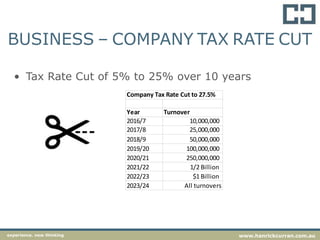

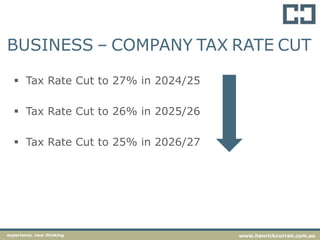

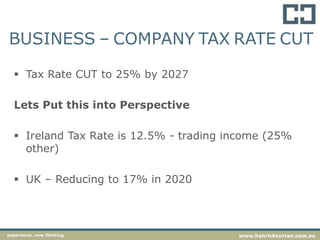

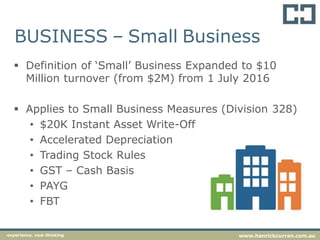

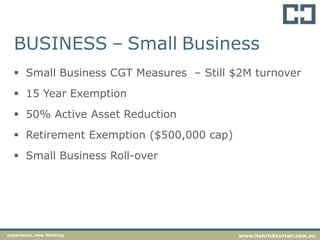

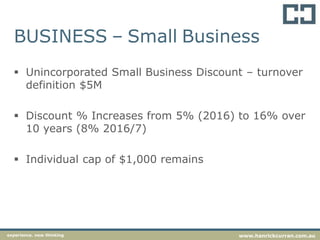

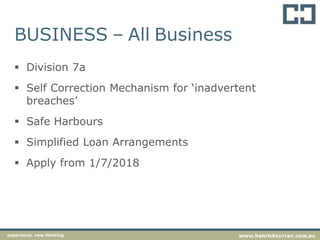

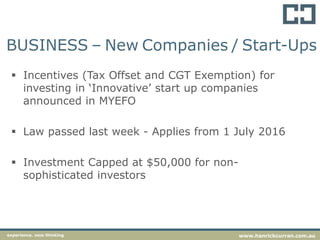

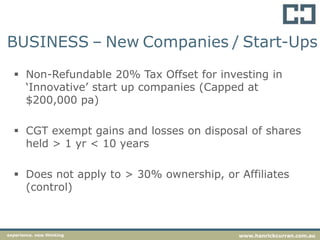

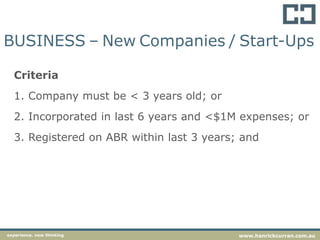

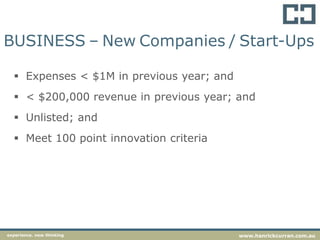

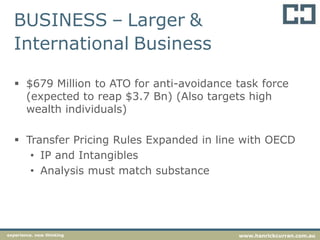

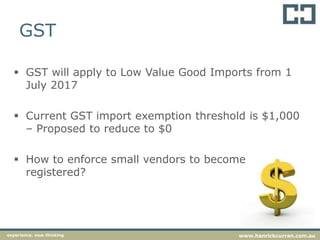

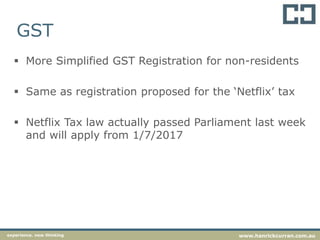

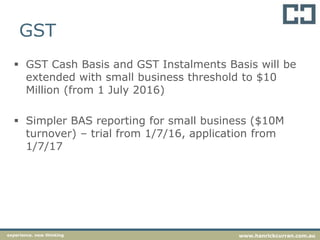

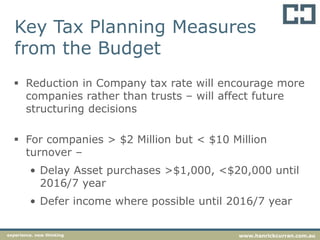

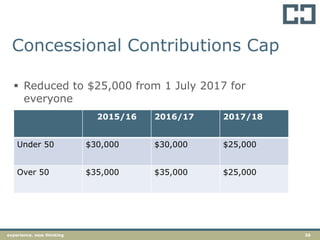

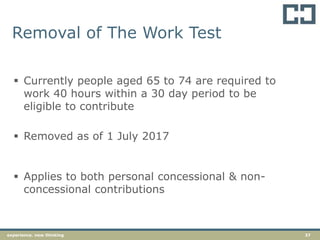

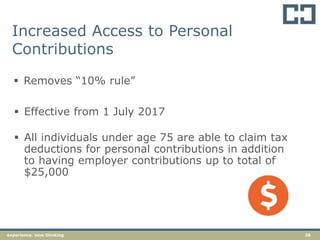

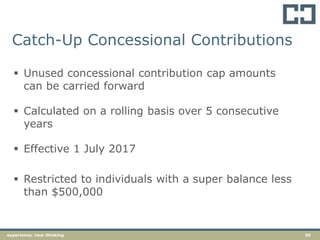

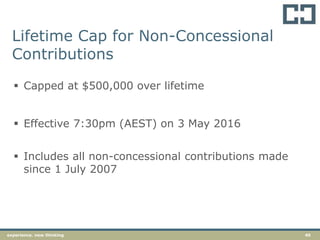

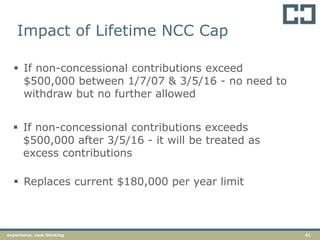

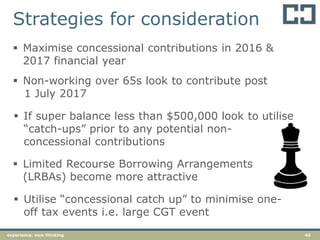

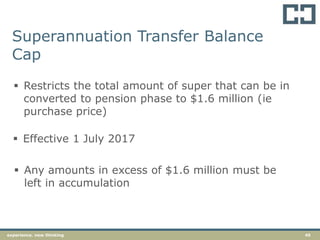

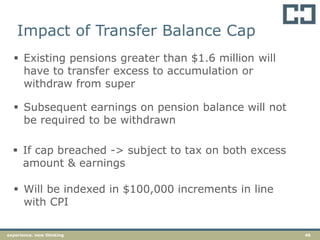

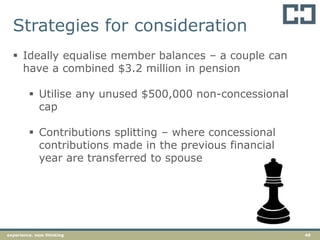

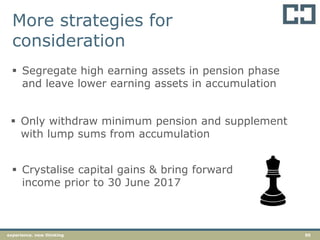

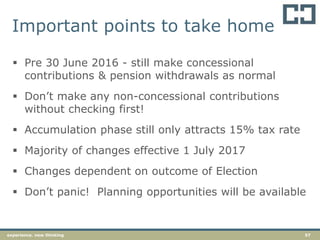

The 2016-17 federal budget projects a $37.1 billion deficit with plans to return to surplus by 2021, alongside new tax measures for individuals and businesses. Key changes include a company tax rate cut phased from 27.5% to 25% by 2027 and adjustments to superannuation contribution caps. Additional updates involve GST reforms, the introduction of lifetime caps for non-concessional contributions, and various incentives for small businesses and startups.