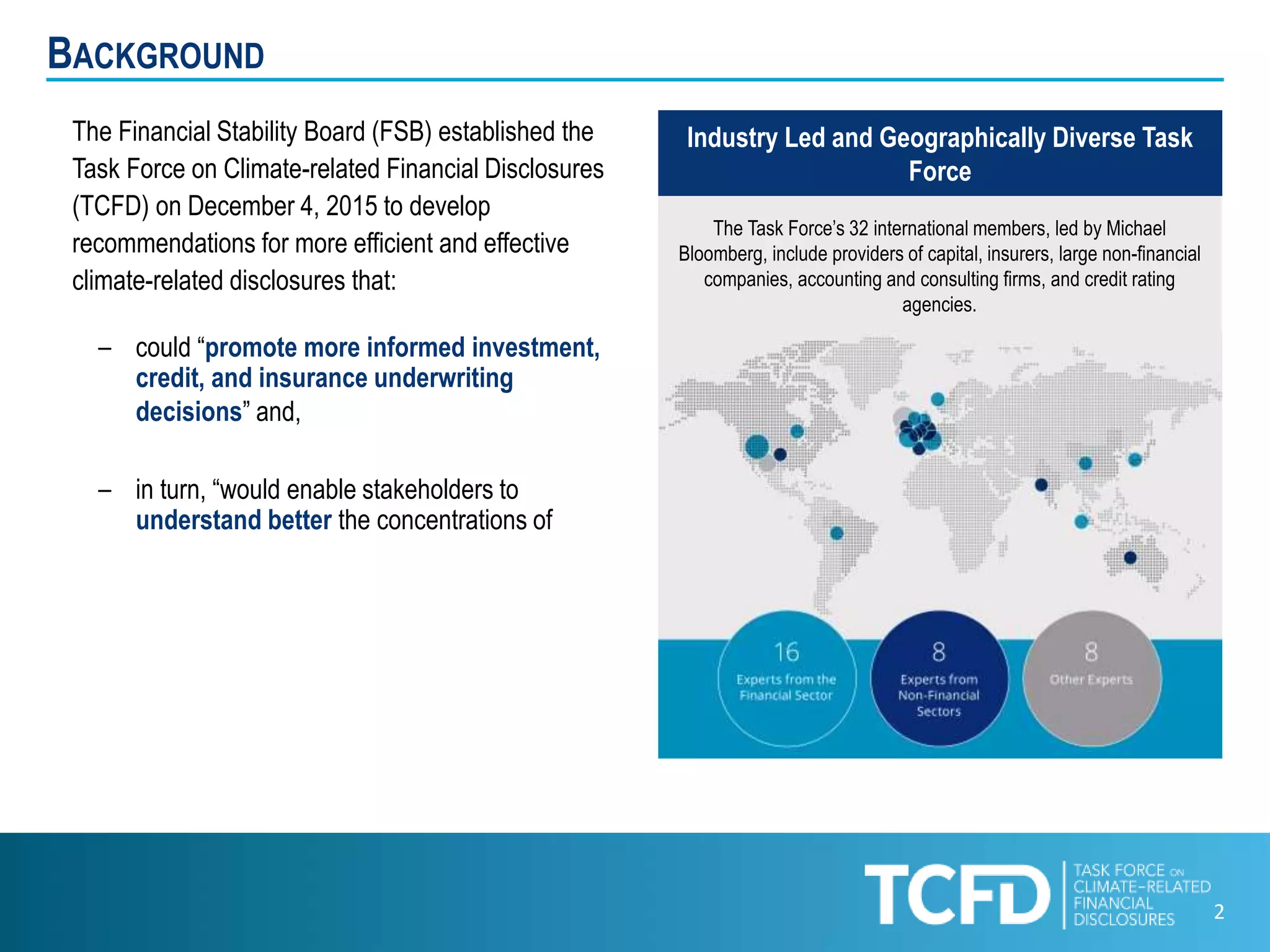

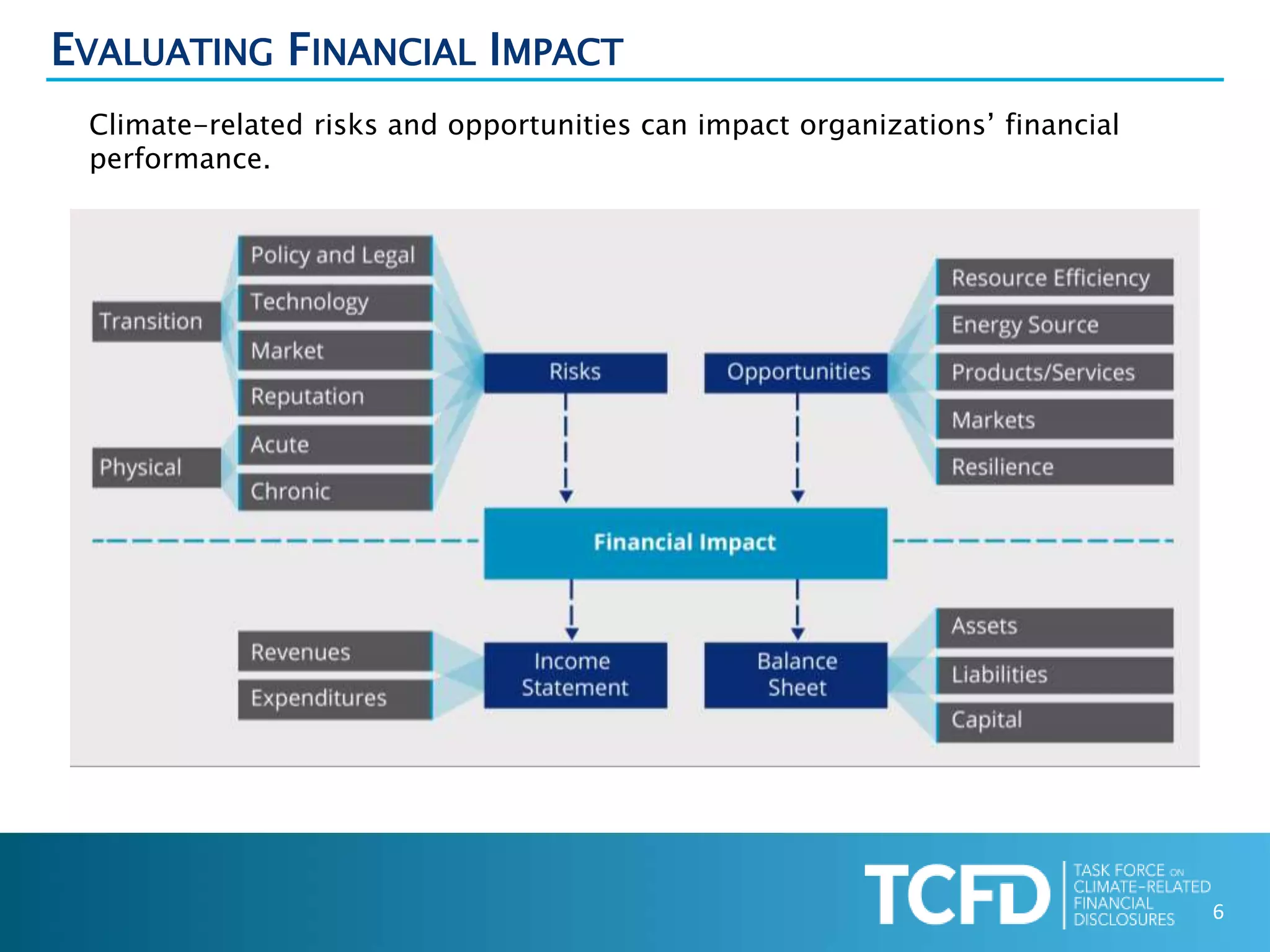

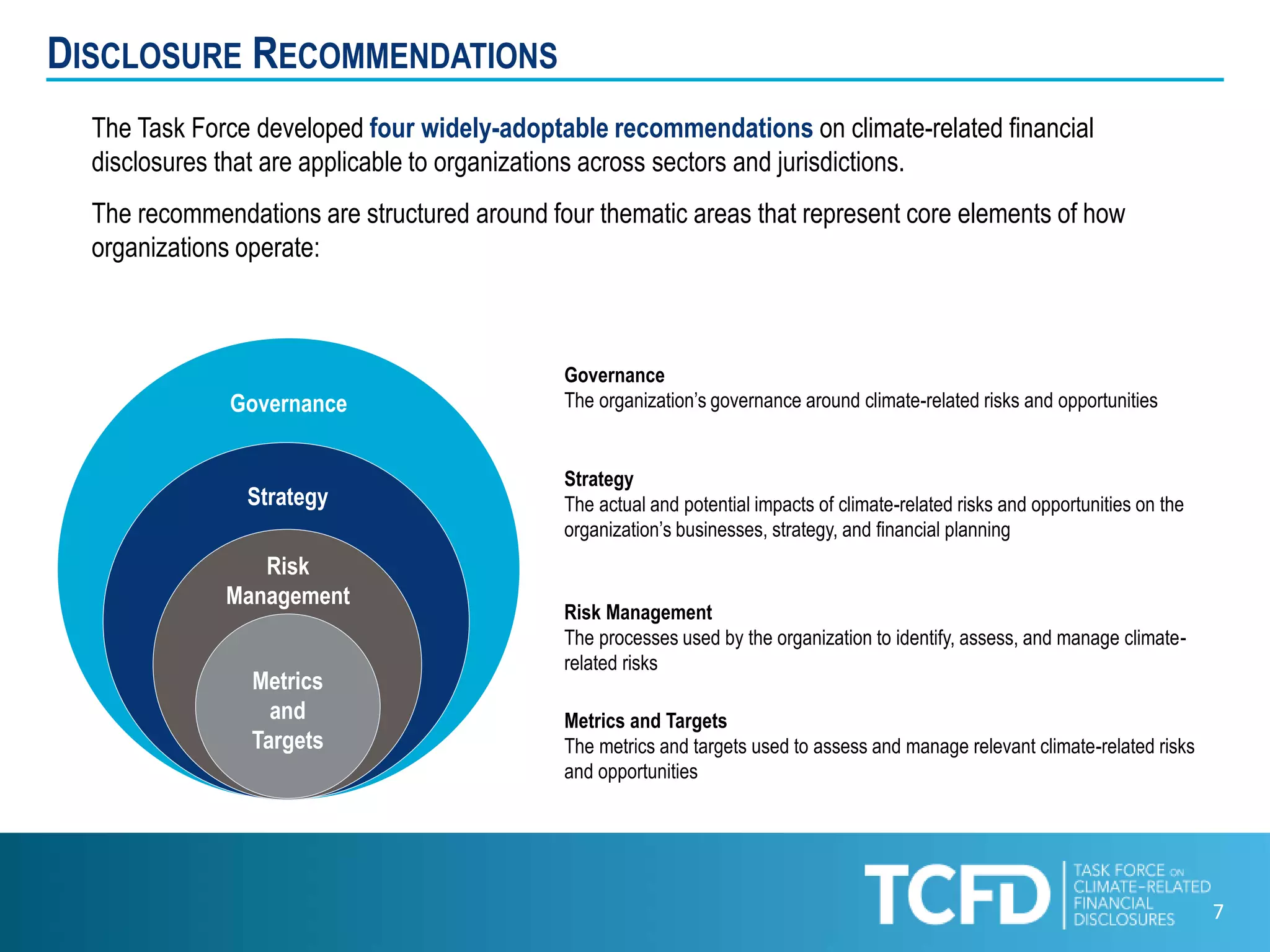

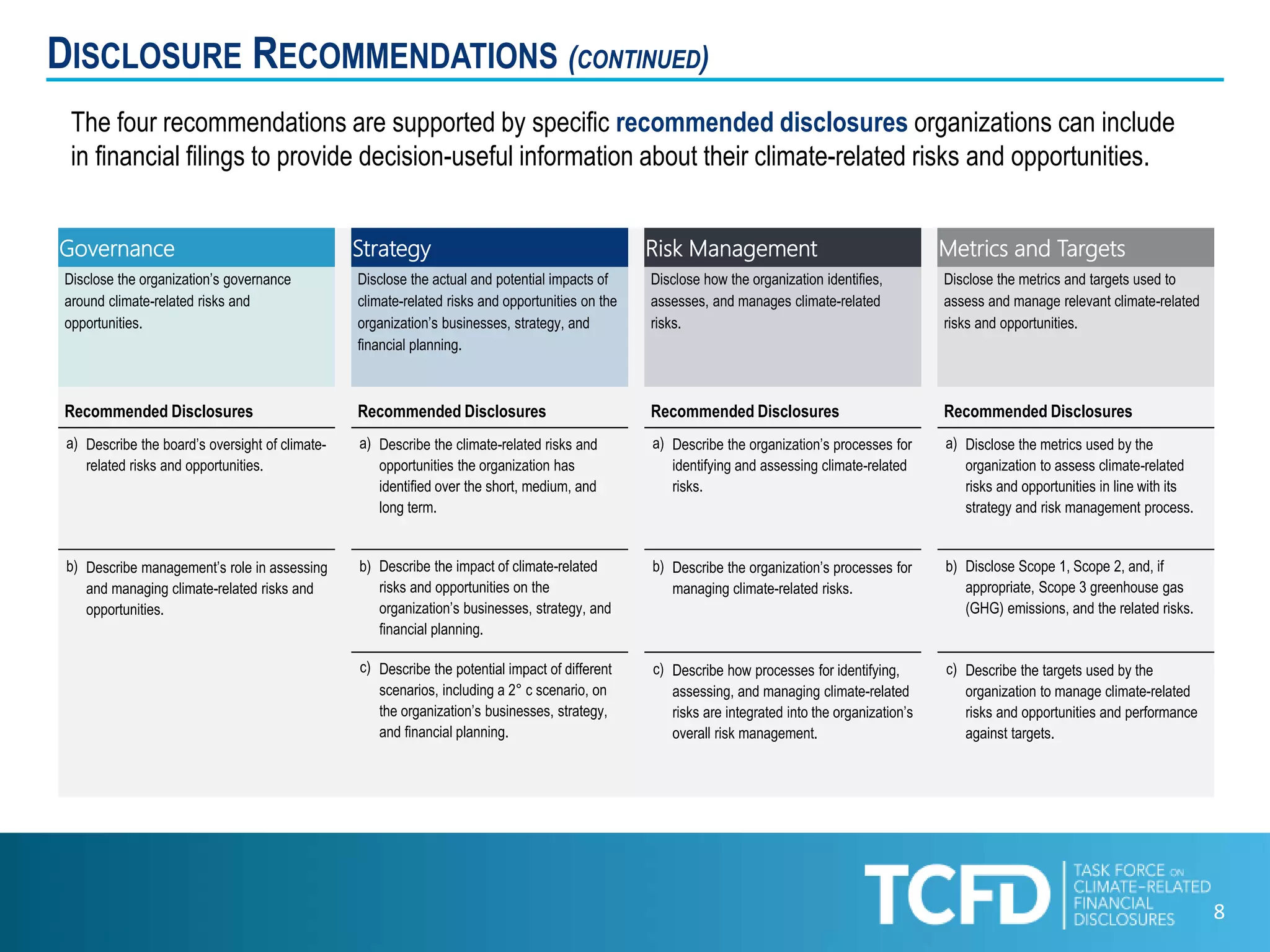

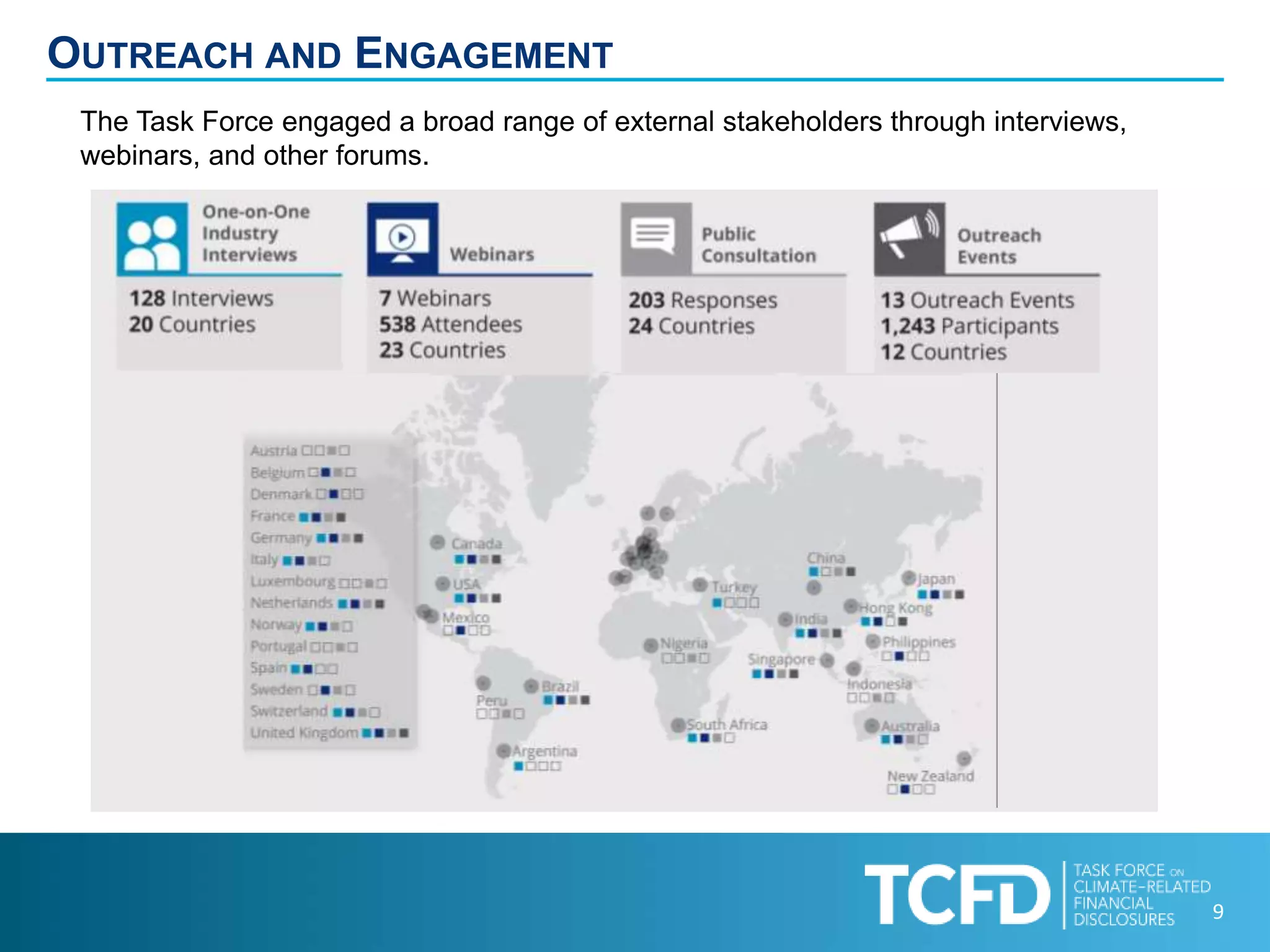

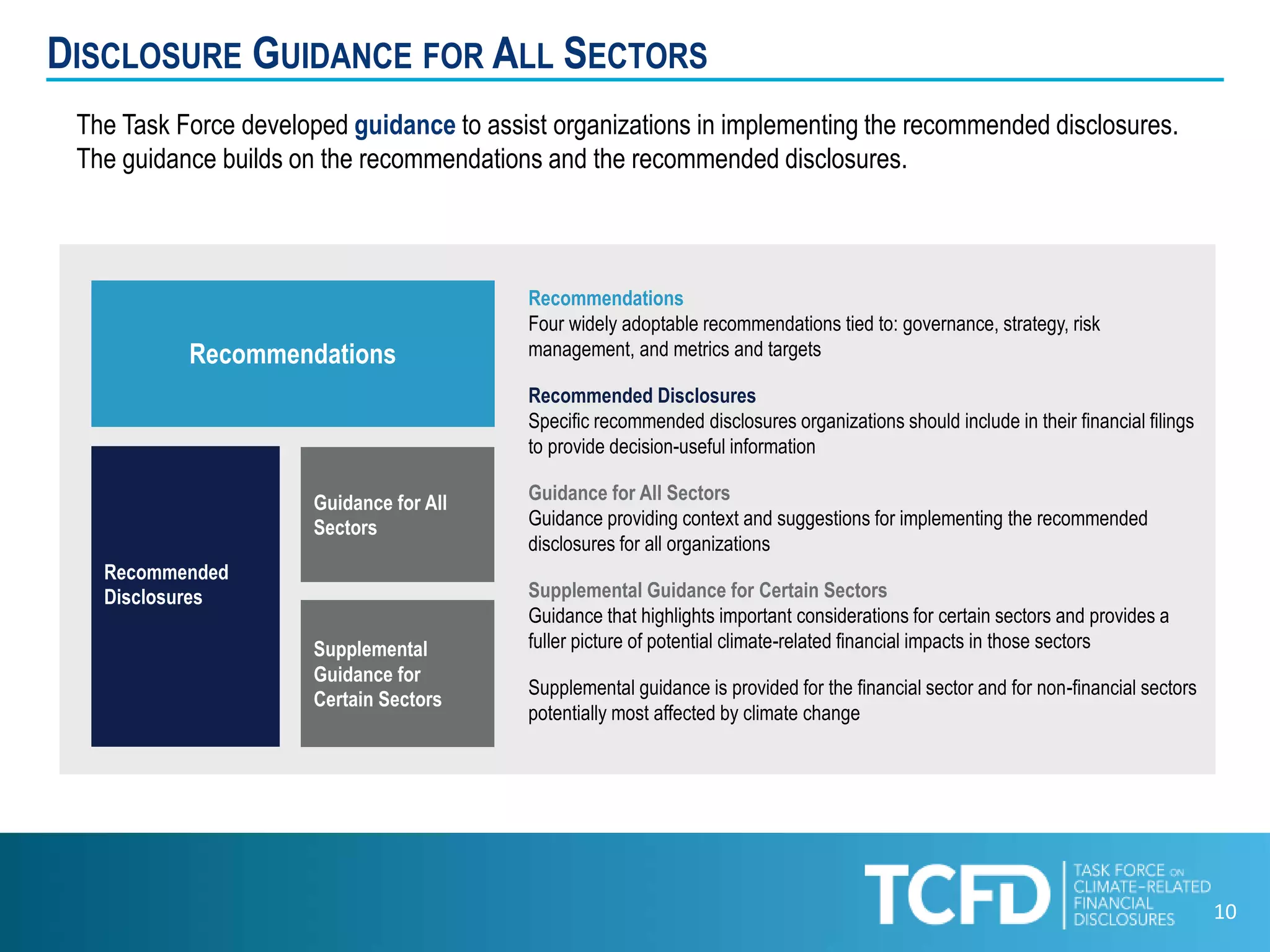

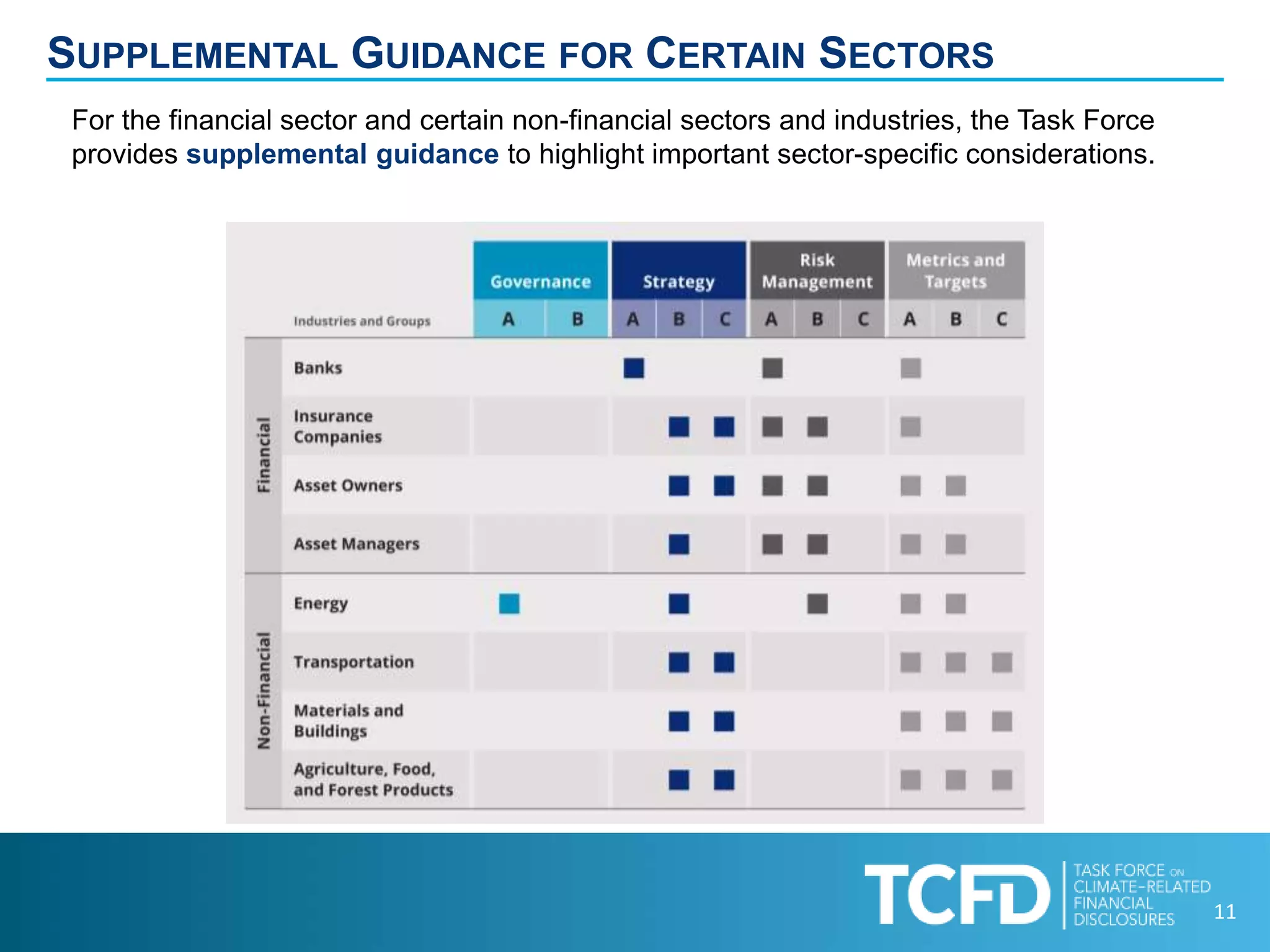

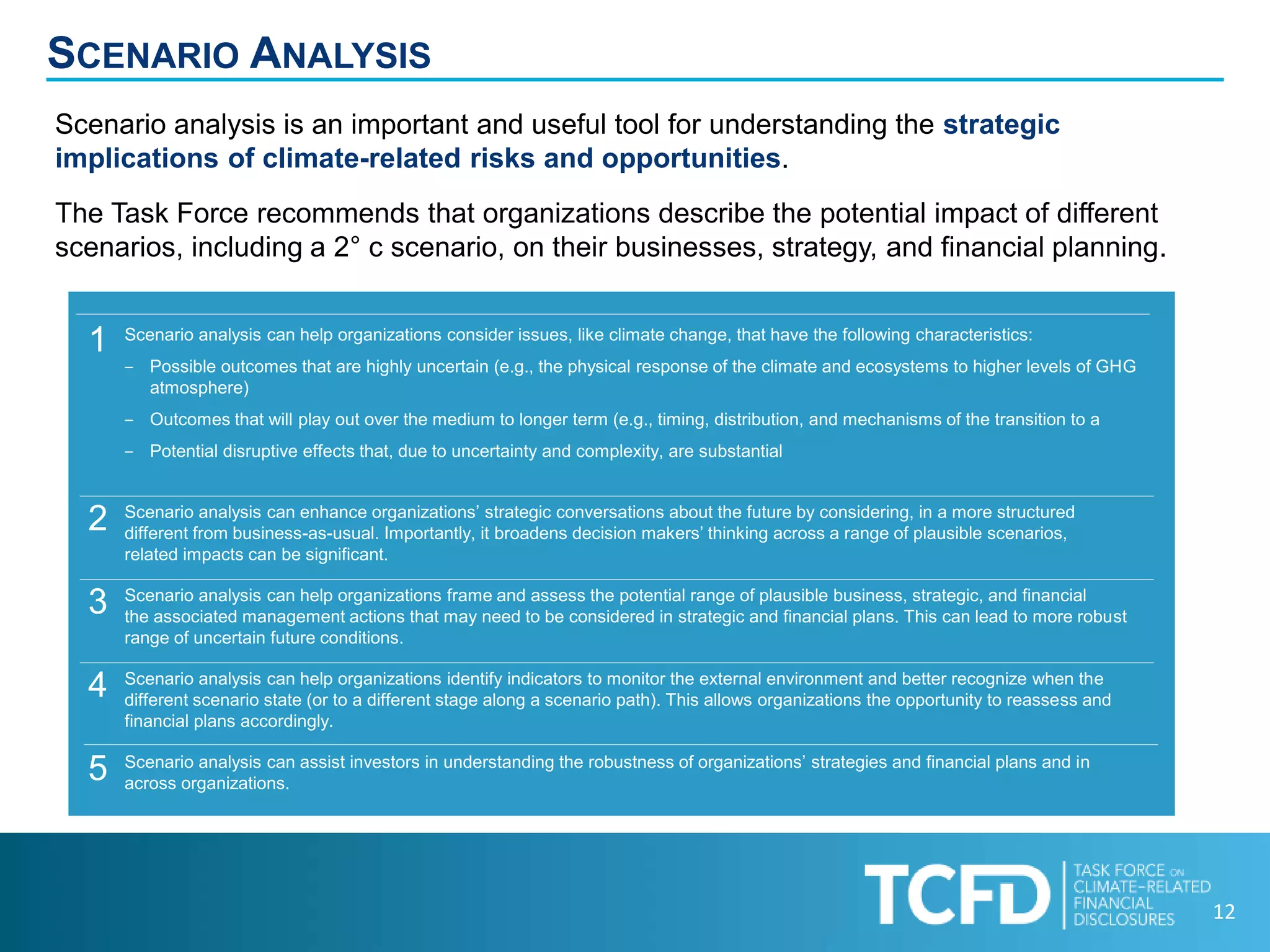

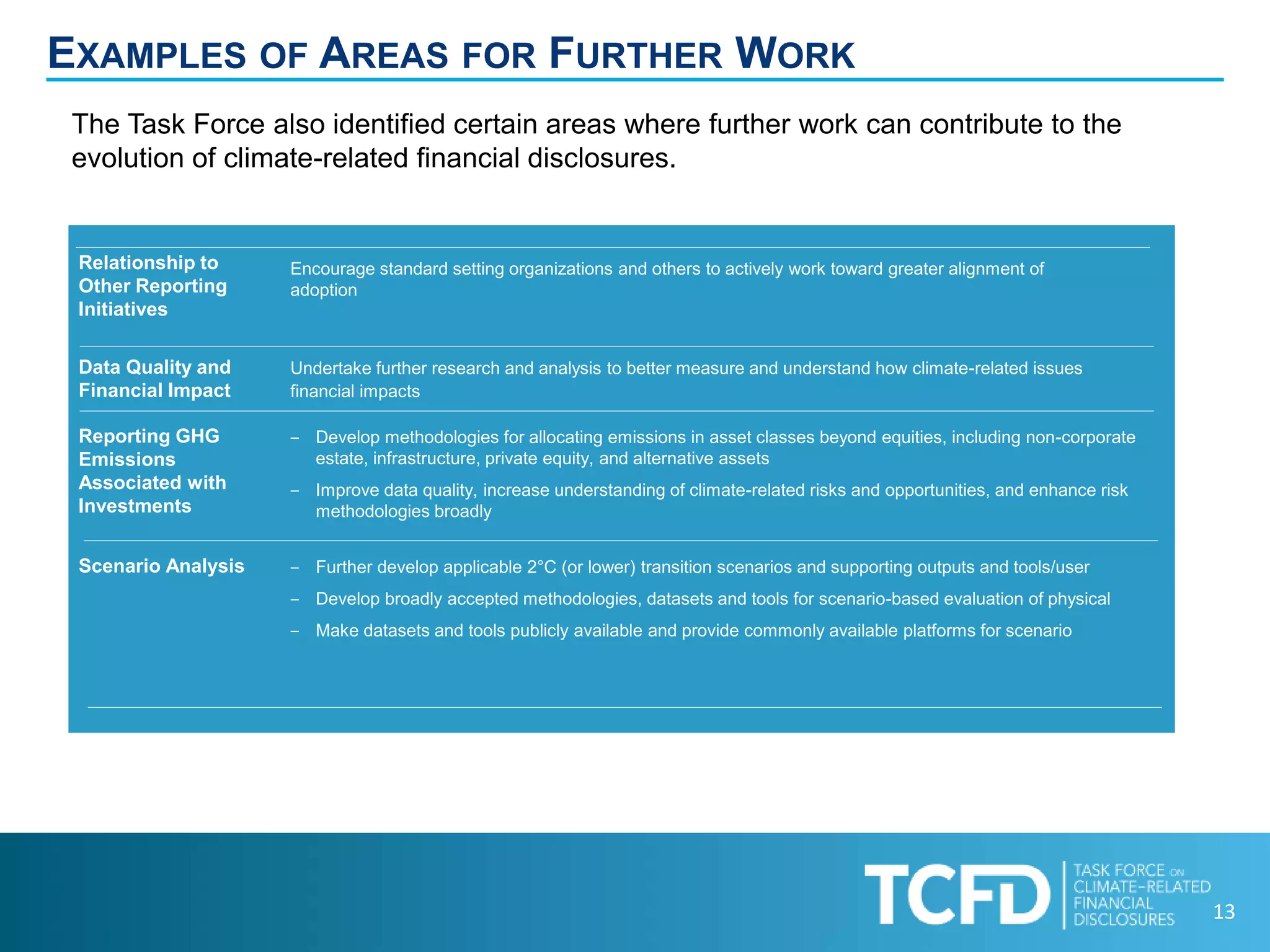

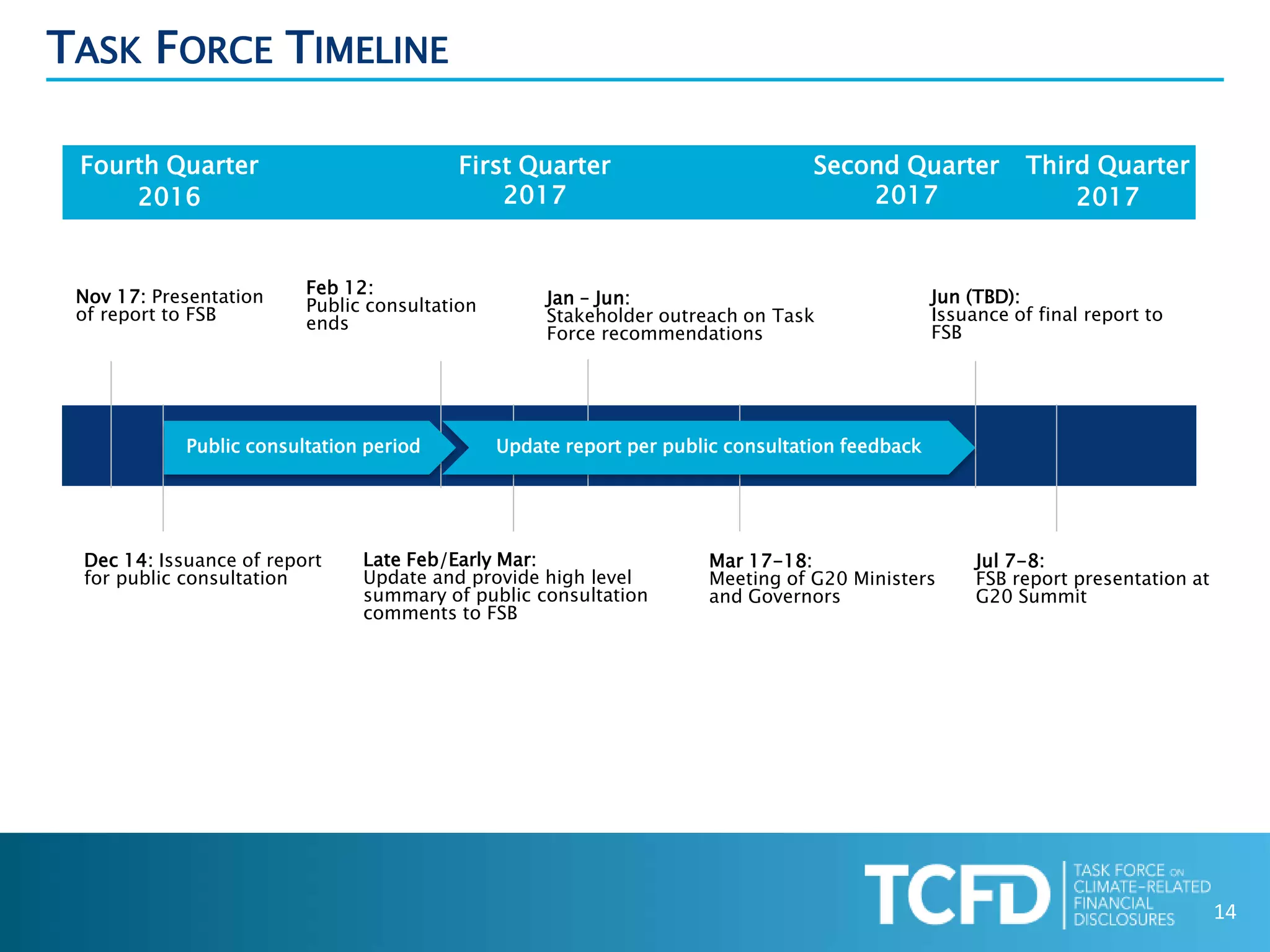

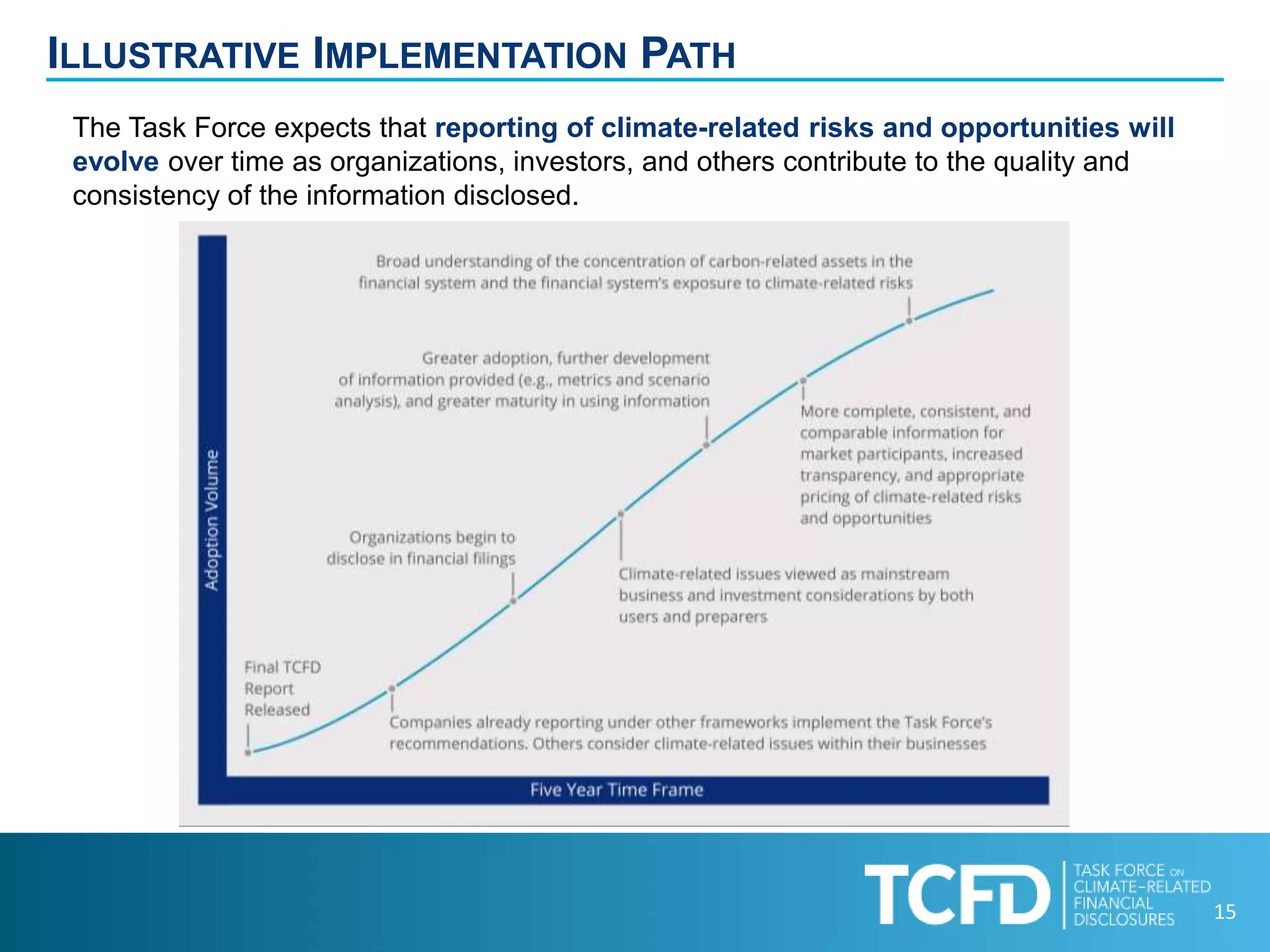

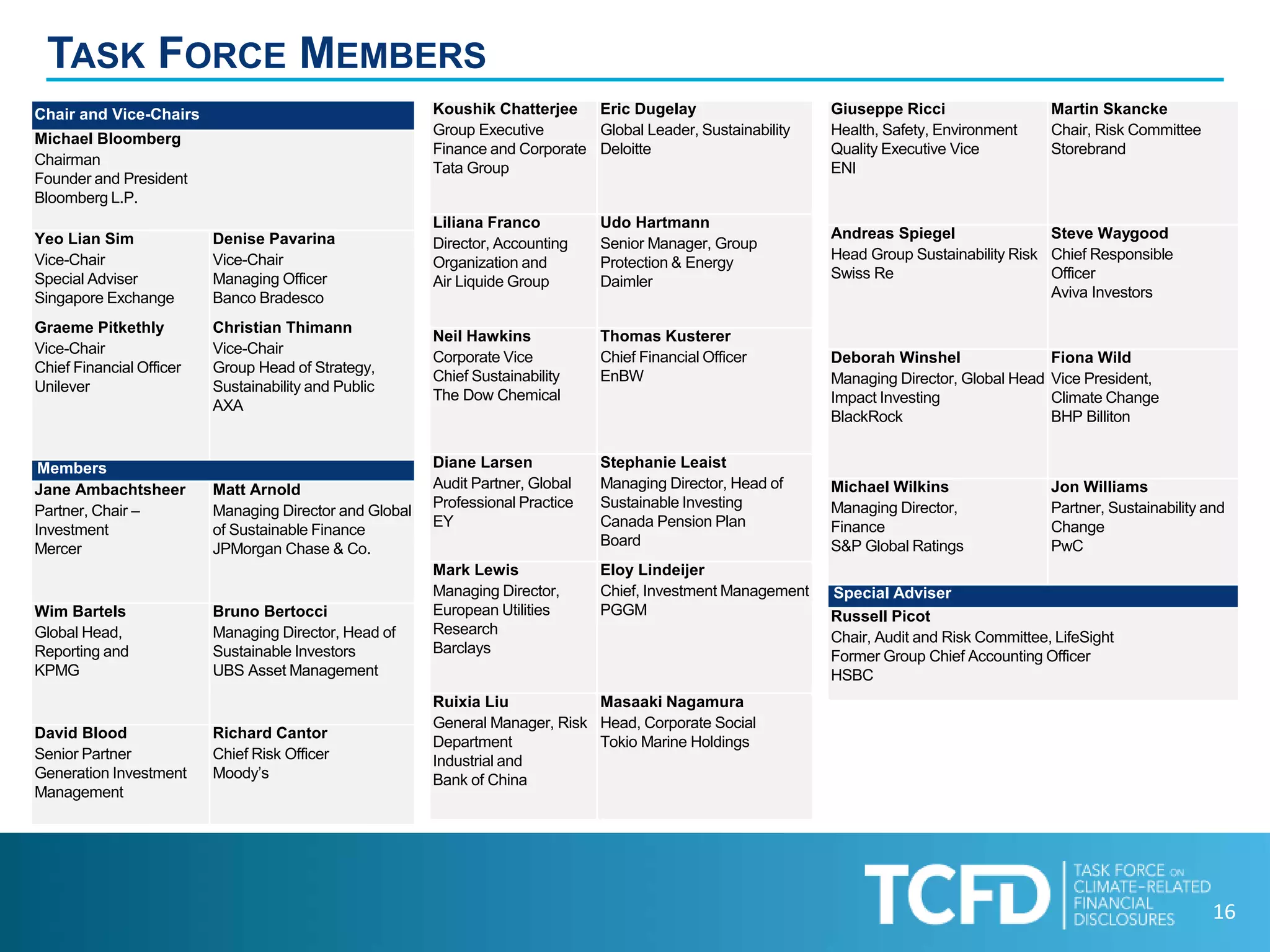

This document provides an overview and implementation guidance for the Task Force on Climate-related Financial Disclosures (TCFD). The TCFD was established to develop climate-related financial risk disclosure recommendations for companies, banks, and investors. The TCFD recommendations include four core elements: governance, strategy, risk management, and metrics/targets. They are designed to provide consistent and decision-useful climate-related financial risk information. The guidance also outlines scenario analysis approaches and supplemental sector-specific guidance. Overall, the TCFD aims to improve understanding of climate-related financial risks and opportunities to facilitate well-informed investments and insurance underwriting decisions.