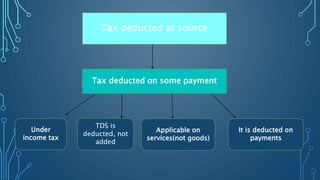

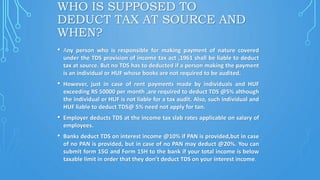

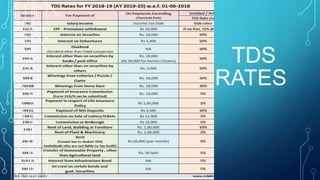

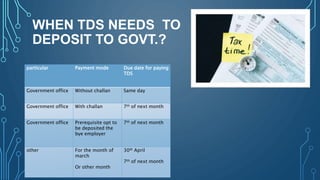

Tax deducted at source (TDS) is a system where a person making specified payments must deduct a percentage of tax before making payments. Common examples include deducting tax from salary payments or professional fee payments. The deducted tax amount is then deposited directly with the government by the paying entity. TDS aims to collect tax directly from the source of income.