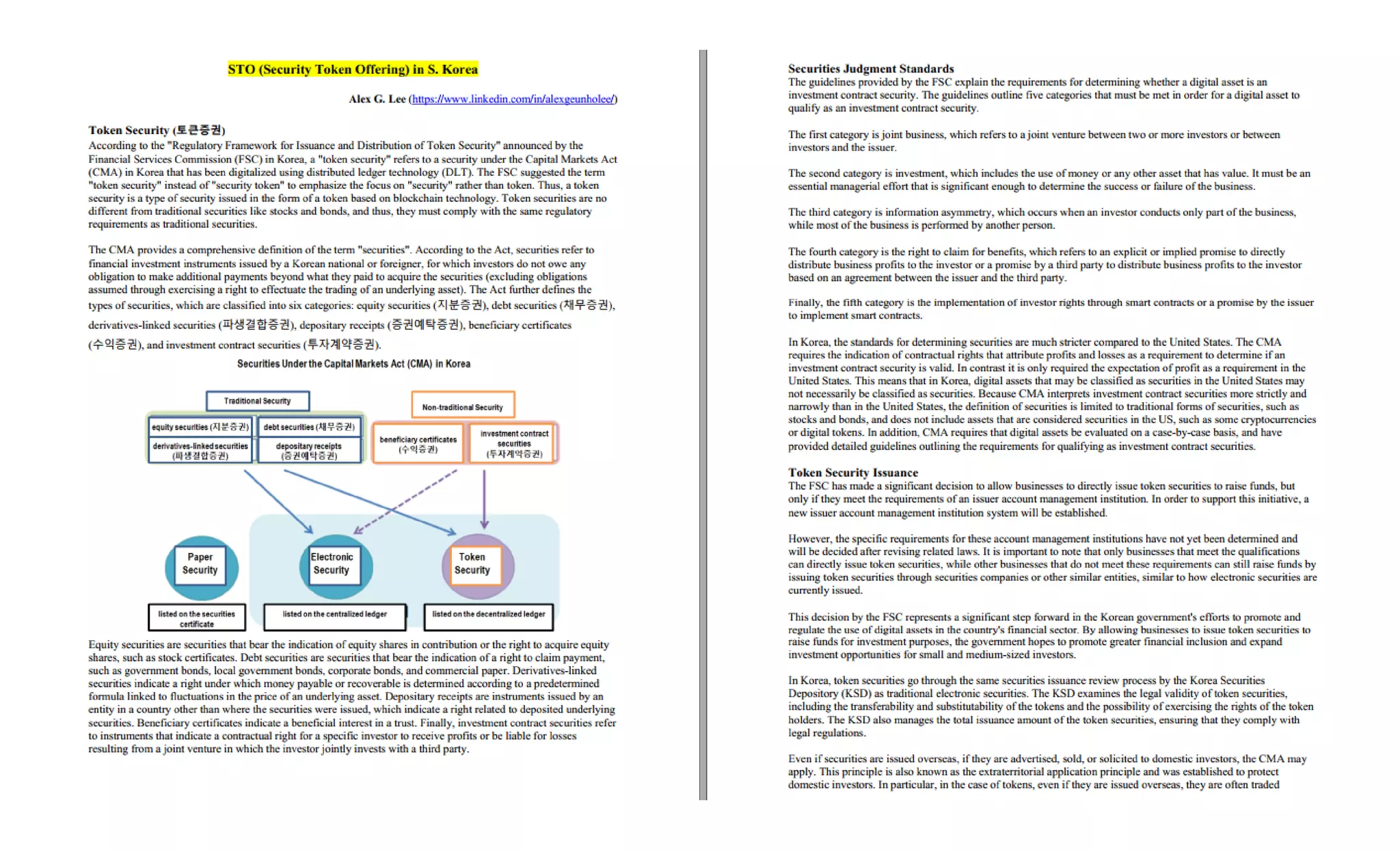

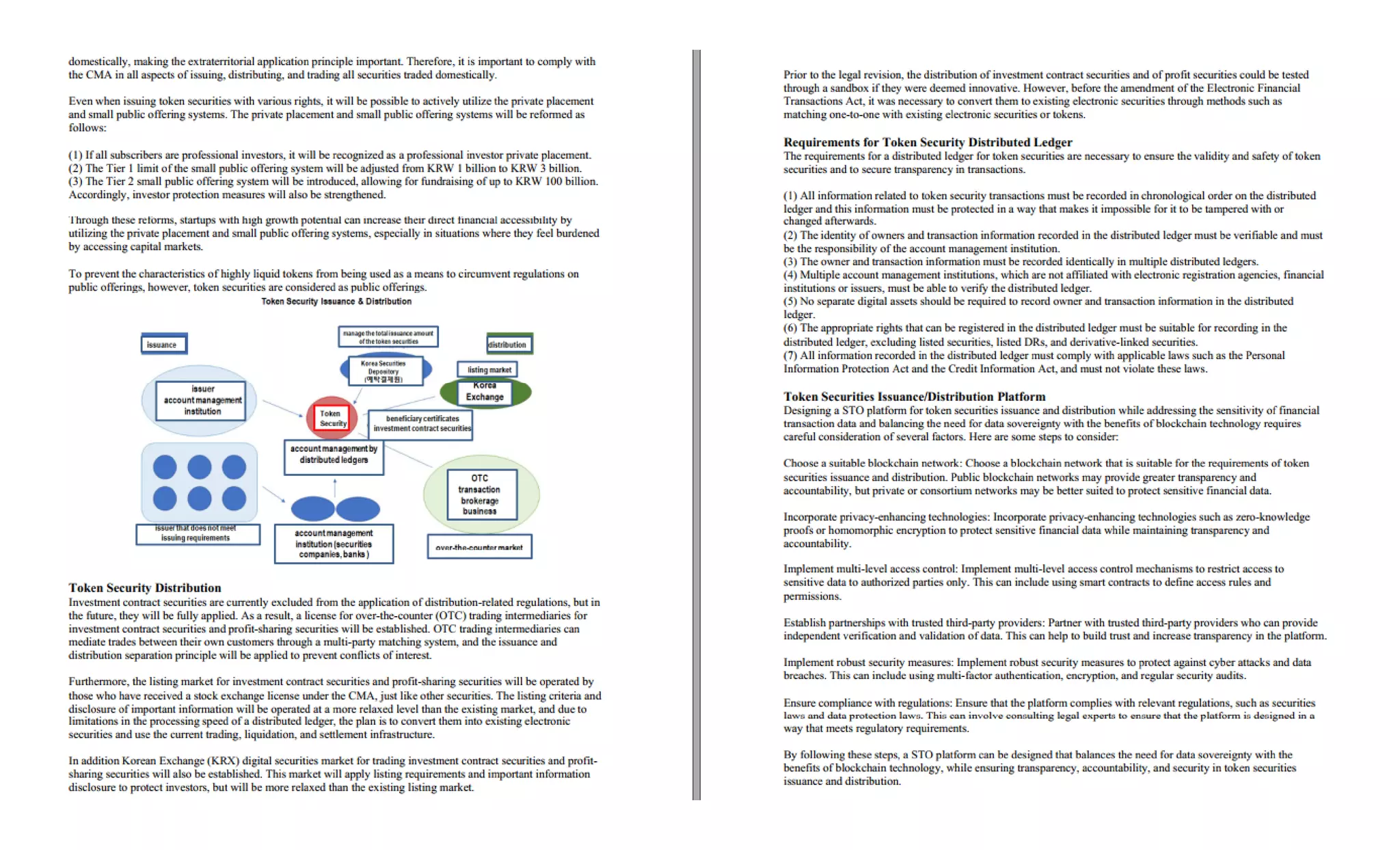

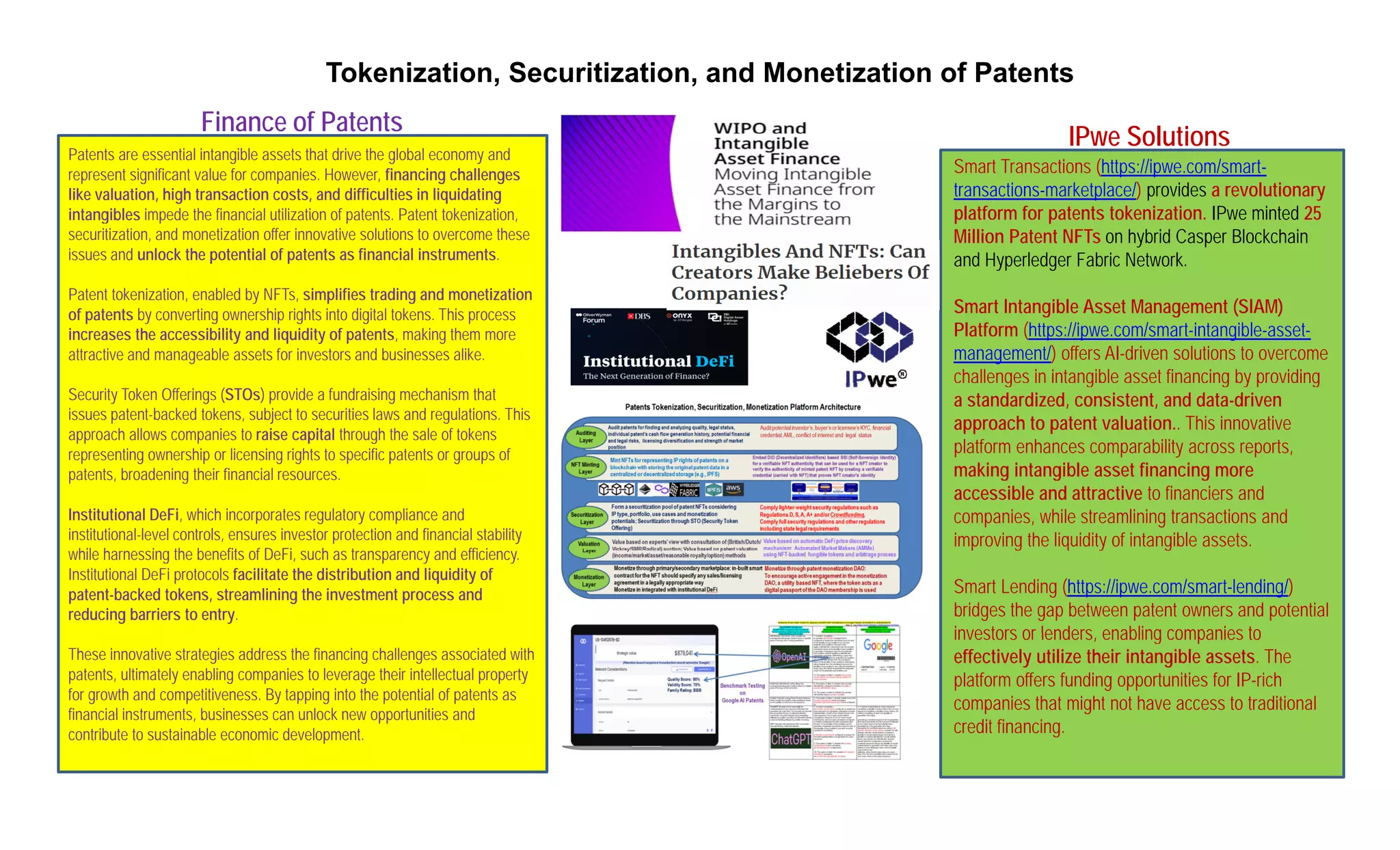

The document outlines a schedule for a discussion on the tokenization, securitization, and monetization of real-world assets, including real estate and patents, featuring various industry experts. It emphasizes the benefits of Security Token Offerings (STOs) over traditional public offerings, such as enhanced liquidity and lower transaction costs, as well as the potential for using tokenization to unlock the value of patents through innovative platforms. The text also highlights the evolving market landscape with secondary markets for tokens and the integration of decentralized finance (DeFi) solutions to improve accessibility and liquidity for investors.