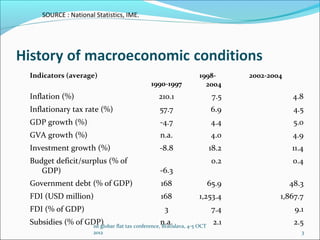

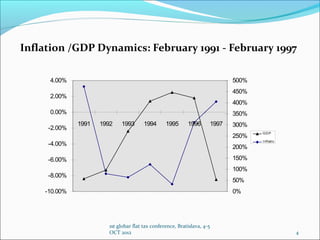

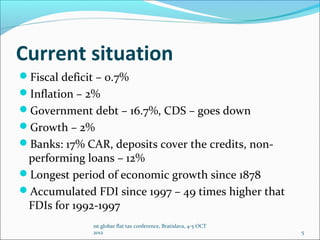

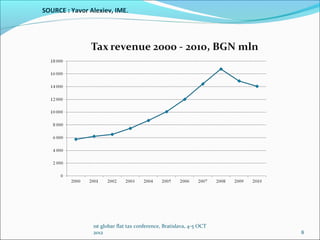

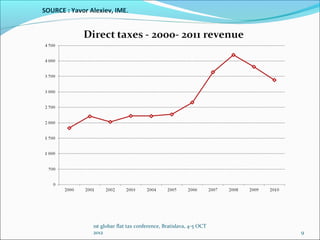

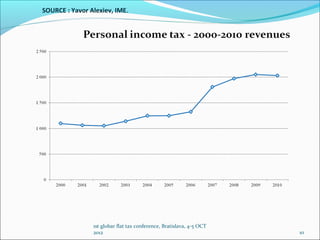

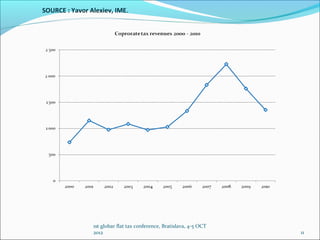

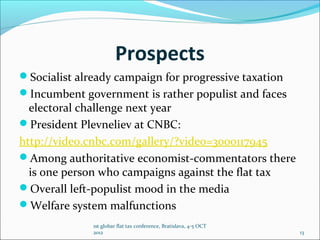

Dr. Krassen Stanchev presented on Bulgaria's flat tax reforms from 1990 to present day. After an economic crisis in the 1990s, Bulgaria implemented tax reforms starting in the 2000s, gradually lowering corporate and income tax rates to a flat 10%. This led to indicators like inflation, GDP growth, investment, and FDI increasing substantially from the 1990s to 2000s. However, there are still domestic challenges like unfinished reforms and expenditure pressures. There is also some populist opposition emerging to Bulgaria's flat tax system.