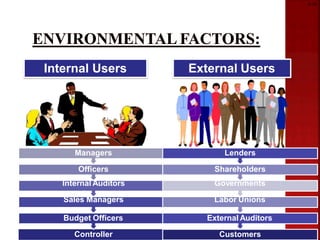

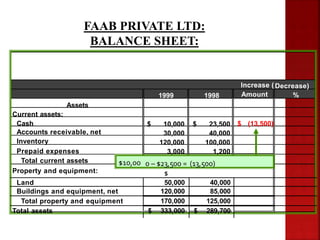

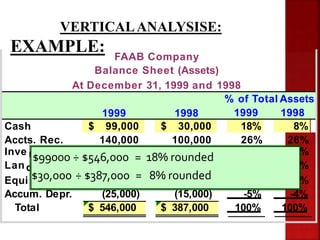

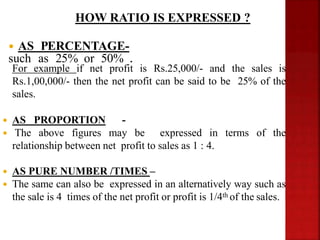

This document defines and discusses financial reporting and analysis. It begins by defining financial reporting as the financial results an organization releases publicly, which is a key function of the controller. Financial analysis is evaluating financial information for decision-making. The document then outlines the main types of financial statements used in reporting and analysis, which include the balance sheet, income statement, cash flow statement, and statement of retained earnings. It also discusses the internal and external uses of financial statement analysis and the main methods used, including horizontal analysis, vertical analysis, and ratio analysis.

![2-6

Form 10-K (Annual Report)

10-Q (Quarterly Report)

20-F (Registration Statement/ Annual Report

[Foreign])

8-K (Current Report)

14-A (Proxy Statement/Prospectus)

Other SEC Filings](https://image.slidesharecdn.com/afspptfinalzaman-221014061137-db98252c/85/Financial-Reporting-Analysis-Environment-By-Zaman-pptx-20-320.jpg)