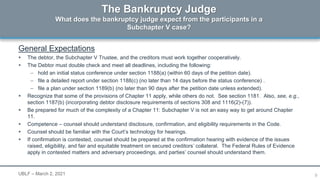

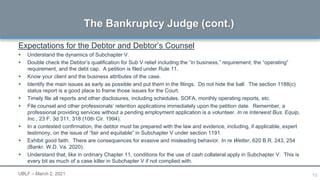

This document provides an overview and discussion of Subchapter V of Chapter 11 of the Bankruptcy Code from the perspective of key participants in Subchapter V cases. It begins with background on Subchapter V and how it provides a streamlined process for small business reorganizations. It then discusses expectations and roles of the main participants in Subchapter V cases - the bankruptcy judge, United States Trustee, Subchapter V Trustee, debtor, creditors, and their attorneys. Open issues with Subchapter V are also identified, such as how to determine the length of payment plans and how to define disposable income for business debtors.