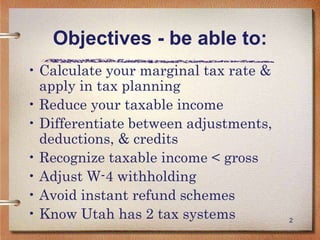

This document provides information about calculating income taxes, including how to determine marginal tax brackets and rates, ways to reduce taxable income through deductions and credits, and tips for tax planning. The key points covered are:

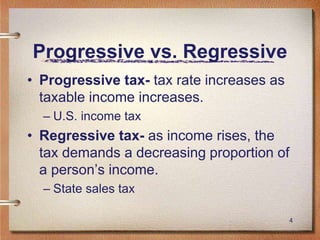

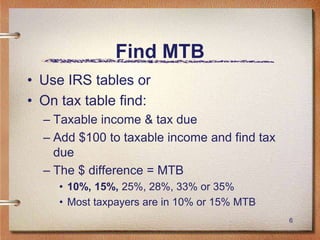

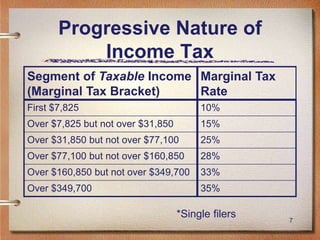

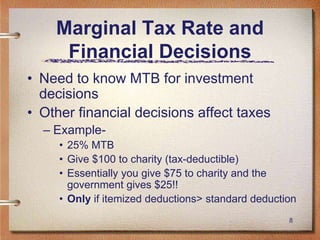

1) Marginal tax brackets determine the tax rate applied to portions of income, with rates ranging from 10-35% depending on taxable income.

2) Standard deductions and personal exemptions can be claimed to reduce taxable income. Itemized deductions may also lower taxes.

3) Various tax credits can further reduce tax liability, such as credits for retirement savings, education, child care, and adoption. Filing status also impacts tax rates.

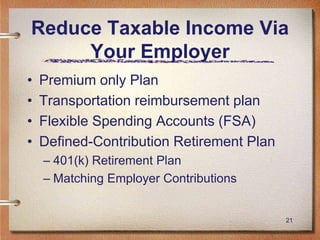

4) Proper tax planning includes legal strategies to

![29

Hiring a Tax Preparer

• Free file - AGI needs to be $54,000 or less

– http://www.irs.gov/efile/article/0,,id=118986,00.html

• USU Accounting students provide VITA

assistance in basement of USU Business

building

– Open Wednesdays 5-9 pm & Saturdays 9 am-1

pm February 13th - April 5th.

• For more info: Joe Fail [failing21@yahoo.com]

– The VITA lab will not be open March 8th, 12th,

15th, or 29th](https://image.slidesharecdn.com/fpw-incometaxes-201210050020/85/Fpw-income-taxes-29-320.jpg)