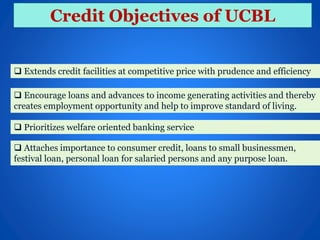

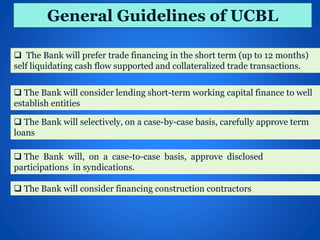

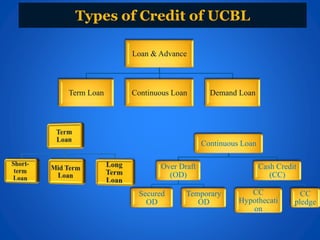

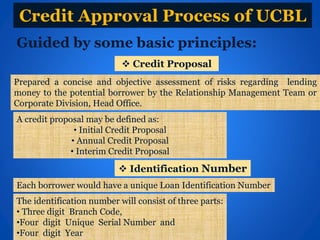

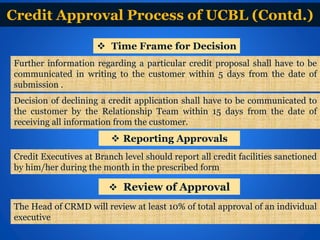

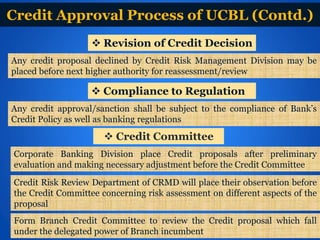

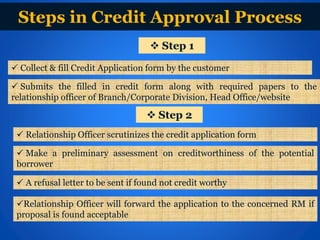

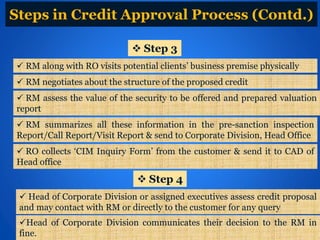

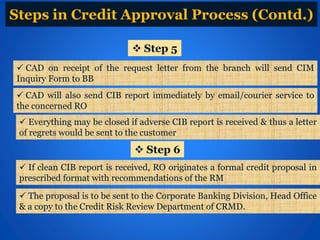

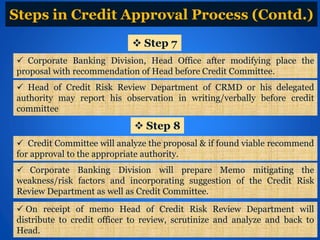

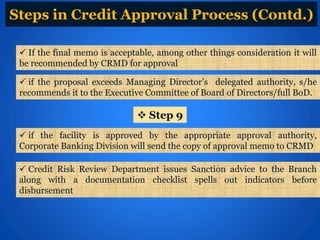

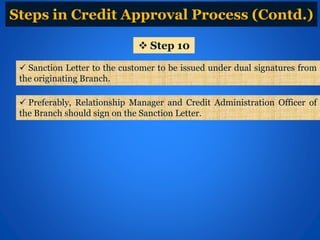

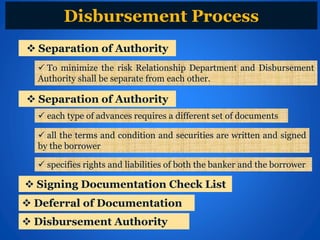

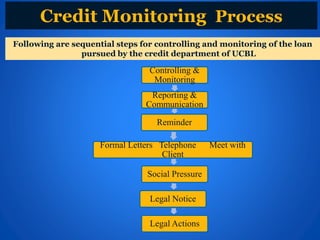

This presentation summarizes the credit management process of United Commercial Bank Limited (UCBL) in Bangladesh. It outlines UCBL's credit objectives of extending credit to income-generating activities. It then describes the general guidelines UCBL follows in approving different types of loans. The main body of the presentation details UCBL's 8-step credit approval process, from a customer submitting a credit application to disbursement of approved loans. It explains each step, including risk assessment, credit committee review, sanctioning and documentation. Finally, it briefly outlines UCBL's credit monitoring process after loan disbursement through reporting, reminders and potential legal actions.