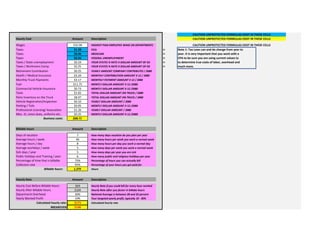

This document outlines the hourly costs and billable hours for an employee to calculate an hourly rate. It lists taxes, benefits, and other expenses totaling $68.71 per hour. It also specifies billable hours of 1,379 per year based on a 40 hour work week with vacations and holidays. To reach a yearly profit of 10% with a department overhead of 30%, the calculated hourly rate is $173 with a breakeven rate of $148.