This document is an application filed by Cordillera Golf Club, LLC (the "Debtor") in the United States Bankruptcy Court for the District of Delaware seeking approval to retain the law firm Foley & Lardner LLP ("Foley") as its general bankruptcy counsel. The application provides background on the Debtor's Chapter 11 bankruptcy filing and requests that the retention of Foley be approved nunc pro tunc to the petition date to represent the Debtor in the bankruptcy case. It describes Foley's qualifications and experience in bankruptcy matters and outlines the services Foley will provide and its proposed compensation structure including hourly billing rates.

![JURISDICTION

1. This Court has jurisdiction over this Application under 28 U.S.C. §§157 and 1334

and the Amended Standing Order of Reference from the United States District Court for the

District of Delaware, dated as of February 29, 2012. This matter is a core proceeding within the

meaning of 28 U.S.C. § 157(b)(2), and the Court may enter a final order consistent with Article

III of the United States Constitution. Venue of this proceeding and this Application in this

District is proper under 28 U.S.C. §§1408 and 1409.

2. The statutory bases for the relief requested herein are Bankruptcy Code Section

327(a) and Rule 2014 of the Bankruptcy Rules and Rule 2014-1 of the Local Rules.

BACKGROUND

3. On June 26, 2012 (the "Petition Date"), the Debtor filed its voluntary petition for

relief under chapter 11 of the Bankruptcy Code (the "Chapter 11 Case"). The Debtor is operating

its business and managing its properties as a debtor-in-possession pursuant to §§ 1107(a) and

1108 of the Bankruptcy Code. No trustee or examiner has been appointed in this Chapter 11

Case.

4. A description of the Debtor's business and the reasons for commencing this

Chapter 11 Case, and the relief sought from the Court to allow for a smooth transition into

chapter 11, are set forth in the Affidavit of Daniel L. Fitchett, Jr. in Support of Chapter 11

Petition and First Day Relief, filed on the Petition Date [Docket No. 2] (the "First Day

Affidavit").

5. The Firm was retained by the Debtor specifically for this Chapter 11 proceeding

pursuant to an engagement agreement dated June 21, 2012 (the "Engagement Agreement").

RELIEF REQUESTED

6. By this Application, the Debtor seeks entry of an order by this Court authorizing

(a) the Debtor to employ and retain the Firm as its general bankruptcy counsel with regard to the

filing and prosecution of this Chapter 11 Case effective nunc pro tunc to the Petition Date; and

(b) the Firm's continued representation, in some instances as special and/or advisory counsel in

2

4852-5095-2719.3](https://image.slidesharecdn.com/10000001209-121112192812-phpapp01/85/10000001209-2-320.jpg)

![UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

In re

Chapter 11

CORDILLERA GOLF CLUB, LLC1

dba The Club at Cordillera, Case No. 12-11893 (CSS)

Debtor.

DECLARATION OF CHRISTOPHER CELENTINO IN SUPPORT OF

APPLICATION OF THE DEBTOR AND DEBTOR IN POSSESSION FOR AN

ORDER AUTHORIZING THE RETENTION AND EMPLOYMENT OF FOLEY

& LARDNER LLP AS GENERAL BANKRUPTCY COUNSEL TO THE

DEBTOR NUNC PRO TUNC TO THE PETITION DATE

PURSUANT TO BANKRUPTCY CODE SECTION 329, RULES 2014 AND

2016(B) OF THE BANKRUPTCY RULES AND LOCAL RULE 2016-1

I, Christopher Celentino, declare as follows:

1. I am an attorney duly admitted to practice before this Court. See Order Granting

Motion Pro Hac Vice [Dkt. No. 27]. I am a partner of the law firm Foley & Lardner LLP

("Firm" or "FL"), proposed counsel for Debtor and Debtor-in-Possession Cordillera Golf Club,

LLC dba The Club at Cordillera (hereinafter "Applicant" or "Debtor") in the above-captioned

matter.

2. The facts stated below are personally known to me, except for those matters based

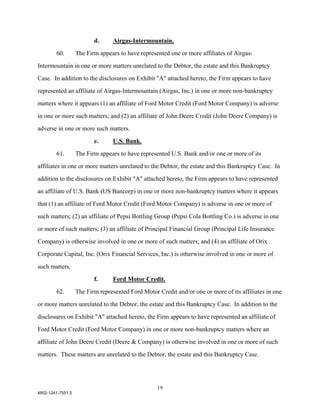

upon information and belief and as to those, I believe them to be true. If called as a witness, I

could and would competently testify to the truth of such facts.

3. The Firm was retained by the Debtor specifically for this Chapter 11 proceeding

pursuant to an engagement agreement dated June 21, 2012.

1

The Debtor in this chapter 11 case, and the last four digits of its employer tax

identification number, is XX-XXX1317. The corporate headquarters address for the Debtor is

97 Main Street, Suite E202, Edwards, Colorado 81632.

4852-1241-7551.5](https://image.slidesharecdn.com/10000001209-121112192812-phpapp01/85/10000001209-15-320.jpg)

![19. On May 24, 2011, the Debtor filed the CTC Litigation complaint in the District

Court for Eagle County, Colorado. As set forth in further detail in the Affidavit of Daniel L.

Fitchett, Jr., in Support of Chapter 11 Petition and First Day Relief, filed on June 26, 2012

[Docket No. 2] (the "First Day Affidavit"), and incorporated herein by reference, the Debtor's

case turns upon a series of actions taken by a sub-group of Club (defined below) members in

furtherance of an apparent strategy to discredit the Debtor, incite Club member resignations,

damage the Debtor financially and reputationally, and ultimately seize ownership of the Club at a

substantially discounted valuation. See First Day Affidavit at Paragraph 35.

20. The CTC Litigation complaint asserts seven causes of action for (1) Tortious

Interference with Contract; (2) Tortious Interference with Prospective Business Advantage; (3)

Colorado Organized Crime Control Act; (4) Fraud; (5) Fraud in the Inducement; (6) Civil

Conspiracy/Collusion; and (7) Defamation. The parties presently are in midst of discovery.

Written discovery has been exchanged by all parties with approximately 145,000 pages of

documents produced in the case. The first series of depositions is scheduled to commence the

week of July 9, 2012 with additional depositions in the process of being scheduled. A three

week jury trial is set for April 1-19, 2013. Id. at Paragraph 36.

21. Later in June 2011, in response to the CTC Litigation, a class action suit was filed

against the Debtor and WFP Cordillera, Cordillera Golf Holdings, Wilhelm, WFPI, Patrick

Wilhelm, Cordillera F & B, LLC and CGH for breach of contract, alleging that management was

required to open all facilities. Foley, et. al. v. Cordillera Golf Club LLC, 2011 CV 552 filed in

Eagle County District Court, Colorado ("Member Lawsuit").2 Id. at Paragraph 37. Class

Plaintiffs seek return of all 2011 membership dues paid as well as an expedited refund of their

membership deposits. Id.

22. On May 4, 2012, the Debtor filed a motion to dismiss the securities claims that

were added by way of third amended complaint. Two other defendants filed a separate motion to

2

A named Plaintiff, Foley, has no relation to the Debtor's proposed counsel, Foley &

Lardner LLP.

7

4852-1241-7551.5](https://image.slidesharecdn.com/10000001209-121112192812-phpapp01/85/10000001209-21-320.jpg)

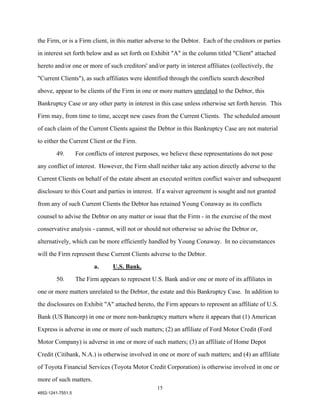

![Exhibit C

Firm Client, Adversary or Creditor or Party in Interest with

Otherwise Involved Similar Name

Ackerman, Charles Murray Ackerman, Charles and Joanne

Ackerman, Charles

Allen, Barry and Linda Allen, Linda

Allen, L.E. [Gene]

Allen, Linda

Allen, Gregory J. Allen, Gregory and Lorraine

Allen, Gregory

Allen, J. Norman Allen, Joshua

Allen, J. Walter and Tressa T.

Allen, Kevin Allen, Kevin, Mr. and Mrs.

Allen, Mark Allen, Mark and Josie

American Tower, LLP American Towers Inc.

Audit Committee of the Board of Directors

of American Tower Corporation

American Tower L.P.

Anderson, Carl A. Anderson, Carl and Claire

Anderson, Carl L., REV., M.S.

Anderson, Clare M.

Anderson, Jeff Anderson, Jeffrey and Roselyn

Anderson, Jeffrey B. and Christina A.

Anderson, Jeffrey B.

Anderson, Jeffrey S.

Anderson, Jeffrey R.

Anderson, Jeffrey A.

Anderson, Rose M.

Anderson, Kristin D. Anderson, Kristen

Aon Advisors, Inc. Aon Risk Services Central, Inc.

Aon Consulting, Inc.

Capitated Network Aon

Apollo Housing Capital LLC Apollo Investment Management, L.P.

Apollo Housing Capital

Caesars Entertainment Corporation

Hamlet Holdings LLC, a joint venture of

4819-2580-0464.1](https://image.slidesharecdn.com/10000001209-121112192812-phpapp01/85/10000001209-50-320.jpg)

![Firm Client, Adversary or Creditor or Party in Interest with

Otherwise Involved Similar Name

Bentley, David M. Bentley, David and Tracey

Berman, Debra Burman, Gary & Debbie

Bernstein, Dave Bernstein, David and Kimberly

Bernstein, David

Bishop, Thomas L. Bishop, Thomas and Trinda

Blair, Richard J. Blair, Richard and Nettie

Blair, Jr., Richard W.

Blattner, Jeffrey T. and Mardee Blattner, Jeffrey and Annie

Blockbuster Entertainment Corporation Dish Network, Inc.

Blockbuster U.K. Group, LTD.

Blockbuster Video [Shirley, Holbrook,

Medford & Coram, NY]

Blockbuster Video

Viacom, Inc.

National Amusements, Inc.

Paul Denario dba Blockbuster Video

Blockbuster Video Locadora E. COM. RICO,

LTDA,

Blockbuster Video LTD.

Blockbuster Video LTDA.

Blockbuster Video, Inc.

Blockbuster Video

Blockbuster Videos, Inc.

Blockbuster

Blockbuster Childrens Amusement

Corporation

Blockbuster Computer Systems Corporation

Blockbuster Promotions

Dish Network Service LLC

BNA U.S., Inc. BNA

(BNA) Bureau of National Affairs Inc.

BNA Realty Advisors

Brady, Jr., William H. Brady, Bill and Debbie

Brady, William W.

Brady, William H. [Estate of]

Brady, William J.

Brady, William

3

4819-2580-0464.1](https://image.slidesharecdn.com/10000001209-121112192812-phpapp01/85/10000001209-52-320.jpg)

![Firm Client, Adversary or Creditor or Party in Interest with

Otherwise Involved Similar Name

Braun, Paul D. and Helen T. Brun, Paul and Rebecca

Brook, Lawrence Brooks, Laurence and Meredith

Brooks, Larry J.

Brown M.D., Jeffrey A. Brown, Jeffery

Brown, Jeffrey F. & Ruby L.

Brown, Jeffrey S.

Brown, Jeff

Brown, Jeffrey E.

Brown, Jeffrey

Brown, Gerald G. and Brown, Janette B. Brown, Jerry

Brown, Geri

Brown, Jerry H. and Virginia A.

Brown, Jerry Z.

Brown, Jr., Gerald R.

Brown, Jerry R.

Brown, Gerald

Brown, Jr., Jerry

Brown, Jerry Windel

Brown, Jerry L.

Brown, Gerald, M.D.

Brown, Jerry, Sr.

Brown, Jerry

Brown, Gerald C.

Brown, Robert M. Brown, Robert and Mary

Brown, Robert, Irene

Brown, Robert

Brown, M.D., Robert W.

Brown, Robert S.

Brown, Robert Scot

Brown, Robert W.

Brown, Robert

Brown, William L. and Mary Ann

Mary Brown Testamentary Trust

Brown, Mary

Brown, Mary Lynn [M.D.]

Bryant, Debbie Bryant, T. Lynn & Debbie

Bushnell Engineering Bushnell Outdoor Products

Bushnell-Gage

BWAB Limited Liability Company BWAB Investments

Capital Bank and Trust Company Guardian Capital Advisors

Capital Guardian Trust Company

4

4819-2580-0464.1](https://image.slidesharecdn.com/10000001209-121112192812-phpapp01/85/10000001209-53-320.jpg)

![Firm Client, Adversary or Creditor or Party in Interest with

Otherwise Involved Similar Name

Capital Guardian Research Co.

Capital Guardian Trust

Caran Precision Engineering and Precision Small Engine Co. Inc.

Manufacturing Corp.

Precision Small Engine Controls

Petersen Precision Engineering Co.

Precision Engineered Products

Jordan Company LLC

Precision Engineering Industries, Inc.

Precision Measurement Engineering, Inc.

PME

Castellini, Robert H. Castellini, Robert and Susan

Cawley International The Cawley Company, Inc.

Charles D. Jones Charles D. Jones Co., Inc.

Charles Jones

Chase, Jonathan Chase, John and Cynthia

Chase, John

Chase, John Mitchell, as Executor of the

Estate of Donnie Hamilton Barden

Chase, Cynthia C., Estate of

Chase, William W. III and Cynthia

Citicorp [Shearman & Sterling] Shearman & Sterling

The Great Western Sugar Company

(Shearman & Sterling

Clark, James Clark, James and Martha

James Clark

Clay, Mary Clay, John and Mary

Cline, Mark E. Cline, Mark and Becky

Clube Maxi Vida Club Essential, Inc.

Cobra Golf, Inc. Cobra Puma Golf Inc.

Cohen, Al Cohen, Alan and Karen

Cohen, Alan H.

Cohen, Alan D.

5

4819-2580-0464.1](https://image.slidesharecdn.com/10000001209-121112192812-phpapp01/85/10000001209-54-320.jpg)

![Firm Client, Adversary or Creditor or Party in Interest with

Otherwise Involved Similar Name

Miller G. William Miller, Bill and Patricia

Miller, William A.

Miller, William Cantwell Trust

Miller, William D.

Miller, William S.

Miller, William Scott

Miller, William V., M.D. and Miller Jeanne

W.

William D. Miller 1992 Irrevocable Trust

Dated August 7, 1992

Miller, II, William Peter

Miller, William

Miller, Robert C. and Patricia A.

Miller, Patricia

Miller, Ronald G. Dr. Miller Amass, Ron and Dr. Amy

Miller, Ronald H.

Miller, Ronald K.

Miller, Thomas C. Miller, Thomas and Nancy

Miller, Thomas L.

Mueller, Thomas

Mueller, Thomas D.

Miller, Tom

Mueller, Nancy

Mueller, Richard M.D. Mueller, Richard & Rita

Mueller Trust, Richard O., U/W Helen L.

Mueller

Mueller, Richard O. [1978 Trust]

Mueller, Richard O., 1951 Trust

Mueller, Richard O.

Mulroy, Jr., Thomas R. and Elaine Mulroy, Thomas and Barbara

Thomas R. Mulroy Trusts

Mundy, Kathleen Mundy Hessler, Frederick and Kathi

Myers, Susan Myers, Norman and Suzanne

Neal, Ronald A. Neal, Ronald and Mary

Neal, Mary

Nelson, Julie A. Nelson, Obert & Julie

Norman, M.D., P.A., James Norma, Gail and Jim

Norman, Jim and Mearline

Norman, Jr., M.D., James G.

Norman, Gail

14

4819-2580-0464.1](https://image.slidesharecdn.com/10000001209-121112192812-phpapp01/85/10000001209-63-320.jpg)

![Firm Client, Adversary or Creditor or Party in Interest with

Otherwise Involved Similar Name

Peterson, Michael

Peterson, Mike

Pieper, Mark Pieper, John and Mart

Pieper, Esq., John

Polartec LLC Chrysalis Valuation Consultants LLC

Chrysalis Capital Partners, L.P.

Polo Fashions, Inc. Polo Ralph Lauren

Porter, Daniel [Mr. and Mrs.] Porter, Daniel and Monica

Porter, Daniel E.

Porter, Daniel

Potts, Robert A. Potts, Robert and Judy

Potts, Robert

Powers, Edward B. and Catherine Powers, Edward and Mary

Powers, E. James

Powers, E. Michael

Powers, Edward D.

Powers, Mary

Price Waterhouse – Office of Government PricewaterhouseCoopers LLP

Services

Price Waterhouse & Co.

Price Waterhouse & Company

Price Waterhouse Oakbrook PL

PwC Product Sales LLC

Pricewaterhousecoopers Juridico Y Fiscal,

S.L

Principle Financial Securities Inc. Principal Financial Group

UBS Principal Finance LLC

Apollo European Principal Finance Fund II

Principle Financial Services, Inc.

Rainey, Johnny Rainey, John and Anne

Red Sky Interactive Red Sky Ranch Golf Club

Reimer, Melissa and Robert Riemer, Robert and Stepheny

Richard's Automotive Consulting, Inc. Rich's Auto Body

Richards Automotive Services, Inc.

16

4819-2580-0464.1](https://image.slidesharecdn.com/10000001209-121112192812-phpapp01/85/10000001209-65-320.jpg)

![Firm Client, Adversary or Creditor or Party in Interest with

Otherwise Involved Similar Name

Rinaldi, Vincent and Anne

Rinaldi, Vincent

Roberts, Clarence M. and Ann Roberts, Anne

Nelson, James and Roberts, Annie V.

Roberts, Ann

Roberts, Annie V. [Estate of]

Robertson, Ronald Robertson, Ronald and Joann

Robertson, J.

Robinson, Miriam C. Robinson Bowen, Myriam

Rogers, James, Sr. Rogers, James and Mary Anne

Rogers, James

Rogers, James F., III, Esquire

Rogers, James P.

Rogers, Maryanne R.

Roman, Joanne Roman, Richard and Joni

Roman, Richard

Roman, Dr., Richard J.

Ross Edwards, Jane, Trust of Edwards, Stan and Jane

Sage Company Sage Software Inc.

Sage Realty Sage Construction Real Estate

Samuels, David G. and Elizabeth J. Samuels, David and Jan

Davis, Samuel

Schilling, Ellen Schilling, Richard and Eileen

Schmidt, John F. Schmidt, John and Meredith

Schmidt, Marilyn M. and John W.

Schmidt, John N.

Schmidt, John

Schmitt, Timothy P. Schmitt, Timothy and Susan

Schneider, Robert L. and Susan B. Schneider, Eric and Susan

Schneider, Susanne

Schwartz, Mark G. Schwartz, Mark and Wendy

Schwartz, Mark

Several companies and individuals with Ping Ping, Inc.

in the name

17

4819-2580-0464.1](https://image.slidesharecdn.com/10000001209-121112192812-phpapp01/85/10000001209-66-320.jpg)