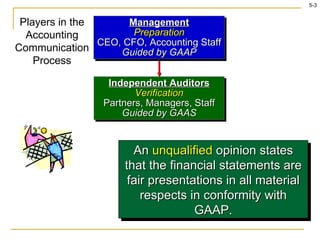

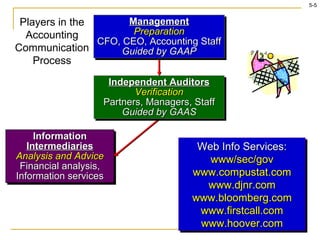

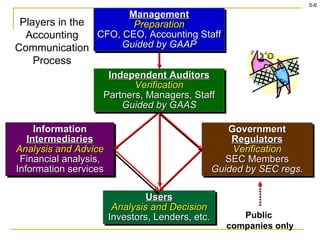

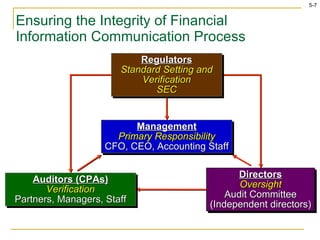

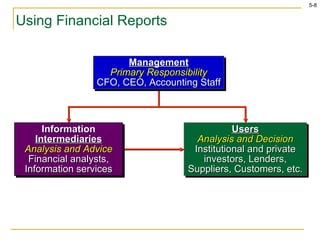

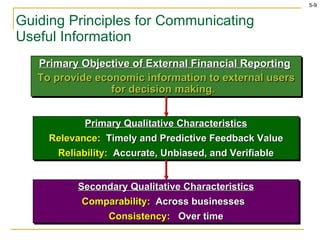

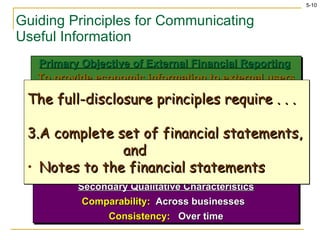

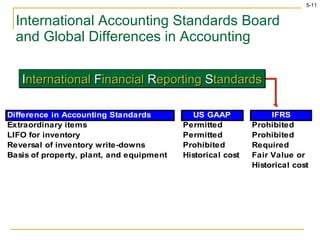

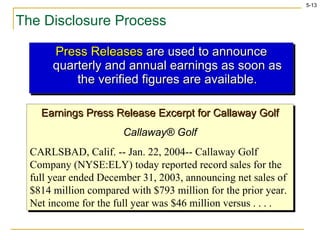

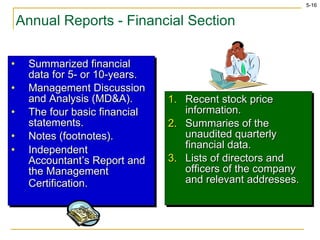

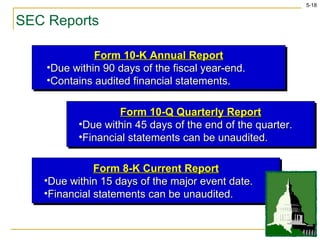

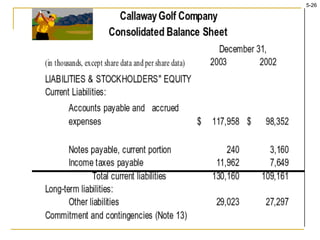

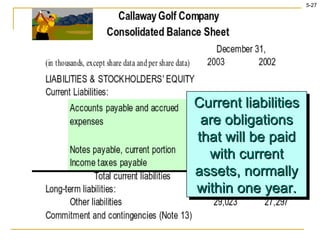

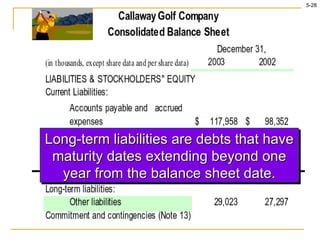

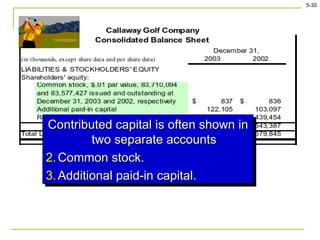

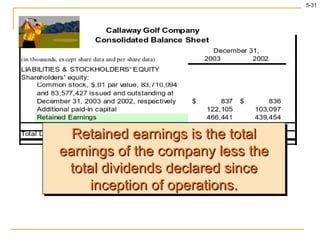

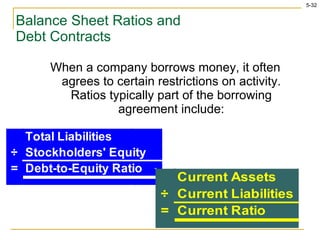

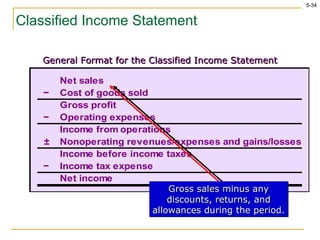

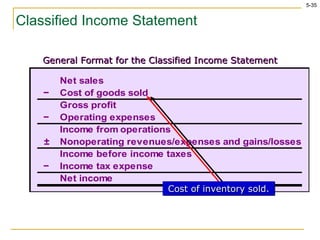

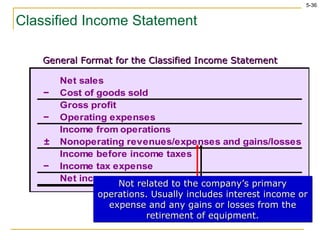

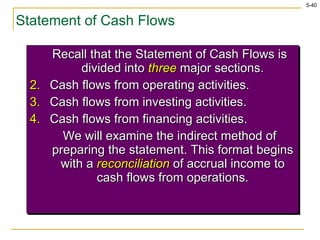

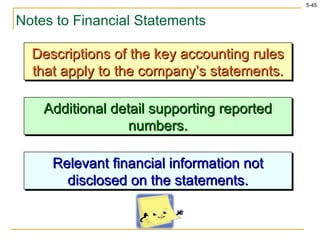

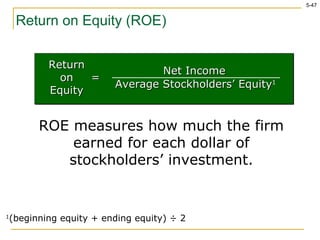

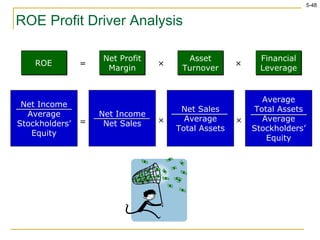

This document discusses the accounting communication process and key players involved, including regulators, managers, directors, auditors, and financial statement users. It covers the roles and guidance these players receive, as well as common financial statements, reports, and disclosures used to communicate accounting information, such as annual reports, quarterly reports, and SEC filings. It also summarizes guidelines for ensuring useful financial reporting and analyzing company performance based on return on equity and its components.