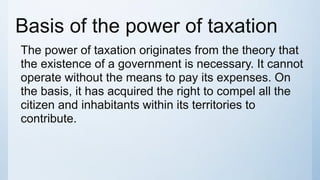

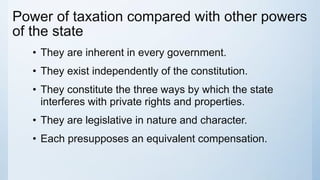

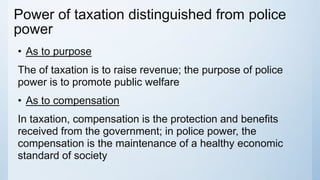

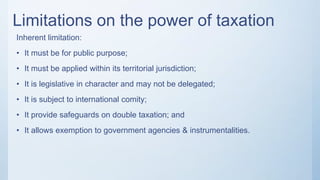

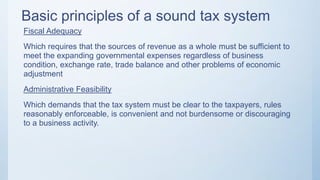

The document discusses the basic concepts and principles of taxation. It states that taxation is an inherent power of sovereign states to raise revenue to fund necessary government expenses. Taxation imposes a levy on persons, property, and property rights. It is an inherent power of the state derived from its sovereignty within its territorial jurisdiction. The document outlines other inherent state powers like police power, eminent domain, and taxation. It distinguishes taxation from eminent domain and police powers. Constitutional and inherent limitations on taxation powers are also discussed. Finally, the document outlines basic principles of a sound tax system including fiscal adequacy, administrative feasibility, consistency with economic goals, and equality and theoretical justice.

![Basic concept-principle-of-taxation[1]](https://image.slidesharecdn.com/basic-concept-principle-of-taxation1-180927025348/85/Basic-concept-principle-of-taxation-1-18-320.jpg)

![Basic concept-principle-of-taxation[1]](https://image.slidesharecdn.com/basic-concept-principle-of-taxation1-180927025348/85/Basic-concept-principle-of-taxation-1-19-320.jpg)