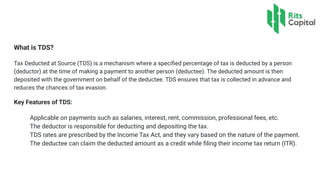

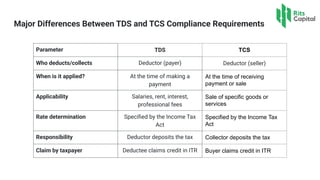

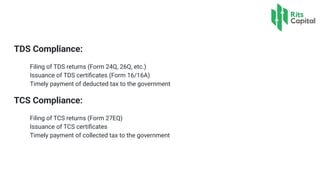

The document explains the differences between Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) in India, highlighting their mechanisms, applicability, and compliance requirements. TDS is applied to various payments like salaries and interest, while TCS is applicable to specific goods and services sold. Understanding these distinctions is essential for ensuring tax compliance and avoiding penalties.