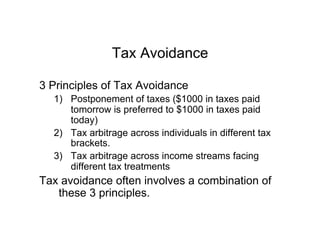

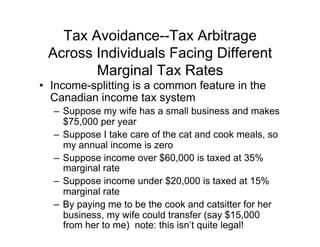

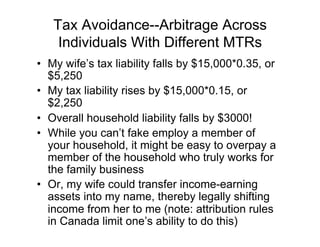

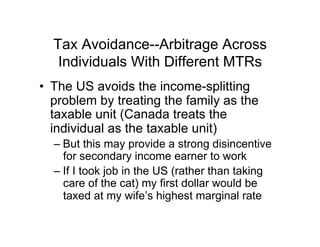

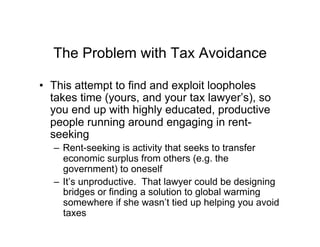

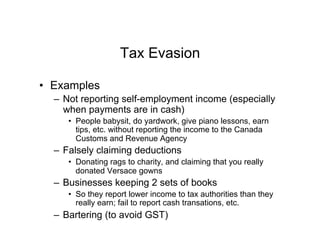

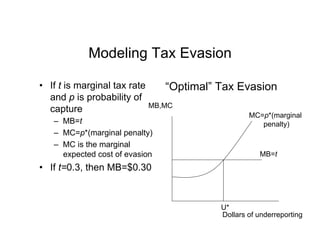

Tax avoidance is legal minimization of taxes through approved means like RRSP contributions or incorporating a business. Tax evasion is illegal non-reporting of income. People engage in both up to the point where marginal benefits equal marginal costs, taking advantage of techniques like postponing taxes, arbitraging across income streams and individuals. While avoidance diverts resources, evasion undermines the tax system and fairness. Higher taxes and penalties reduce evasion, while audits are also deterrent but costly.