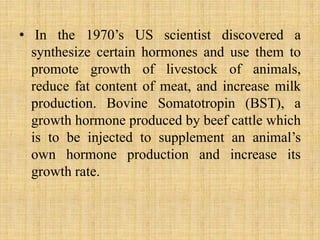

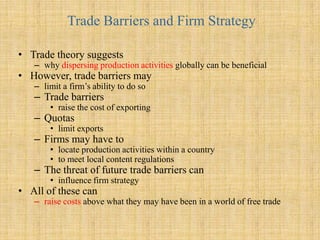

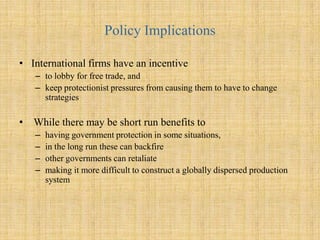

This document summarizes the political economy of international trade. It discusses how governments often intervene in trade to protect domestic groups, using instruments like tariffs, subsidies, import quotas, and voluntary export restraints. Tariffs raise the costs of imports but also domestic prices. Subsidies help domestic producers but are costly for consumers and taxpayers. The document analyzes examples of trade interventions and their effects, such as the EU ban on hormone-treated beef and US steel tariffs. It also discusses the emergence of institutions like the GATT and WTO that aim to liberalize trade.