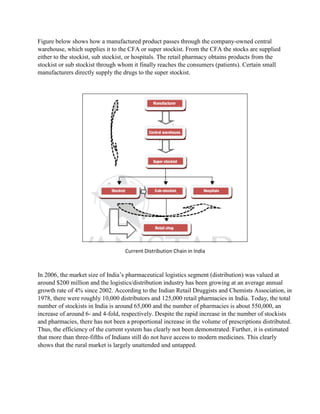

The document discusses the supply chain of the pharmaceutical industry. It describes the typical supply chain process including raw material sourcing, manufacturing, distribution and dispensing. It highlights several critical issues in managing pharmaceutical supply chains including maintaining temperature control, complex network design, and focus on research and development. It also discusses risks in pharmaceutical supply chains such as uncertainty in demand and the product development pipeline. Finally, it provides an overview of the current distribution system in India which involves clearing and forwarding agents and stockists.

![companies in India are partly foreign-owned. The major companies in India are Cipla, Lupin Ltd,

Dr.Reddy’s, Sun Pharmaceuticals, Merck, Novartis, Glenmark and Cadila healthcare. Economic

growth in India has also contributed to increase in purchasing power and higher spending on

healthcare among middle class Indians.

Some of the companies ranked by market capitalization in India are listed below:-

Rank Company Market Capitalization

2015 (INR crores)

1 Sun Pharmaceutical 2,17,636

2 Lupin Ltd 84,193

3 Dr. Reddy's Laboratories 63,779

4 Cipla 52,081

5 Aurobindo Pharma 42,454

6 Cadila Healthcare 38,677

7 Glenmark Pharmaceuticals 26,026[16]

9 Divi's Laboratories 24,847

10 Torrent Pharmaceuticals 22,320

The Indian pharmaceutical industry is witnessing significant acquisition activity, increased

investment, deeper penetration into rural markets and increased healthcare insurance coverage.

Patented drug sales are projected to increase, and Over-the-counter (OTC) segment is expected to be

a strong growth driver in the industry.](https://image.slidesharecdn.com/group33reportscm-170314070359/85/Supply-chain-in-pharma-sector-4-320.jpg)

![[and for use in] restoring, correcting or modifying organic functions in man or animal. This is a very

wide definition, and correspondingly, there are number of key players in the pharmaceutical industry,

including:

The large, research and development-based multinationals with a global presence in branded

products, both ethical/prescription and over-the-counter. They tend to have manufacturing

sites in many locations.

The large generic manufacturers, who produce out-of-patent ethical products and over-the-

counter products.

Local manufacturing companies that operate in their home country, producing both generic

products and branded products under license or contract.

Contract manufacturers, who do not have their own product portfolio, but produce either key

intermediates, active ingredients (AI) or even final products by providing outsourcing services

to other companies.

Drug discovery and biotechnology companies, often relatively new start-ups with no

significant manufacturing capacity.

Most of the material in this paper is particularly relevant to the first group. This group dominates the

marketplace and, due to the global nature of the enterprises involved, tends to have the most

challenging supply chain problems.

Changing Circumstances in the Industry

In the recent past, the high returns on investment and high turnovers from “blockbuster” products

resulted in the following regime,

Good R&D productivity, often creating compounds to treat previously untreatable diseases

Long effective patent lives of these compounds

Ability of these patents to provide technological barriers to entry

A limited number of product substitutes in a given therapeutic area

A low price sensitivity; supported by the separation between prescribing and paying

responsibilities.

The resulting corporate strategy was to ensure high margins by exploiting the price inelasticity and

invest a large proportion of the resultant profits in R&D (approximately 25% of sales), in order to

ensure a healthy product pipeline.

The more recent circumstances are much more challenging:

R&D productivity (in terms of numbers of new chemical entities (NCE) registered per unit

amount of investment) is declining

Effective patent lives are shortening

Even while active, patents provide lower barriers to entry

There are many product substitutes in many therapeutic areas; either alternative compounds

(“me-too drugs”) or off-patent generics](https://image.slidesharecdn.com/group33reportscm-170314070359/85/Supply-chain-in-pharma-sector-9-320.jpg)