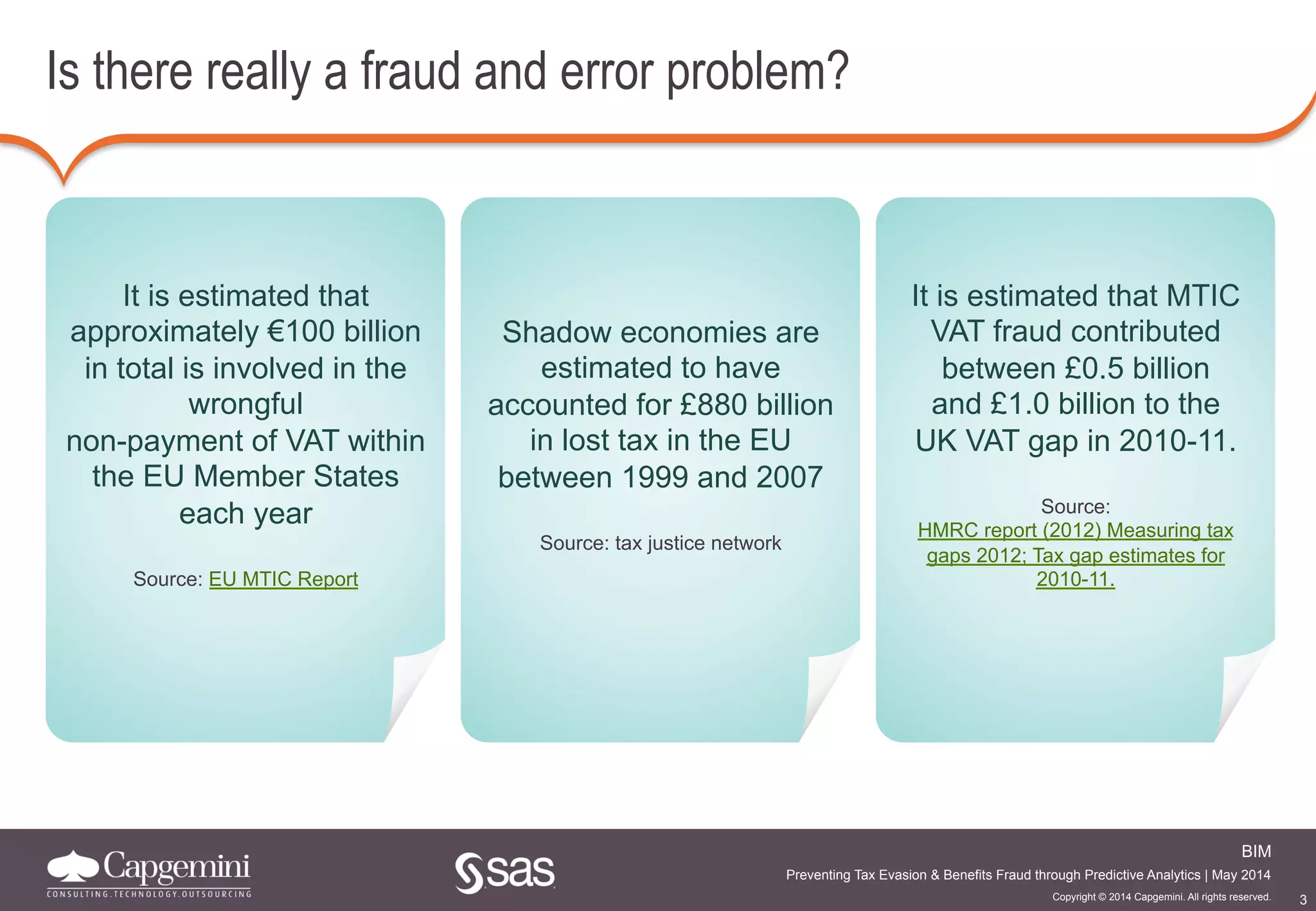

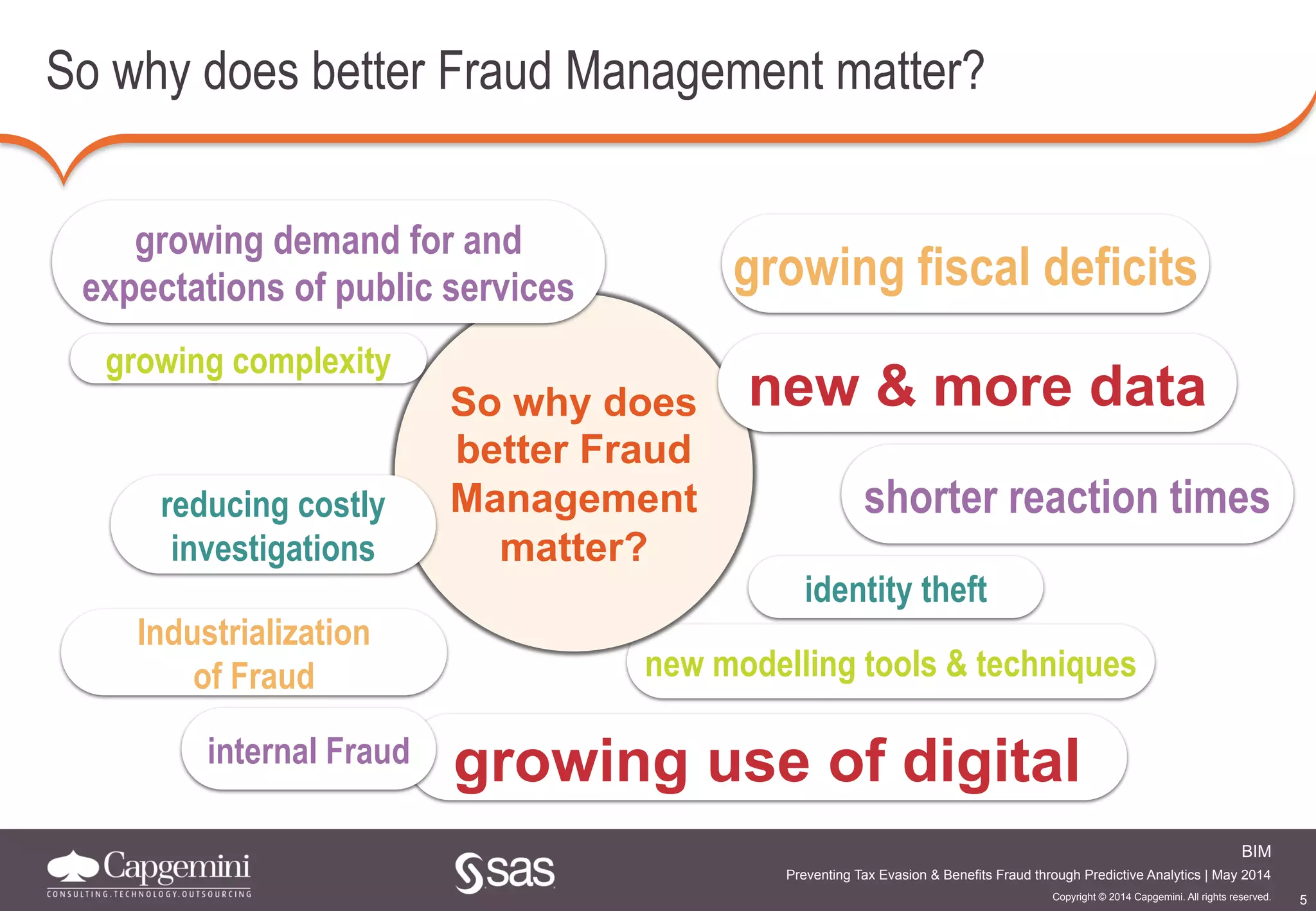

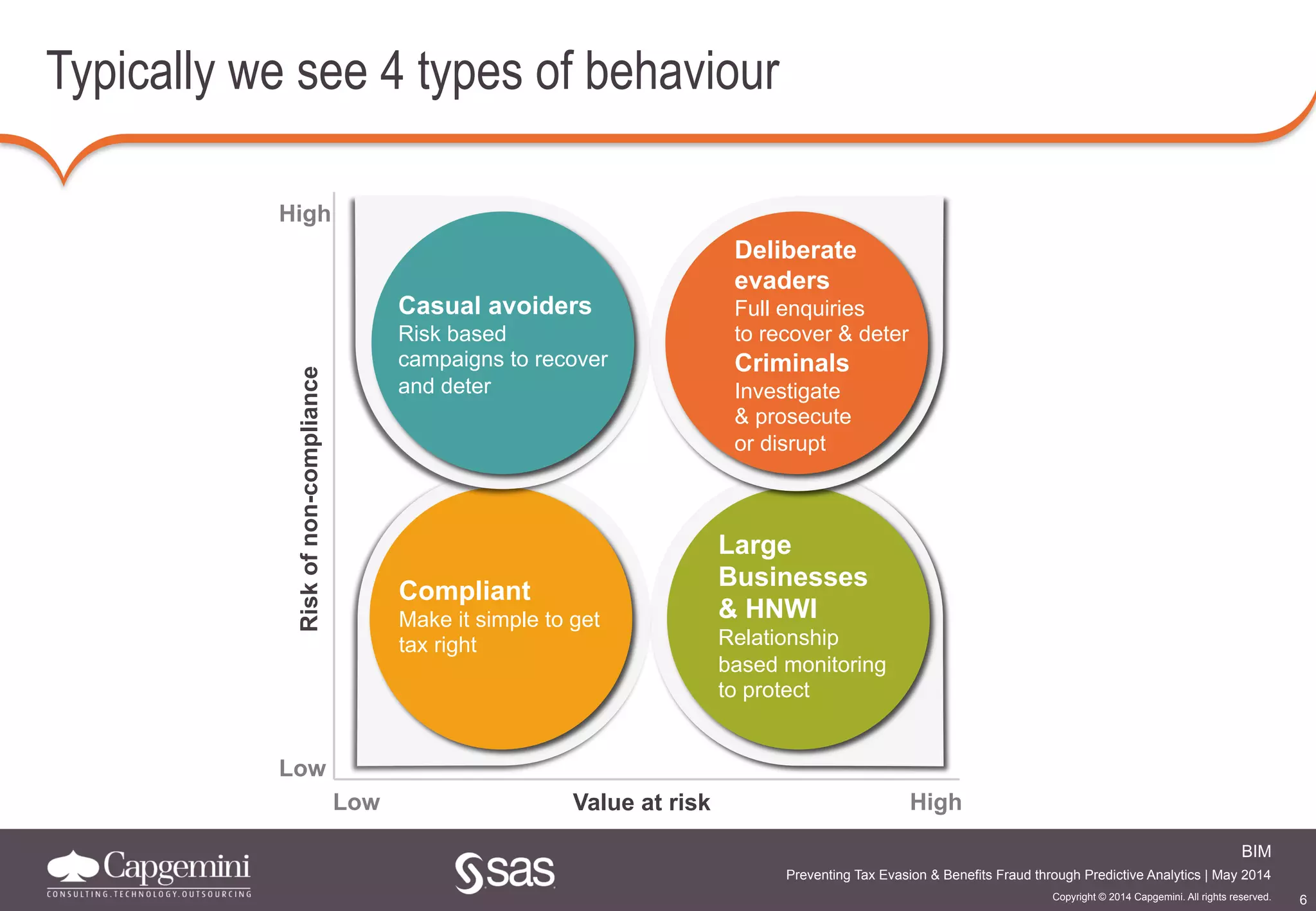

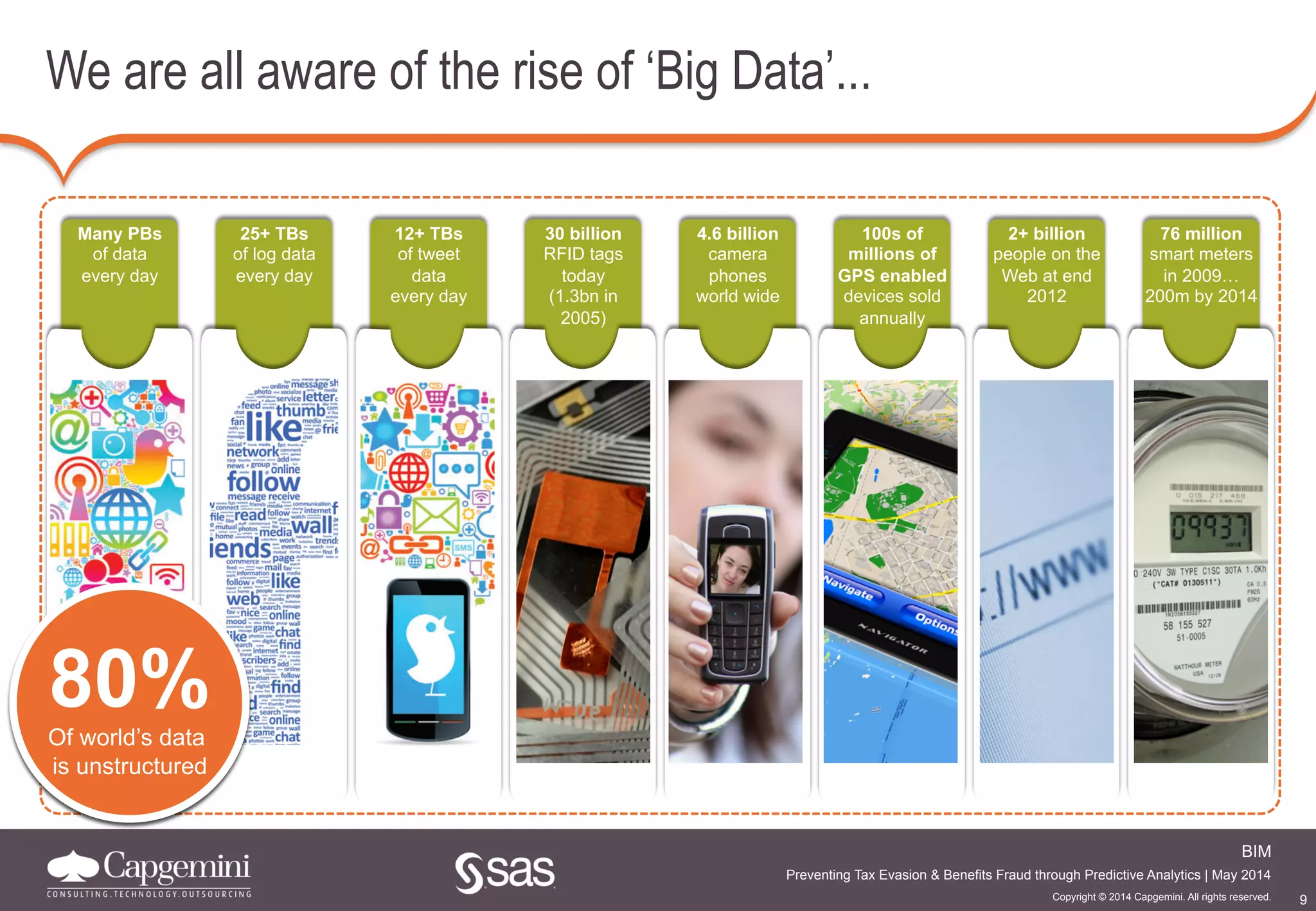

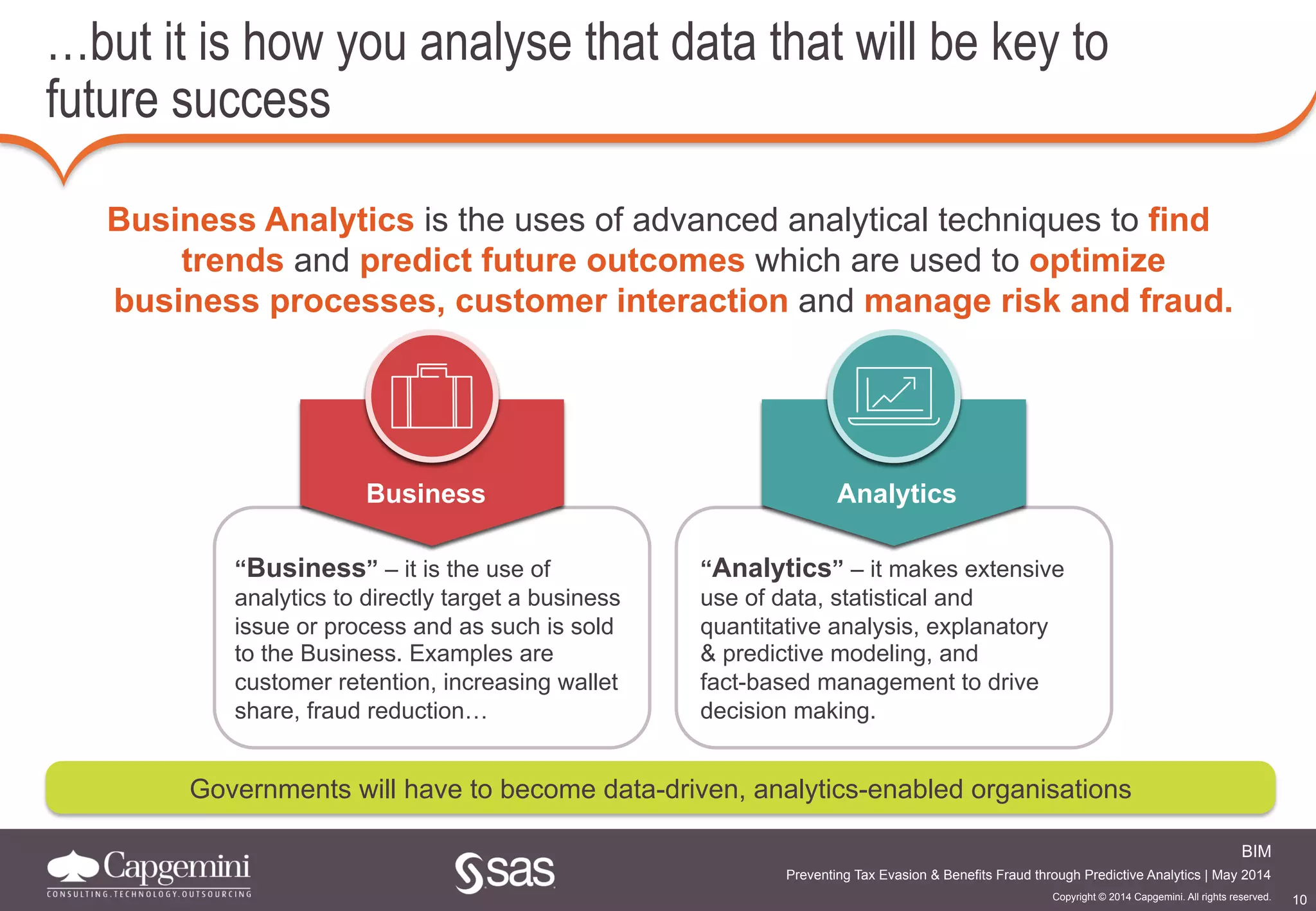

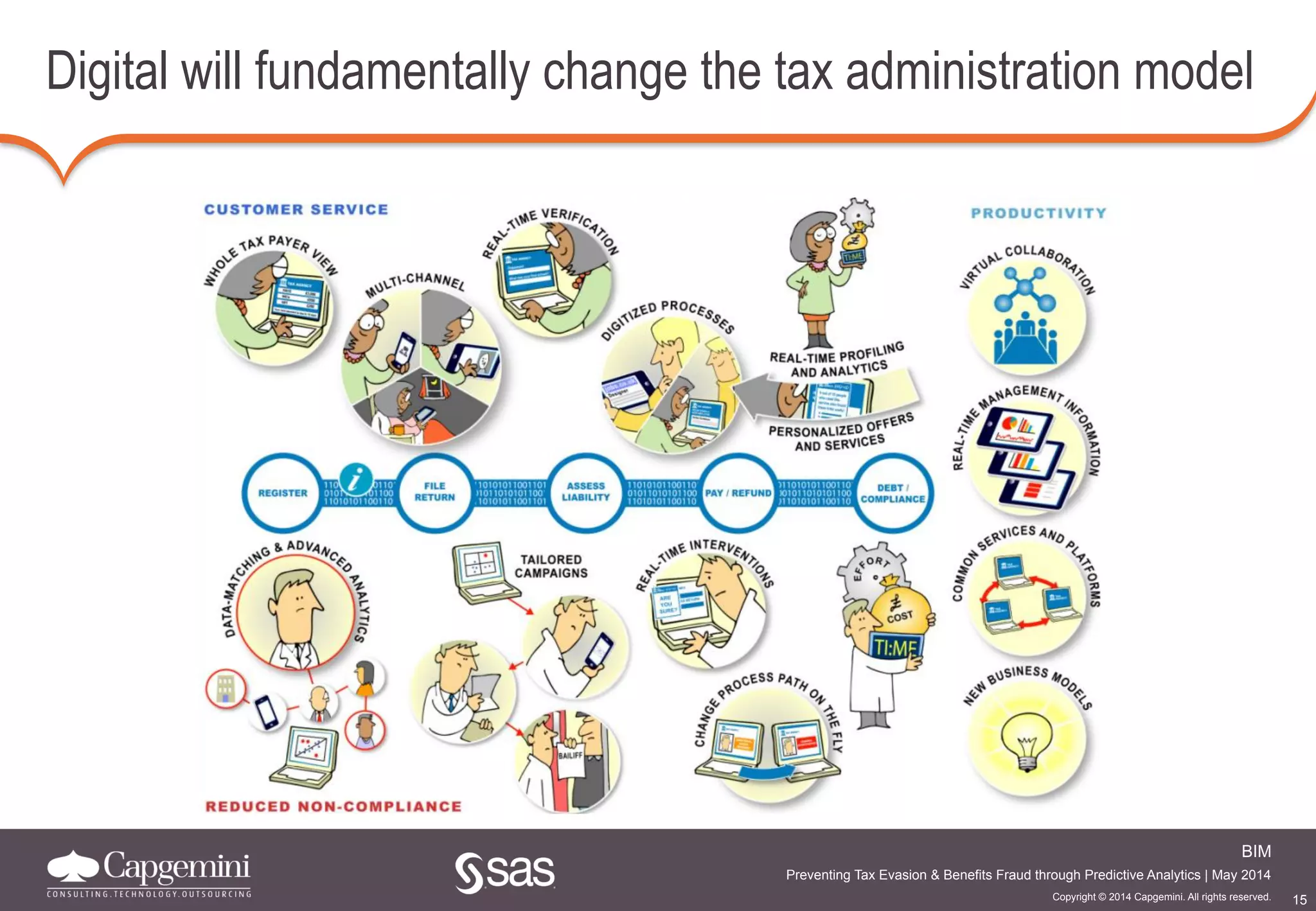

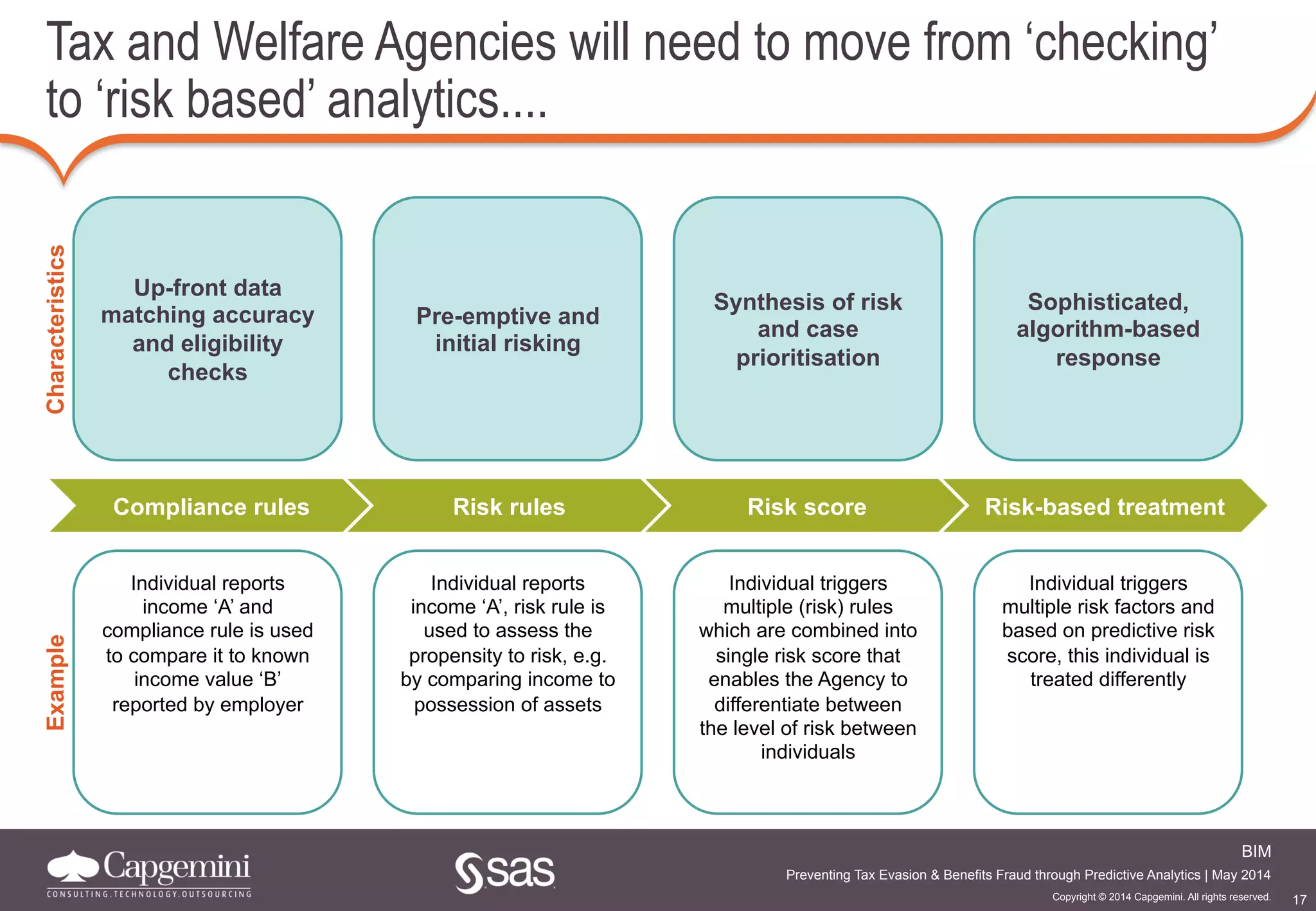

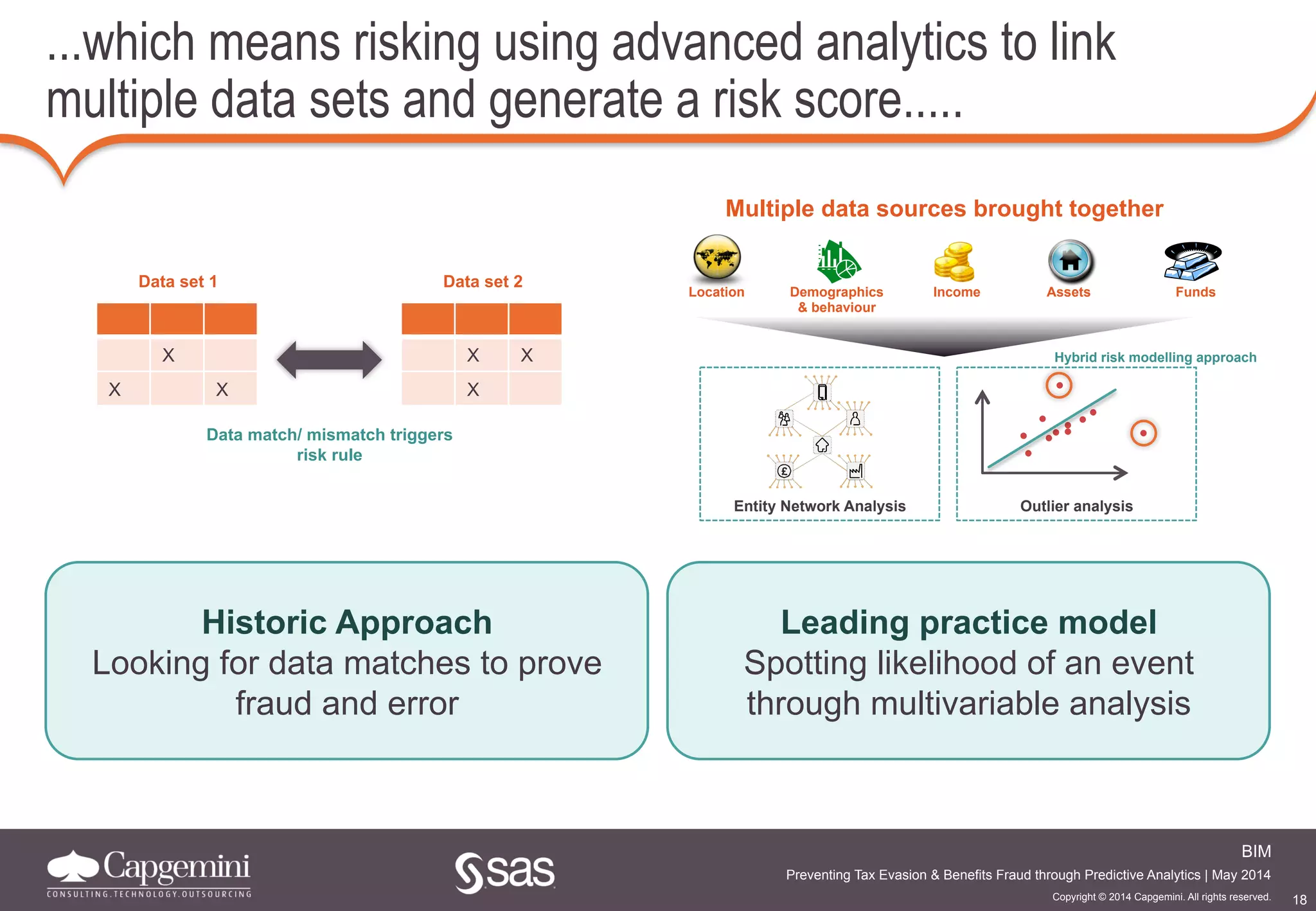

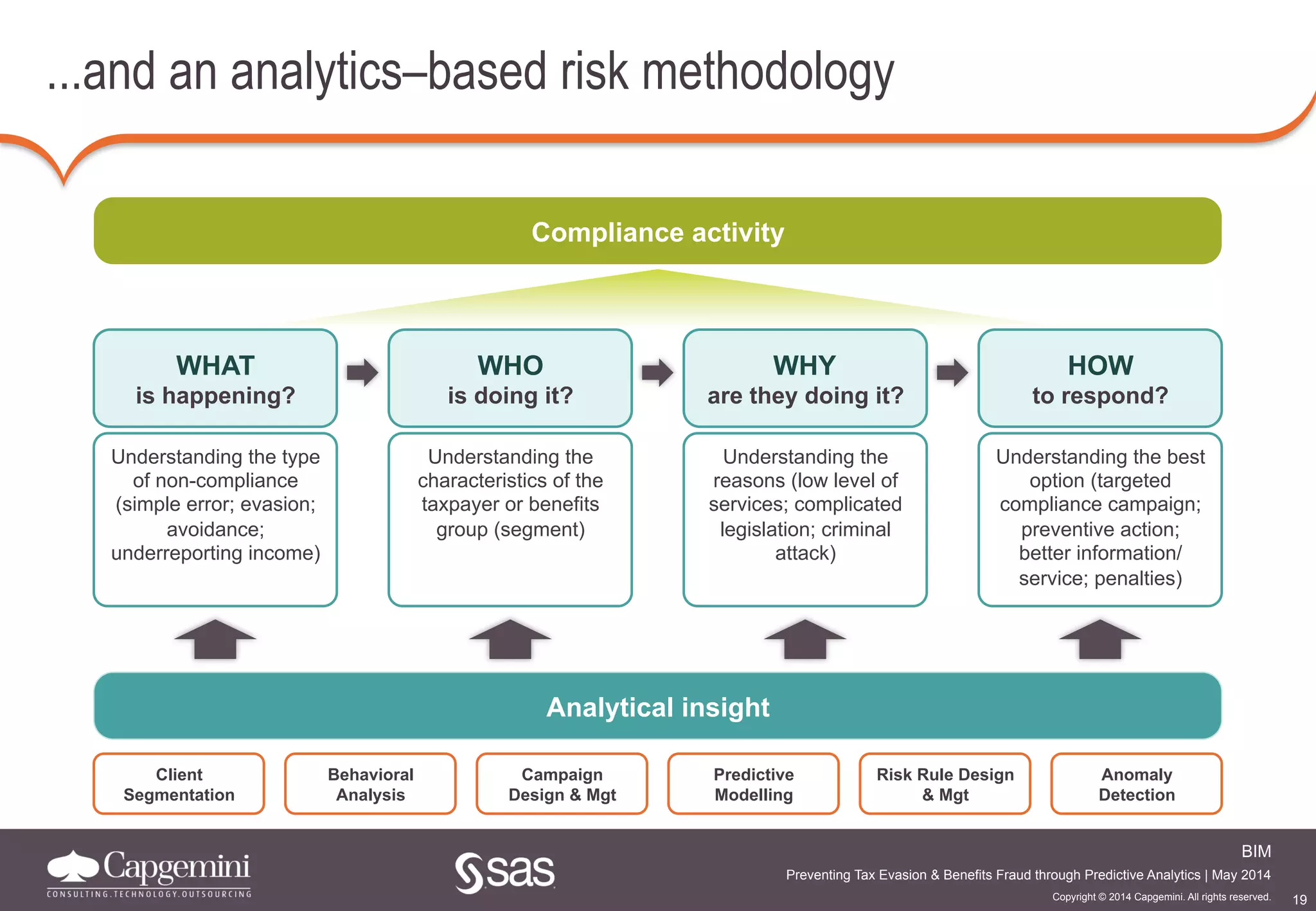

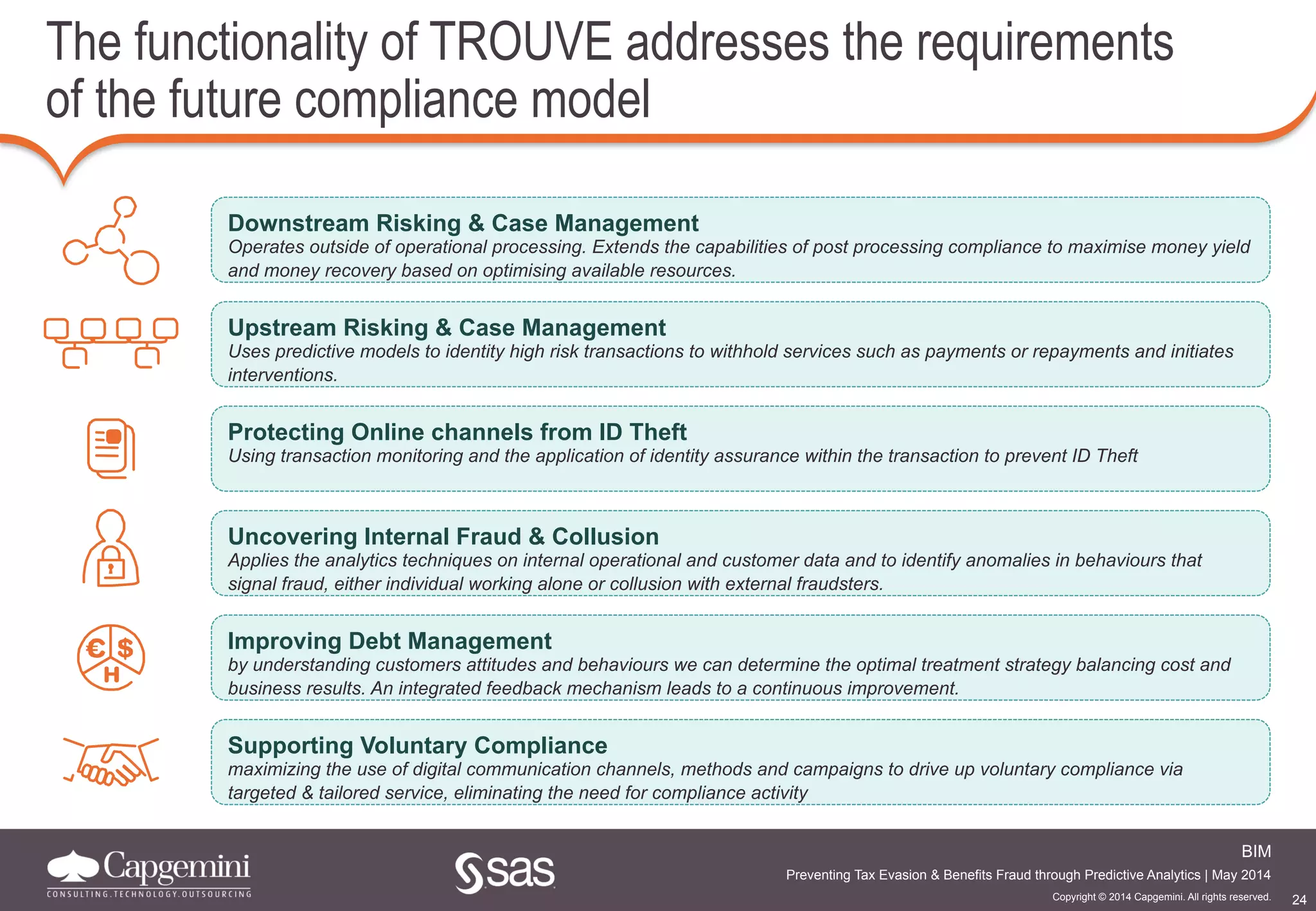

The document discusses the use of predictive analytics to prevent tax evasion and benefits fraud, highlighting the significant financial losses attributed to these issues in the EU. It emphasizes the necessity for tax and welfare agencies to adopt technology-driven approaches and advanced data analytics to improve compliance and efficiency in fraud detection. Capgemini offers a solution, showcasing their strategic risking tool for HM Revenue & Customs that has successfully recovered substantial tax yield.