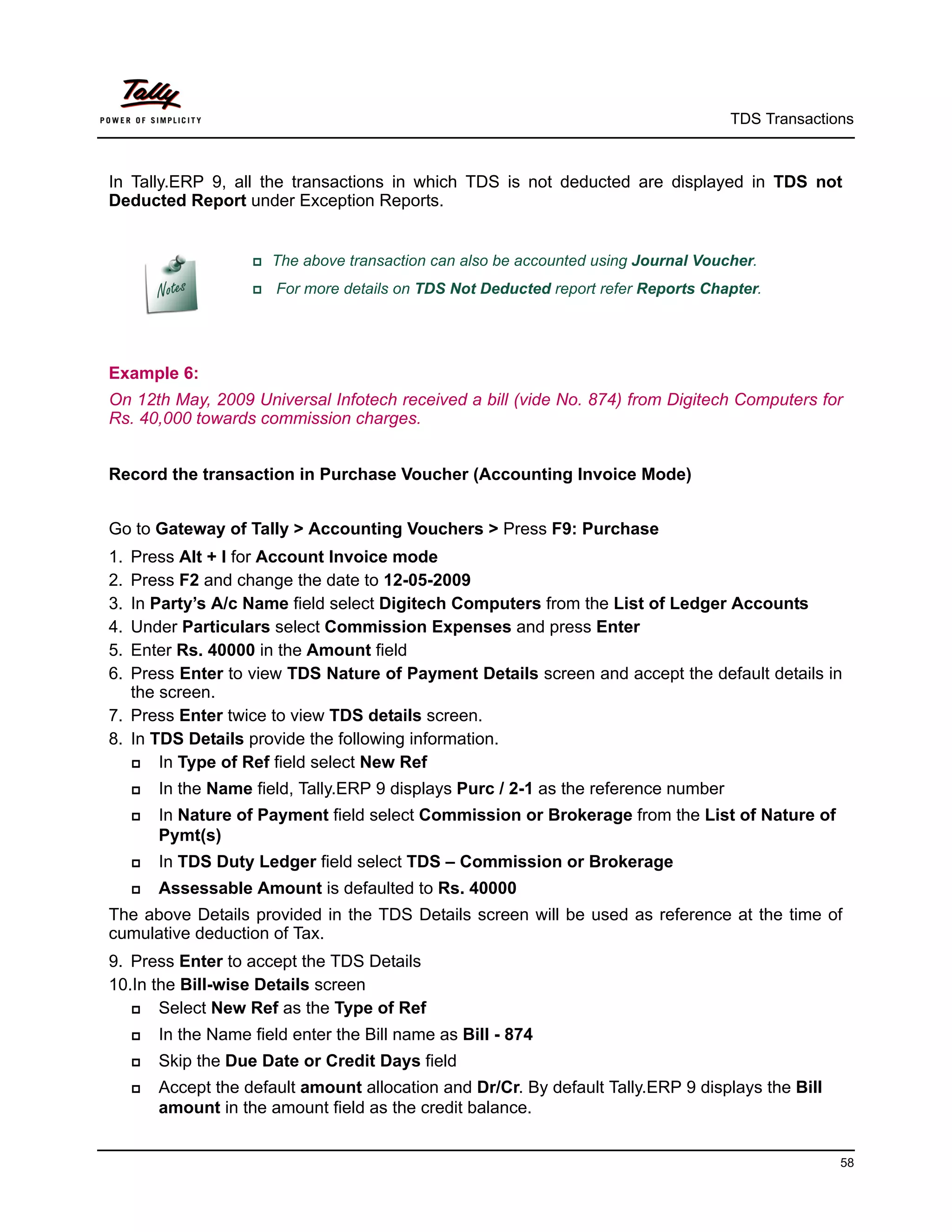

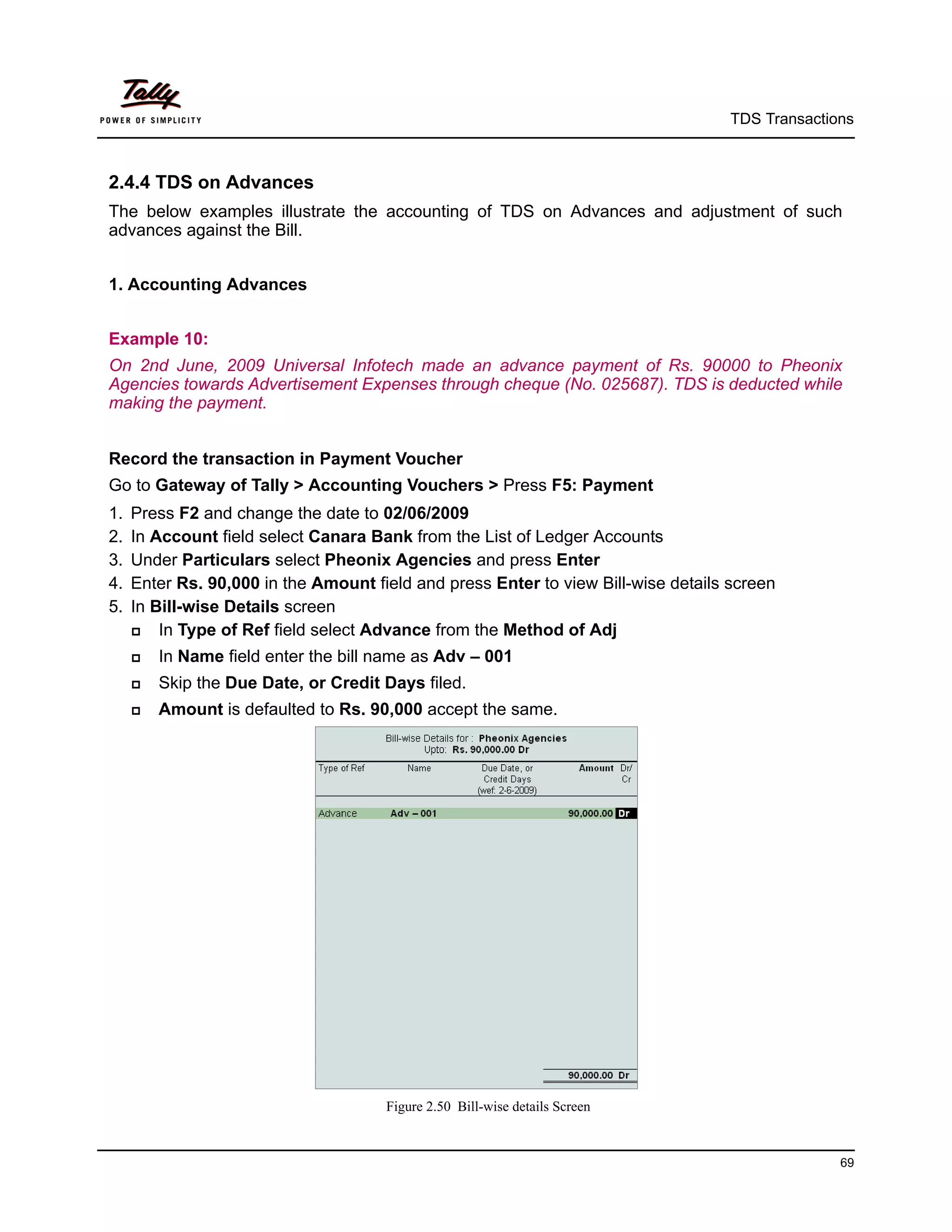

9. In Bill–wise Details screen,

Select Agst Ref in Type of Ref, to adjust the Advance against the Bill amount.

In the Name field select Adv - 001 from the Pending Bills

In the Amount field, Tally.ERP 9 displays Rs. 90,000, accept the default allocation and

press Enter.

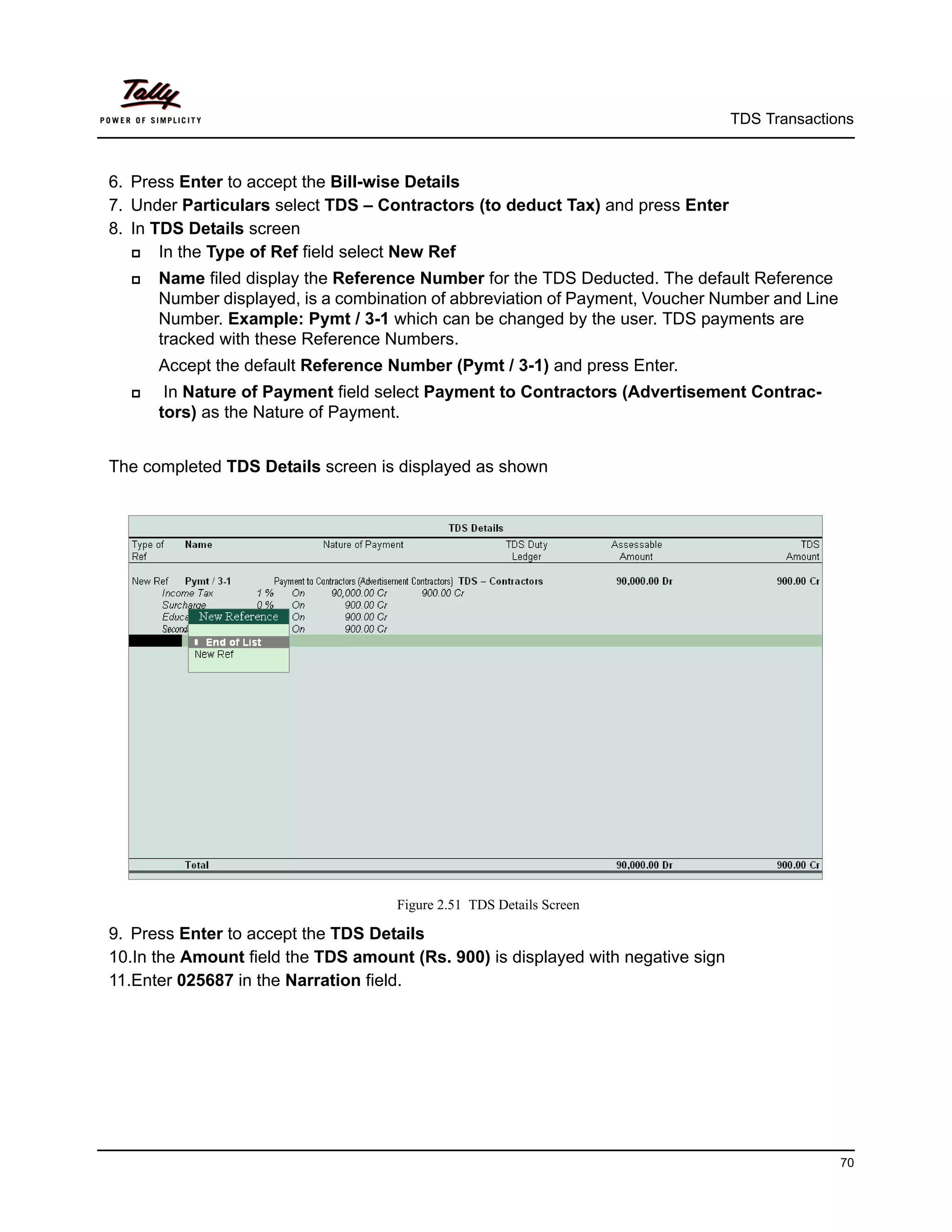

Select New Ref in the Type of Ref field to adjust the Balance amount payable to the party.

In the Name field enter the Bill name as Bill - 982

Skip the Due Date or Credit Days field

In the amount field enter the balance Bill amount Rs. 60,000[1,50,000 – Advance (90,000)]

in the amount field as the credit balance.

Press Enter, select New Ref as Type of Ref and enter Bill name as Bill -982

Skip the Due Date or Credit Days field and accept the default amount allocation and Dr/

Cr. By default Tally.ERP 9 displays the Tax amount in the amount field as the debit bal-

ance.

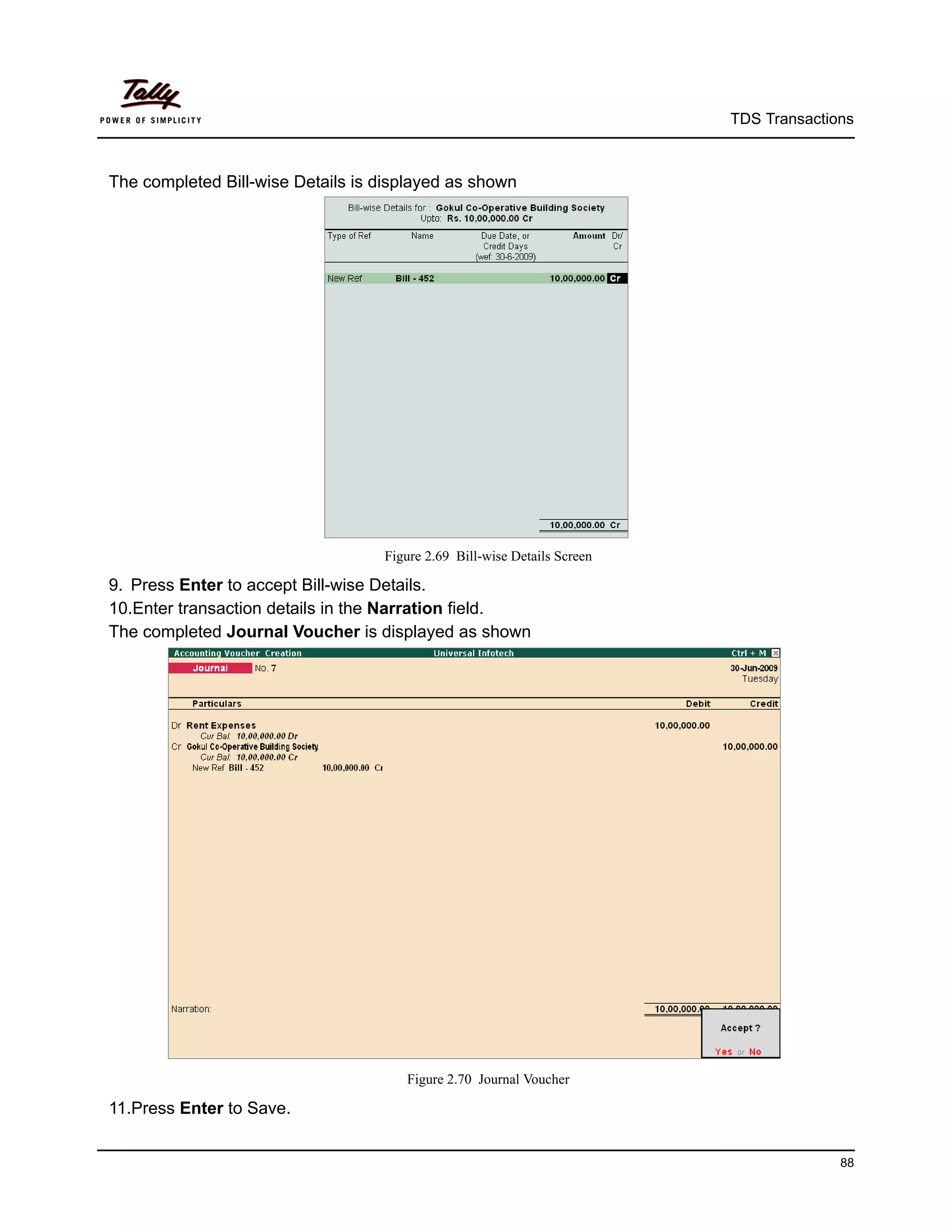

The completed Bill-wise Details is displayed as shown

Figure 2.54 Bill-wise Details Screen

10.Press Enter to accept Bill-wise Details.

73](https://image.slidesharecdn.com/implementationoftdsintallyerp92-121026085515-phpapp02/75/tally-erp-9-77-2048.jpg)

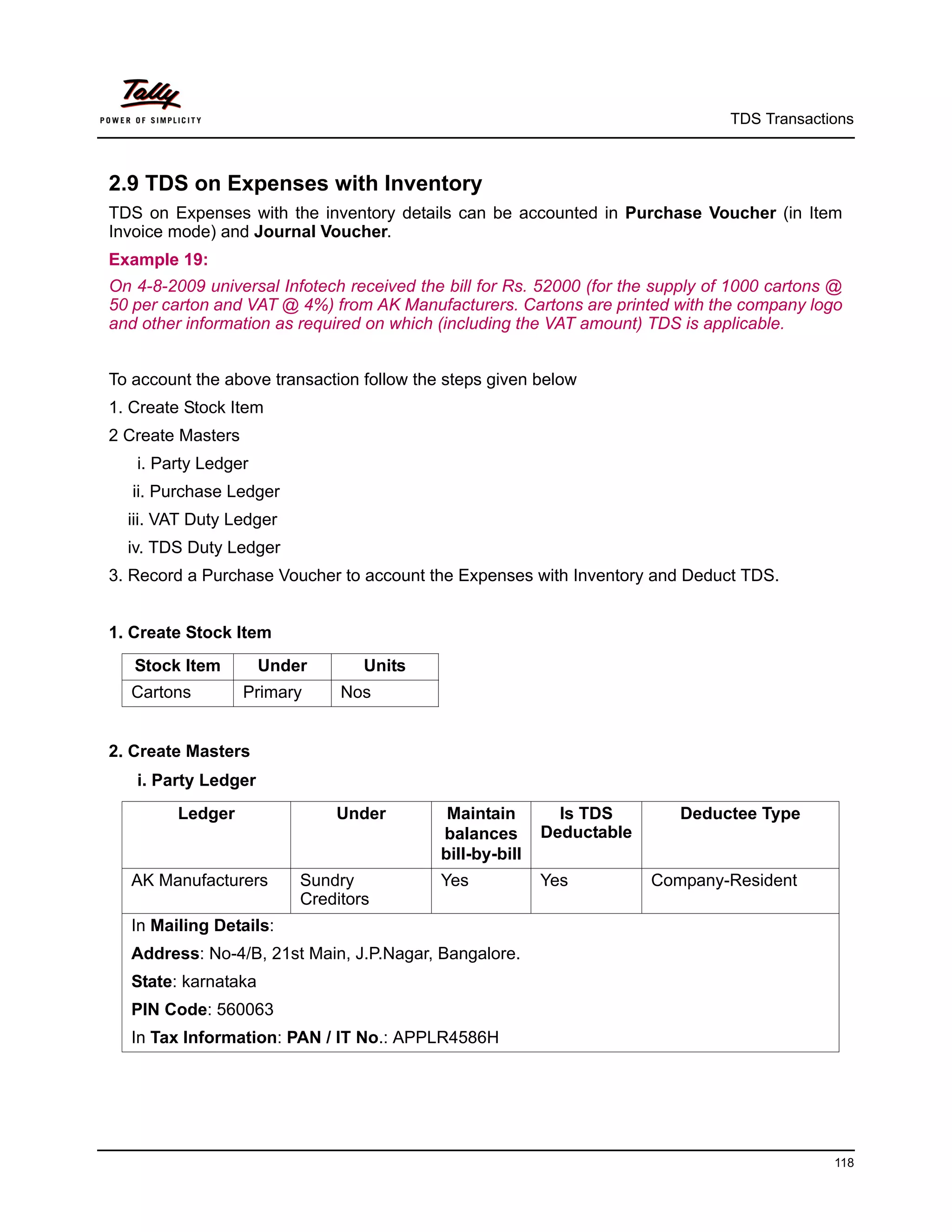

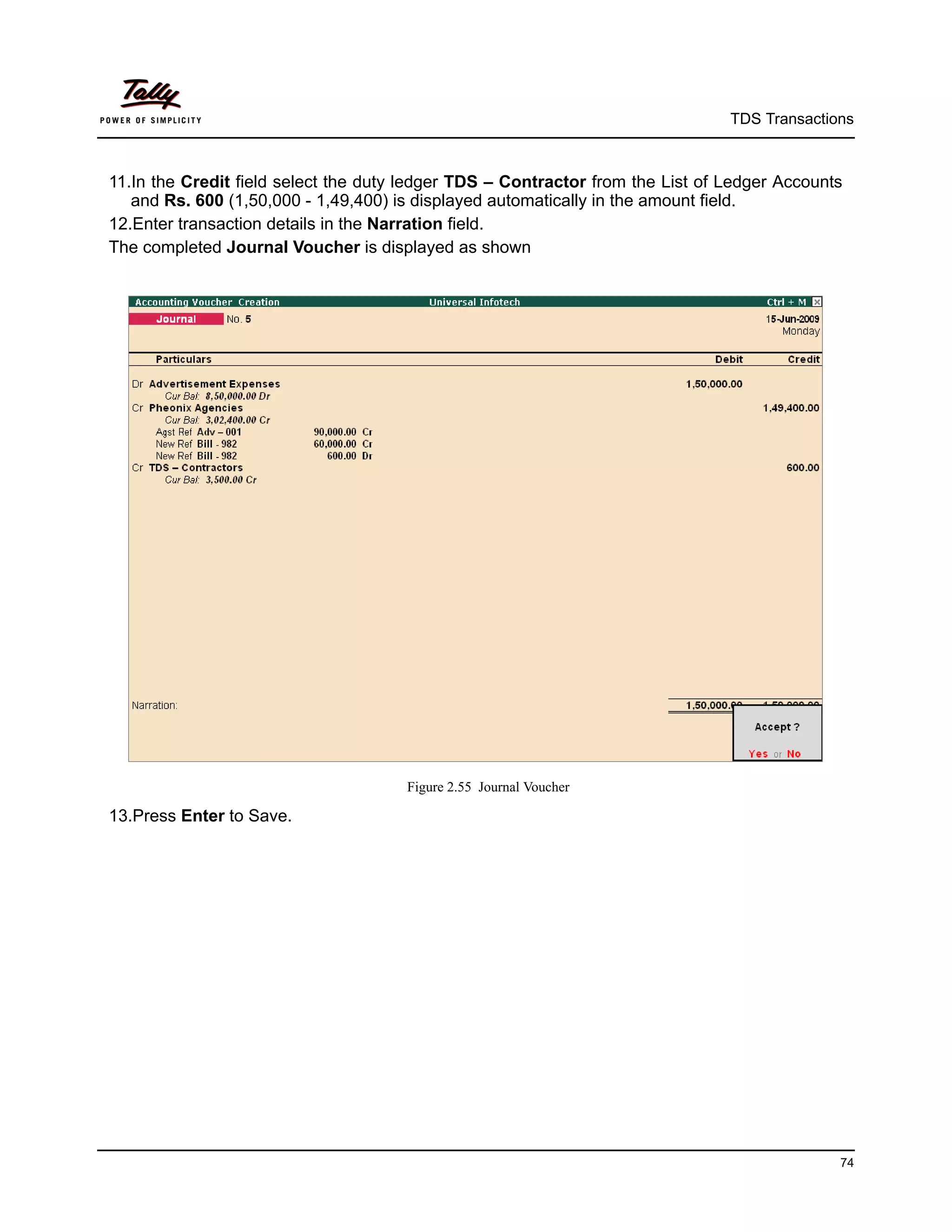

![TDS Transactions

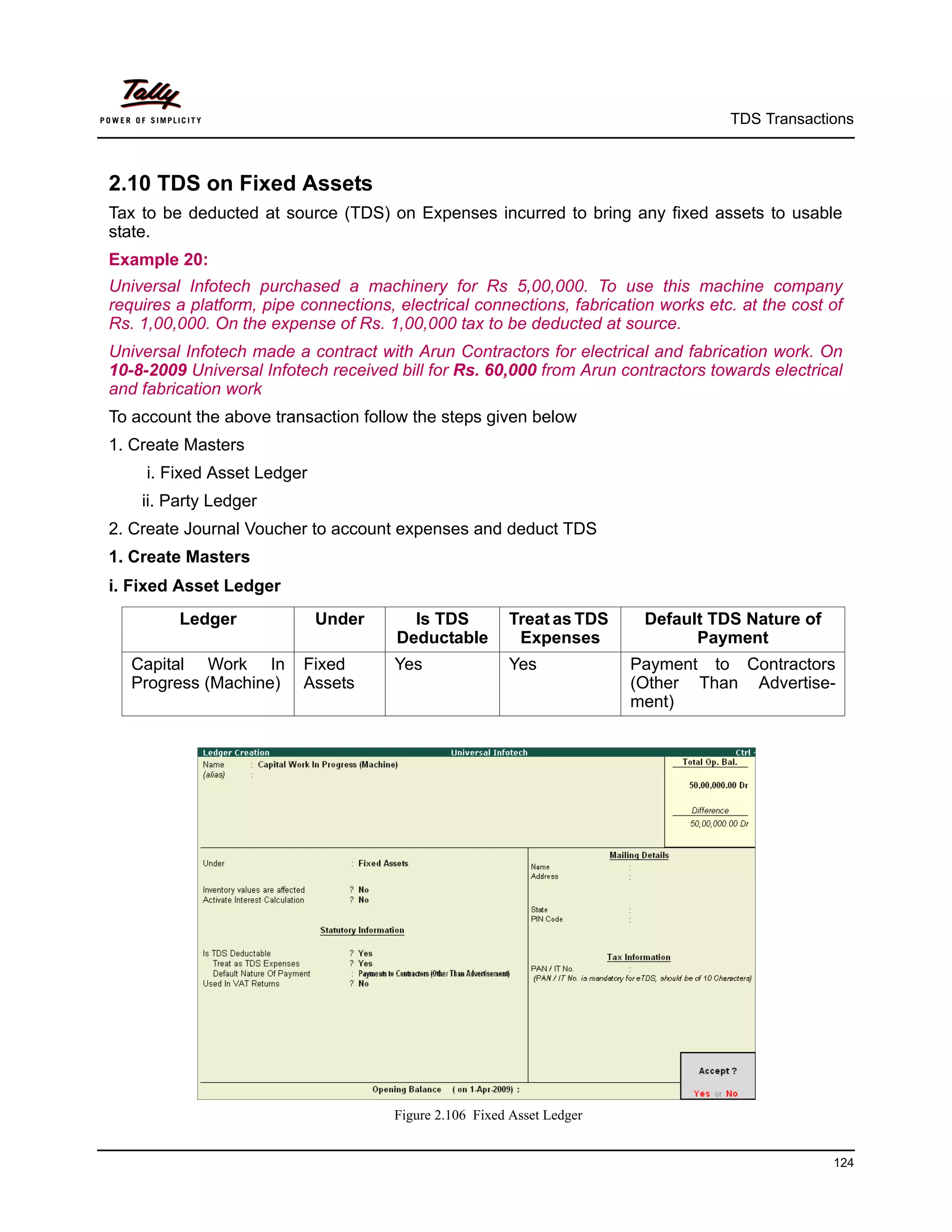

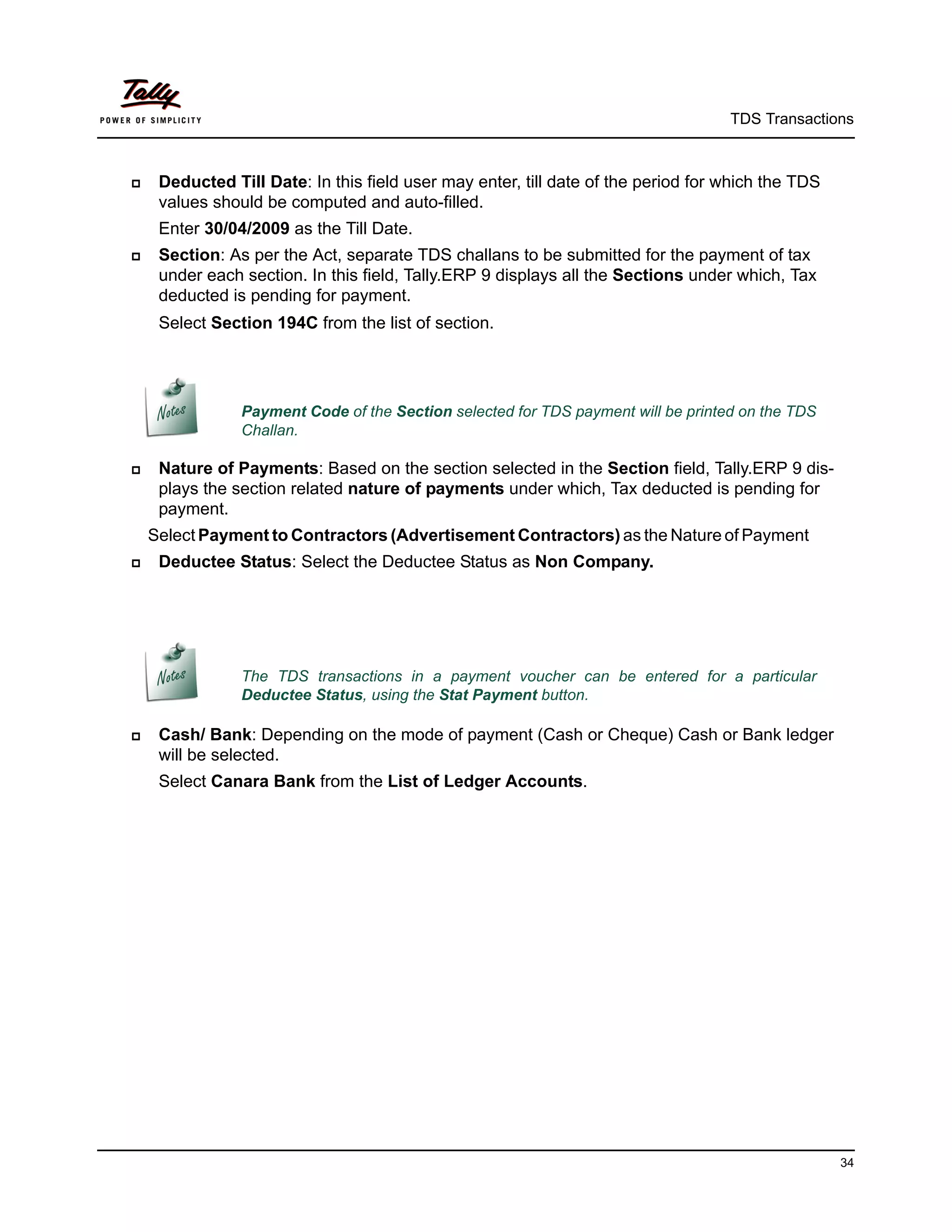

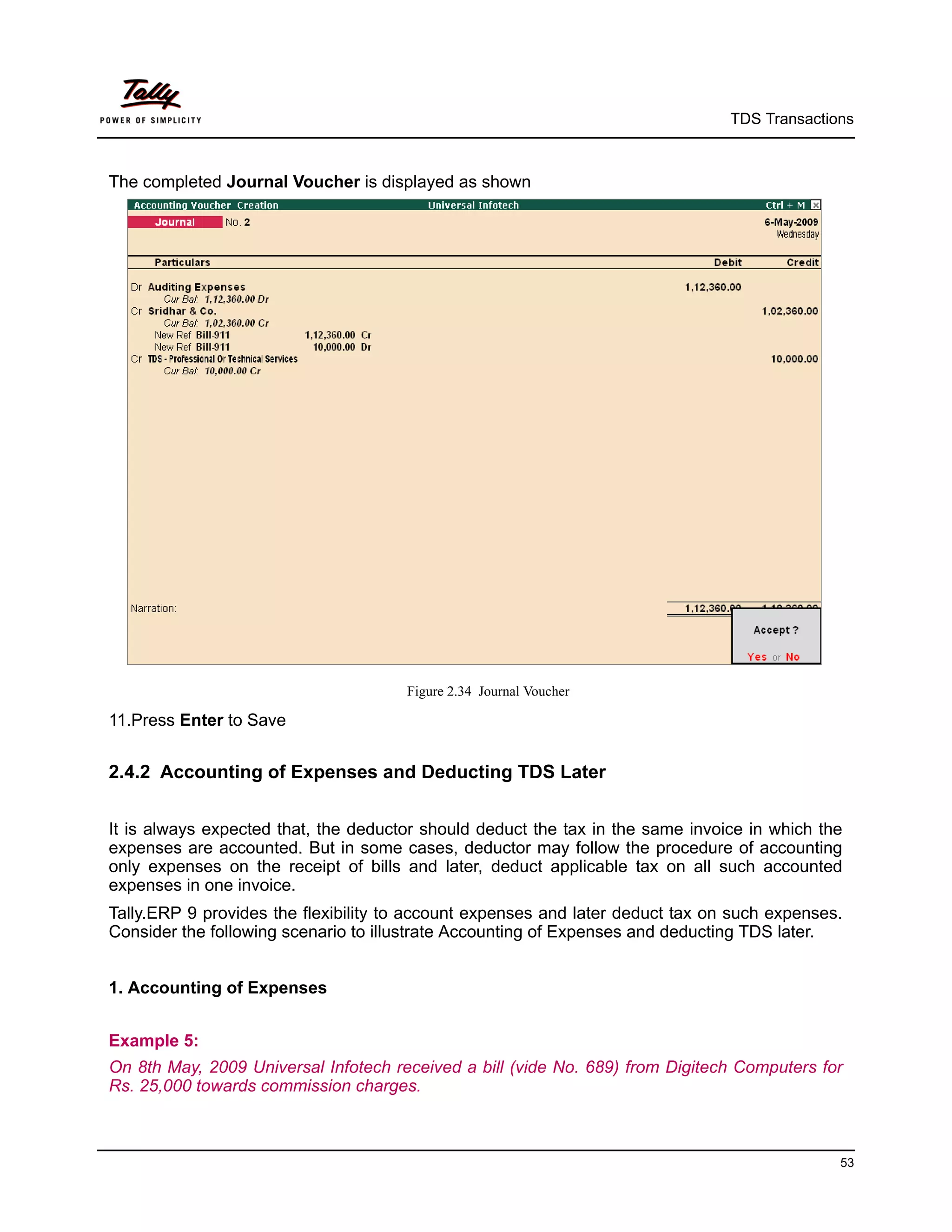

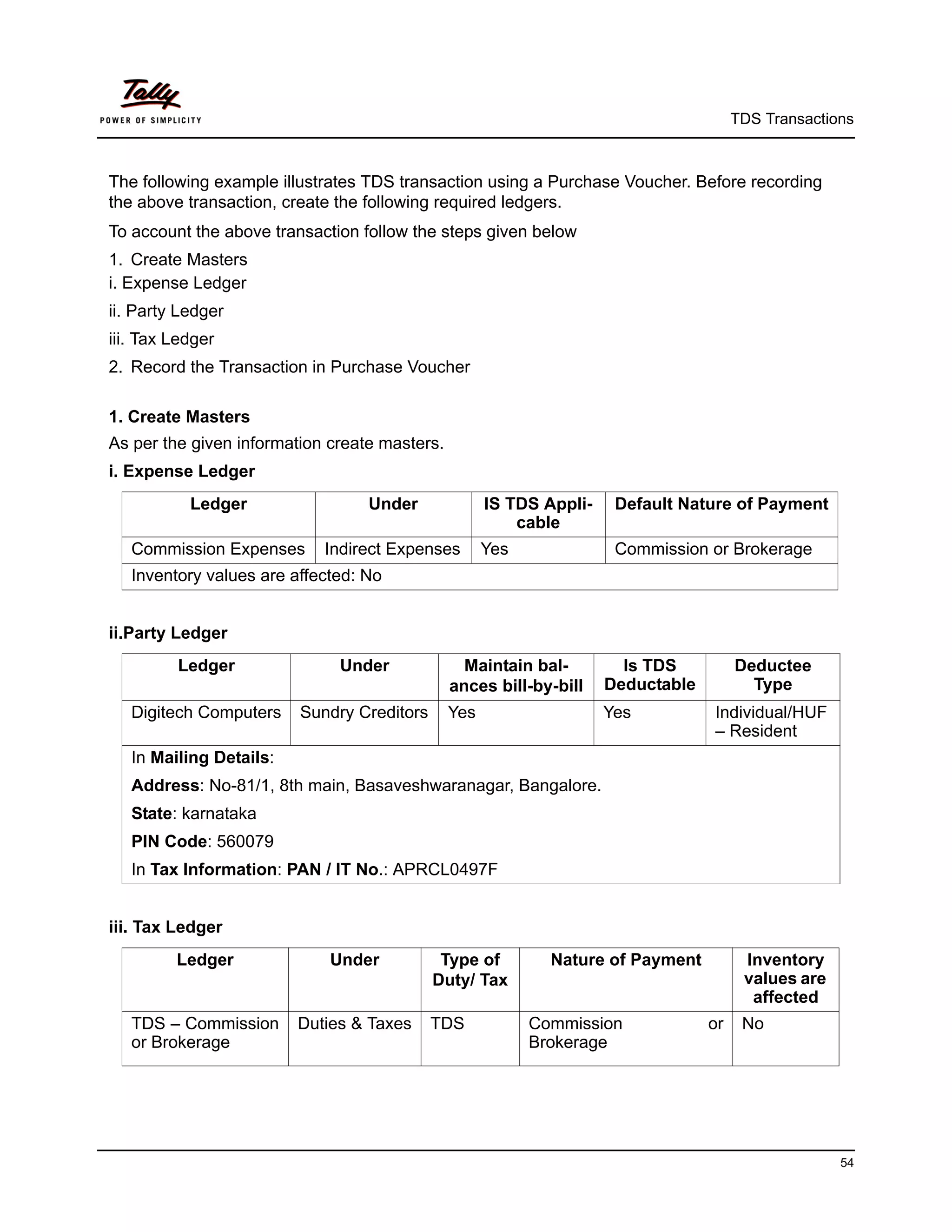

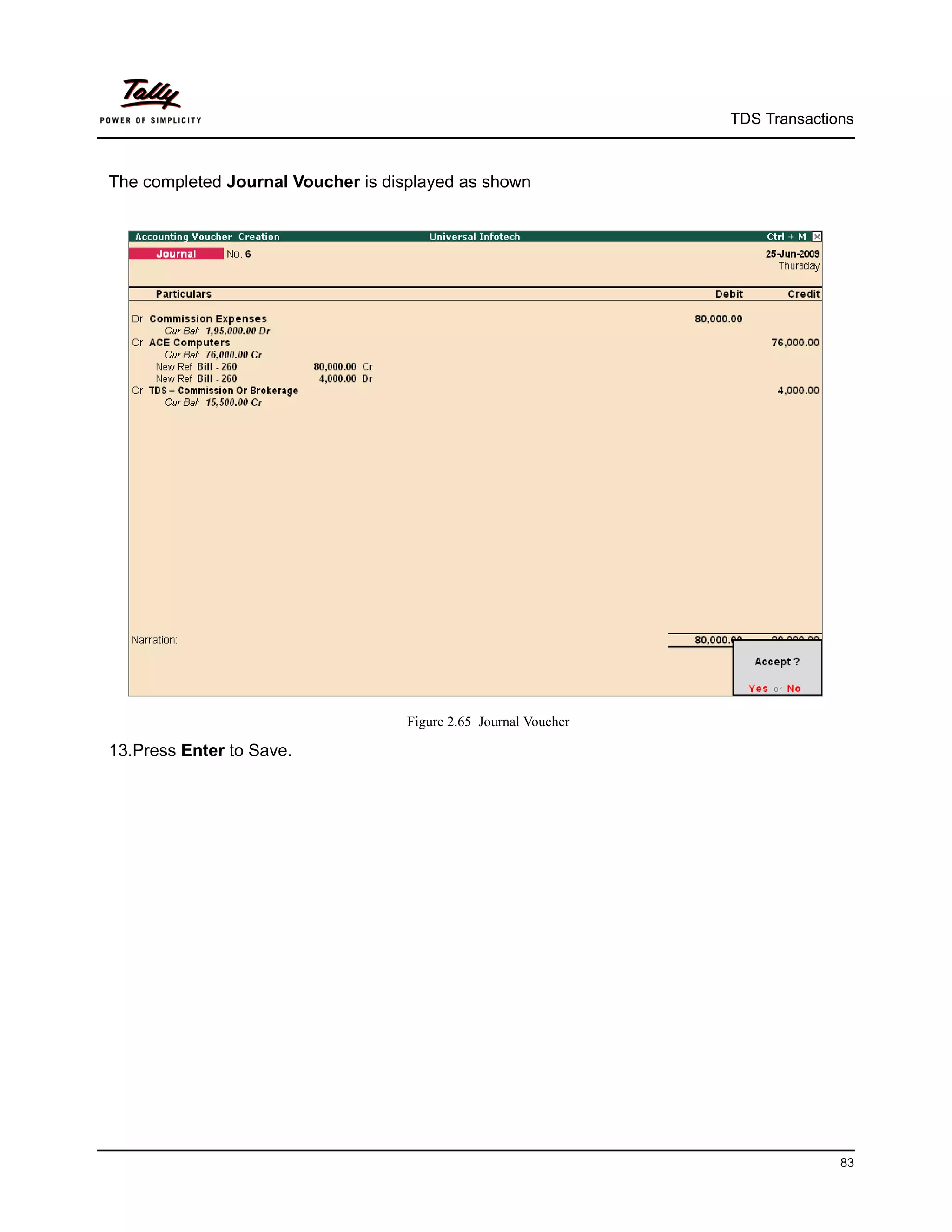

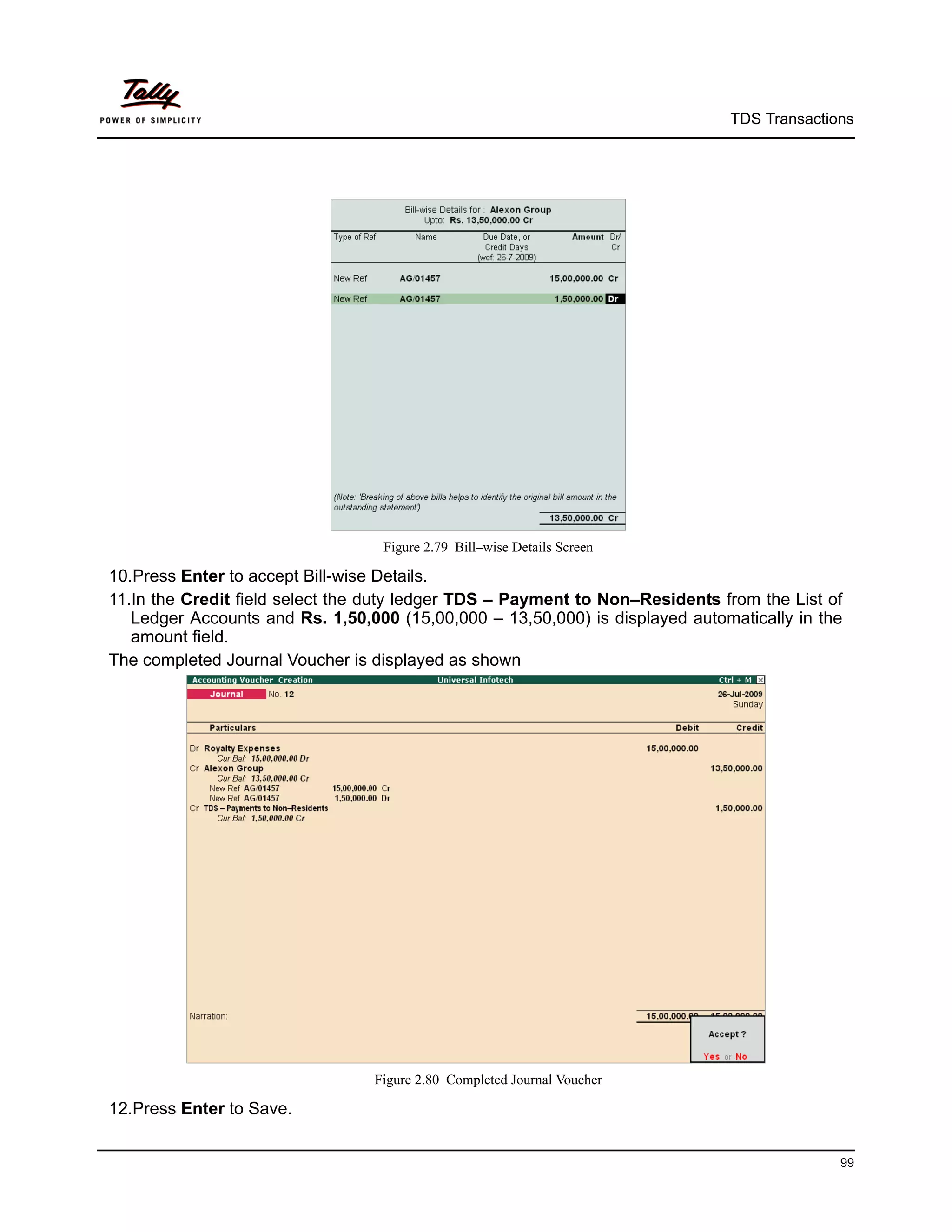

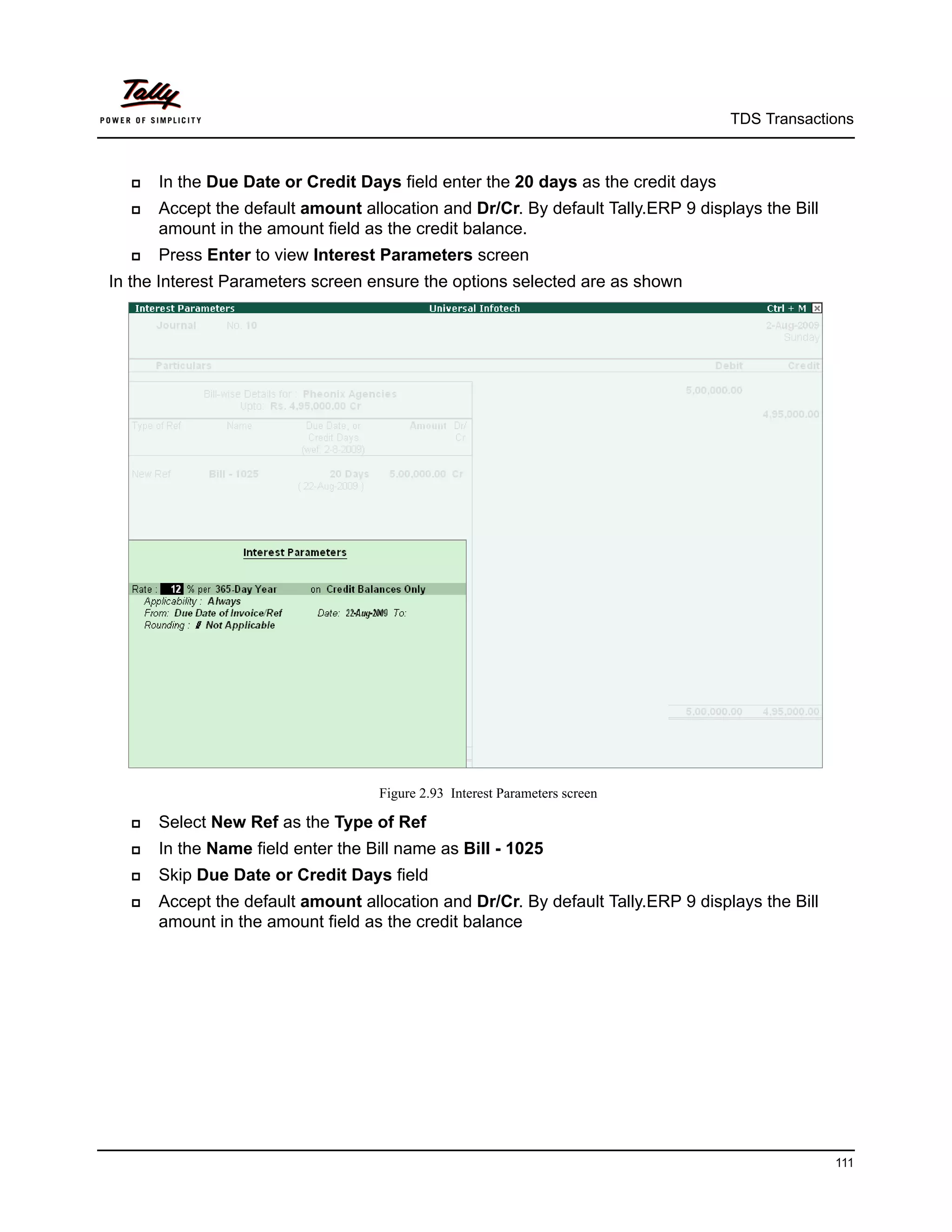

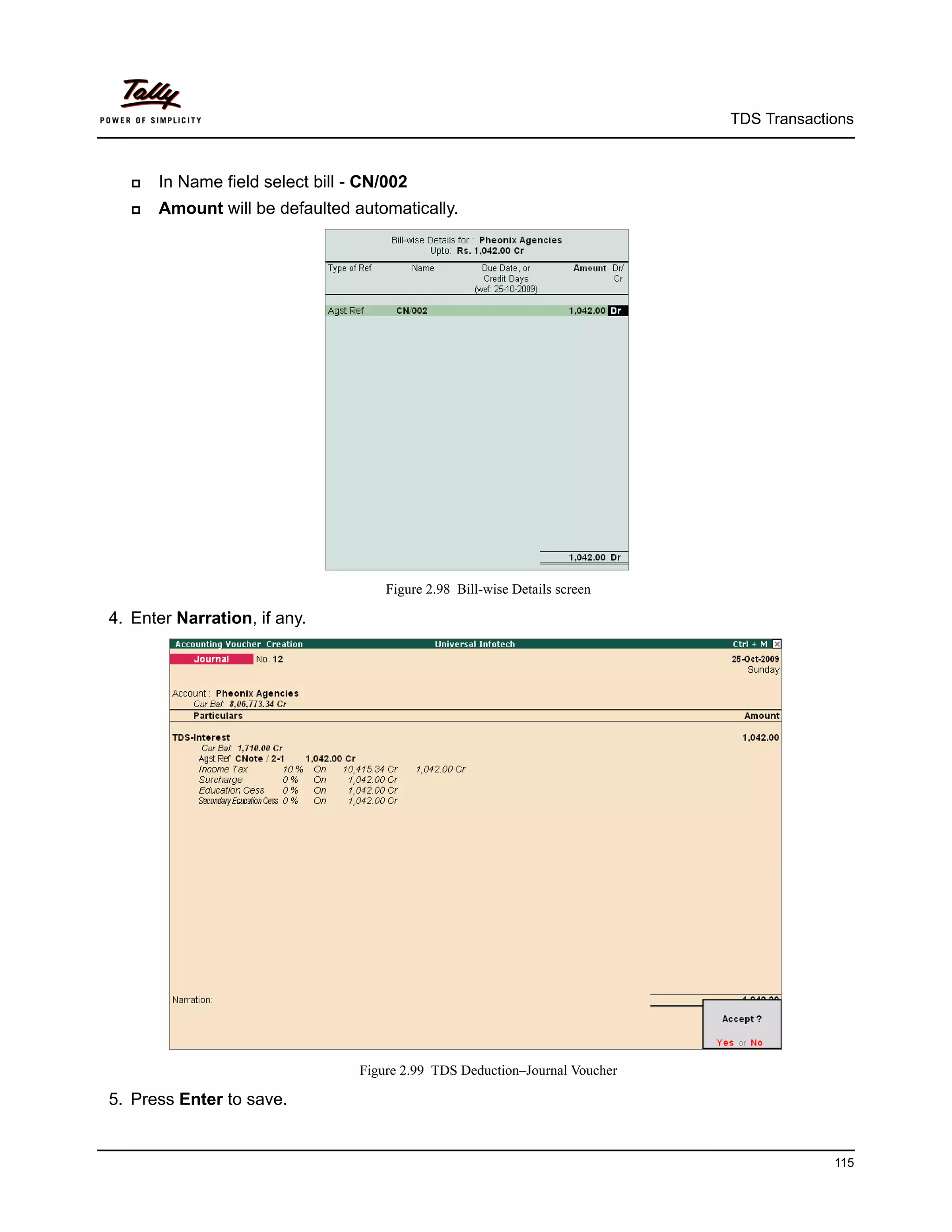

5. Record a Payment Voucher (payment of bill amount with interest)

Go to Gateway of Tally > Accounting Vouchers > F5: Payment

1. Press F2 and change the date to 25-10-2009

2. In the Account field select Canara Bank

3. Under Particulars select Pheonix Agencies

4. Enter Rs. 504373.34 [495000 + 9373.34 (10415.34 - 1042)] in the Amount field

In the Bill-wise Details screen select the bills as shown below

Figure 2.100 Bill-wise Details screen

5. Enter Narration, if required

116](https://image.slidesharecdn.com/implementationoftdsintallyerp92-121026085515-phpapp02/75/tally-erp-9-120-2048.jpg)