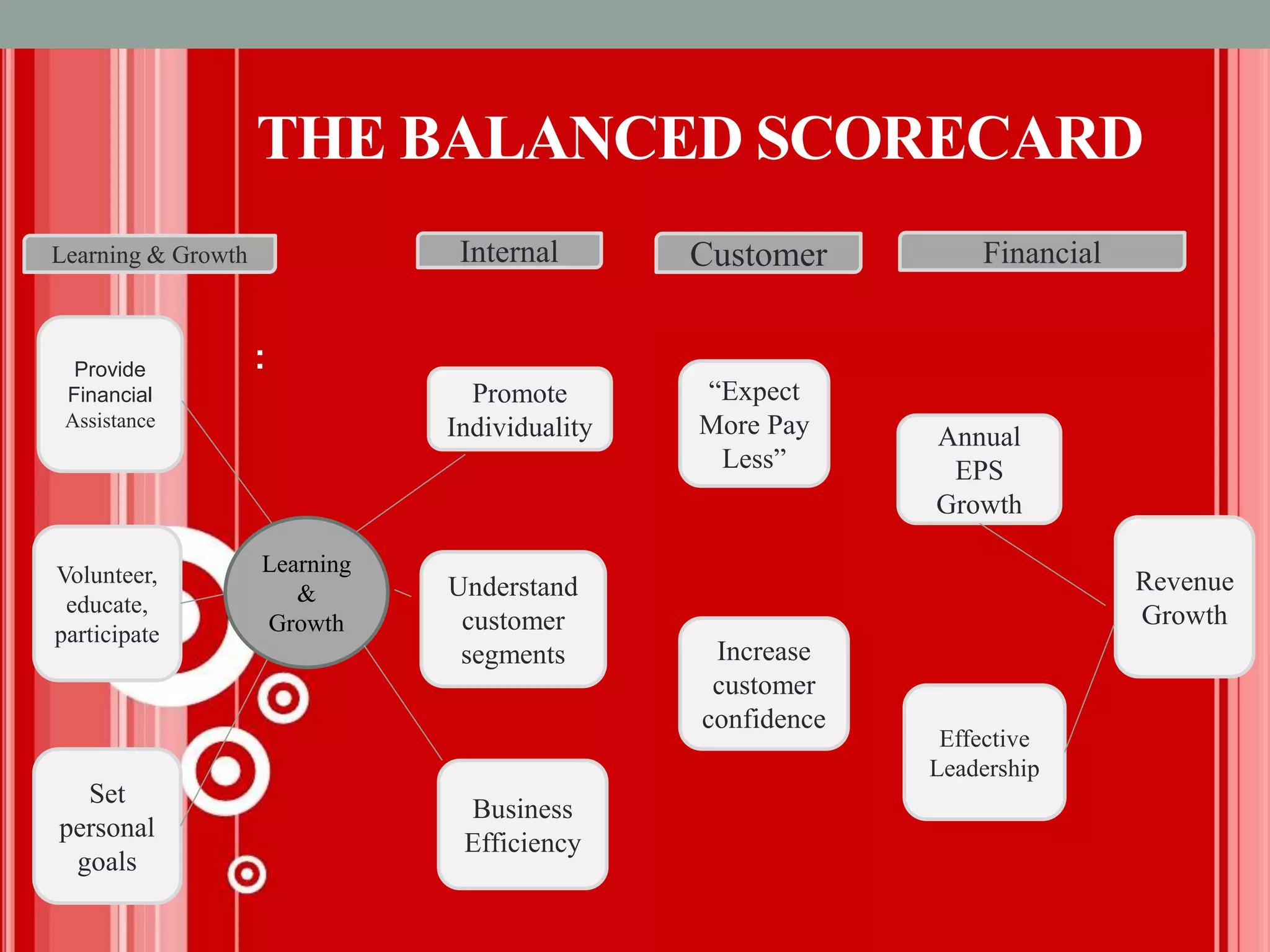

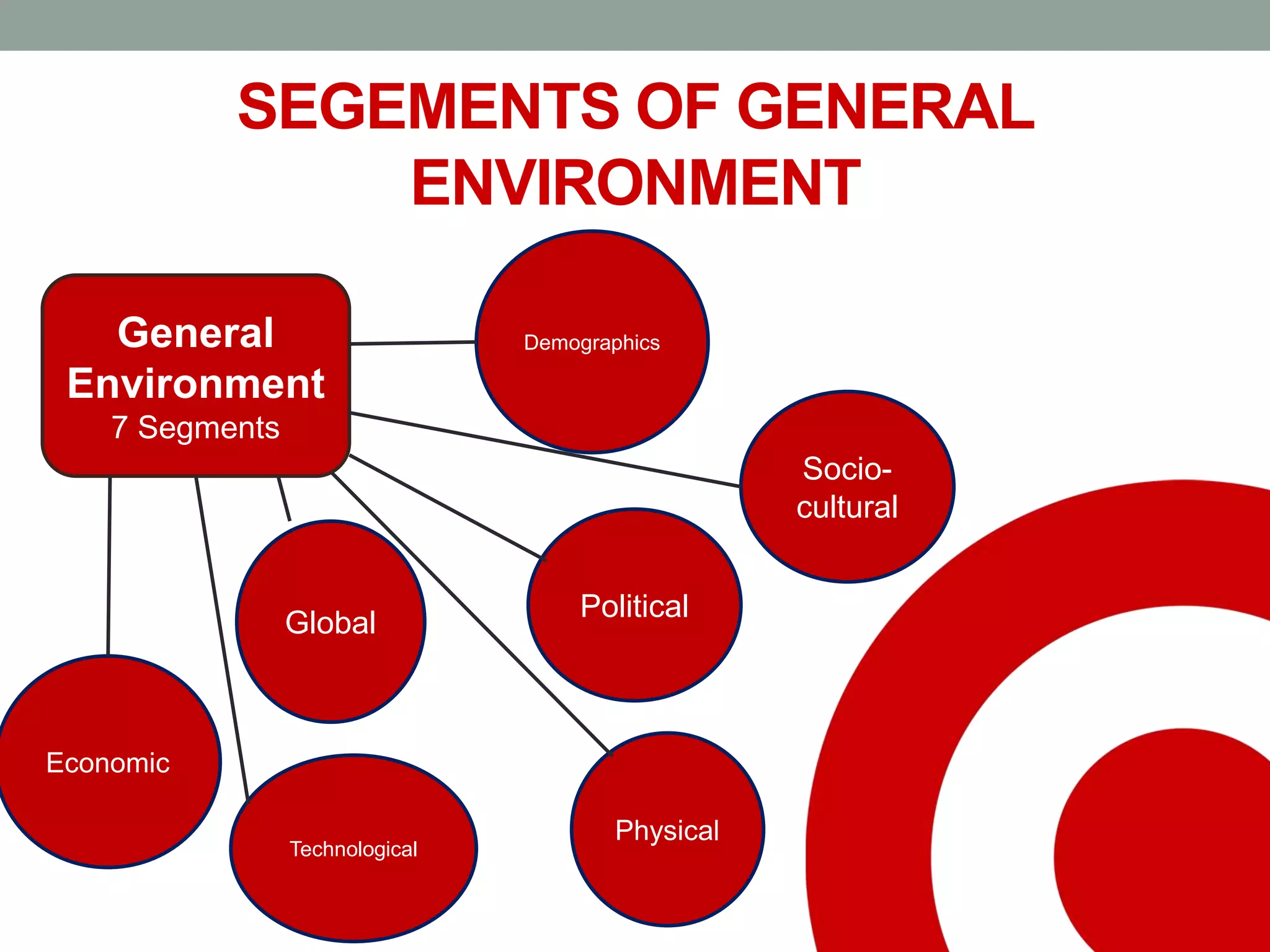

The document analyzes Target Corporation's performance using the balanced scorecard framework, highlighting its financial metrics, consumer perspectives, and overall business strategies. Key findings include a declining return on capital employed (ROCE), increasing economic value added (EVA), and free cash flows, coupled with a strong customer loyalty base and competitive advantages in marketing and branding. The analysis identifies threats and opportunities across various environmental segments and compares Target's performance against competitors like Walmart and Amazon, noting both strengths and areas needing improvement.

![Target’s Performance –

1. Compared with…

Disadvantage Ratios Why?

1 Inventory

Turnover

(Days Sales

Inventory)

TGT = 72,596,000 / 8,766,000 = 8.28

*days sales inventory = (1 / 8.28) x 365

= 44.08

AMZ = 74,452,000 / 7,411,000 = 10.05

*days sales inventory = (1 / 10.05) x 365

= 36.32

Days Sales Inventory = [1/ (sales/inventory)] x 365

Target’s days sales inventory of 44.08 means that they sell

their entire inventory in 44 days. However, Amazon sells

their entire inventory within 36 days, which is 8 days faster.

This means Amazon doesn’t have to store inventory as long,

giving them lower inventory storage costs and the ability to

put new merchandise out their sooner.

2 Fixed Asset

Turnover

TGT = 72,596,000 / 31,378,000 = 2.31

AMZ = 74,452,000 / 10,949,000 = 6.80

Fixed Asset Turnover = net sales/net property, plant,

equipment

Amazon has a significantly higher fixed asset turnover ratio,

indicating that they generate more sales from their fixed

asset investments.

3 Receivables

Turnover

TGT = 72,596,000 / 5,841,000 = 12.43

AMZ =74,452,000 / 4,767,000 =

15.62

Receivables Turnover = sales / accounts receivable

Target’s receivables turnover is slightly lower, meaning they

should investigate their method of collecting accounts

receivable.

They aren’t quite as efficient as Amazon.

4 Fixed Asset /

Sales

TGT = 31,378,000 / 72,596,000 =

43.2%

AMZ = 10,949,000 / 74,452,000 =

14.71%

This ratio shows the percentage of fixed asset dollars per

sales dollars.

Target’s percentage is about 30% higher than Amazon’s,

concluding that Amazon once again generates mores sales

dollars from their fixed assets.](https://image.slidesharecdn.com/completetargetcorppresentation-150313090806-conversion-gate01/75/Target-Corporation-Strategic-Analysis-29-2048.jpg)

![Target’s Performance –

2. Compared with…

Disadvantage Ratios Why?

1 ROCE TGT = 4,229,000 / (44,553,000 -

12,777,000) = 13.3%

WMT = 26,991,000 / (204,751,000 -

69,345,000) = 19.93%

ROCE = EBIT / (total assets - current liabilities)

Target’s ROCE is 6.5% lower than Walmart’s, indicating their

need to use their capital more efficiently.

2 Inventory

Turnover

(Days Sales

Inventory)

TGT = 72,596,000 / 8,766,000 = 8.28

*days sales inventory = (1 / 8.28) x 365 =

44.08

WMT = 476,294,000 / 44,858,000 = 10.62

*days sales inventory = (1 / 10.62) x 365 =

34.37

Inventory Turnover = [1/(sales/inventory)] x 365

Again, Target sells their entire inventory in 44 days, while

Walmart sells its entire inventory within 34 days.

Walmart has lower inventory storage costs as a result.

3 Fixed Asset

Turnover

TGT = 72,596,000 / 31,378,000 = 2.31

WMT = 476,294,000 / 117,907,000 = 4.04

Fixed Asset Turnover = net sales/net property, plant,

equipment

Target’s fixed asset turnover ratio is about half of Walmart’s.

This means that Target must work on better using their

assets to generate revenue.](https://image.slidesharecdn.com/completetargetcorppresentation-150313090806-conversion-gate01/75/Target-Corporation-Strategic-Analysis-31-2048.jpg)