The document discusses the Insolvency and Bankruptcy Code (I&BC) of India and its potential impact. It notes that previous schemes for restructuring stressed assets and reviving sick companies were largely unsuccessful. The I&BC aims to expedite the recovery process within strict timelines of 180 days, appointing resolution professionals to manage proceedings. If no resolution is found, companies will go into liquidation. The code overhauls previous recovery and insolvency laws, consolidating processes in the National Company Law Tribunal to potentially reduce recovery time and costs compared to other countries.

![Therefore all in all the existing Rehabilitation and Recovery provisions did not lead to the desired

results .It will be apparent that the chronic problem needed a dynamic solution to reign in the existing

NPA’s and a deterrent to avoid further wilful defaults and new NPA’s . The I&BC 2016 has been brought

with great hope of speeding up the recovery in a time bound manner.

It is pertinent to note that several acts have been replaced or amended to make Insolvency &

Bankruptcy Code 2016 an effective tool. These are outlined in brief below :

1. SICA stand repealed with effect from 1st

December 2016 vide notification dated 25 November

2016. Accordingly ,proceedings in appx 1200 cases at various stages will abate and be referred

to under I&BC under a fresh application.

2. The provisions relating to Revival & Rehabilitation contained in Chapter XIX of Companies

Act 2013 [ sections 253 to 269 ] stand omitted .

3. The provision of winding up for failure to pay “debts”in Section 271 of companies Act 2013

are omitted . Consequently, failure in payment of debts by corporate will be dealt with under

I&BC rather than High Courts. There are appx 4500 cases pending in High Courts which are in

pre-order stage. A notification provides that such cases will stand transferred to NCLT under

the I&BC .

4. The provisions relating to winding up of LLP for failure to pay “debts”in Section 64 of LLP Act

2008 are omitted. Consequently, failure in payment of debts by LLPs will be dealt with under

I& BC.

5. Debt Recovery Tribunals established under The Recovery of Debts Due to Banks and Financial

Institutions Act 1993 would continue to operate and Banks and Financial Institutions can still

approach them in case of Defaults . However, Banks and Financial Institutions can start the

Insolvency procedure under the I&BC by withdrawing the application filed before the NCLT.

6. SARFAESI provisions are not disturbed and Banks and FI can still resort to this Act and taking

possession and selling. However, Banks and FI are eligible to apply under I& BC . On their

application being accepted there will be a moratorium of 180 days on the SARFAESI

proceedings .The recovery will be as per the procedure of I&BC.

Before we look at the highlights of the I&BC which is today looking to be one of the big game changer

for Recovery of NPAs of Banks and Financial Institutions and also of all creditors in general we may

look at what were the objectives in making of this code. The Bankruptcy Law Reform committee laid

down 3 objectives:

1.Low Time to Resolution

2.Low loss in Recovery

3.Higher levels of Debt Financing across a wide variety of Debt instruments.

The committee noted that it took an average 4 years in India to resolve insolvency as compared to

0.8 years in Singapore and 1 Year in London. The committee also noted that creditors, in India

,recover about 25% as against 80%-90% elsewhere making it one of the Lowest Recovery Rate in the

World.](https://image.slidesharecdn.com/article-171102092922/75/INSOLVENCY-BANKRUPTCY-CODE-A-GAME-CHANGER-2-2048.jpg)

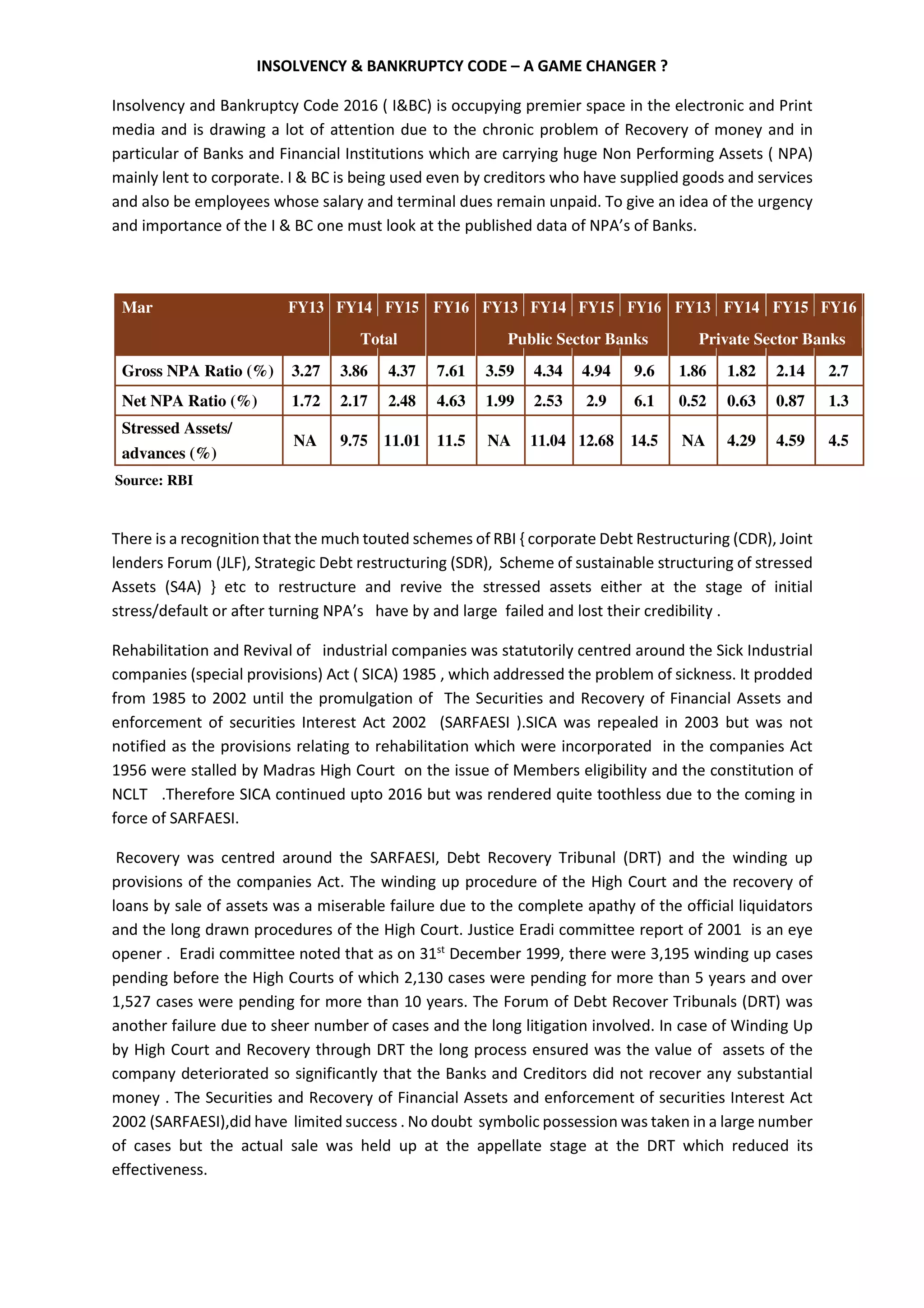

![This can be seen from the chart below :

Region/Country Recovery Rate Time Cost

OECD high income 73 1.7 9.1

East Asia & Pacific 33.9 2.6 20.6

Europe & Central Asia 38.2 2.2 13.1

Brazil 15.8 4 12

Canada 87.4 0.8 7

China 36.9 1.7 22

Denmark 88 1 4

Finland 90.3 0.9 3.5

France 78.5 1.9 9

Germany 84.4 1.2 8

Hong Kong Sar,China 87.2 0.8 5

India 26 4.3 9

Japan 92.1 0.6 4.2

Slovenia 89.2 0.8 4

Singapore 88.7 0.8 4

South Africa 35.1 2 18

United States 78.6 1.5 10

HIGHLIGHTS OF THE CODE

1.I&BC will cover debt defaults of Corporates, LLP, Partnership firms and individuals.The provisions

relating to partnership Firms and Individuals are yet to be notified.

2.Applications can be made to NCLT by Financial Creditors [ Secured and Unsecured Lenders ];

Operational Creditors [ creditors for goods ,services and employees ] and the corporate themselves.

3. Time lines for consideration of Applications and Resolution of Cases. Resolution is to be completed

within 180 days ( with an extention of 90 days ) and thereafter the corporate goes for liquidation.

4. On the application being admitted the Board of Directors stand Suspended and the entire

Resolution is to be done by a Resolution Professional who is so qualified .The liquidation is also to be

conducted by Professionals as opposed to the government official Liquidator .

4.Voluntary liquidation is to be done under the I&BC code.

5. Tremendous opportunities for Chartered Accountants ( And other Professionals ) to qualify as

Insolvency Professional and Liquidators. A new class of professional and Professional entities

emerging.

Coming to the details of the code, the Application by Financial Creditors [Secured /unsecured

Creditors ] or the Operational Creditors [ creditors for goods and services] or the corporate itself is

required to be disposed off within 14 days. On the date of such occurrence the Board of Directors

stand suspended and an Interim Resolution is appointed . A moratorium on all legal proceedings

against the assets of the company is declared for a period of 180 Days. The interim resolution

professional is primarily required to issue an advertisement and settle a list of creditors. He is required

to appoint Valuers for the current and Fixed Assets of the company and get the valuation done. He is](https://image.slidesharecdn.com/article-171102092922/75/INSOLVENCY-BANKRUPTCY-CODE-A-GAME-CHANGER-3-2048.jpg)