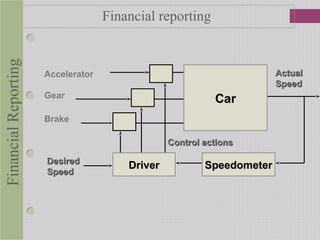

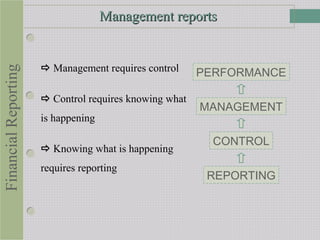

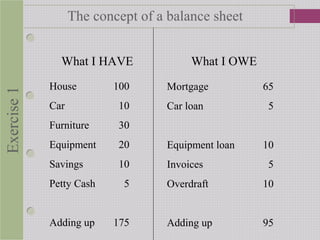

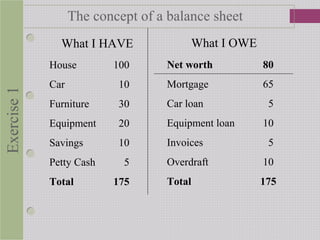

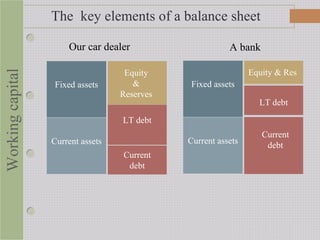

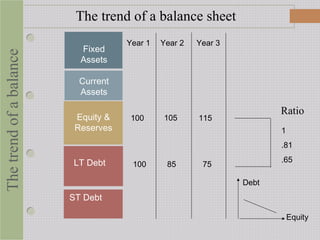

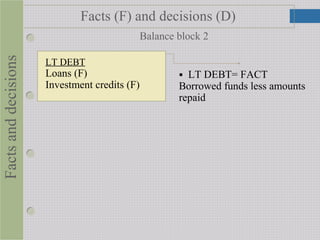

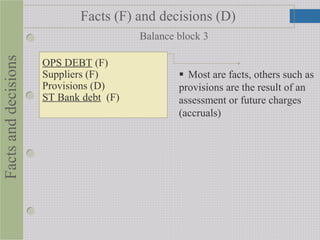

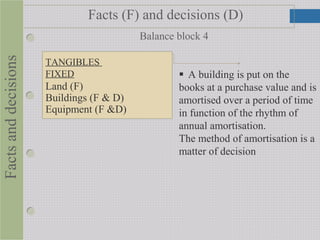

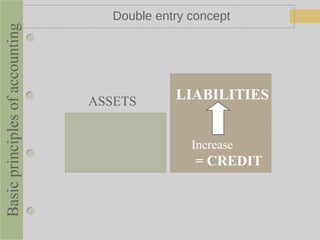

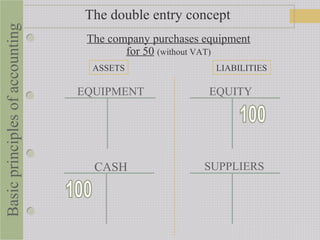

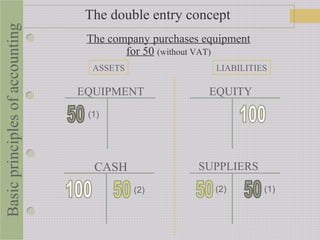

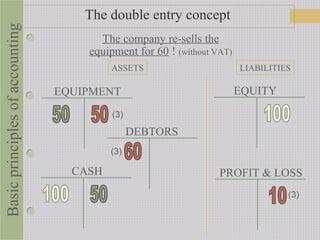

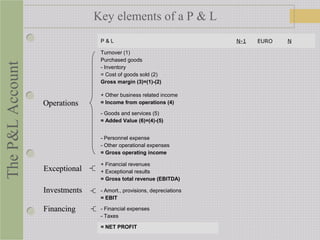

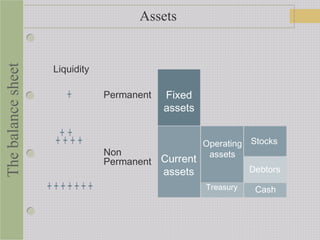

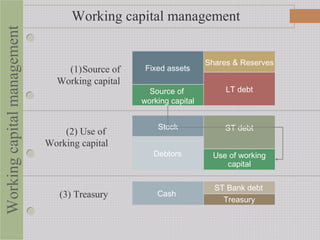

This document provides an overview of basic accounting and financial analysis principles. It discusses the need for financial reporting to allow management to monitor and control business performance. The three main sources of financial information are introduced as the balance sheet, profit and loss account, and cash flow report. The balance sheet is defined as having two sides - assets (what a company owns) and liabilities and equity (how it was financed). Key elements of the balance sheet like different asset and liability categories are explained. Facts reflected in the balance sheet are distinguished from management decisions that can impact balance sheet values and interpretation.