The document outlines the principles and procedures of taxation, detailing the authority to levy, assess, and collect taxes in the Philippines. It covers the purpose of taxation, types of taxes, the rights and responsibilities of taxpayers, and the limitations placed by law on taxation powers. Additionally, it specifies the roles of the Bureau of Internal Revenue and various tax-related entities in tax administration and compliance.

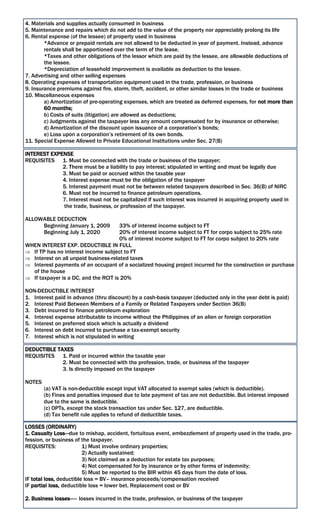

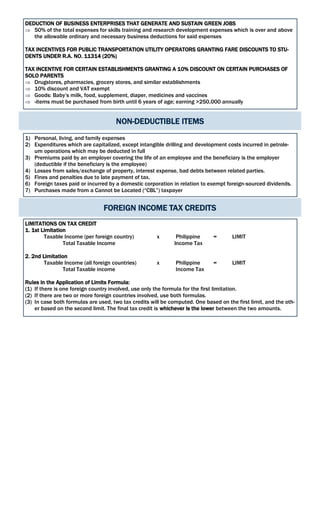

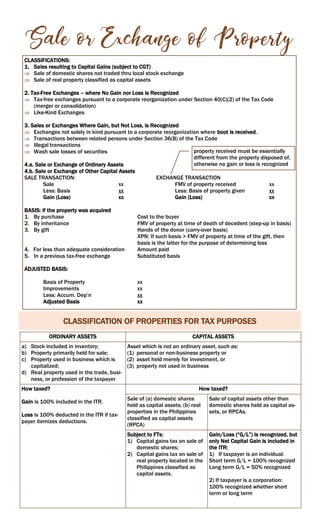

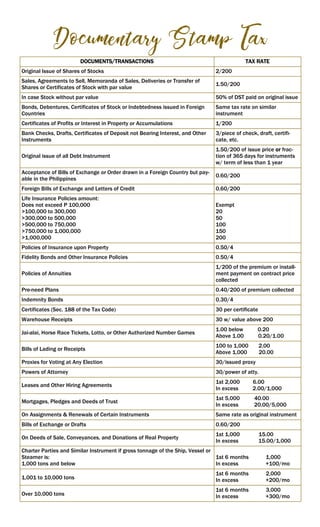

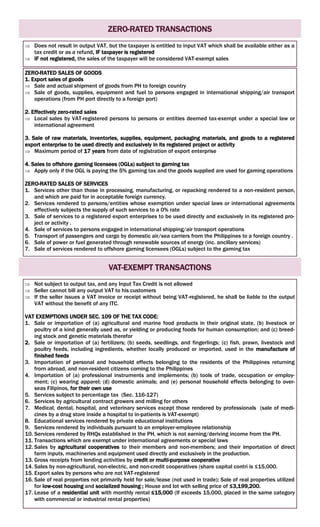

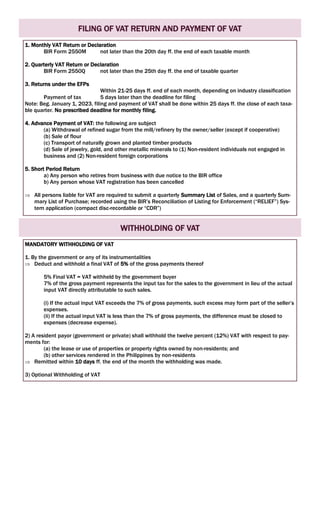

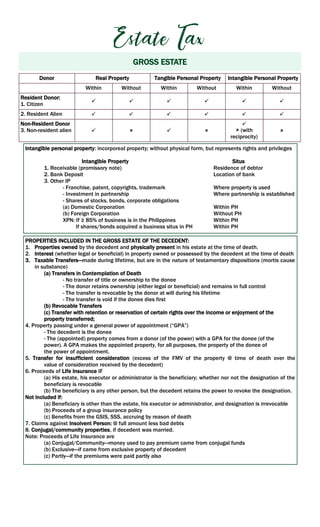

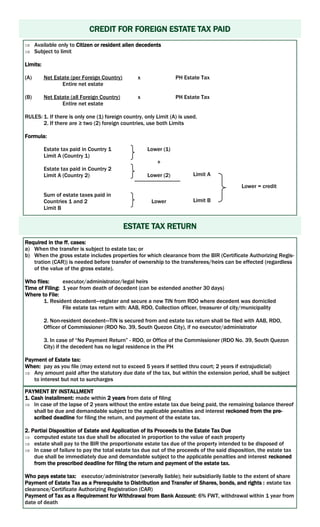

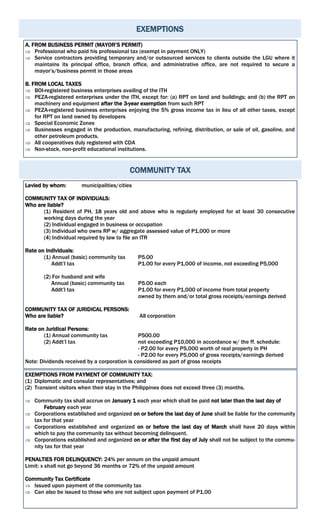

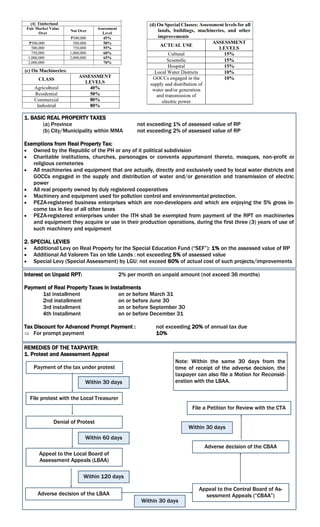

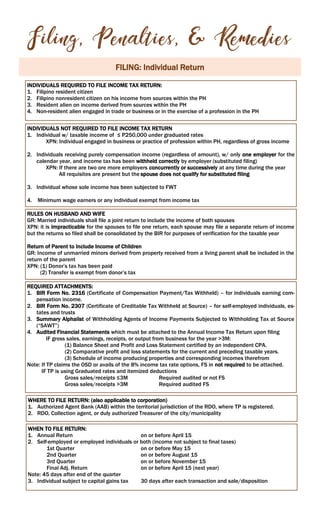

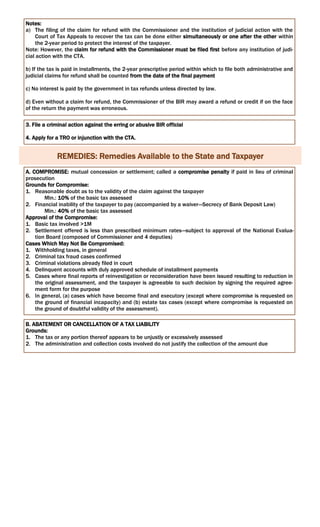

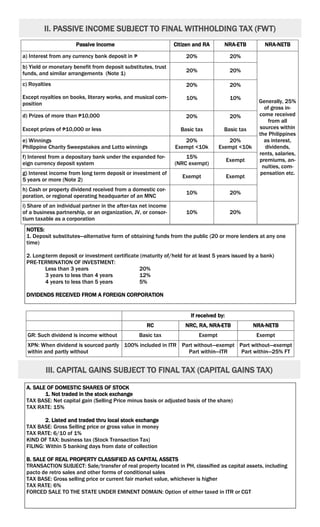

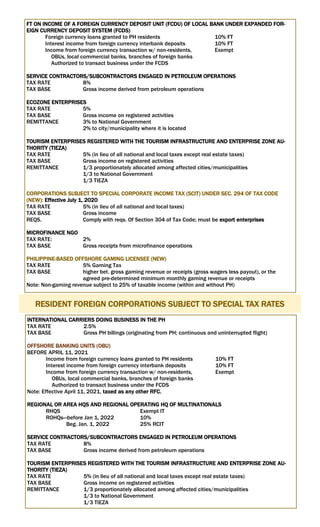

![REMEDIES AGAINST ASSESSMENT

1. Where Tax Has Not Been Paid

Receipt of FLD/FAN

Protest by Filing with the CIR [Note (a)]

Within 30 days

Request for

Reconsideration

Request for

Reinvestigation

OR

Submission of all relevant

supporting documents

Protest is denied OR Not acted upon

Within 60 days

Within 180 days

Within 180 days

Request for Reconsideration

with the CIR (Administrative

Appeal) [Note (b)]

Within 30 days

Appeal to the CTA

[Note (b)]

Within 30 days

Await the decision; Protest is

eventually denied by the CIR

Appeal to the CTA

Within 30 days

Within 30 days

Notes:

(a) Contents of the Protest (must all be present, otherwise void)

- Nature of the protest, whether it is a request for reconsideration or reinvestigation

- Newly discovered or additional evidence the taxpayer intends to present if it is a request for

reinvestigation

- Date of the assessment notice or letter of demand

- The applicable law, rules and regulations, or jurisprudence on which the protest is based

(b) The Motion for Reconsideration (administrative appeal) shall not toll the 30-day period to appeal to the

CTA.

2. Where Tax Has Been Paid

Remedy: Claim for refund

Date of payment of tax

File claim for refund with the

Commissioner

Denial of Claim

Appeal to the CTA

Within 2 years

Within 30 days

Within 2 years](https://image.slidesharecdn.com/taxationcompiled-240925054744-fd428858/85/TAXATIONACCOUNTINGSUBJECTMAJOR_COMPILED-pdf-9-320.jpg)

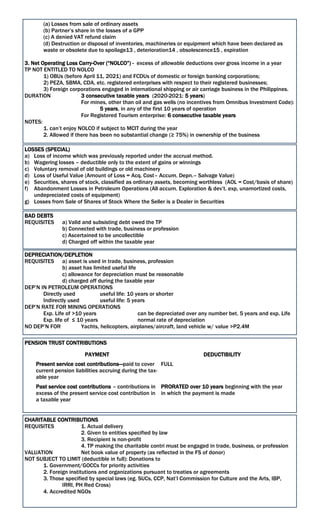

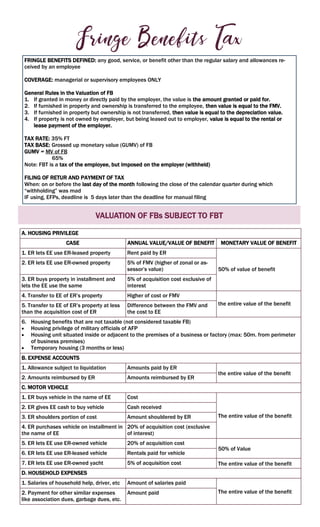

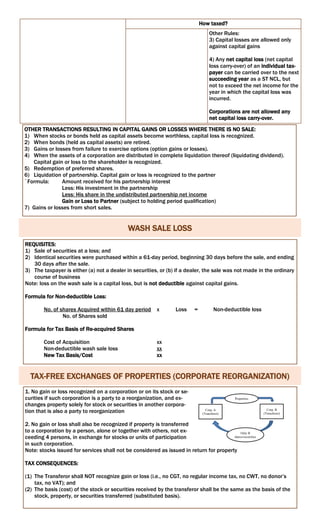

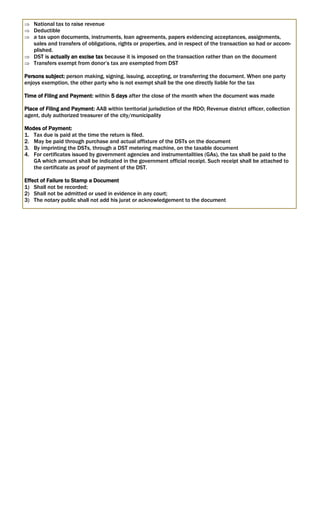

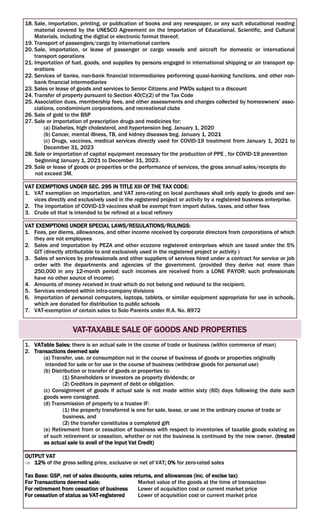

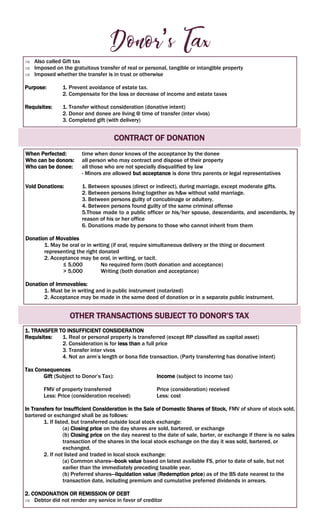

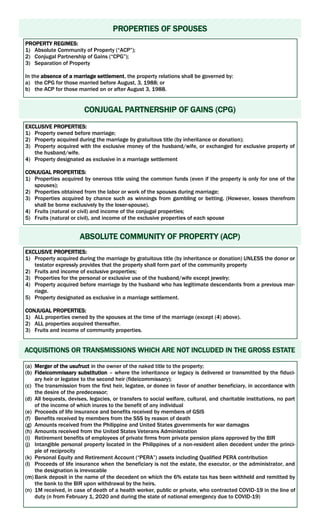

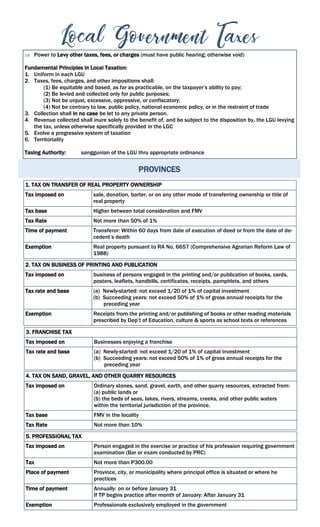

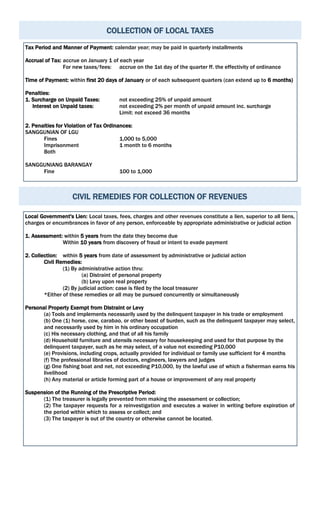

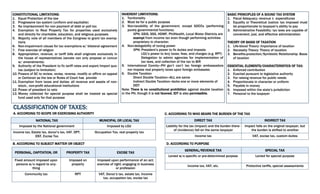

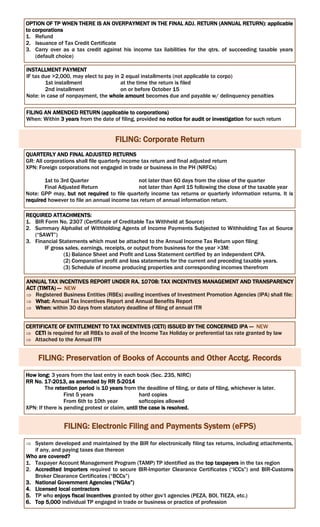

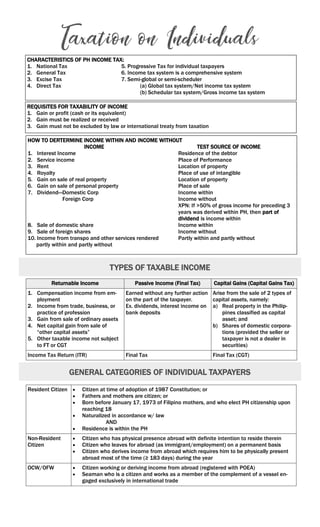

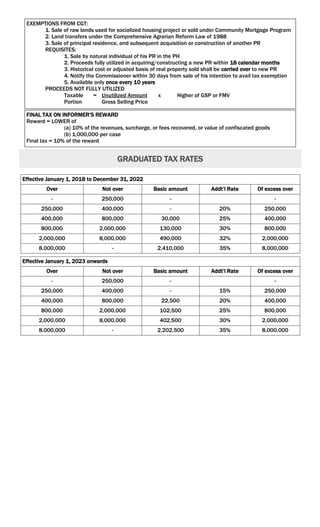

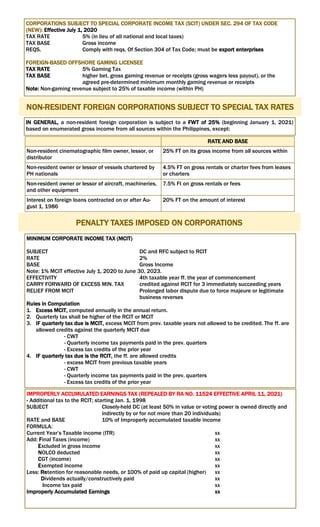

![SUMMARY OF ALLOWABLE DEDUCTIONS (AFTER TRAIN)

OPTIONAL STANDARD DEDUCTION (OSD)

In lieu of both ordinary and special ID

Who may claim?

1. Individuals a. Citizen

b. Resident aliens

c. Estates and Trusts

Amount of OSD = 40% of [Gross Sales, net of returns, allowances, and discount (accrual

basis) + other taxable income from operations not subject to FTs]

OR

40% of [Gross Receipts, net of returns, allowances, and discounts (cash

basis) + Other taxable income from operations not subject to FTs)

Note: For individuals, OSD is in lieu of COGS/COS + Itemized deductions

2. Corporations a. DC

b. RFC

Amount of OSD = 40% of [Gross income (Sales/Receipts net of returns, allowances and

discounts LESS COGS/COS) + Other taxable income not subject to FTs]

Note: For corporations, OSD is in lieu of the ID only.

DEDUCTIONS INDIVIDUALS ESTATES TRUSTS CORP PS

Self-employed taxed

under graduated

rates

1. Itemized Deductions or

OSD

2. Income distributed to

heirs/beneficiaries

Who compute their income tax un-

der the graduated rates

*NRAETBs cannot claim the OSD

Subject to 25%/20% of net taxable

income

Who may claim?

1. DC, including partnerships and GOCCs

2. RFC

3. Individuals engaged in trade, business, profession

4. Estates and trusts

Items of IDs: Business expenses Depletion of oil and gas wells

Interest expense Charitable and other contributions

Deductible taxes Research and development expenses

Losses Pension trust contributions

Bad debts

Depreciation

ITEMIZED DEDUCTIONS (IDs)

ORDINARY ITEMIZED DEDUCTIONS

BUSINESS EXPENSES

REQUISITES: 1. Ordinary and necessary for the business

2. Incurred or paid during the taxable year

3. Connected with the trade, profession, or business of the taxpayer

4. Reasonable expenses of the business

5. Substantiated by official receipts/record

6. The withholding tax required to be withheld has been withheld and remitted to the BIR

1. Compensation expenses (of employer) for personal services actually rendered.

*Additional deduction of 1/2 of the value of labor training expenses incurred for skills development of

enterprise-based trainees enrolled in public senior high schools, public higher education institutions,

or public technical and vocational institutions and duly covered by an apprenticeship agreement

under the Labor Code. IT shall not exceed 10% of the direct labor wage.

2. Travelling expenses (must be incurred while away from home “tax home”

3. Entertainment, Amusement, and Recreational Expense (EAR)

CEILING: 1/2 of 1% of net sales For TP engaged in the sale of goods and properties

1% of net revenues For TP engaged in the sale of services/leasing of properties](https://image.slidesharecdn.com/taxationcompiled-240925054744-fd428858/85/TAXATIONACCOUNTINGSUBJECTMAJOR_COMPILED-pdf-21-320.jpg)