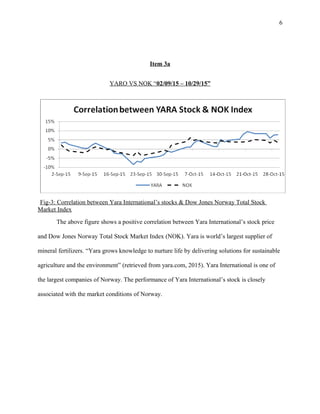

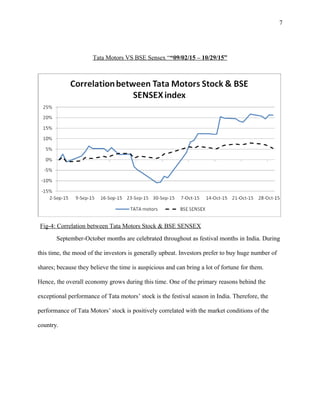

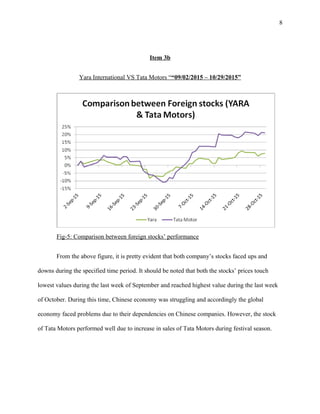

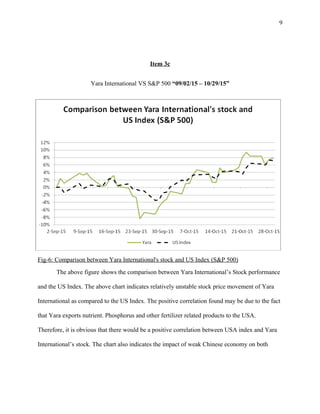

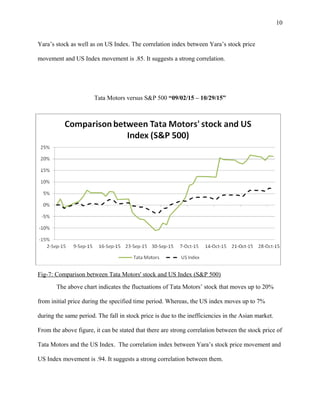

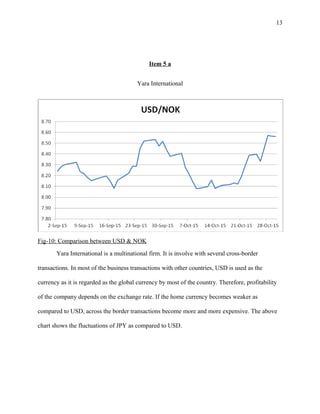

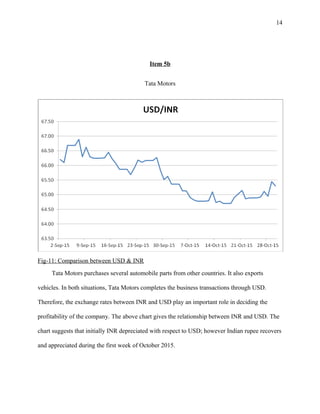

The document provides a stock market analysis of four companies - Starbucks, Goldman Sachs, Yara International, and Tata Motors - over a period from September 2nd to October 29th, 2015. It analyzes the percentage change in stock prices for each company and correlates the stock performance with various economic factors. For each company, the document also examines the impact of exchange rate fluctuations between the US Dollar and the respective local currencies on their business.