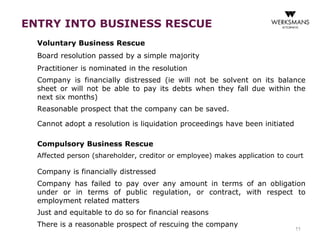

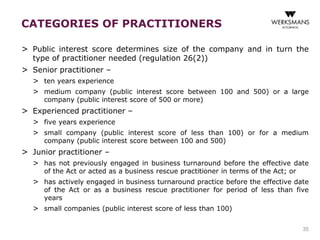

The document discusses the business rescue process introduced by the Companies Act 71 of 2008, which aims to rehabilitate financially distressed companies rather than liquidating them. Key features include temporary supervision by a business rescue practitioner, moratorium on claims, and the need for affected parties to be engaged in the rescue plan. It outlines the roles and responsibilities of directors, entry into business rescue, and the implications of debt and suretyships during the process.