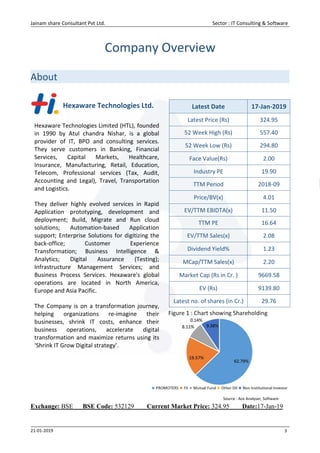

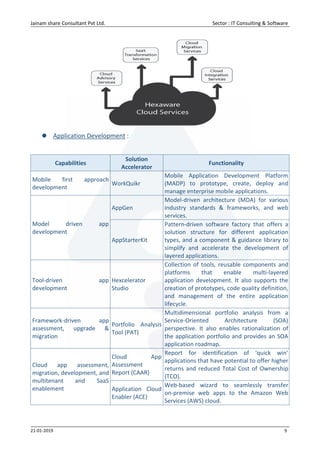

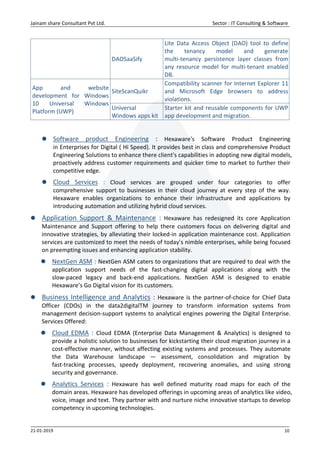

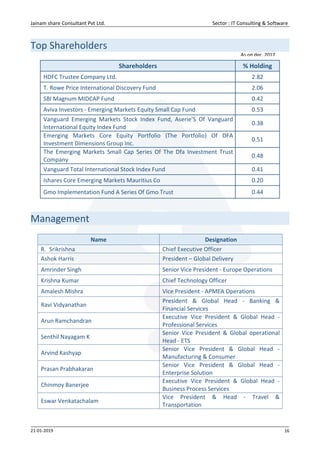

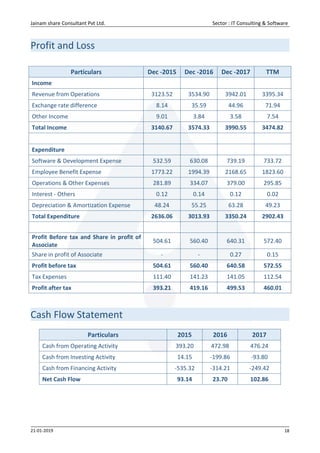

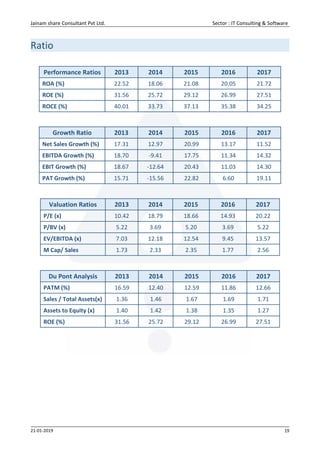

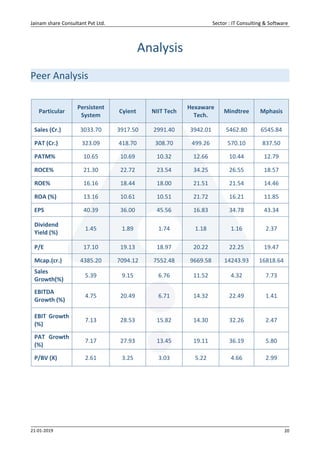

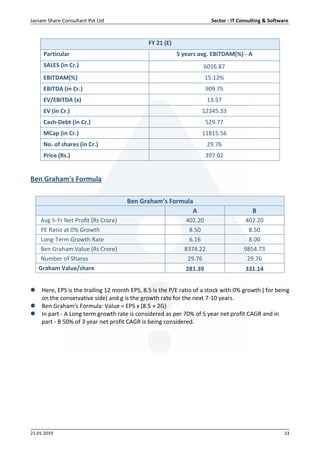

The document is a research report from Jainam Share Consultant regarding Hexaware Technologies Ltd, a global IT services provider. It outlines the company's financial performance, service offerings, and growth strategies while also discussing market trends and risks in the IT industry. The report concludes with an investment rationale highlighting Hexaware's robust growth potential compared to its peers and the overall software industry.