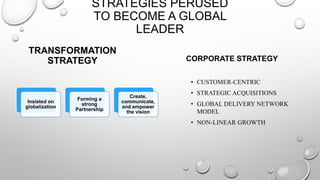

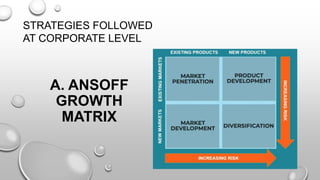

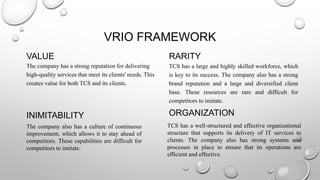

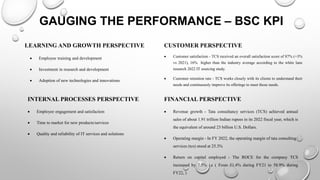

TCS is a global IT consulting and services company headquartered in India. Over the past 50 years, TCS transformed into a global leader through strategies like globalization, strong partnerships, and empowering its vision. It pursued customer-centricity, strategic acquisitions, a global delivery network model, and non-linear growth. At the corporate, business, and operational levels, TCS employed strategies like diversification, partnerships, market segmentation, investing in R&D, and embracing new technologies. Through effective strategic management, TCS was able to become the largest IT services company in India.