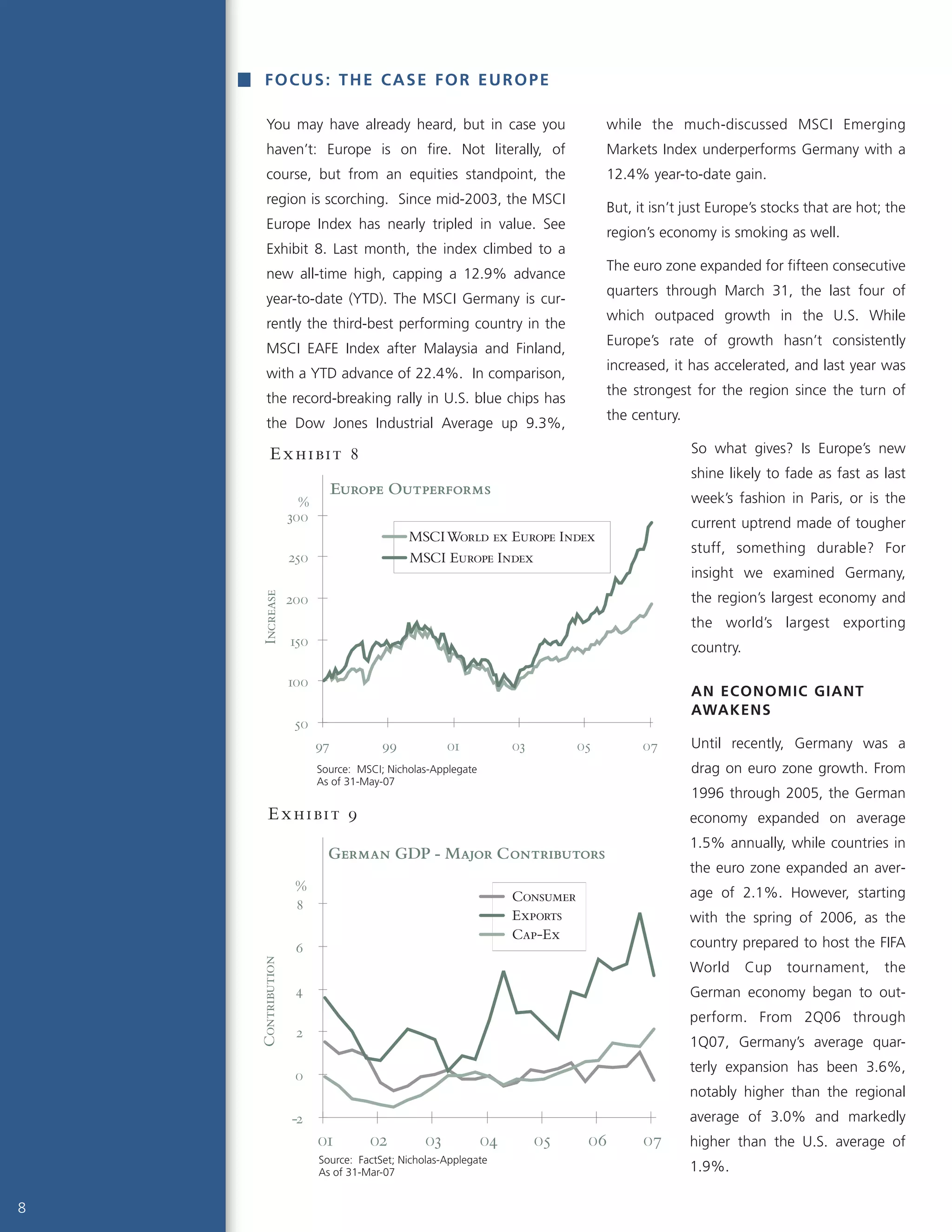

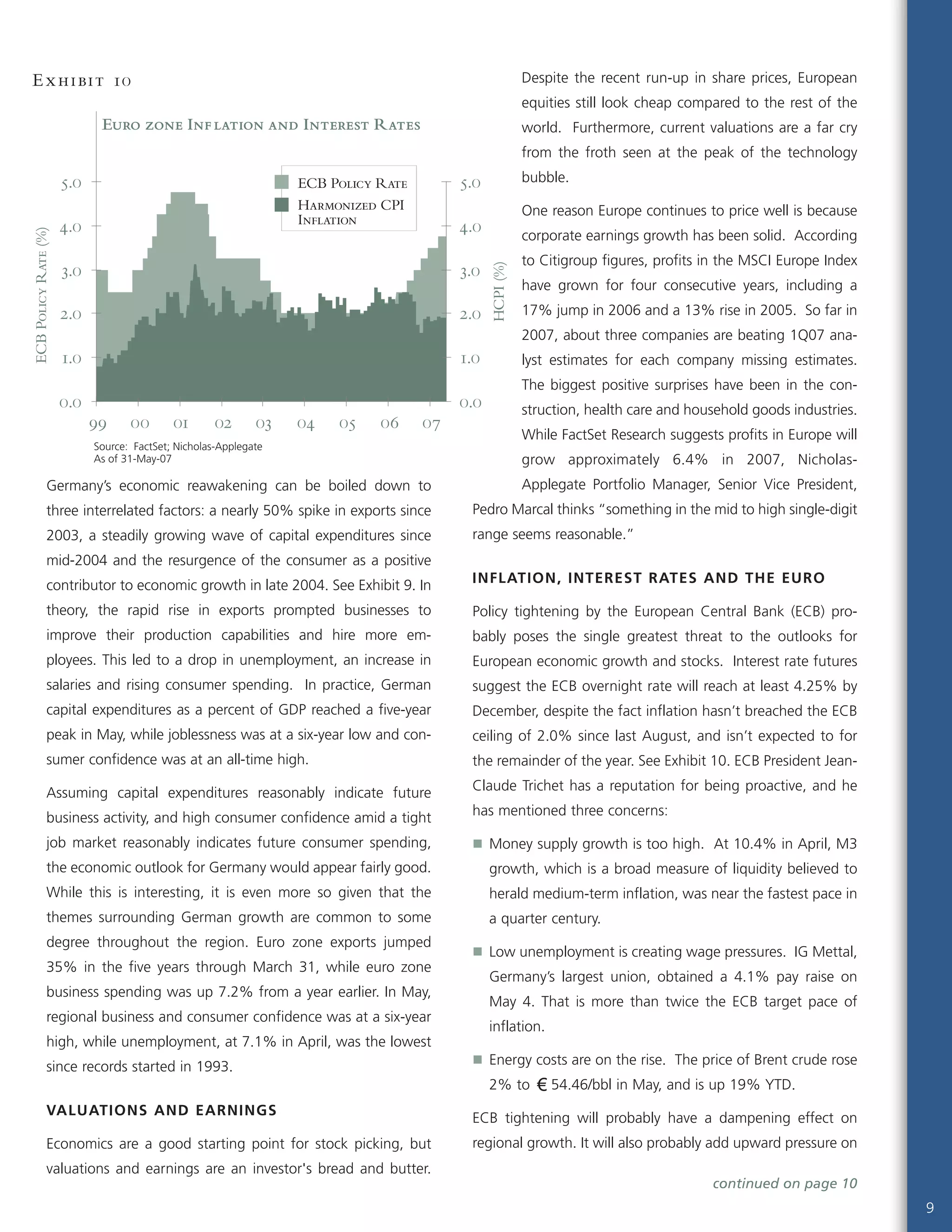

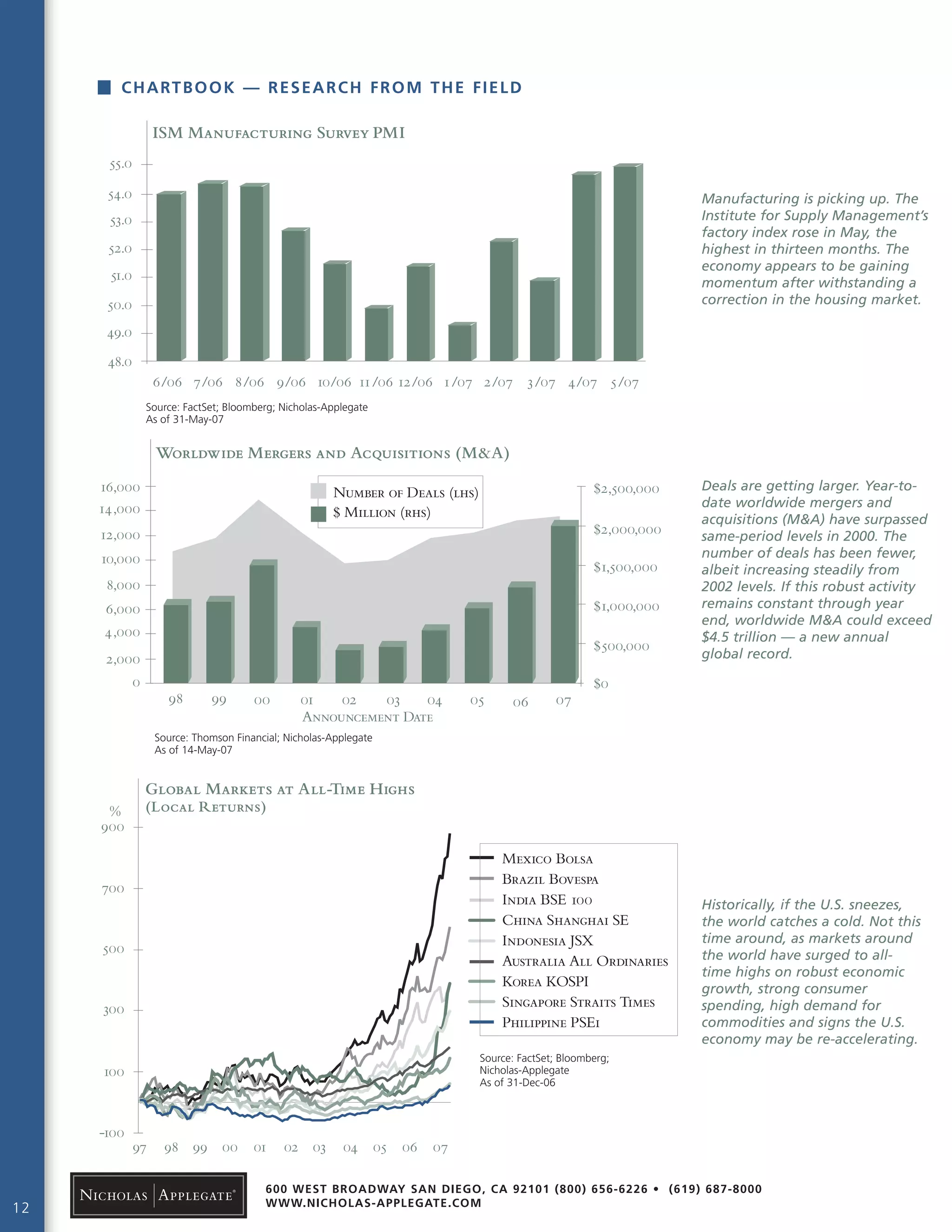

Stocks rallied in May, with several indexes reaching record highs. Economic conditions have improved from a year ago, with inflation stabilizing and business spending recovering. Corporate earnings grew 8.1% in the first quarter, ending a streak of 14 quarters of double-digit growth. While markets have reached milestones, valuations are still relatively reasonable compared to the tech bubble peak in 2000.