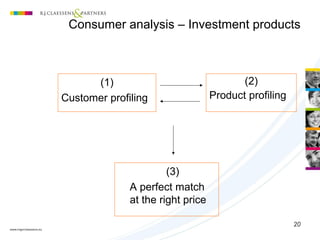

The document discusses the origin and concepts of generic funds. It explains that managing investment portfolios involves managing risks from the instruments themselves and from the market. Diversification and allocation are used to address these risks. Pooled funds are a good idea since individual good investments are expensive. Fund selection involves analyzing balance sheets, management, commercial strategies, and industries.

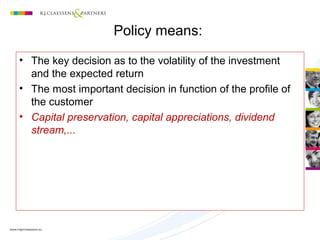

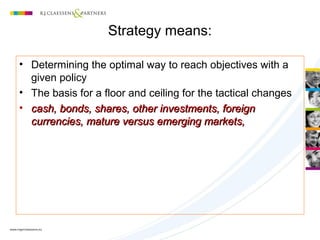

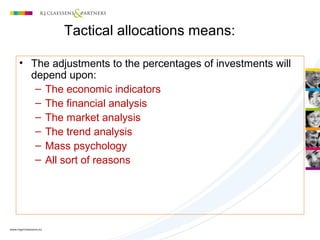

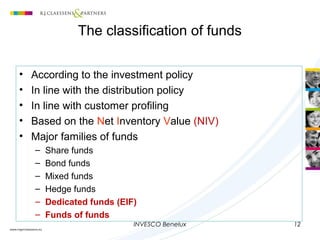

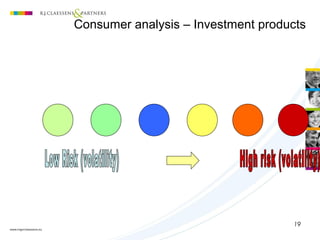

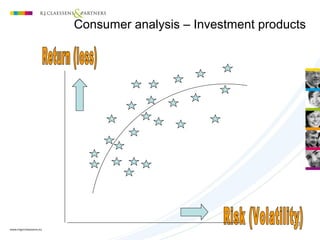

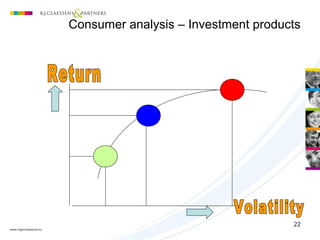

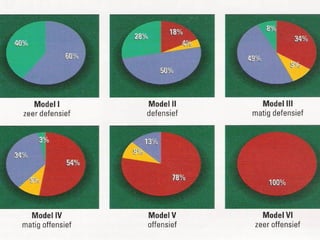

The key concepts for undertaking collective investments are the investment policy, investment strategy, and tactical allocations as outlined in the prospectus. The policy determines the expected volatility and return. The strategy details how objectives will be reached given the policy. Tactical allocations make adjustments based on economic, financial, market, and trend analyses.

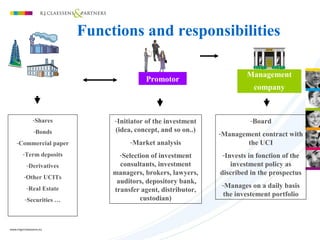

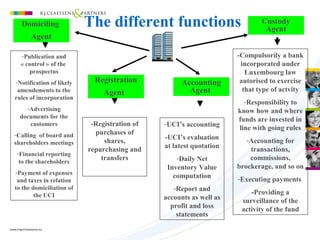

The functions of the promotor