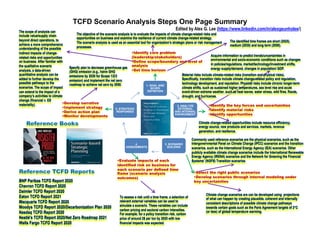

This document outlines the steps for conducting scenario analysis as per TCFD guidelines, aiming to evaluate climate change-related risks and opportunities for businesses. The process includes defining goals, analyzing environments, building scenarios, assessing impacts, and developing strategic responses with a focus on long-term climate resilience. It emphasizes the importance of identifying risks, opportunities, and employing public scenarios to inform decision-making and establish action plans for reducing greenhouse gas emissions.