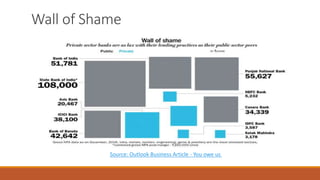

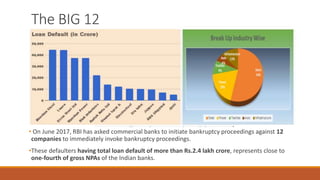

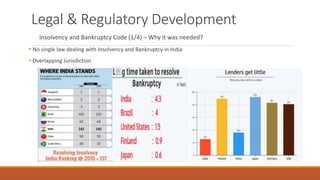

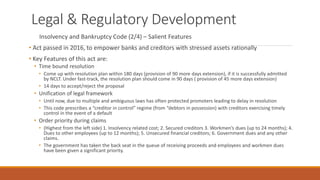

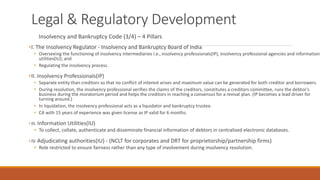

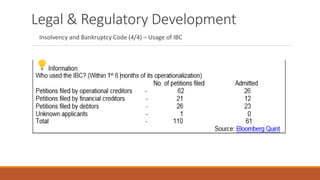

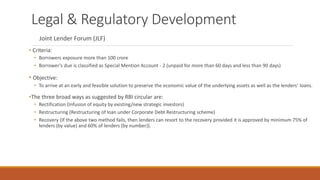

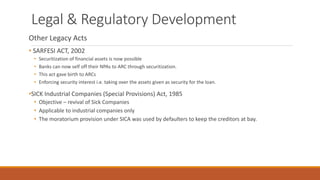

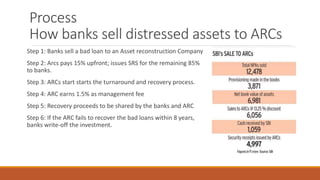

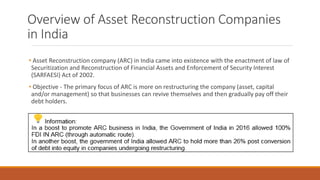

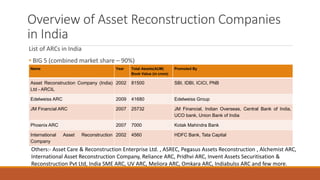

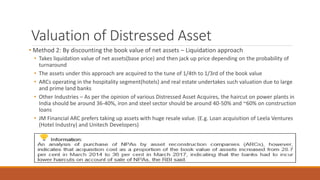

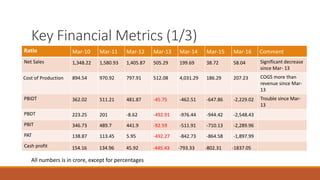

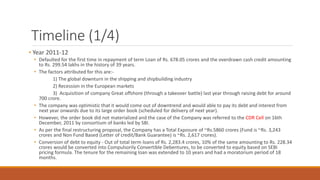

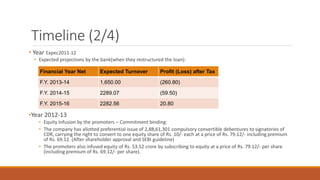

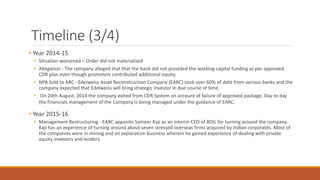

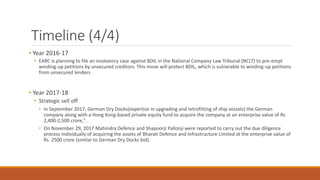

The document discusses the prevalence of distressed assets in the Indian banking sector, highlighting that more than INR 10 trillion in stressed assets pose a significant risk to banks, particularly public sector banks. It details the legal framework established by the Insolvency and Bankruptcy Code (IBC) to address these issues, including the roles of asset reconstruction companies (ARCs) and various regulatory developments aimed at managing non-performing assets. Additionally, the document presents a case study of Bharat Defence and Infrastructure Limited, illustrating financial challenges and the impact of market conditions on debt repayment.