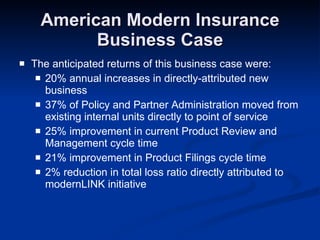

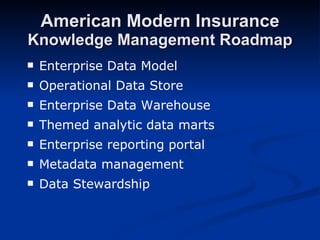

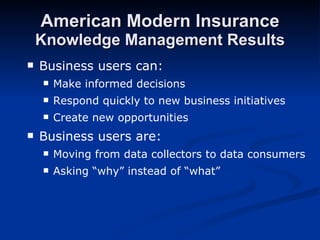

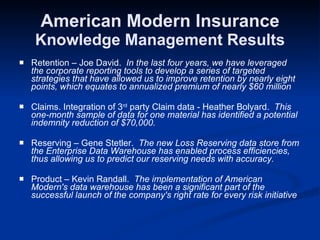

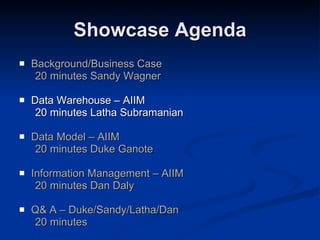

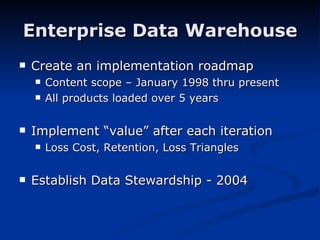

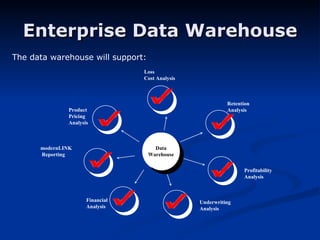

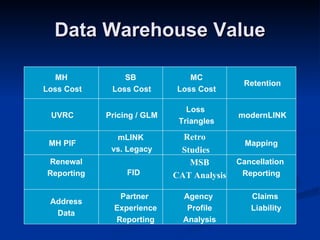

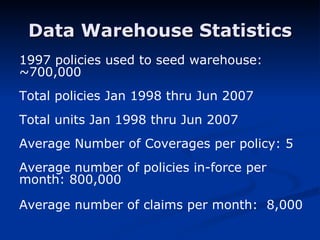

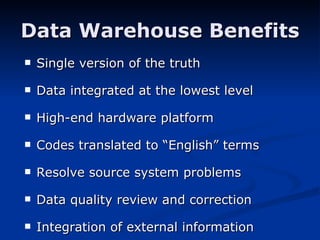

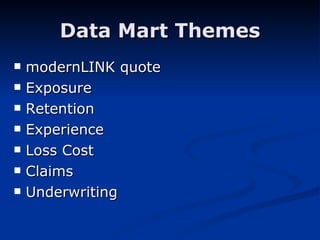

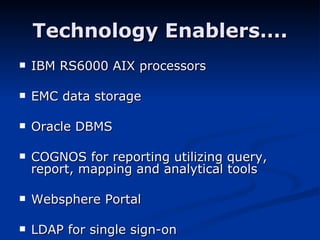

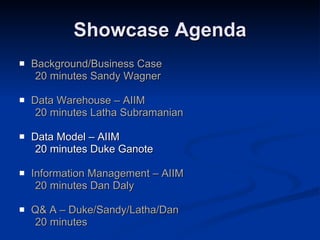

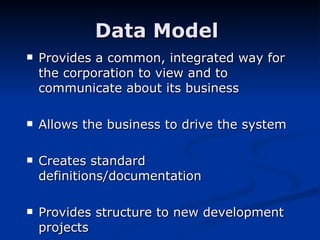

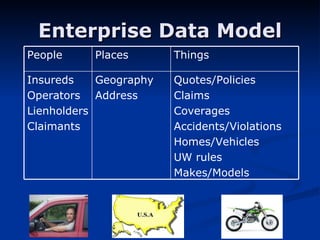

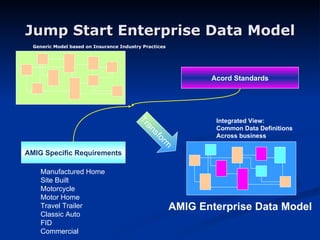

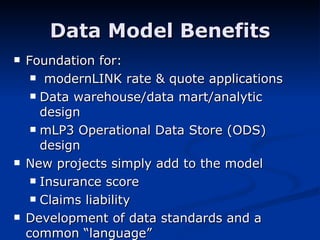

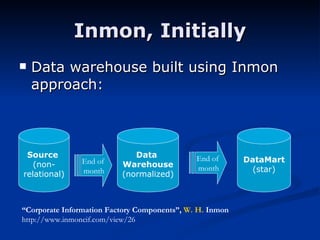

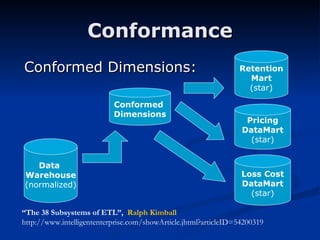

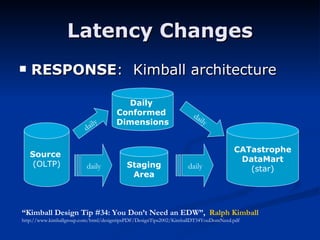

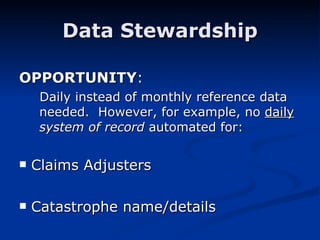

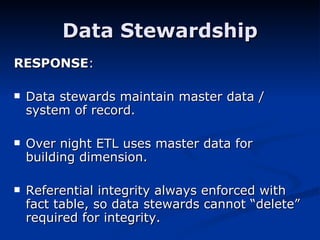

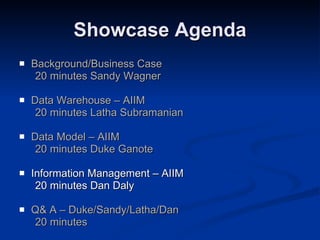

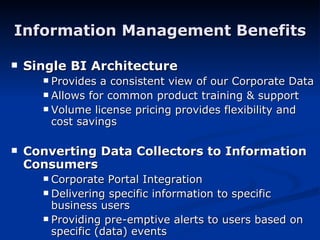

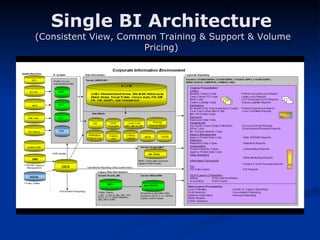

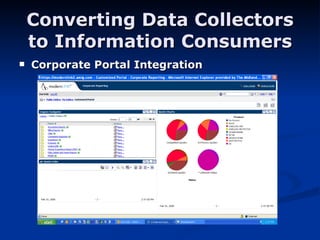

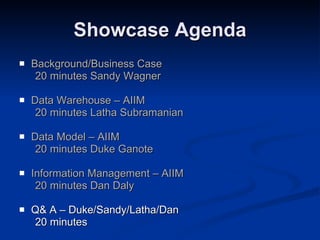

The document describes a data warehousing showcase at American Modern Insurance. It provides background on the company and its initiative to build an enterprise data warehouse and knowledge management architecture. The showcase agenda includes presentations on the data warehouse, data model, and information management. The data warehouse implementation follows Kimball's approach and provides benefits like a single version of truth and integrated data.