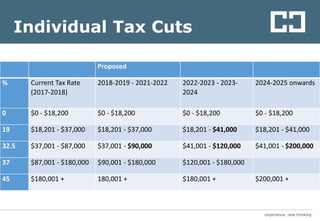

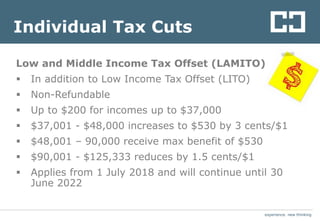

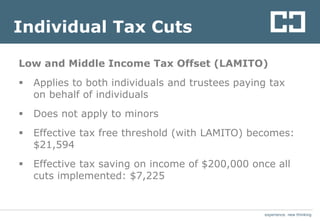

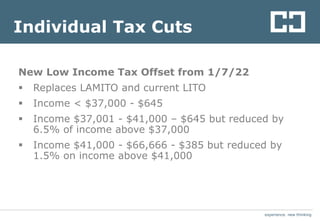

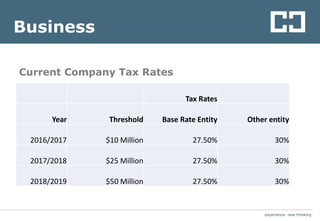

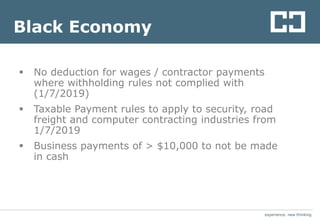

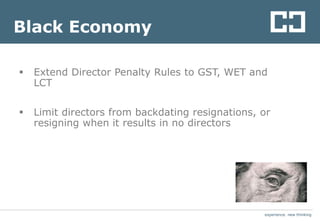

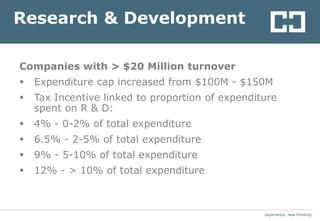

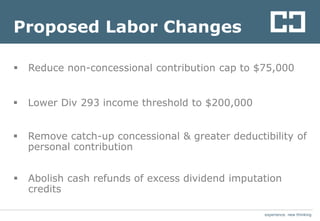

The document provides a comprehensive update on the 2017/18 federal budget, detailing proposed tax changes including individual tax offsets, company tax rates, and superannuation updates. Key highlights include a return to budget surplus earlier than expected, an extension of the instant asset write-off for small businesses, and changes to low-income tax offsets. Additionally, it discusses implications for taxpayers and businesses, as well as potential changes anticipated from future elections.