The petitioning creditors, who are lenders under credit agreements with Allied Systems Holdings, Inc. and Allied Systems, Ltd. (L.P.), filed involuntary bankruptcy petitions against the companies. The petitioners state that events of default have occurred, including the failure to pay over $57 million in interest and principal to first lien lenders and $9.6 million in interest to second lien lenders over the past two years. The petitioners further allege that Yucaipa, which controls Allied, engaged in conduct to prevent the lenders from exercising their rights despite the defaults. The petitioners assert that Allied is insolvent and unable to pay its debts, and needs a bankruptcy restructuring.

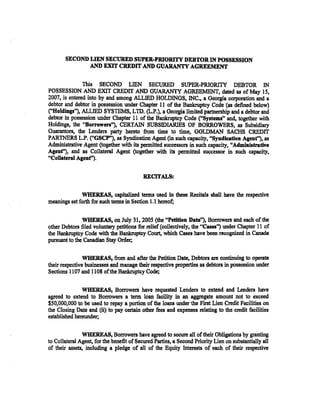

![UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

·------------------------------------------------------------------------------------------x

In re:

Chapter 11

ALLIED SYSTEMS HOLDINGS, INC.,

Case No. 12-'-[_ _,] (LJ)

Alleged Debtor.

--------------·---------------------------------------------------------------------------X

In re:

Chapter 11

ALLIED SYSTEMS, LTD. (L.P.),

Case No. 12-._[_ __,] (LJ)

Alleged Debtor.

·------------------------------------------------------------------------------------------x

STATEMENT OF PETITIONING CREDITORS IN SUPPORT

OF THE INVOLUNTARY CHAPTER 11 PETITIONS FILED AGAINST

ALLIED SYSTEMS HOLDINGS, INC. AND ALLIED SYSTEMS, LTD. (L.P.)

The Petitioning Creditors 1 are lenders (in such capacity, the "Lenders") under the Credit

Agreements (as defined below), and respectfully submit this statement (i) in support of the

involuntary chapter 11 petitions filed against Allied Systems Holdings, Inc. ("Allied") and

Allied Systems, Ltd., (L.P.) ("Allied Systems", collectively, the "Alleged Debtors"), and (ii) to

assist the Court and other parties-in-interest in understanding the circumstances that led to the

filing of these involuntary petitions.

INTRODUCTION

The Petitioning Creditors are Lenders under the Credit Agreements (defined below),

pursuant to which the Alleged Debtors obtained approximately $315 million in financing when

they emerged from Chapter 11 in 2007 under the control of Yucaipa American Alliance Fund I,

1

The Petitioning Creditors are BDCM Opportunity Fund II, LP, Black Diamond CLO 2005-1 Ltd., and Spectrum

Investment Partners, L.P.](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-1-320.jpg)

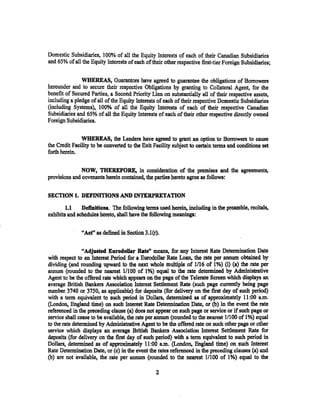

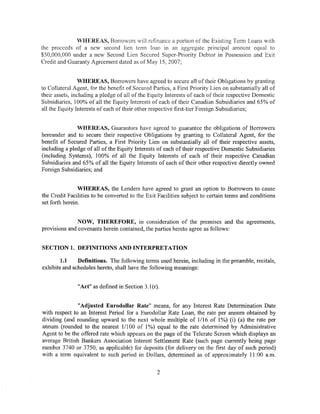

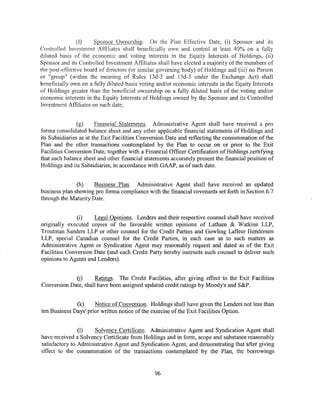

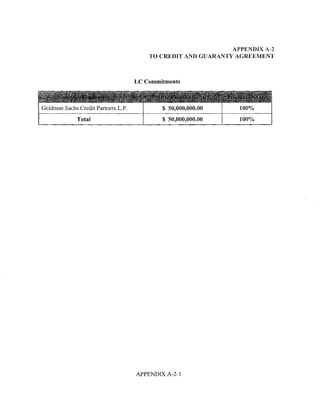

![APPENDICES: A-1 Term Loan Commitments

A-2 LC Commitments

A-3 Revolving Commitments

8 Notice Addresses

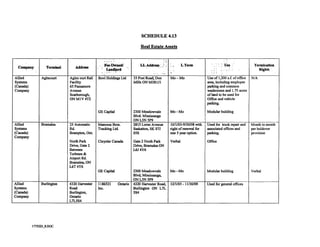

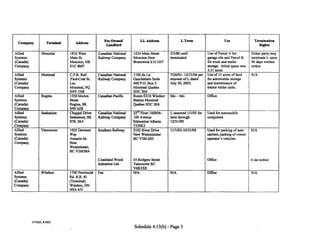

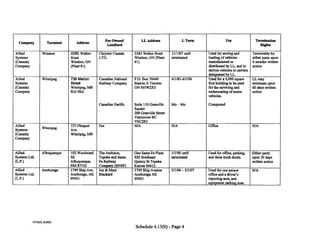

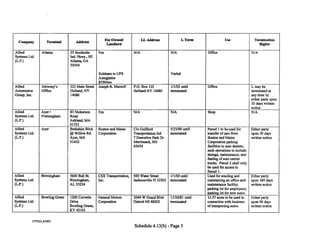

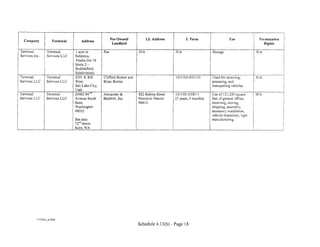

SCHEDULES: 4.1 Jurisdictions of Organization and Qualification

4.2 Equity Interests and Ownership

4.7 Contingent Liabilities

4.13 Real Estate Assets

4.16 Material Contracts

4.19 Employee Matters

4.20 Employee Benefit Plans

4.25 Post-petition Liens

6.1 Certain Indebtedness

6.2 Certain Liens

6.5 Certain Restrictions on Subsidiary Distributions

6.6 Certain Investments

6.8(a) Planned Asset Sales

6.8(b) Restructuring Asset Sales

6.11 Certain Affiliate Transactions

10.23 Post-Closing Actions

EXHIBITS: A-1 Funding Notice

A-2 Conversion/Continuation Notice

A-3 Issuance Notice

B-1 Term Loan Note

B-2 Revolving Loan Note

B-3 Swing Line Note

c Compliance Certificate

D [Intentionally Omitted]

E Assignment Agreement

F Certificate Re Non-bank Status

G-1 Closing Date Certificate

G-2 Solvency Certificate

H Counterpart Agreement

I Pledge and Security Agreement

J Mortgage

K Landlord Waiver and Consent Agreement

L Intercompany Note

M Interim Supplemental DIP Order

N Canadian Pledge and Security Agreement

0 Affirmation Agreement

v](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-24-320.jpg)

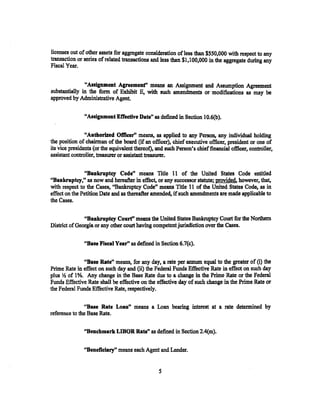

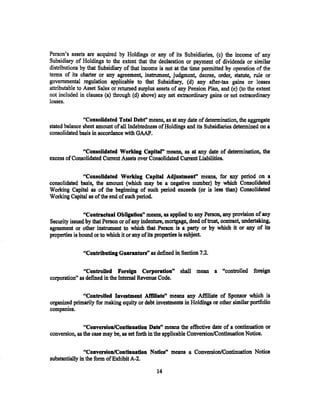

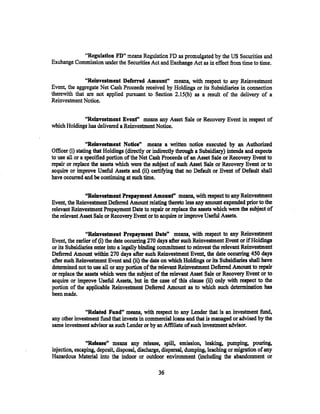

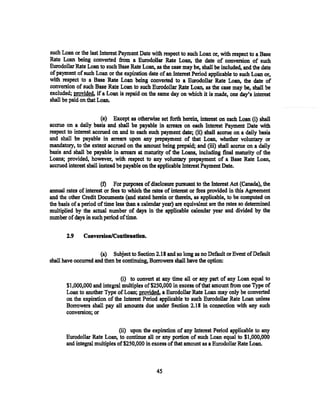

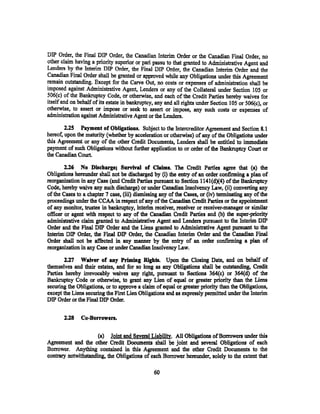

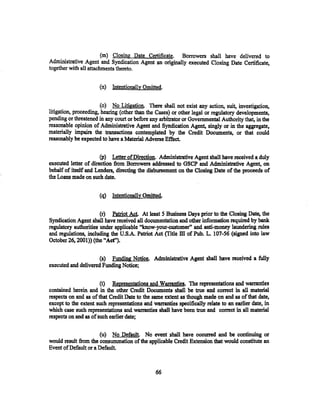

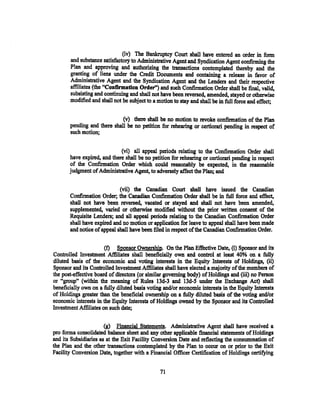

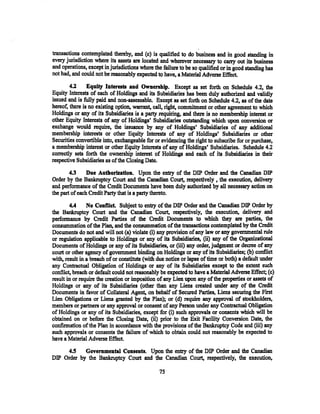

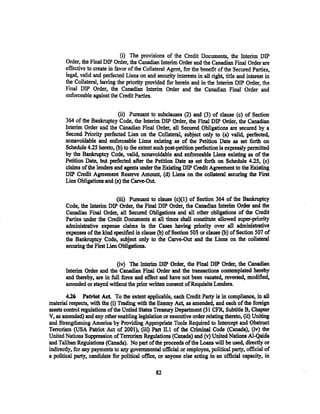

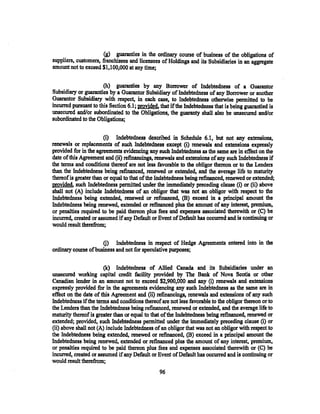

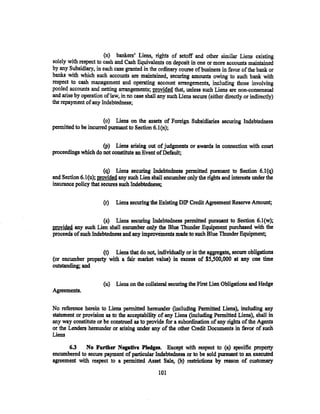

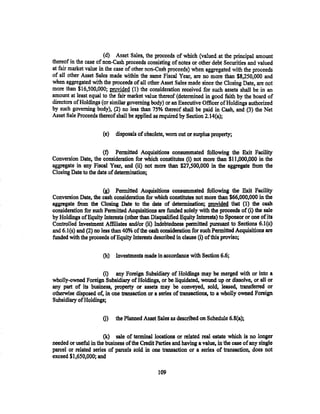

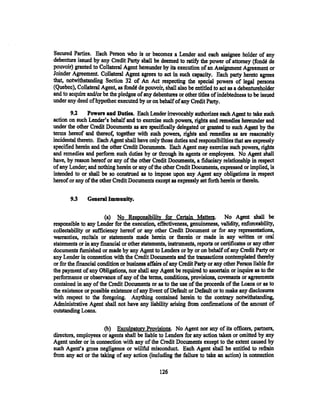

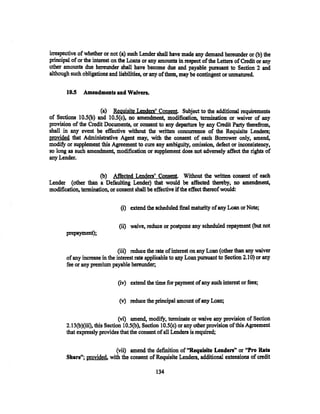

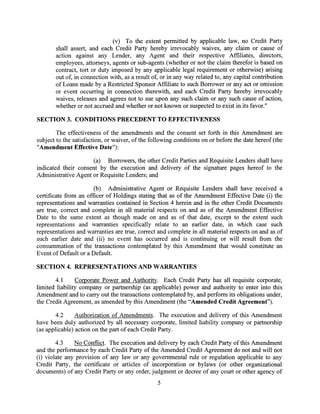

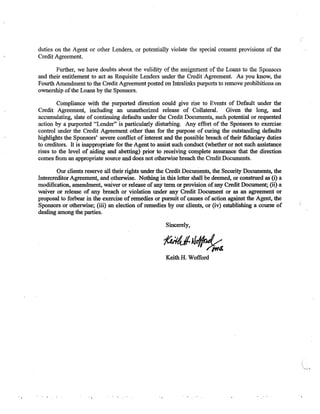

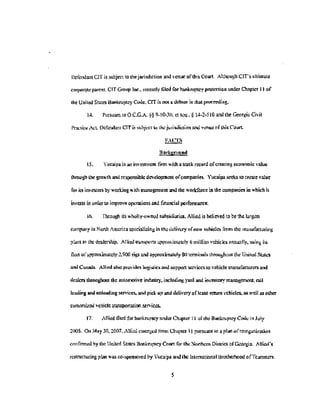

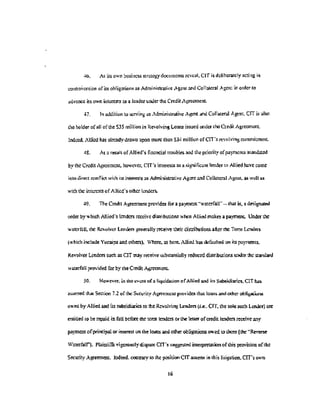

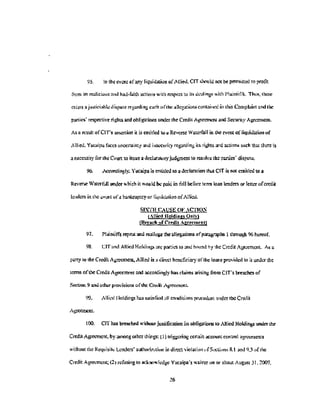

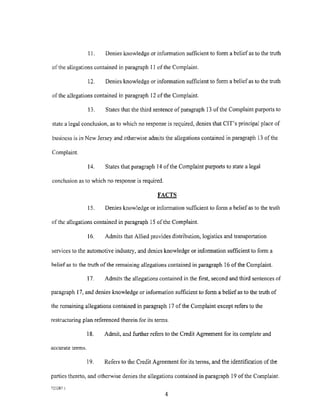

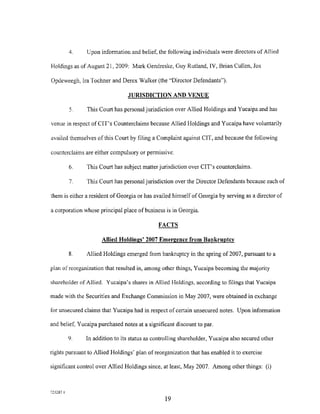

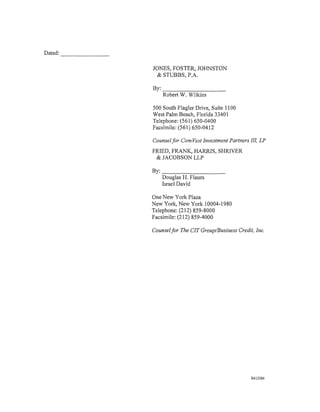

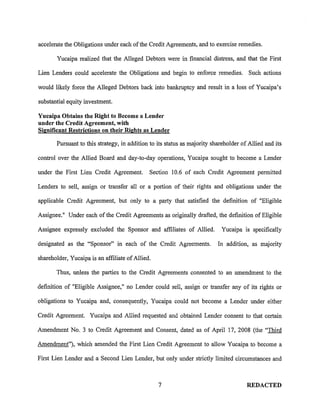

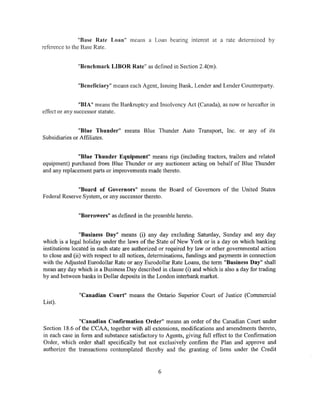

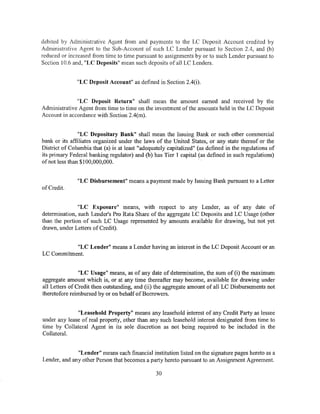

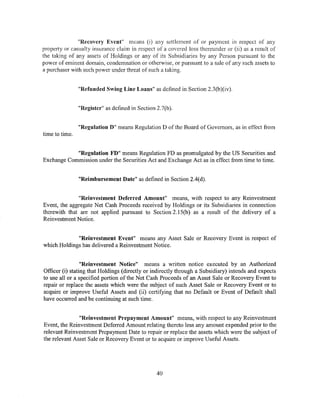

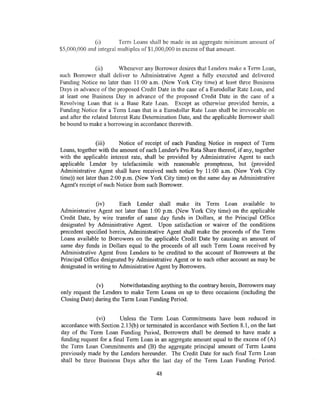

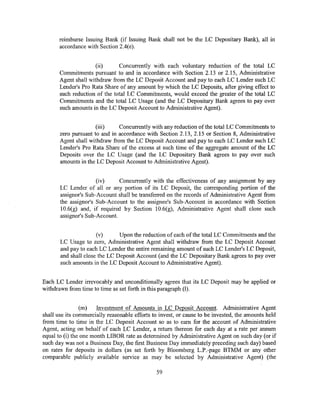

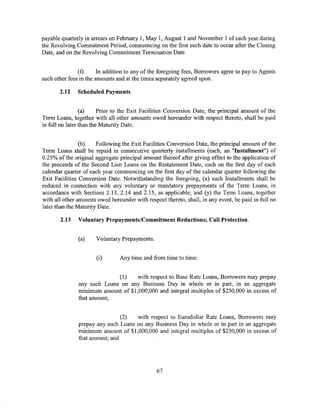

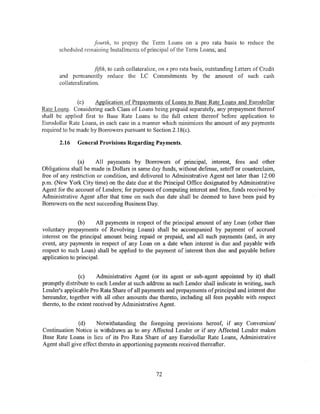

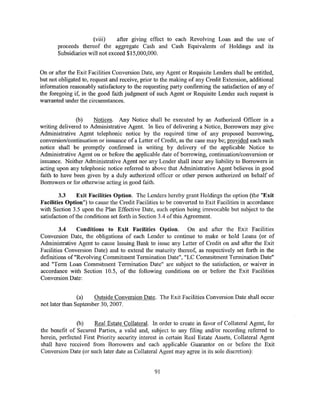

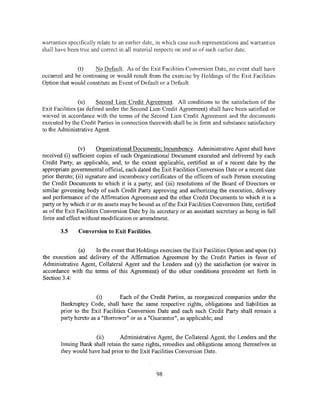

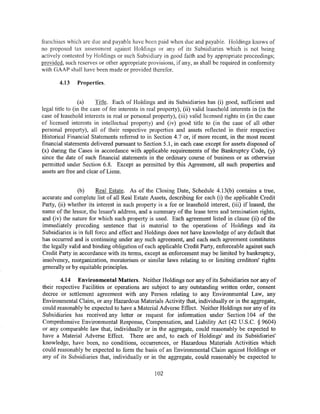

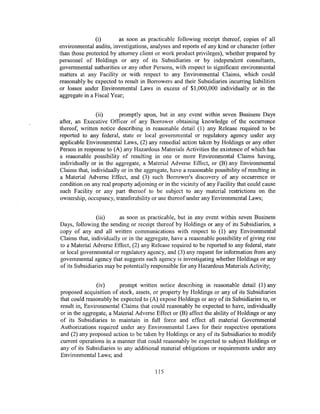

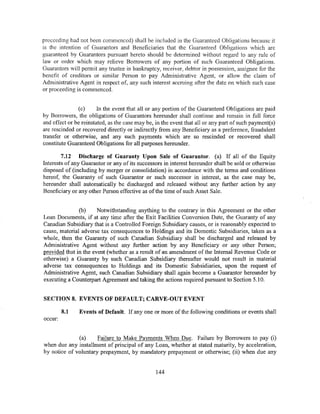

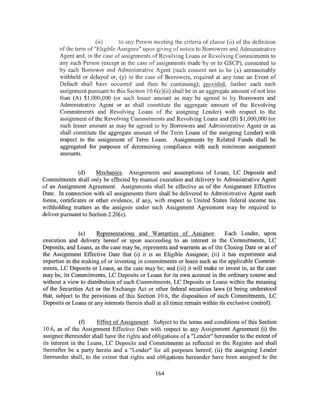

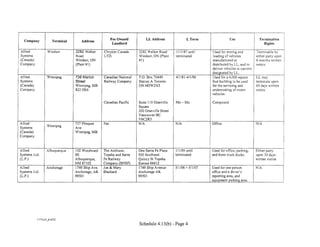

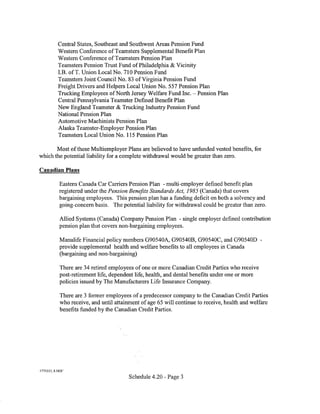

![December 31, 2010 < {){). 1 {){)

.J.VV.l.VV

Thereafter 3.50:1.00

(v) the Leverage Ratio on a pro forma basis after giving effect to such

acquisition as of the last day of the Fiscal Quarter most recently ended for

which financial statements have been delivered pursuant to Section 5.1(b)

or (c) (as determined in accordance with Section 6.7(e)) shall be no greater

than the correlative ratio indicated:

~1i~~n;~~ill~~]~~±~~2{J

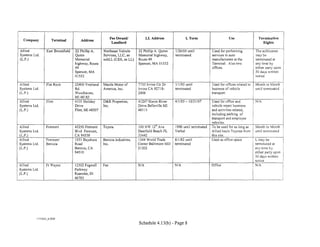

June 30, 2007 6.50:1.00

September 30, 2007 5.50:1.00

December 31, 2007 4.75:1.00

March 31, 2008 4.25:1.00

June 30, 2008 3.25:1.00

September 30, 2008 3.25:1.00

December 31,2008 3.25:1.00

March 31, 2009 3.00:1.00

June 30, 2009 3.00:1.00

September 30, 2009 3.00:1.00

December 31, 2009 3.00:1.00

March 31,2010 3.00:1.00

June 30, 2010 3.00:1.00

September 30,2010 3.00:1.00

December 31,2010 3.00:1.00

Thereafter 2.50:1.00

(vi) Holdings and its Subsidiaries shall be in compliance with the financial

covenants set forth in Section 6. 7 on a pro forma basis after giving effect

to such acquisition as of the last day of the Fiscal Quarter most recently

ended for which financial statements have been delivered pursuant to

Section 5.1(b) or (c) (as determined in accordance with Section 6.7(e));

(vii) for any proposed acquisition in excess of $5,000,000, Holdings shall have

delivered to Administrative Agent (A) at least 10 Business Days prior to

36](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-60-320.jpg)

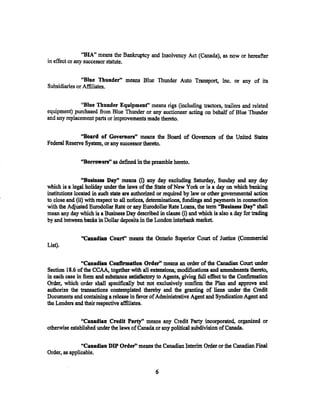

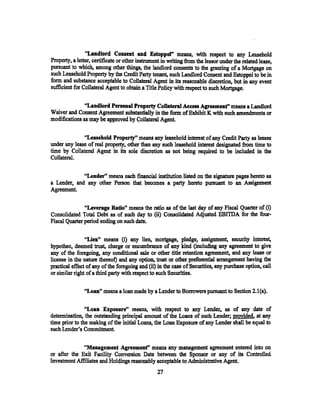

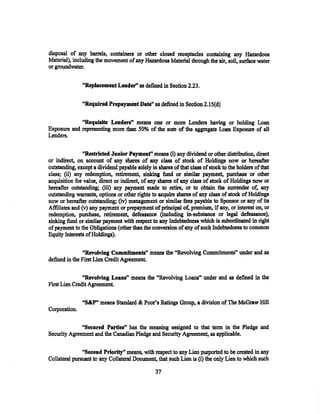

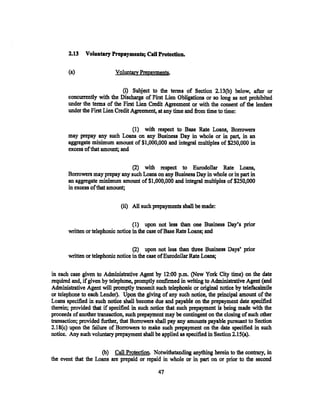

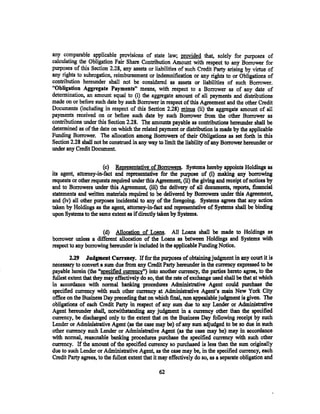

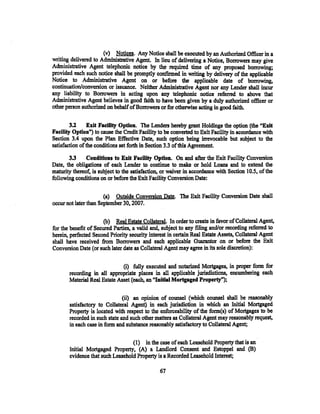

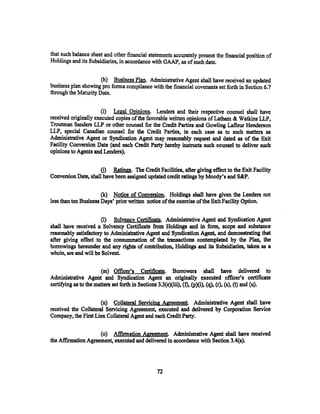

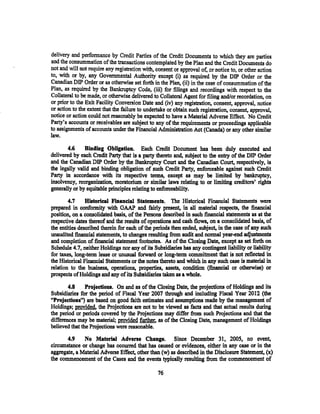

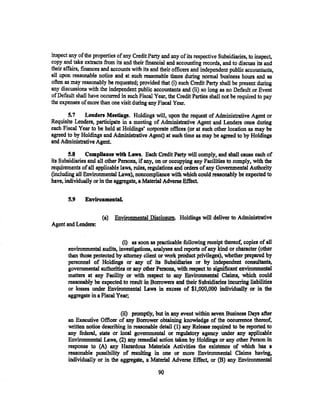

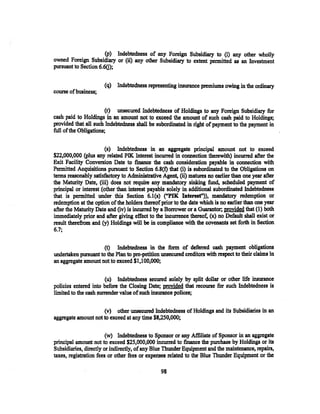

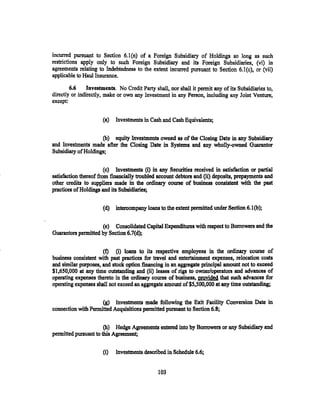

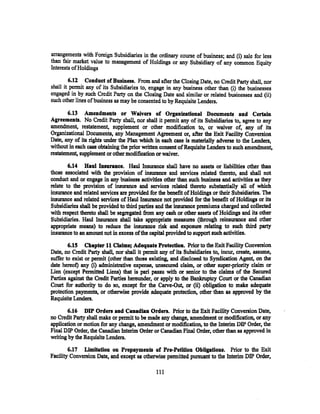

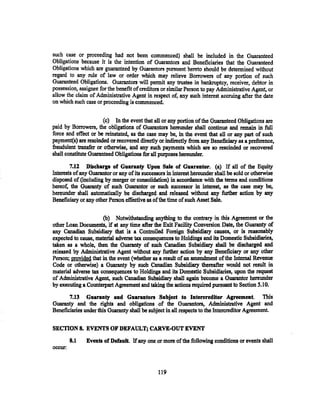

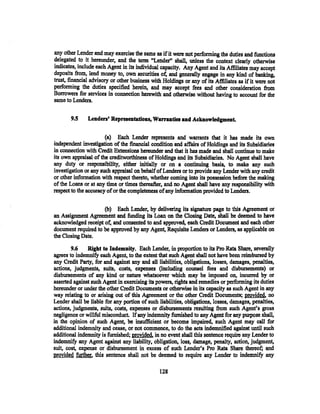

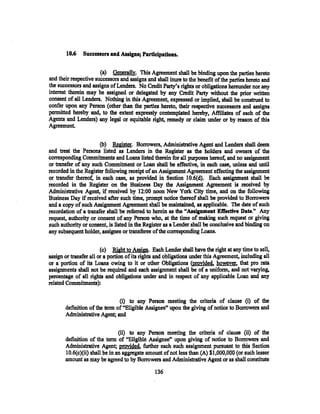

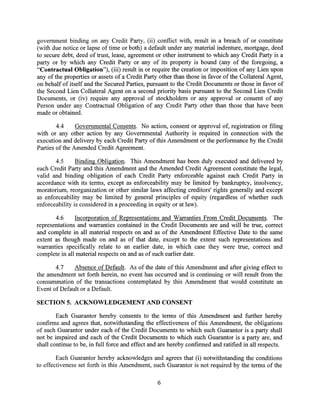

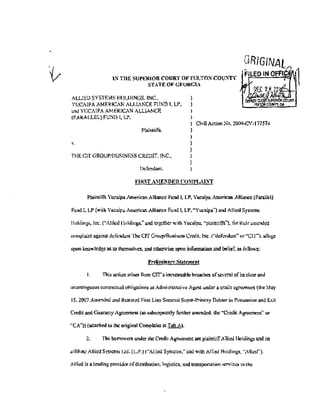

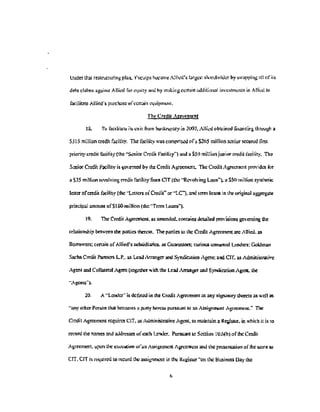

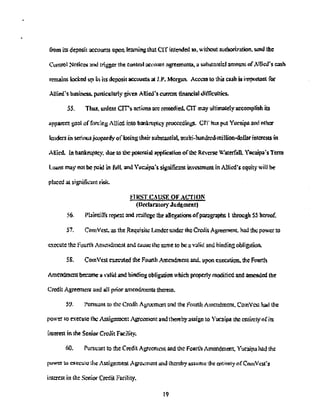

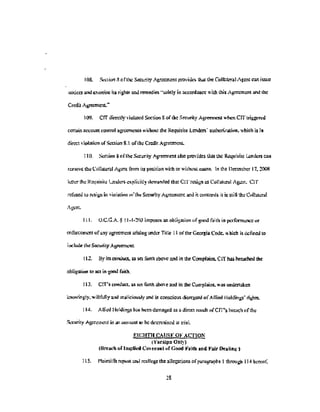

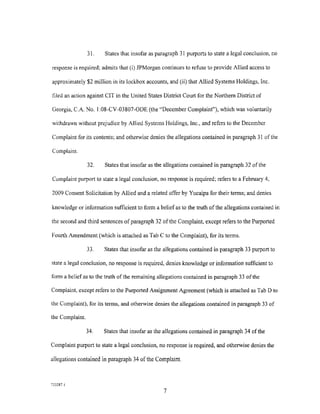

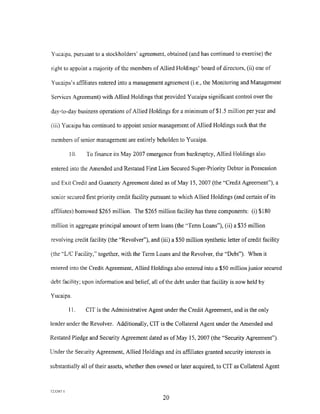

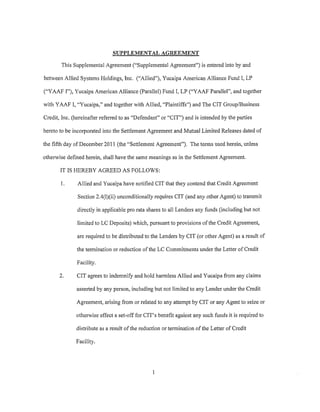

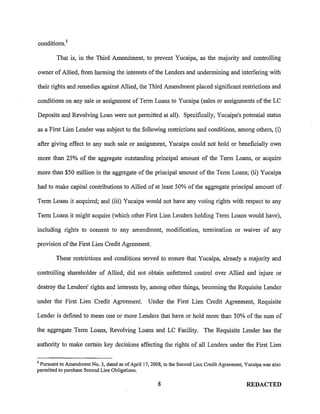

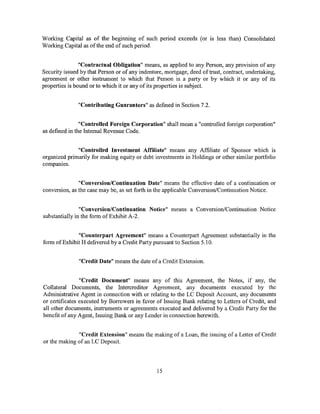

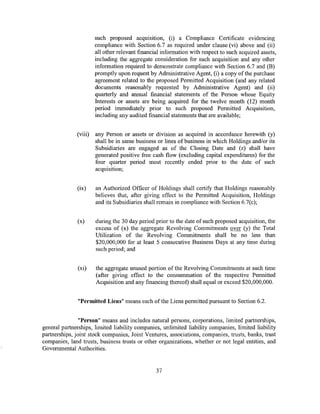

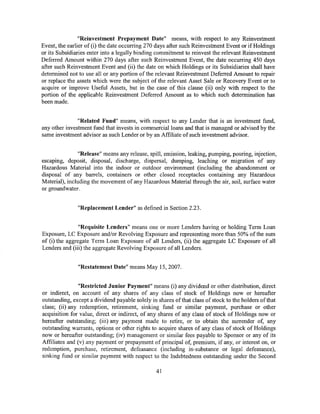

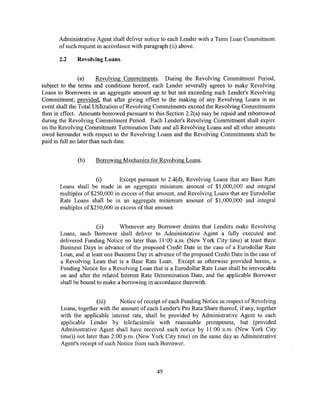

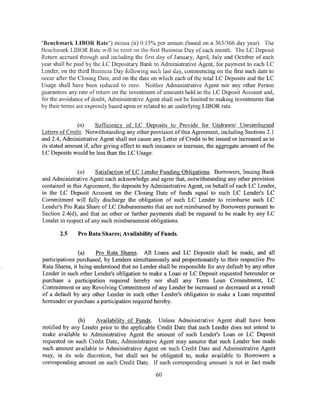

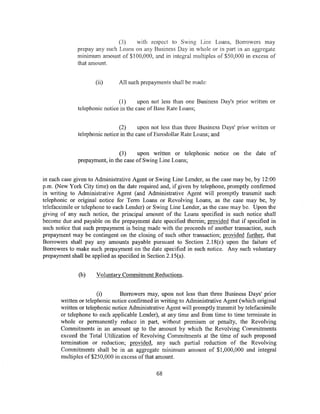

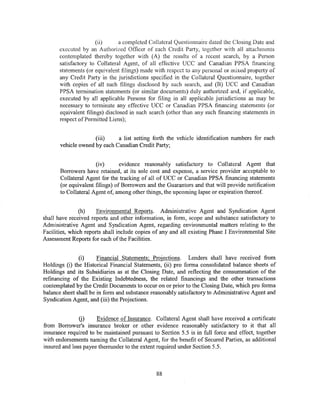

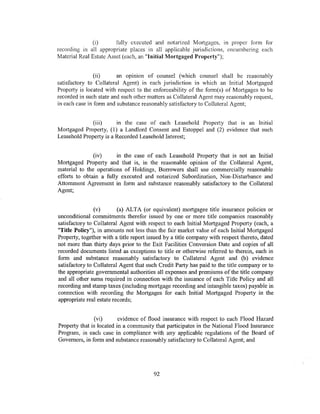

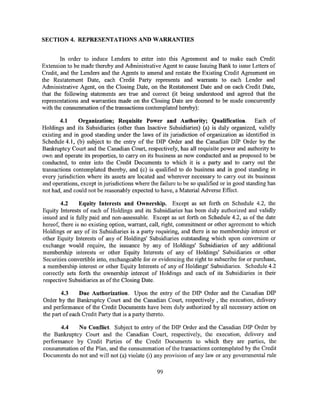

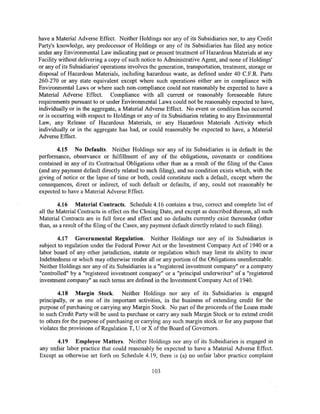

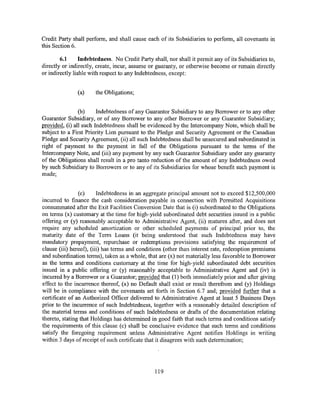

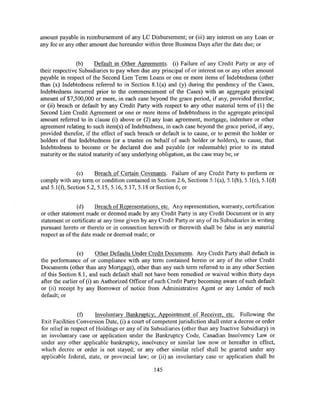

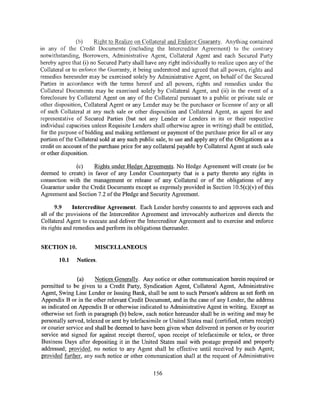

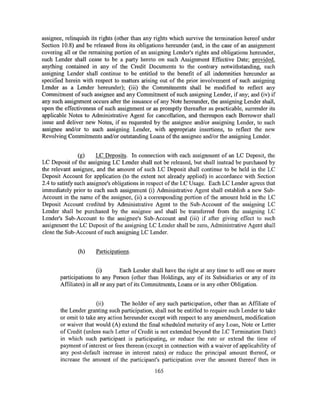

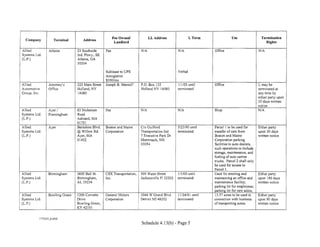

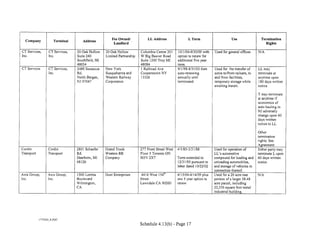

![March 31, 2008 4.50:1.00

June 30, 2008 3.50:1.00

September 30, 2008 3.50:1.00

December 31, 2008 3.50:1.00

March 31, 2009 3.25:1.00

June 30, 2009 3.25:1.00

September 30, 2009 3.25:1.00

December 31, 2009 3.25:1.00

March 31,2010 3.25:1.00

June 30,2010 3.25:1.00

September 30, 201 0 3.25:1.00

December 31,2010 3.25:1.00

Thereafter 2.75:1.00

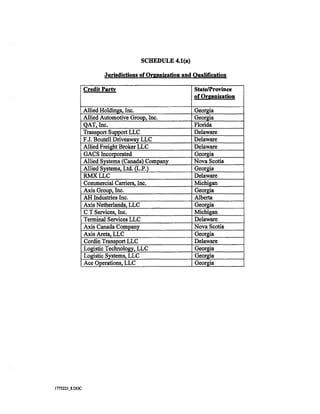

(c) Consolidated Adjusted EBITDA. Until the Exit Facilities Conversion

Date, permit Consolidated Adjusted EBITDA as of the end of any month, beginning with the

month ending March 30, 2007, for the twelve month period then ended to be less than the

correlative amount indicated:

[~]}~7E~,~~1J~lt~~i~~~f~~

March 2007 $46,000,000

April 2007 $43,000,000

May2007 $37,000,000

June 2007 $32,000,000

July 2007 $32,000,000

August 2007 $32,000,000

September 2007 $32,000,000

(d) Maximum Consolidated Capital Expenditures. Holdings shall not, and

shall not permit its Subsidiaries to, make or incur Consolidated Capital Expenditures in any

Fiscal Year indicated below, in an aggregate amount for Holdings and its Subsidiaries in excess

of the sum of (i) the corresponding amount set forth below opposite such Fiscal Year plus (ii)

cash proceeds from a capital contribution to, or Lhe issuance of any Equity Interest in, Holdings

received by Holdings during such Fiscal Year and not required to be applied to prepay Loans

pursuant to Section 2.14(b); provided that such proceeds are applied by Holdings no later than

six months after receipt thereof plus (iii) the Permitted Carry-Forward Amount; provided

however, that for purposes of this Section 6.7(d), if during any Fiscal Year (a "Base Fiscal

130](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-154-320.jpg)

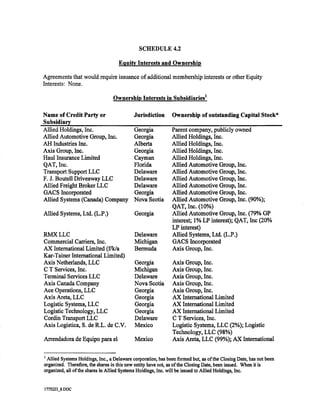

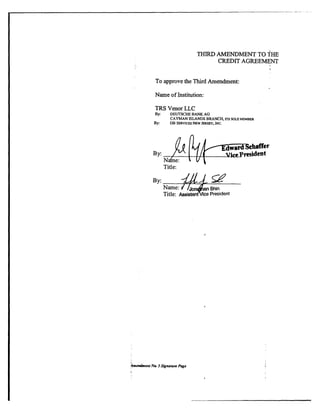

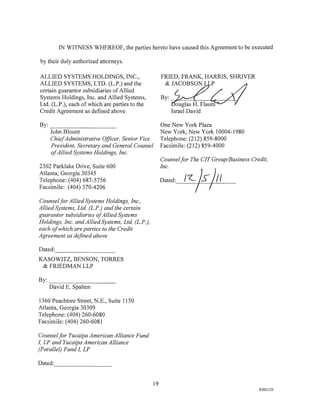

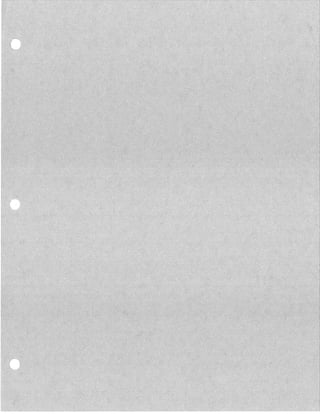

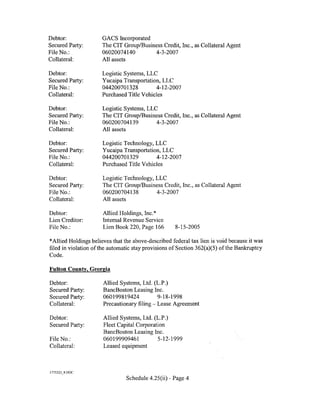

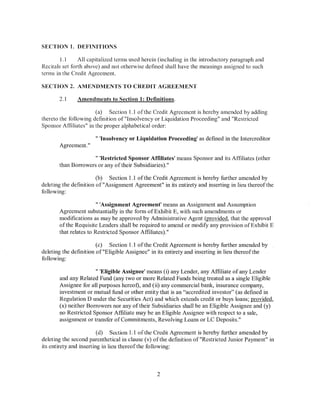

![Documents executed and delivered herewith do not constitute a novation, payment and

reborrowing or termination of the Obligations under the Existing Credit Agreement and the other

Credit Documents as in effect prior to the Restatement Date, (b) such Obligations are in all

respects continuing with only the terms being modified as provided in this Agreement and the

other Credit Documents, (c) the liens and security interests in favor of the Collateral Agent for

the benefit of the Secured Parties securing payment of such Obligations are in all respects

continuing and in full force and effect with respect to all Obligations and (d) all references in the

other Credit Documents to the Credit Agreement shall be deemed to refer without further

amendment to this Agreement.

(Remainder of page intentionally left blank]

173](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-197-320.jpg)

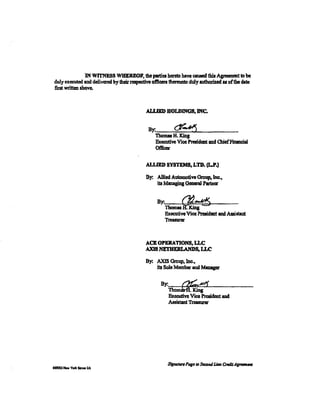

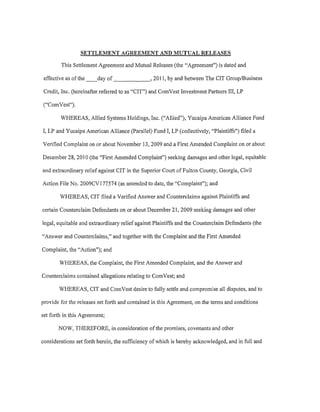

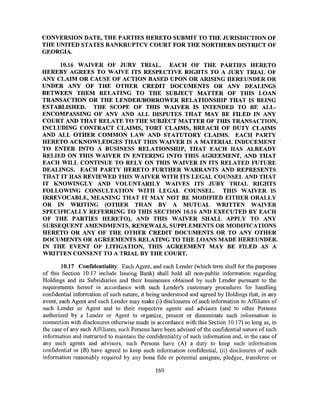

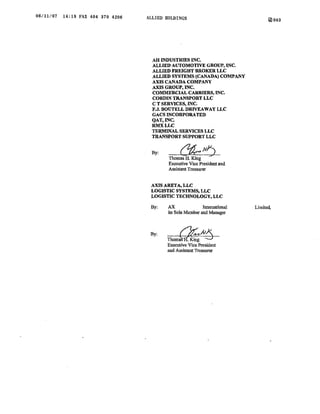

![IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly

executed and deiivcrcd by their respective officers thereunto duly authorized as of the date first

written above.

ALLIED HOLDINGS, INC.

By: &,~l!j

Thomas H. King

Executive Vice President and Chief Financial

Officer

ALLIED SYSTEMS, LTD. (L.P.)

By: Allied Automotive Group, Inc.,

its Managing General Partner

By: (]f~

Thomas H. King

Executive Vice President and Assistant

Treasurer

ACE OPERATIONS, LLC

AXIS NETHERLANDS, LLC

By: AXIS Group, Inc.,

its Sole Member and Manager

By: ~#~

Thomas H. King

Executive Vice President and

Assistant Treasurer

Signature Page to Amended and Restated First Lien Credit Agreement

12J5309·Ncw Yorlc Server 7A](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-198-320.jpg)

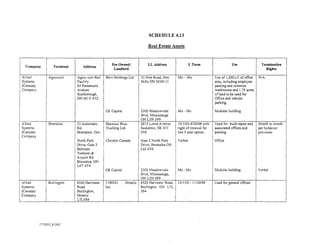

![APPENDIX A-1

TO CREDIT AND GUARANTY AGREEMENT

Term Loan Commitments

![~~B;{f]I1;~~~~F:;h~;~j}rJ21,~:~~~~,}~~:J1~·~~~'~f~~: '.:t~;:".:.Jt~

Goldman Sachs Credit Partners L.P. $180,000,000.00 100%

Total $180,000,000.00 1 100%

The term loans will be fully funded on the Restatement Date.

APPENDIX A-1-1](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-203-320.jpg)

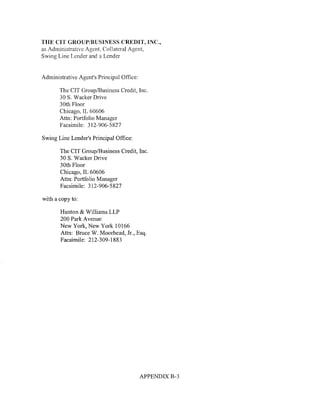

![APPENDIX A-3

TO CREDIT AND GUARANTY AGREEMENT

Revolving Commitments

~~~~t?ft';~~:~:Ji:~i·f .i~,:~l]~l~l~~~:;~i:~fr~~1~~,~:~~r~}t~t7;>~~~d~~~~~I;~~r~:~::~J':;;)~~::i~,2~,~~~~::~~::~~

The CIT Group/Business Credit, Inc. $ 35,000,000.00 100%

Total $ 35,000,000.00 100%

APPENDIX A-3-1](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-205-320.jpg)

![Administrative Agent of written or telephonic notification of such execution and

authorization of delivery thereof.

[The remainder ofthis page is intentionally left blank.]

9](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-271-320.jpg)

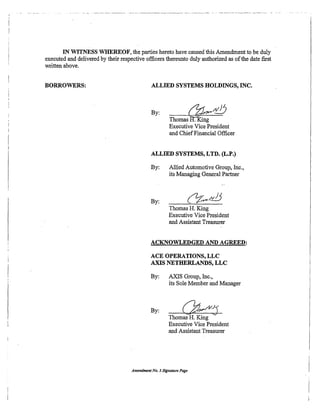

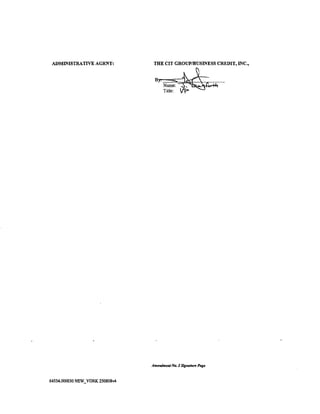

![IN fiTNESS "'HEREOF, the parties hereto have caused this Amendment to be duly

executed and delivered by their respective officers thereunto duly authorized a<> Of the date first

writien above. ·

BORROWERS: ALLlED HOLDINGS, INC.

By:

Thomas H. Kini

Executive Vice President

and Chief Financial Officer

ALLlED SYSTEMS, LTD. (L.P .)

By: Allied Automotive Group, Inc.,

its Managing General Partner

By:

Thomas H. King

Executive Vice President

and Assistant Treasurer

ACKNOWLEDGED AND AGREED:

ACE OPERATIONS, LLC

AXIS NETHERLANDS, LLC

By: AXlS Group, Inc.,

its Sole Member and Manager

By:

Thomas H. King

Executive Vice President

and Assistant Treasurer

]Sign:llurc J'<~ge- Limited Wai'Cr and Amendment No.1 to First l..ien Credit Agreement!](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-272-320.jpg)

![AS A LENDER:

By: ---f:_~~,----/L___-

Name.

Title.:

[First Lte11 Limited Waiver and Amendment]](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-275-320.jpg)

![THEREOF (OTHER THAN SECTION 5--1401 AND 5--1402 OF THE NEW YORK GENERAL

OBLIGATIONS LAW).

G. Counterparts. This Amendment may be executed in any number of

counterparts, each of which when so executed and delivered shall be deemed an original, but all such

counterparts together shall constitute but one and the same instrument As set forth herein, this

Amendment shall become effective upon the execution of a counterpart hereof by each of the parties

hereto and receipt by Administrative Agent of written or telephonic notification of such execution and

authorization of delivery thereof.

[The remainder ofthis page is intentionally left blank.]

6](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-281-320.jpg)

![in form and substance reasonably acceptable to Administrative Agent acknowledging the

irrevocable prepayment, termination, extinguishment and cancellation of such Term

Loans and confirming that such Borrower has no rights as a Lender under the Credit

Documents or otherwise.

(iv) As soon as practicable after a Borrower's acquisition of Term

Loans from a Restricted Sponsor Affiliate in accordance with this Section 10.6(k), such

Borrower shall take all actions necessary to cause such Term Loans to be extinguished or

otherwise cancelled in its books and records in accordance with GAAP.

(v) To the extent permitted by applicable law, no Credit Party

shall assert, and each Credit Party hereby irrevocably waives, any claim or cause of

action against any Lender, any Agent and their respective Affiliates, directors,

employees, attorneys, agents or sub-agents (whether or not the claim therefor is based on

contract, tort or duty imposed by any applicable legal requirement or otherwise) arising

out of, in connection with, as a result of, or in any way related to, any capital contribution

of Term Loans made by a Restricted Sponsor Affiliate to such Borrower or any act or

omission or event occurring in connection therewith, and each Credit Party hereby

irrevocably waives, releases and agrees not to sue upon any such claim or any such cause

of action, whether or not accrued and whether or not known or suspected to exist in its

favor.."

2.8 Amendments to Exhibits.

(a) Exhibit E to the Credit Agreement (Assignment and Assumption

Agreement) is hereby amended by deleting the heading of Section 1 in its entirety and inserting

in lieu thereofthe following:

"1. Representations and Warranties; Covenants."

(b) Exhibit E to the Credit Agreement (Assignment and Assumption

Agreement) is hereby further amended by deleting Section 1.1 ofthe Standard Terms and

Conditions for Assignment and Assumption Agreement in its entirety and inserting in lieu

thereofthe following:

"1.1 Assignor. The Assignor (a) represents and warrants that (i) it is the

legal and beneficial owner of the Assigned Interest, (ii) the Assigned Interest is free and

clear of any lien, encumbrance or other adverse claim[,)[ and] (iii) it has full power and

authority, and has taken all action necessary, to execute and deliver this Assignment and

to consummate the transactions contemplated hereby [and it is not in possession of any

information with respect to Borrowers, their Affiliates or the Obligations that (A) has not

been disclosed by or on behalf of Borrowers to the Lenders generally or otherwise been

posted to that portion of the Platform designated for "private-side" Lenders and (B) could

have a Material Adverse Effect or otherwise be material to a decision by a Person to

purchase the Loans or a participation interest therein] 1; (b) assumes no responsibility with

To be added only if Assignor is a Restricted Sponsor Affiliate.

9](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-294-320.jpg)

![respect to (i) any statements, warranties or representations made in or in connection with

any Credit Document, (1i) the execution, legality, validity, enforceability, genuineness,

sufficiency or value of the Credit Agreement or any other instrument or document

delivered pursuant thereto, other than this Assignment (herein collectively the "Credit

Documents"), or any collateral thereunder, (iii) the financial condition of the Borrower,

any of its Subsidiaries or Affiliates or any other Person obligated in respect of any Credit

Document or (iv) the performance or observance by the Borrower, any of its Subsidiaries

or Affiliates or any other Person of any of their respective obligations under any Credit

Document[; and (c) agrees that ifthe Assignee sells and assigns all or a portion ofthe

Assigned Interest to any Person, the Assignee may, in its sole discretion, disclose to any

2

such Person that the Assignee acquired the Assigned Interest from the Assignor.] "

(c) Exhibit E to the Credit Agreement (Assignment and Assumption

Agreement) is hereby further amended by deleting Section 1.2 ofthe Standard Terms and

Conditions for Assignment and Assumption Agreement in its entirety and inserting in lieu

thereofthe following:

"1.2 Assignee. (I) The Assignee (a) represents and warrants that (i) it

has full power and authority, and has taken all action necessary, to execute and deliver

this Assignment and to consummate the transactions contemplated hereby and to become

a Lender under the Credit Agreement, (ii) it meets all requirements of an Eligible

Assignee under the Credit Agreement, (iii) from and after the Effective Date, it shall be

bound by the provisions of the Credit Agreement and, to the extent of the Assigned

Interest, shall have the obligations of a Lender thereunder, (iv) it has received a copy of

the Credit Agreement and such other documents and information as it has deemed

appropriate to make its own credit analysis and decision to enter into this Assignment and

to purchase the Assigned Interest on the basis of which it has made such analysis and

decision[,] [ and] (v) if it is a Non-US Lender, attached to the Assignment is any

documentation required to be delivered by it pursuant to the terms of the Credit

Agreement, duly completed and executed by the Assignee[, (vi) it is not in possession of

any information with respect to Borrowers, their Affiliates or the Obligations that (A) has

not been disclosed by or on behalf of Borrowers to the Lenders generally or otherwise

been posted to that portion of the Platform designated for "private-side" Lenders and (B)

could have a Material Adverse Effect or otherwise be material to a decision by a Person

to sell the Loans or a participation interest therein, (vii) immediately prior to and after

giving effect to the assignment of Term Loans contemplated by this Assignment, the

aggregate amount of the Term Loan Exposure held or beneficially owned by all

Restricted Sponsor Affiliates does not and will not exceed 25% of the aggregate amount

of Term Loan Exposure held or beneficially owned by all Lenders (including Restricted

Sponsor Affiliates) and (viii) after giving effect to such assignment or transfer of Term

Loans to the Restricted Sponsor Affiliate, the aggregate principal amount of Term Loans

acquired by all Restricted Sponsor Affiliates since the Closing Date would not exceed

$50 million (notwithstanding whether all or any portion of such acquired Term Loans

To be added only if Assignor is a Restricted Sponsor Affiliate.

10](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-295-320.jpg)

![have been contributed to Borrowers or otherwise disposed of by the Restricted Sponsor

Affiliates on or prior to the Effective Date)] 3 ; [and] (b) agrees that (i) it will,

independently and without reliance on the Administrative Agent, the Assignor or any

other Lender, and based on such documents and information as it shall deem appropriate

at that time, continue to make its own credit decisions in taking or not taking action under

the Credit Documents, [and] (ii) it will perform in accordance with their terms all of the

obligations which by the terms of the Credit Documents are required to be performed by

it as a Lender[.][, (iii) (w) notwithstanding anything in the Credit Agreement to the

contrary other than Section 10.6(k) ofthe Credit Agreement, it shall not sell, assign,

contribute, transfer or otherwise convey all or a portion of its rights and obligations as a

Lender to Borrowers or their Subsidiaries, (x) notwithstanding anything in the Credit

Agreement to the contrary (including, without limitation, Section 5.7 ofthe Credit

Agreement), it shall not attend or otherwise participate in any conference calls or

meetings between (A) Agents and/or Lenders, on the one hand, and Borrowers or any

Affiliate of Borrowers, on the other hand, or (B) and among Agents and/or Lenders, in

each case, unless consented to by Administrative Agent or Requisite Lenders, (y) it shall

not disclose any information it receives in its capacity as a Lender to Borrowers or to any

Affiliate of Borrowers, and (z) Lenders, Agents and their respective officers, partners,

directors, employees or agents shall not be liable to such Restricted Sponsor Affiliate (in

its capacity as a Lender or otherwise) for any action taken or omitted by any Lender or

Agent under or in connection with any ofthe Credit Documents; and (c) acknowledges

and agrees that prior to the Effective Date, the Assignor may have disclosed to any

Person that sold and assigned all or any portion of the Assigned Interest to the Assignor

that the Assignor intended to sell all or a portion of the Assigned Interest to the

Assignee. ]4

[(II) The Assignee further represents and warrants that after giving effect

to such assignment or transfer of Term Loans to the Restricted Sponsor Affiliate, the

aggregate principal amount of Term Loans acquired by all Restricted Sponsor Affiliates

since the Closing Date is$[ ]]. 5"

To be added only if Assignee is a Restricted Sponsor Affiliate.

4

To be added only if Assignee is a Restricted Sponsor Affiliate.

To be added only if Assignee is a Restricted Sponsor Affiliate.

11](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-296-320.jpg)

![Agreement, and each reference in the other Credit Documents to the "Credit Agreement",

"thereunder", "thereof', "therein" or words of like import referring to the Credit Agreement shall

mean and be a reference to the Amended Credit Agreement.

7.4 Fees and Expenses. The Credit Parties acknowledge that all costs, fees and

expenses as described in Section 10.2 and Section 10.3 ofthe Credit Agreement incurred by

Administrative Agent, Collateral Agent and Arranger and their respective counsel with respect to

this Amendment and the documents and transactions contemplated hereby shall be for the

account ofBorrowers.

7.5 Headings. Section headings herein are included herein for convenience of

reference only and shall not constitute a part hereof for any other purpose or be given any

substantive effect.

7.6 APPLICABLE LAW. THIS AMENDMENT AND THE RIGHTS AND

OBLIGATIONS OF THE PARTIES HEREUNDER SHALL BE GOVERNED BY, AND

SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH, THE LAWS

OF THE STATE OF NEW YORK WITHOUT REGARD TO CONFLICT OF LAWS

PRINCIPLES THEREOF (OTHER THAN SECTION 5-1401 AND 5-1402 OF THE NEW

YORK GENERAL OBLIGATIONS LAW).

7. 7 Counterparts. This Amendment may be executed in any number of counterparts,

each of which when so executed and delivered shall be deemed an original, but all such

counterparts together shall constitute but one and the same instrument. As set forth herein, this

Amendment shall become effective upon the execution of a counterpart hereof by each of the

parties hereto and receipt by Administrative Agent of written or telephonic notification of such

execution and authorization of delivery thereof.

[The remainder of this page is intentionally left blank.]

15](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-300-320.jpg)

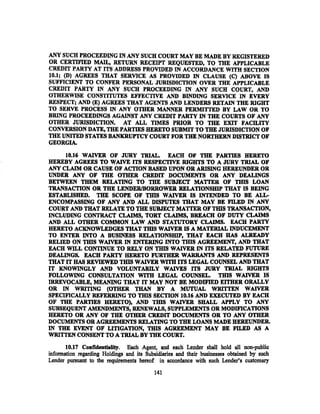

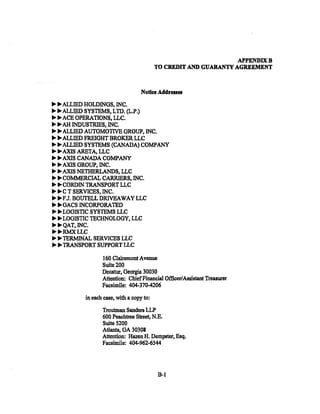

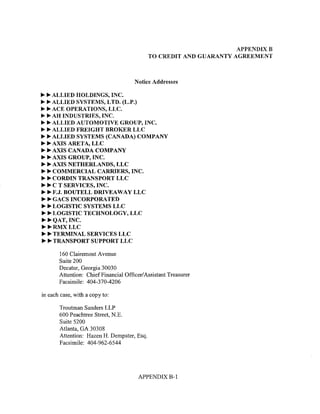

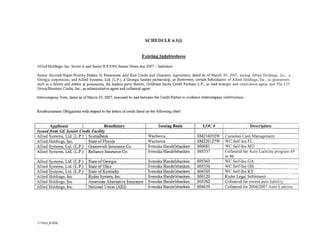

![APPENDICES: A Commitments

B Notice Addresses

SCHEDULES:

4.1 Jurisdictions of Organization and Qualification

4.2 Equity Interests and Ownership

4. 7 Contingent Liabilities

4.13 Real Estate Assets

4.16 Material Contracts

4.19 Employee Matters

4.20 Employee Benefit Plans

4.25 Post-petition Liens

6.1 Certain Indebtedness

6.2 Certain Liens

6.5 Certain Restrictions on Subsidiary Distributions

6.6 Certain Investments

6.8(a) Planned Asset Sales

6.8(b) Restructuring Asset Sales

6.11 Certain Affiliate Transactions

10.23 Post-Closing Actions

EXIDBITS: A-1 Funding Notice

A-2 Conversion/Continuation Notice

B Note

C Compliance Certificate

D [Intentionally Omitted]

E Assignment Agreement

F Certificate Re Non-bank Status

G-1 Closing Date Certificate

G-2 Solvency Certificate

H Counterpart Agreement

I Pledge and Security Agreement

J Mortgage

K Landlord Waiver and Consent Agreement

L Intercompany Note

M Interim DIP Order

N Canadian Pledge and Security Agreement

0 Affirmation Agreement

v](https://image.slidesharecdn.com/10000000009-121112185955-phpapp02/85/10000000009-310-320.jpg)