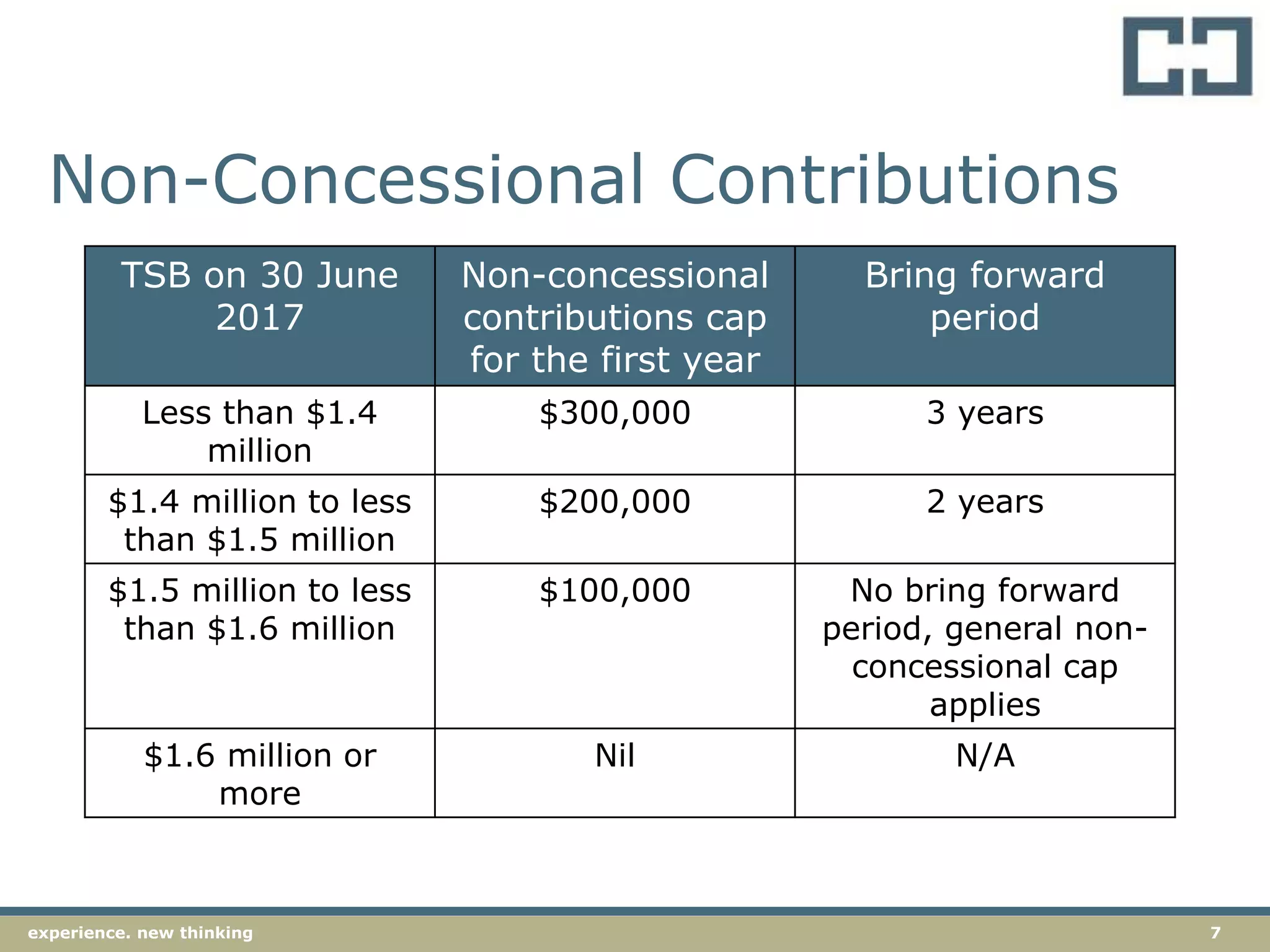

The document summarizes recent changes to Australia's superannuation system announced in the 2016 federal budget. Key changes include lowering the concessional contributions cap to $25,000 per year, introducing a $1.6 million transfer balance cap on superannuation that can be transferred to pension phase, and implementing a $500,000 lifetime cap on non-concessional contributions. The changes aim to simplify the system, reduce tax concessions, and ensure superannuation is used primarily for retirement. Many of the changes will take effect on July 1, 2017, though some provisions are delayed or still require legislation.