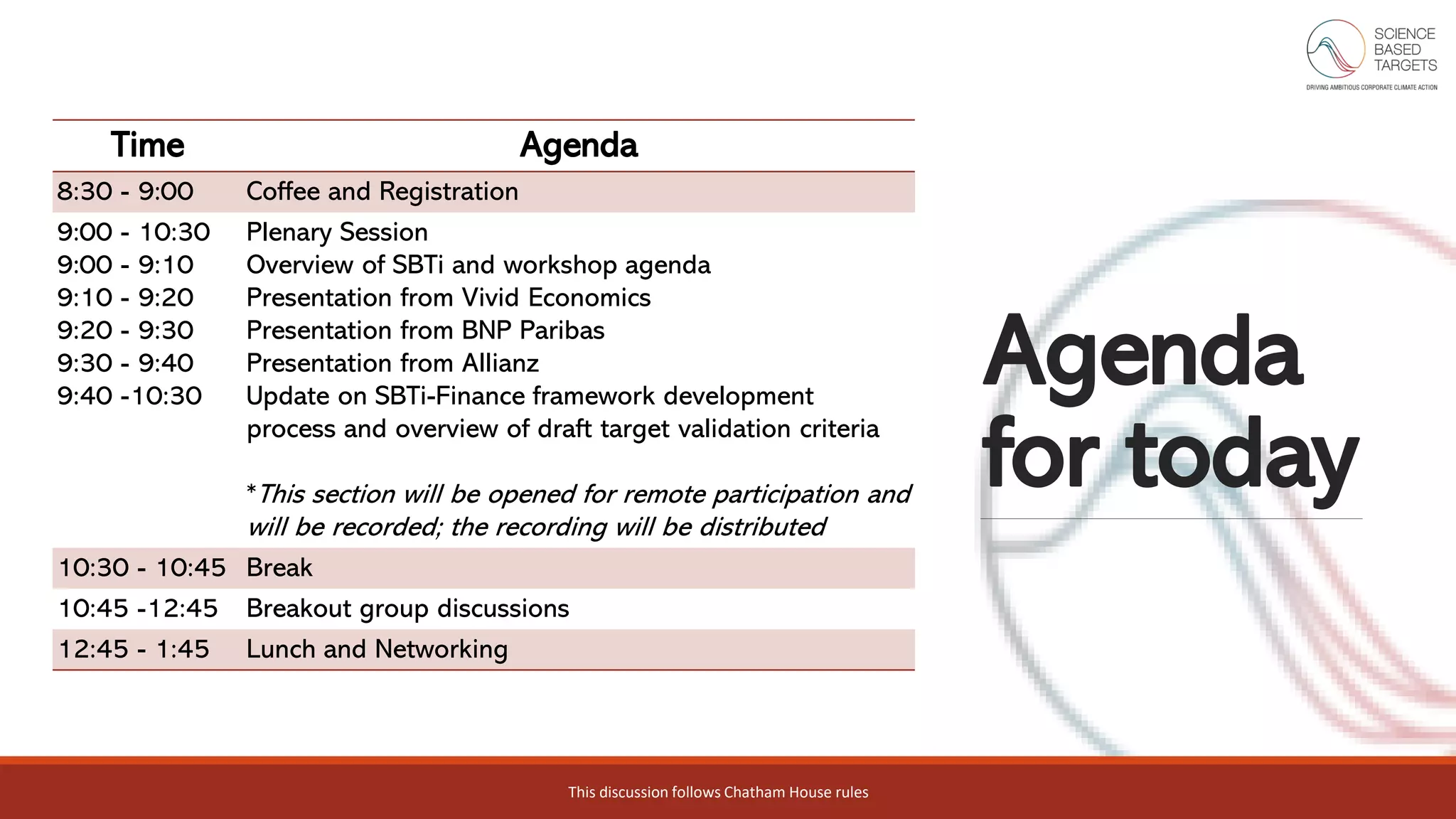

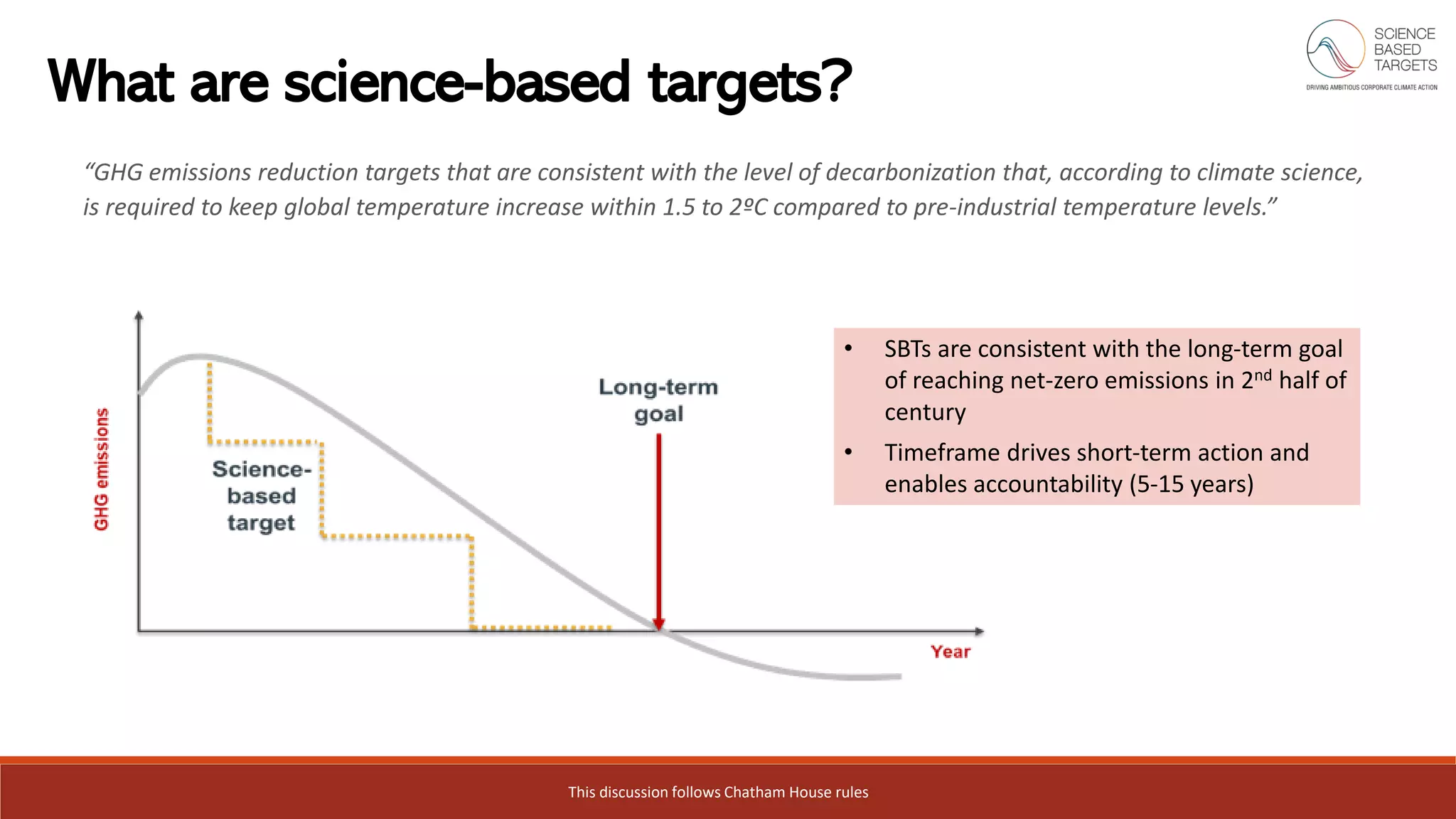

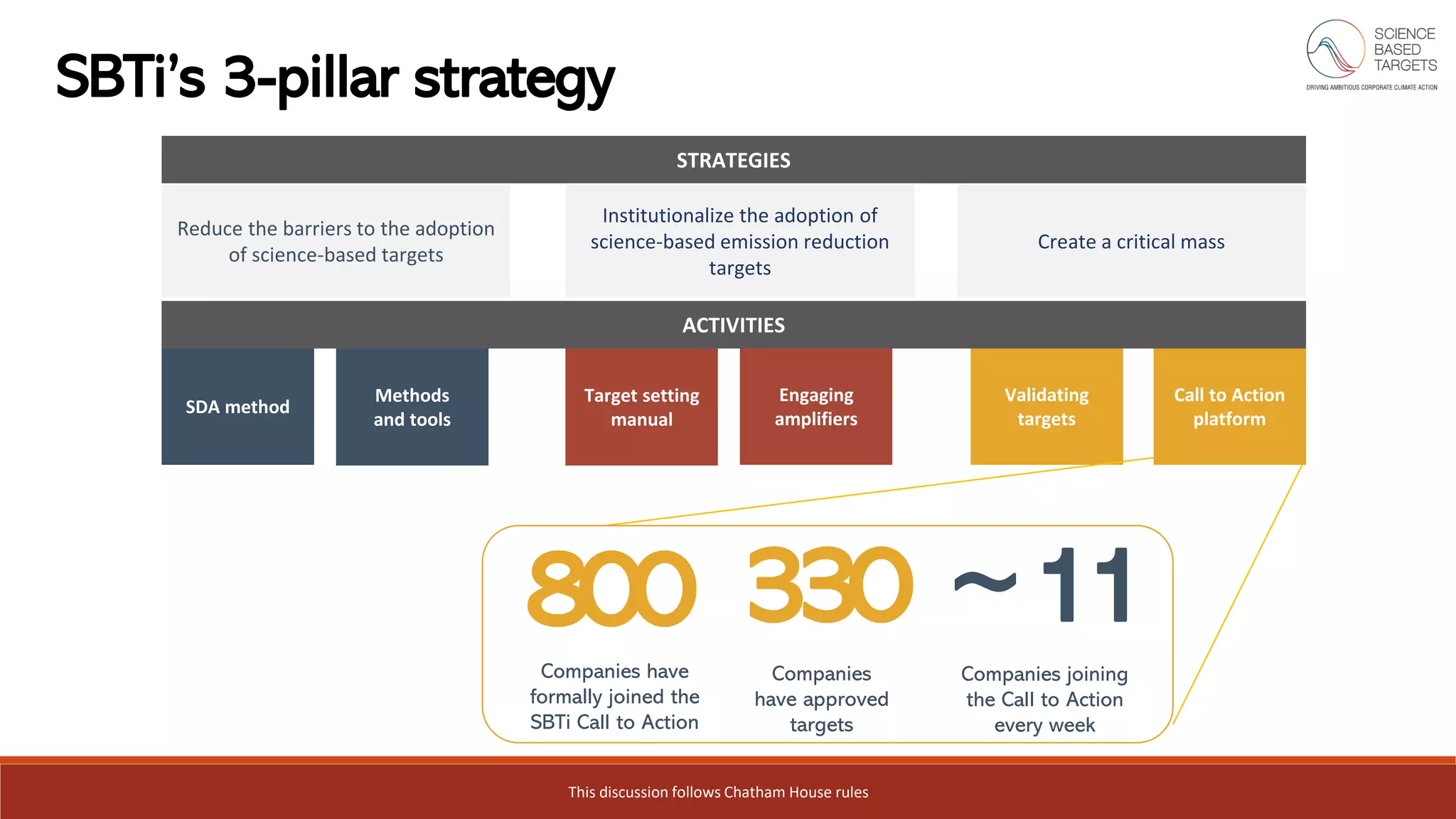

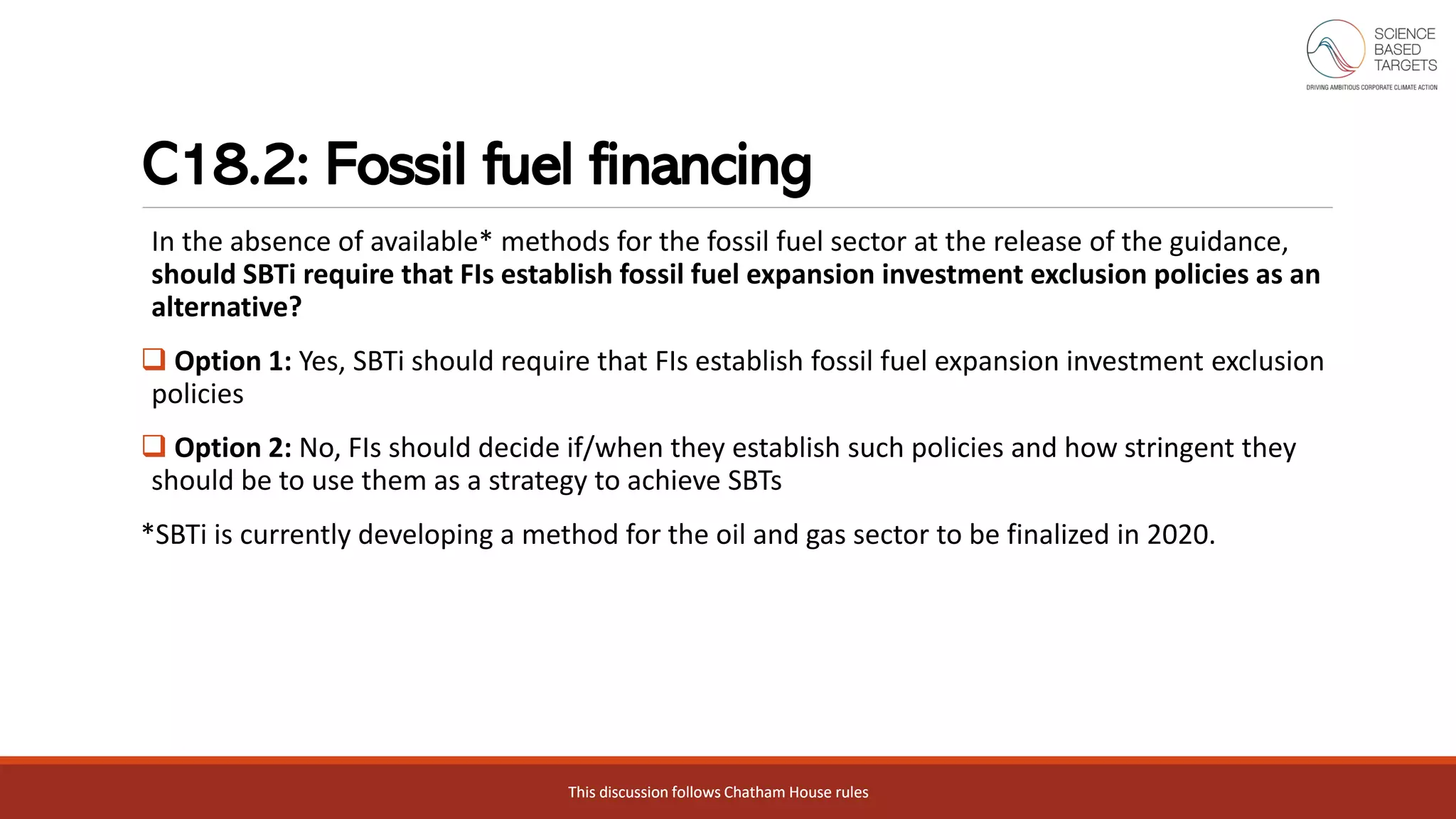

This document outlines the agenda and discussions from a stakeholder consultation workshop held on February 11, 2020, for the Science Based Targets Initiative (SBTi) on target validation criteria for financial institutions. Key topics included input on criteria for assessing financial institutions' targets regarding greenhouse gas emission reductions in alignment with the Paris Agreement. The workshop also covered the SBTi's role in mobilizing companies toward science-based targets and the evolution of criteria for investment and lending activities.